Today, we’re looking at the best stocks for iron condors. Let us know what you think. Did we miss any?

Contents

-

-

-

-

- Introduction

- What Is An Iron Condor?

- Iron Condor Strike Selection

- My Top 15 Best Stocks For Iron Condors

- Picking The Best Stocks For Iron Condors

- Putting It All Together

- Iron Condor Examples

- Iron Condor vs Short Strangle

- Iron Condor vs Iron Butterfly

- Iron Condor Scanners

- Other Considerations When Trading Iron Condors

- FAQ

- Conclusion

-

-

-

Introduction

Most investors are familiar with the investing mantra “the trend is your friend”.

The problem with this mantra is that markets actually trade sideways most of the time, so you need to have strategies in place that allow you to profit when markets are range-bound.

An iron condor is one such options strategy that can be used in a sideways market.

It is used when a trader believes that the price of an underlying stock will not move very much.

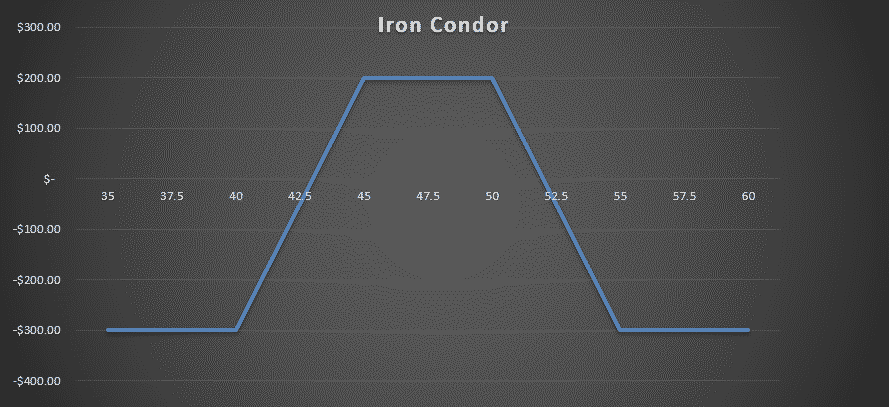

It gets its name from the shape of the payoff diagram that looks like a bird with two wings.

At its core, it uses four options contracts – two calls above the trading price and two puts below the trading price.

The effect is that risk is minimized, however, so are profits.

This article will explore how you can improve your profits by ensuring you select the best stocks for an iron condor.

What Is An Iron Condor?

The Iron Condor strategy is an income strategy that profits if the underlying stock or index stays within a specific range over the life of the trade.

Throughout any trade, stocks can move one of five ways:

Up a lot

Up a little

Sideways

Down a little

Down a lot

Stock investors would make money in the first two of the above five scenarios.

Iron condors will make money in the middle three situations and sometimes, if they are managed well, can make money in ALL of the five scenarios.

An Iron Condor is a combination of a Bull Put Spread and a Bear Call Spread.

Iron Condor Strike Selection

You could consider several different factors when choosing strikes on your iron condor trades.

We like to trade iron condors with the short strike around delta 15.

When there is a lot of skew on a particular stock, we sometimes need to use 15 delta on the puts and 10 delta on the calls.

In terms of the width, it depends on the underlying stock, index, or ETF.

For SPY, IWM, QQQ, and most stocks, we usually go 5 points wide.

For RUT, we are usually 10 or 20 points wide.

SPX is usually best at 25 points wide.

My Top 15 Best Stocks For Iron Condors

While I prefer to trade index options index options for iron condors, there are times when I will trade individual stocks, but will strict criteria for which stocks to choose.

Below is a list of what I believe are the 15 best stocks for iron condors.

AAPL

AMZN

BABA

CRM

DIS

GOOGL

HD

JNJ

MA

META

MSFT

NFLX

NVDA

TSLA

WMT

Let’s take a look at why I think these ones are the best.

Picking The Best Stocks For Iron Condors

Not all stocks are created equal when executing an iron condor and a key part of being profitable is avoiding the wrong types of stocks in the first place.

An iron condor is profitable when a stock moves as little as possible in the price – this gives us the most important criteria when considering which stocks to pick.

Several factors inform whether a stock is a good candidate for moving as little as possible:

Factor 1: High Liquidity

If you’re looking at a stock for an iron condor trade and it has low liquidity, that is a huge problem .

Generally, if a stock has low liquidity, there will be a large bid-ask spread which makes it difficult to get filled for a good price.

This is going to impact your bottom line on trade entry, exit and any time you need to make an adjustment.

All the stock listed above are large market cap stocks with highly liquid options and tight bid ask spreads.

Always check volume and open interest for the stock and strikes you are looking to trade.

If there is low liquidity, the market makers will take their pound of flesh from you.

Factor 2: Stock Price Above $100 (Or Thereabouts)

It can be very hard to trade iron condors on low priced stocks.

There isn’t enough strike prices available and you need to trade lots of contracts which can then get expensive.

For this reason, it’s best to focus on stock trading above $100.

Factor 3: Large Capitalization

Large-cap companies are much better suited to an iron condor strategy than small caps.

Small caps encompass small, agile, and nimble companies that can quickly create new products and services, resulting in a possible spike in revenue and their share price.

On the contrary, large caps are slow, lumbering beasts with generally steady earnings.

Their risk appetite is lower and their level of bureaucracy means they are slow to pivot and change direction.

Coupled with sizeable market share, large changes in earnings growth are highly unlikely, resulting in a slower growth, but much more stable share price.

Basically any company in the Dow Jones Industrial Average could apply here.

Factor 4: Implied Volatility Rank

One of the most useful technical indicators for iron condors is the implied volatility rank.

Implied volatility rank is a measure of how cheap or expensive a stocks options are relative to its historic volatility.

When implied volatility rank is high, iron condors have the best chance of being profitable so use the rank as a handy guide for timing your entries.

Putting It All Together

When combining all these factors, the stocks you’re likely to pick will be ‘blue-chips’ – the sort of household names everyone knows and that have been around for decades.

Your final consideration should be the timing of the trade – it is no use picking a fantastic stock that meets the four factors above and then executing the trade when an earnings announcement is due in a few days.

Always check that no upcoming announcement is due from the company and be aware of any key government statistic dates which could have an impact (e.g. employment participation rate and its impact on websites that provide job listings).

Iron Condor Examples

Iron condors are one of our favorite strategies here at Options Trading IQ, so we have lots of examples.

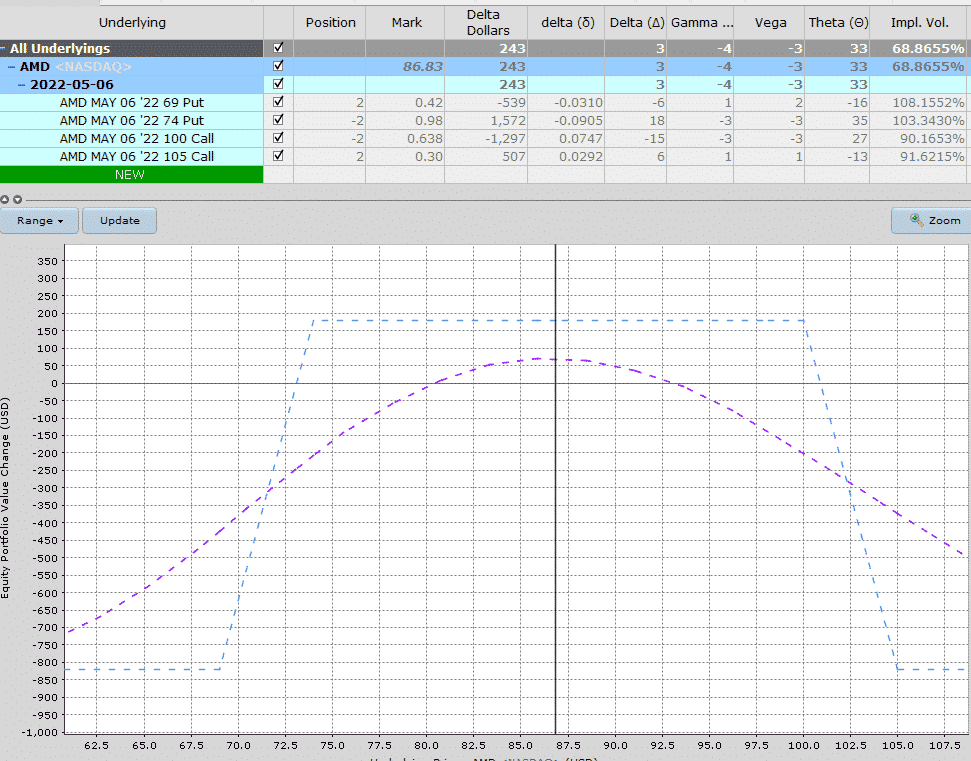

Here we have an example of a Condor on AMD.

This condor was traded over earnings in May 2022.

Using the May 6 expiry, we sold the 74 put and bought the 69 put.

We sold that spread for $0.55.

Then we sold the 100 call and bought the 105 call to complete the iron condor.

We sold that spread for $0.35.

In total, the iron condor generated $0.90 per contract or $90 of premium with a maximum risk of $410.

The profit zone ranges between 73.10 and 100.90.

This can be calculated by taking the short strikes and adding or subtracting the premium received.

AMD closed at 95.34 on May 6th, which saw the iron condor expire worthless for a full profit of $90.

If we take the $90 profit over the $410 risk, the condor returned 21.95% in just a few days.

You can find some other iron condor examples below:

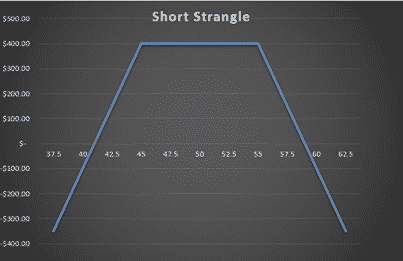

Iron Condor vs Short Strangle

The main difference between iron condors and short strangle is that iron condors are defined risk.

Buying the further out-of-the-money options gives an iron condor limited risk.

A Short Strangle involves naked options and therefore has unlimited risk.

You can read more about the differences here.

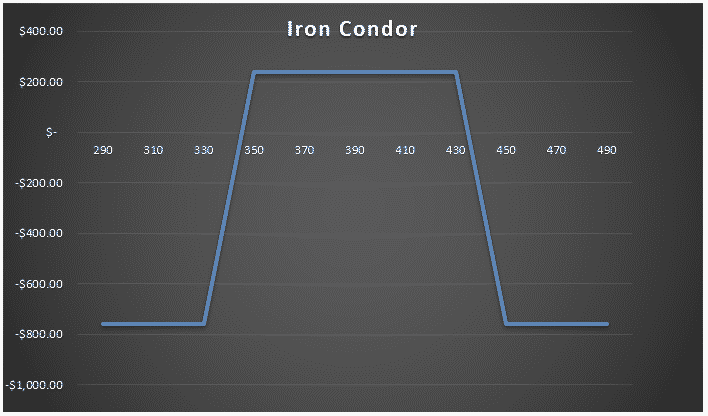

Iron Condor vs Iron Butterfly

An iron condor uses out-of-the-money options, whereas an iron butterfly is usually placed at-the-money.

An iron condor has a square-shaped profit tent, whereas an iron butterfly has a triangular or tent-shaped profit zone.

With an iron butterfly, the short put and short call are placed at the same strike price.

You can read more about the differences here.

Iron Condor Scanners

Using an iron condor scanner can be an excellent way to find trade ideas.

We have found that the best iron condor scanners are available from Barchart and Slash Traders.

A good iron condor scanner should incorporate the following parameters:

- Finding the optimal days to expiration

- Find opportunities with a high chance of IV contraction

- Eliminate stocks with low option volume

- Eliminate stocks with low market cap

- Avoid earnings

- High potential return on capital

Other Considerations When Trading Iron Condors

Before you jump straight into iron condor trading, it’s important to understand this trading strategy.

Here are some essential things to consider before getting started with condors:

- How To Delta Hedge For Iron Condors

- Adjusting Iron Condors

- Why Delta Dollars Will Change Your Option Trading Forever

- Iron Condor Success Rate

- Trading Weekly Iron Condors For Income

- What Are Big Boy Iron Condors?

- What Is An Unbalanced Iron Condor?

- The Chicken Iron Condor

- Iron Condor Calculator

- Are 10% Per Month Returns Possible With Iron Condors

- Why I Prefer Long-Term Iron Condors

- Legging In To An Iron Condor: Is It Worth The Risk?

- What Happens To Iron Condors When The Market Tanks?

FAQ

Are Iron Condors Profitable?

Yes, iron condors are profitable in the long run.

There will be periods where iron condors outperform (when markets are calm and volatility contracts or remains low).

The will also be periods where iron condors underperform (when markets are unstable and volatility rises).

This is the same as any trading strategy.

The key with iron condors is to minimize losses when they are not working well.

One good rule of thumb is to avoid trading condors when the market is in Backwardation.

We refer to this as “panic mode,” which is when big moves can occur.

Big moves in stock prices can be a killer for iron condors.

Every major market meltdown has occurred after the VIX futures curve went into Backwardation.

Whether iron condors are profitable or not comes down to trader skill and experience in many cases.

Knowing how to adjust and delta hedge iron condors that come under pressure is a crucial skill.

What Is A Good Iron Condor Success Rate?

The success rate of iron condors will depend largely on the strike selection.

Traders using a high delta for their short strikes will receive a higher premium, but will have a higher probability of those strikes being tested.

Traders that use a lower delta will have a much wider iron condor with a higher success rate.

Assuming a condor is placed with the short strikes at 15-delta, the trade will have a roughly 70% probability of success.

You can read more about iron condor success rates here.

Having a good understanding of the Probability of Profit is also important when trading iron condors.

When Should I Buy An Iron Condor?

The most important criteria for buying an iron condor is that the trade should have a neutral outlook on the stock price.

Iron condors will be successful when the stock price is range bound.

Another factor to consider is implied volatility.

Iron condors that are placed when the stock has a high IV Percentile or IV Rank will be wider and therefore have a higher chance of success.

Iron condors are best entered with 30-60 days to expiration.

This helps to reduce gamma risk.

Weekly iron condors (10 days to expiry or less) can be highly profitable, but they also move very quickly, are hard to adjust, and are very risky.

Can An Iron Condor Be Assigned?

Yes, iron condors can be assigned.

Stock options are American in style and can be assigned at any time.

Usually, this occurs when there is very little time premium remaining, and the option is close to expiry.

Index options are European in style and are cash settled at expiry.

These types of options cannot be assigned early and include RUT, NDX, SPX, and VIX options.

Any option trade that involves a short option can be assigned.

With iron condors, if the stock is below the long put or above the long call, the short and long options cancel each other out.

Let’s take the puts, for example.

The trader could be assigned on the short put and required to buy 100 shares of the underlying.

At the same time, they could exercise their long put, which allows them to sell 100 shares.

The two effectively cancel each other out, although there will be assignment fees involved.

This scenario also (most likely) means an iron condor trade that has suffered a full loss. Not a great scenario.

There can be a tricky situation where the stock is in between the short put (or call) and long put (or call).

The short put (or call) could be assigned in this scenario, but there would be no point in exercising the long put (or call).

For this reason, it is vital to close or adjust iron condors before the stock breaks through the short strike.

While assignment is possible at any time, keeping the stock between the short options is the best way to avoid assignment.

Conclusion

An iron condor is an advanced options strategy that allows a trader to take advantage of a stock that doesn’t move much in price.

As a result, the primary criterion for success is that you choose a stock that you think is likely to move as little as possible.

There are five factors to consider – high liquidity, price above $100, large capitalization, and implied volatility rank.

Finally, ensure you avoid entering an iron condor around significant events such as earnings reports as these will increase your risk unnecessarily.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks! Gav. What is a good options strategy for high flying stocks like TSLA/BYD/ROKU?

You seem to suggest that Iron Condors are not good for the high flying stocks (read your IV post as well) like TSLA. You seem to suggest that stocks that are not anticipated to move much from the current price are good for Iron Condors as they make maximum profit. Two questions:

1. What if I take high volatile stock and go to a safe zone with a relatively lesser premium (compared to staying in the zone that the stock swings wildly) and improve my win probability? For instance, for TSLA, I could say it will not go beyond 710 this week (protect with a long call at 730) and will not fall below 550 this week (protect with long put at 500), is it still a bad choice?

2. You suggested sell high (buy low) when the IV rank is high. Building from question-1, the IV-rank shows that TSLA is a good candidate for an Iron Condor given its high IV Rank.

TSLA for instance, today is at

30-Day IV: 100.6 (change: -3.6)

IV30 % Rank: 81%

IV30 Level: Elevated

Please suggest if you would still avoid TSLA. Thanks again! Great blog!

Yes TSLA has a high IV rank, so that makes it a good candidate, BUT… it does have a history of making huge moves. 15% in a day. So it’s definitely a risky underlying to trade.

In wich level of IV rank or IV percentile do you prefer to do Iron Condor and how long do You prefer the expiration for this strategy?