IV rank tells us how high implied volatility is in comparison to the last twelve months. This gives us key insights into whether options are cheap or expensive on a relative basis.

Contents

- What Is The Implied Volatility Rank?

- Using Implied Volatility Rank

- Don’t Get Trapped In Always Relying On Implied Volatility Rank

- IV Rank And Earnings Season

- Conclusion

One of the most important data points for an options trader is the implied volatility measure. It is derived from an option pricing model and is used to represent expectations of future price fluctuations.

When there is rising demand, option premiums increase which in turn, increases implied volatility. Similarly, when demand and therefore option premiums drop, so does implied volatility.

While knowing the implied volatility of an option is incredibly important on its own. It is important to understand it within the context of the option’s history, as well as relative to other options, as this can yield important insights such as whether an option may be underpriced or overpriced.

To determine this context we need to calculate the implied volatility rank, also known as IV rank.

What Is IV Rank?

Through the use of a measure called the implied volatility rank, you can determine whether the implied volatility is high or low relative to what it was in the past and even relative to other options.

The way it works is that a stock’s current implied volatility is compared against the historic range of implied volatilities for that option. Then a rank is assigned between 0 (minimum) and 100 (maximum).

This rank shows how low or high the current implied volatility is compared to where it has been at different times in the past.

As an example, say you have six readings for implied volatility which are 10, 14, 19, 22, 26 and 30. You’ve just calculated the current implied volatility and it is 10.

In this example, it would be given a rank of 0 since it is equal to the lowest value in the range.

If instead the current implied volatility was 30, it is given a rank of 100 as it is equal to the highest value in the range.

Likewise, a current implied volatility of 20 would equal an implied volatility rank of 50 as it is half way between the low and high limits of the range.

Implied volatility rank is also sometimes expressed as a percentile (and is called the implied volatility percentile in that instance).

If we continue with the previous example, a current implied volatility of 20 would mean it is in the 50th percentile, that is to say, 50% of results are below the implied volatility value of 20.

Now that we’ve covered what IV rank is and how it is calculated, we can turn our attention to how to apply it in options trading.

Using IV Rank

While implied volatility is a very important metric, it can be misleading in demonstrating whether an option is cheap or expensive. For example, say you were looking at options for company XYZ which is currently trading at 50.

You run a pricing model and determine that implied volatility is 20%. If you were to just look at this figure, you might believe that the current implied volatility is fairly low and that the option is likely cheap.

To be sure, you calculate the implied volatility rank which works out to be 95. As the implied volatility rank is very high (close to the maximum of 100) it means that the option is in fact expensive, when its historical implied volatility is taken into account.

By understanding both IV and IV rank, you can determine the true nature of a stock’s volatility.

IV Rank Examples

Take for example high flying stocks like TSLA, BYND and ROKU vs stable, boring companies like PFE, KMB and VZ.

You would be forgiven for thinking only the high flying stocks suffer from high volatility and are a cause for caution, but is that actually the case?

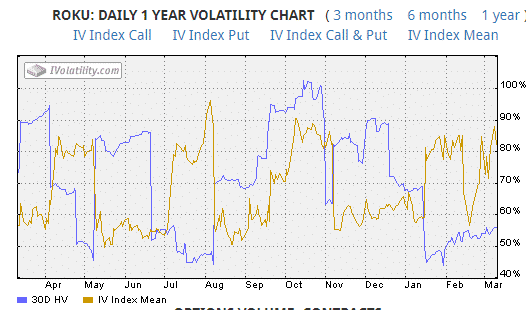

Let’s start with ROKU.

It has an implied volatility of 80 and IV rank of 90.

Both are high ratings, so no surprises there.

What about PFE?

It has an implied volatility of 37, which is what we’d expect.

However looking at the IV rank we discover it sits at 99% – that’s higher than ROKU!

This means that while the IV for PFE is much lower than ROKU’s, the IV rank is actually higher, potentially making this a riskier trade, depending on your strategy.

This can be very useful to determine whether you should be more or less bullish on volatility.

Not only can you use implied volatility rank to get a sense of the relative expensiveness of an option, you can use it as part of a dedicated trading strategy for finding premium selling and buying opportunities.

Say you’re looking to implement a strategy to short premium. You’ve done a scan and found two potential trades. Company ABC has an implied volatility of 13% and company XYZ has an implied volatility of 20%.

By only comparing implied volatility you might fall under the impression that company XYZ is more expensive than ABC and thus a better candidate for the trade.

However by looking at the IV rank for both options you discover ABC’s implied volatility rank is 92 and XYZ is only 42.

This means that ABC’s implied volatility is very high relative to its history, making it a much better candidate for a short premium strategy.

Don’t Get Trapped In Always Relying On Implied Volatility Rank

While implied volatility rank is a very useful metric, the way it simplifies trades to “historically expensive” or “historically cheap” can make it seem very appealing to use in isolation.

Many a novice has fallen into the trap of simplifying their trading to “buy when implied volatility rank is low and sell when it is high.”

As tempting as this may be, implied volatility rank is no different to any other indicator – it works some of the time but not all of the time.

Implied volatility rank can stay high or low for very long periods of times, from weeks to even months. Like with any indicator, make sure it forms part of a comprehensive strategy and is not the sole indicator you rely on.

IV Rank And Earnings Season

If using IV rank in your trading, it’s important to be aware of the behaviour of IV rank in the lead up to and after an earnings announcement.

Generally speaking, as an earnings announcement approaches IV rank goes up and can sometimes do so spectacularly.

The reason being is that implied volatility will increase whenever there is an expectation of a big move in prices. So as an earnings announcement approaches, there will be a lot of unknown around what the final outcome will be.

Due to these unknowns, traders and analysts will have a lot of differing opinions on how the underlying will behave. In some cases that may include expectations of big moves in prices.

These expectations can push up implied volatility values, which in turn impacts implied volatility rank. Traders should proceed with caution at this point, due to what will likely happen post earnings announcement.

Since markets are always forward looking, implied volatility can be crushed post an earnings announcement as the cause for the implied volatility (the unknown nature of the earnings announcement) is now known (the earnings announcement has occurred) and traders will update their expectations of future price movements with a higher degree of certainty.

Conclusion

Implied volatility is one of the most import metrics for traders. Like all metrics, in isolation it doesn’t paint the full picture.

The use of an implied volatility rank allows traders to determine whether implied volatility is historically high or low, giving clues as to whether the option is expensive or cheap.

Implied volatility rank allows you to conduct like-for-like comparisons across different options, to determine premium selling and buying opportunities and confirm bullish or bearish sentiment.

It is tempting to fall into the trap of using implied volatility rank as the sole metric for entering trades, however there are times when it can stay high or low for very long periods of time so it should be used in conjunction with other metrics and analysis.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Dear Gav.

I’m so thankfull for all the high quality info You share..

Wich broker do You use?

Interactive Brokers:

https://optionstradingiq.com/interactive-brokers-tws-tutorial/

https://optionstradingiq.com/interactive-brokers-risk-navigator-tutorial/