Iron condors an income strategy that profits if the underlying stock or index stays within a certain range over the life of the trade.

If you’re relatively new to Iron Condors, welcome to Options Trading IQ. I’ve been trading options since 2004 and Condors since 2008.

This post is over 5,000 words and designed to teach you everything you need to know about Condors.

Enjoy!

Contents

- Introduction

- When To Enter Iron Condors

- Long-Term Or Short-Term Iron Condors

- Understanding Contango and Backwardation

- Legging In To Iron Condors

- Selecting Iron Condor Strikes

- Delta Dollars

- Delta Hedging

- Should You Trade Index or ETF Options?

- How To Trade Iron Condors With a Small Account

- How To Survive a Flash Crash

- Understanding Gamma Risk

- Adjusting Iron Condors

- Are 10% Returns Possible With Iron Condors

- Iron Condor Examples

- FAQ

- Conclusion

Introduction

The Iron Condor strategy is an income strategy that profits if the underlying stock or index stays within a certain range over the life of the trade.

Over the course of any trade, stocks can move one of five ways:

Up a lot

Up a little

Sideways

Down a little

Down a lot

Stock investors would make money in the first two of the above five scenarios.

The iron condor strategy will make money in the middle 3 situations and sometimes, if they are managed well, can make money in ALL of the five scenarios.

An Iron Condor is actually a combination of a Bull Put Spread and a Bear Call Spread.

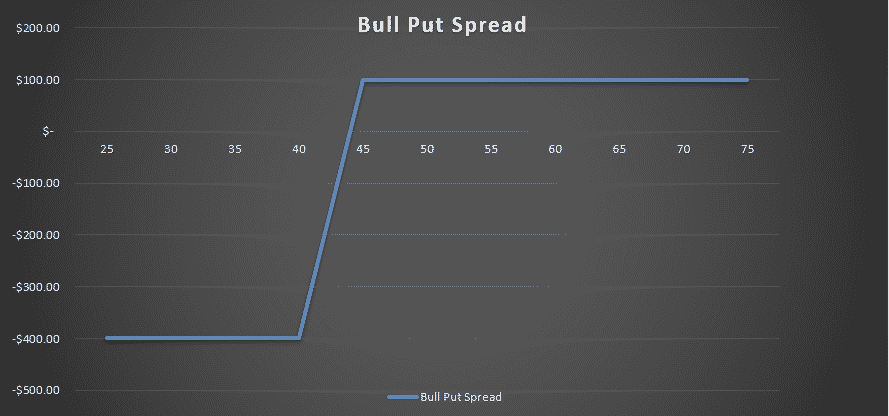

The Bull Put Credit Spread strategy involves selling a put option and buying another put option with a lower strike price in the same expiry month.

As the name suggests, this is a bullish option strategy.

Your outlook on the underlying stock is neutral to slightly bullish. Let’s looks at an example:

ABC stock is trading at $47.50 in September.

A trader thinks that ABC will not fall below $45 before October options expiration.

He enters a Bull Put spread by selling an October $45 put for $2 and buying an October $40 put for $1.

The net premium received in the traders account is $100 ($1 x 100 shares per contract).

The maximum risk on the trade is $400 ($5 difference in strike prices, less $1 premium received times 100)

At expiry, if ABC finishes above $45, the trader keeps the $100 premium for a return of 25% on capital at risk.

BEAR CALL SPREAD

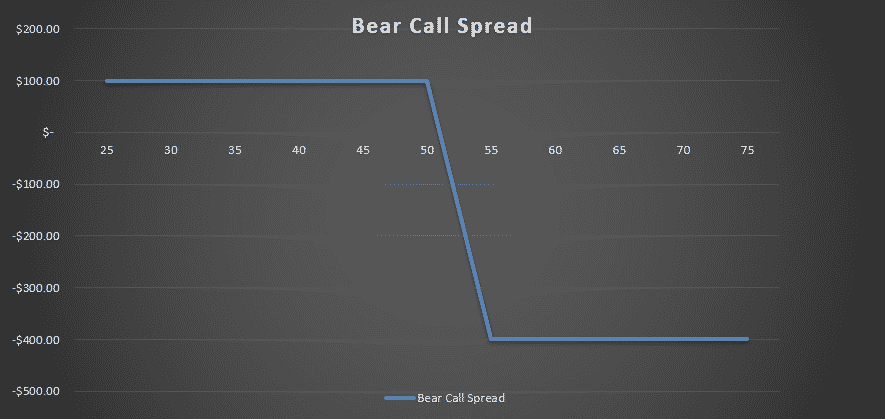

The Bear Call Credit Spread strategy involves selling a call option and buying another call option with a higher strike price in the same expiry month.

This is a bearish option strategy.

Your outlook on the underlying stock is neutral to slightly bearish.

Let’s looks at an example:

ABC stock is trading at $47.50 in September.

A trader thinks that ABC will not rise above $50 before October options expiration.

He enters a Bear Call spread by selling an October $50 call for $2 and buying an October $55 call for $1.

The net premium received in the traders account is $100 ($1 x 100 shares per contract).

The maximum risk on the trade is $400 ($5 difference in strike prices, less $1 premium received times 100)

At expiry, if ABC finishes below $50, the trader keeps the $100 premium for a return of 25% on capital at risk.

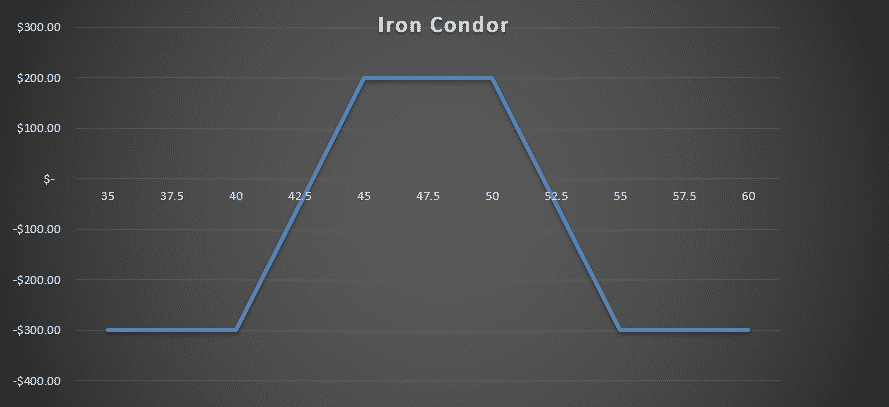

PUTTING IT ALL TOGETHER

Placing the above two trades together creates and Iron Condor.

In this example, the trader is betting that ABC will stay somewhere between $45 and $50 between now and October expiration.

If that occurs, the trader keeps the total $200 in premium.

Some benefits of Iron Condors is that you can essentially receive double the income for the same amount of risk, with reduced margin.

If you place the Bull Put Spread or Bear Call Spread in isolation, the maximum risk would be $400.

If you placed both at the same time to create an Iron Condor, your capital at risk slightly less because of the 2 lots of premium you are bringing in.

Let’s look at the details of an Iron Condor option strategy using the above examples:

Maximum Profit = $200

Maximum Loss = $300

Potential Return = 66.67%

When To Enter Iron Condors

AFTER A RANGE EXPANSION

The market goes in ebbs and flows.

Sometimes there is range expansion and sometimes markets are pretty flat and benign.

After one comes the other. If we experience and extended period of contraction, then soon after we will see a period of expansion.

After a big period of expansion, comes a period of contraction.

That’s when Condors can do well.

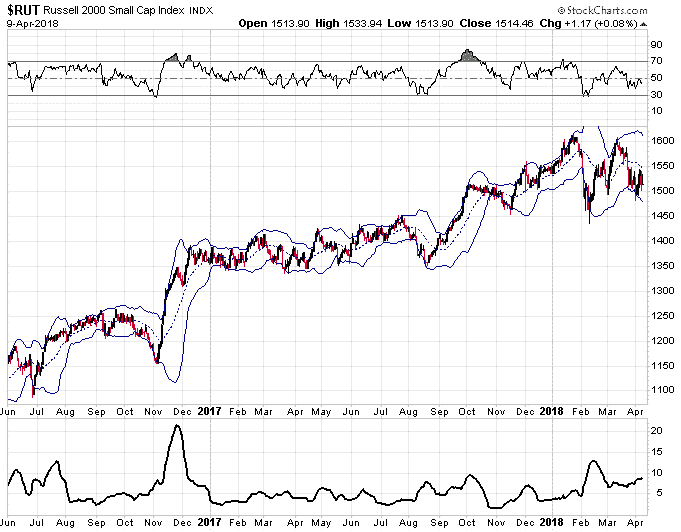

In the chart below, you can see there was a massive range expansion in November 2016 coinciding with Donald Trump’s surprise election win.

The Bollinger Bands blew out to the widest they had been in a long time.

What happened after that?

RUT stayed in a range between 1350 and 1450 for the best part of eight months!

Yes, Condor traders, myself included, suffered losses in November 2016, but what followed was one of the best periods on record for short Iron Condor traders.

If a new trader gave up after November just because they had a bad loss, they would have missed eight months of good times.

ON A VOLATILITY SPIKE

These are short Vega trades.

We’re selling vol, so we want to open trades when vol is high. Sell high, buy low.

The caveat to that is that sometimes we’ve seen some pretty aggressive V-shaped reversals which is where some traders have gotten into trouble.

We get a big drop in the market and a massive volatility spike and they think, “Great, vol is super high, this is a perfect time for an Iron Condor”.

But, sometimes that’s not the case and it can even be the worst time to enter.

If markets have a big V-shaped reversal, then the call side of an Iron Condor is going to come under pressure pretty quickly.

I’ve seen it many times in recent years.

A good idea is to wait a week or two after those big vol spikes, you don’t necessarily want to get the absolute top in volatility.

A great place to find volatility data is www.ivolatility.com.

I use it every day and you can get most of the data you need for free, or by providing your email address.

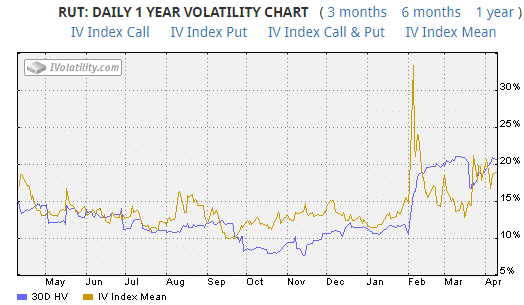

The below chart shows the implied volatility and historical volatility for RUT.

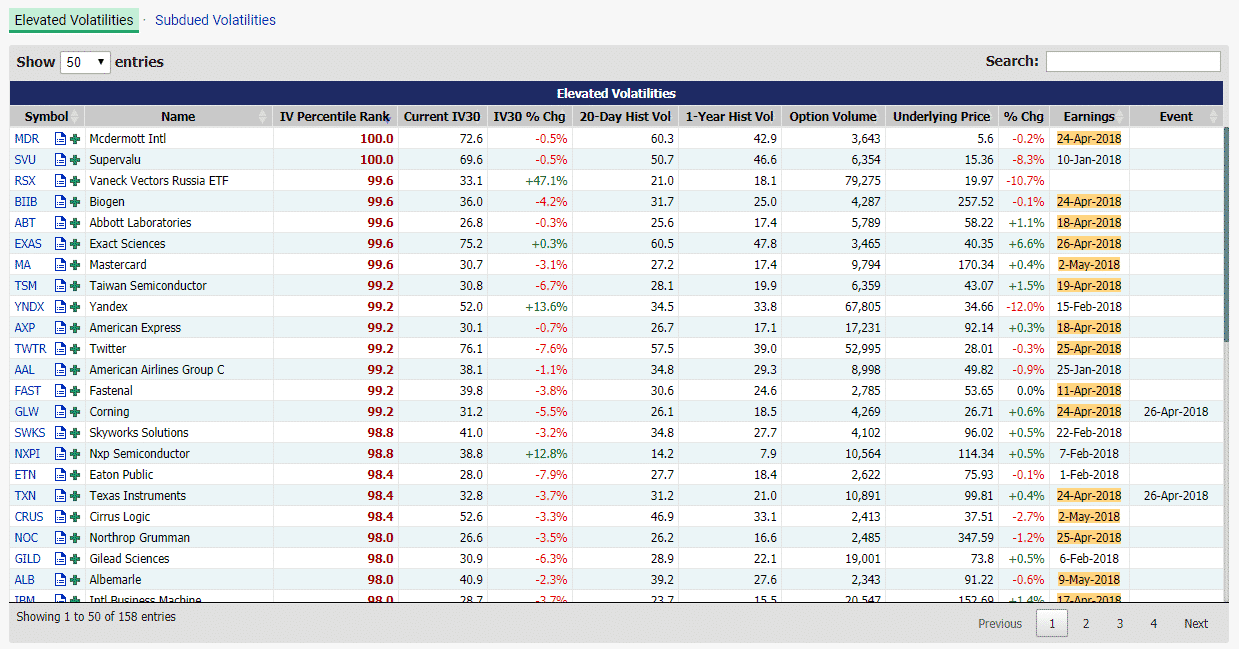

BASED ON IV RANK

Through the use of a measure called the implied volatility rank, you can determine whether the implied volatility is high or low relative to what it was in the past and even relative to other options.

The way it works is that an option’s current implied volatility is compared against the historic range of implied volatilities for that option.

Then a rank is assigned between 0 (minimum) and 100 (maximum).

This rank shows how low or high the current implied volatility is compared to where it has been at different times in the past.

As an example, say you had six readings for implied volatility which were 10, 14, 19, 22, 26 and 30.

You’ve just calculated the current implied volatility and it is 10.

In this example, it would be given a rank of 0 since it is equal to the lowest value in the range.

If instead the current implied volatility was 30, it would be given a rank of 100 as it is equal to the highest value in the range.

A good free scanner for IV Rank is available from www.marketchameleon.com.

You can access this data for free and can be a good way to find trade ideas.

They also have a scanner for low IV Rank stocks.

You can find a more detailed guide on IV Rank here.

ANY TIME?

There’s an argument to be said that you should trade them in a consistent manner ever week or every month.

There will be good period and there will be bad period, like any trading strategy. But over the long run, the probabilities should play out.

One of the worst things you can do is quit trading Iron Condors after a bad period, because chances are a good period is right around the corner.

Likewise, don’t get too cocky after a good period, because your next losing trade is probably not far away.

Consistency is the key to success.

Scaling in to trades can be a good idea.

Rather than going in with 100% position size on day 1, start with 25% size and then each week, open the next 25% until you’ve built the full position.

You can also do the same on the way out.

Rather than exit the whole position at once, take it off in 25% increments.

Long-Term Or Short-Term Iron Condors

I tend to generate a lot of controversy when I share this opinion, but I much prefer long term iron condors to short term condors.

Part of the reason for switching to longer terms condors was out of necessity.

Moving back to Melbourne where the time difference is an issue, I needed a much lower maintenance method of trading.

Long term condors move very slowly in comparison to their short term counterparts so they have proven perfect for my timezone constraints.

SLOW MOVERS

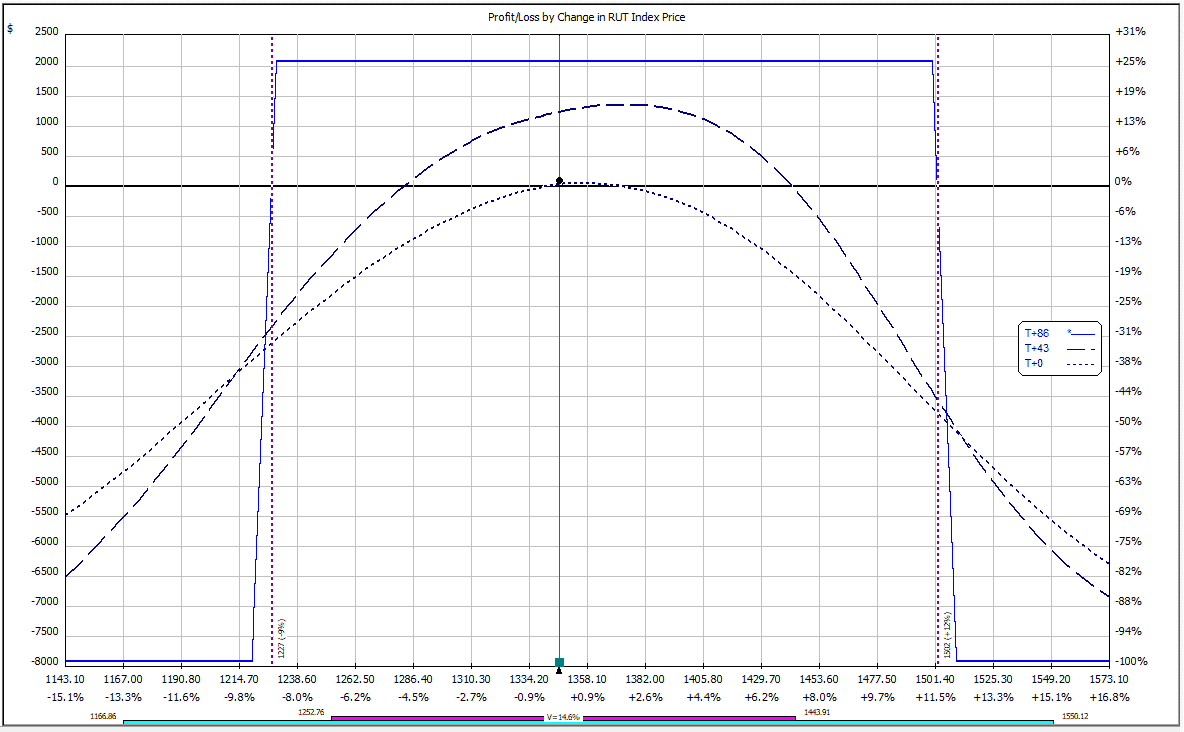

I like to share an example from March 2018 to illustrate the point.

RUT dropped 2.18% on March 20th with an associated spike in volatility.

That’s just about the worst thing that can happen to an iron condor the day after you enter it.

Let’s look at 3 different condors to see how they performed:

- Monthly Condor with Delta of -16

- Weekly Condor with Delta of -12

- 90 Day Condor with Delta of -10

Give that the monthly condor had the highest negative delta, you might think that one would perform the best in a falling market, but the results might surprise you.

Here’s how the trades looked after the next day:

Monthly Condor down $550

Weekly Condor down $2,150

90 Day Condor up $100

You can see the 90 day condor performed by far the best out of the 3.

Yes, the trade off is slower time decay and lower profits in quiet markets, but I’ll take that in return for reduced P&L volatility.

In situations like this, the weekly condor is in real trouble, the monthly condor might need to be adjusted but the 90 day condor can just be left alone to do its thing.

Everyone has their own preference and trading style, but for me, I find the long-term condors suit my style much better than the shorter-term condors.

In this article, I list out the best stocks for iron condors.

Understanding Contango and Backwardation

Any discussion about short-term and long-term Iron Condors wouldn’t be complete without a discussion on Contango and Backwardation. Fun stuff this is!

So, funny names, but important concepts.

Contango and Backwardation refer to the shape of the volatility term structure.

You can find the full details here, but the general idea is that the level of implied volatility is different for each different option expiration period.

The normal situation is that volatility is lower in the front months and the back months are higher.

This makes sense if you think about, because the further out in time you go, the more chance that a volatility event can occur, so traders want to be compensated for that risk.

This situation is called Contango and occurs most of the time in the market, particularly during bull markets.

The opposite occurs when the market experiences a volatility event.

The volatility in the front months skyrockets while the back months don’t rise as much.

This is because the market knows that panics usually die down within a few weeks and things return to normal.

VIX Term Structure is important because it tells us a lot about the current state of the market.

When the Term Structure is in Contango, markets are in a calm state and are behaving normally.

When we shift to Backwardation, markets are in panic mode.

Sometimes panics can reverse quickly such as during Brexit, but other times the market can remain in Backwardation for an extended period such as during the financial crisis of 2008.

Yes, taking a contrarian view can be profitable when markets panic, but we also need to be aware that some of the worst market declines in history have come AFTER the VIX Futures market moved into Backwardation.

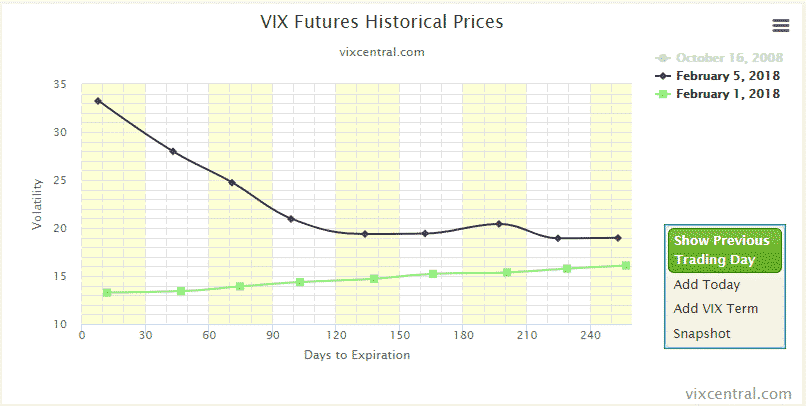

THE “VOLPOCALYPSE”

Here’s an example from February 2018 when VIX spiked an almighty 115.6% from 17.31 to 37.32.

The previous biggest spike (excluding the 1987 crash because VIX didn’t exist then) was 64.20% in February 2007.

Just let that sink in for a minute.

The spike was nearly twice as big as the previous biggest spike. It literally wiped out traders by the thousands and even saw the collapse of a few volatility ETF’s.

Below, you can see what happened to the VIX Term Structure on that day.

You can see that the market went from Contango to Backwardation and the impact of the volatility spike was greatest in the front month options.

The back months weren’t impacted much at all.

Now you might realize why I prefer long-term Iron Condors!

Legging In To Iron Condors

When I’m entering an iron condor trade, I like to wait until one of the verticals gets filled and then quickly make sure the other one gets filled.

Legging in is the process of selling one of the verticals and waiting for the stock to move (hopefully in your direction) before entering the other vertical.

Legging in to an iron condor offers the potential for higher returns, but it also comes with higher risk.

RISKS OF LEGGING IN TO IRON CONDORS

There are risks with any trading strategy and the same goes for legging in to iron condors.

If a trader is bullish they might start by selling a bull put spread.

Then, if the market declines, that spread is placed under pressure with no offsetting gains from the declining price of the bear call spread.

However, the opposite is also true. If the market rallies, the trader makes all the gains from the declining put spread with no offsetting loss on the call spread.

Selecting Iron Condor Strikes

There are number of different factors you could take into consideration when choosing strikes on your iron condor trades.

Some people tend to over analyze and then are overcome with analysis paralysis.

Others try to take a rules based approach and take the emotions out of the decision making process.

For those suffering from the dreaded analysis paralysis, let’s see if we can come up with some pretty standard rules for iron condor entry.

There are 3 main ways to choose the short strikes:

- Delta. I.e. Sell 10 delta or 15 delta

- Standard deviation. i.e. sell strikes 1 or 2 standard deviations away from the current price

- Technical analysis

Using a combination of all three makes sense, but you also don’t want to overcomplicate things.

Some traders will just sell 15 delta iron condors no matter what.

There is nothing wrong with that.

Personally, I use delta as the main criteria and tend to place the short strike around a 10-15 delta.

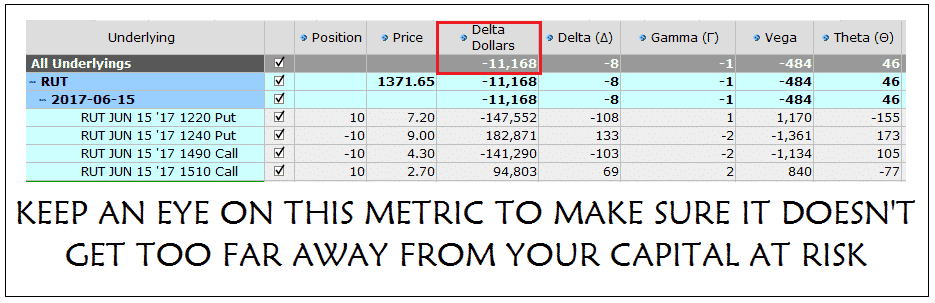

The Single Most Important Metric To Learn – Delta Dollars

Delta is one of the four main option greeks, and any serious trader needs to have a thorough understanding of this greek if they hope to have any chance of success in the trading options.

Delta dollars is quite simply the position delta x the underlying price.

We know that delta gives us the share equivalency ratio, so if we own a long call with delta 0.40 it is equivalent to being long 40 shares of the underlying.

Let’s assume the stock is trading at $100.

The delta dollars figure would be 40 x $100 = $4,000.

This tells us that the option position is equivalent to having $4,000 invested in the stock.

The delta dollars figure is going to depend a lot on the price of the stock.

Let’s say that instead of the stock trading at $100, it was trading at $500.

Our delta dollars figure in this example would be 40 x $500 = $20,000.

Perhaps now you can understand why it’s important to look at the delta dollars number and not just the delta.

WHY IS IT IMPORTANT

Delta dollars tells us our overall directional exposure in the market.

If our account size is $50,000 and out delta is 100, that doesn’t really tell us much.

But if our delta dollars exposure is $200,000 then we know that it is too high for our account size.

I like to set a rule that I don’t let my delta dollar exposure get above 50% of my account size.

Some traders might like to set that rule at 100%, whereas more aggressive traders might set it at 200%.

It’s personal preference, but the first step as a delta neutral trader is to start paying attention to delta dollars and then develop rules around this metric.

I also have rules regarding the delta dollar exposure for each trade and strategy.

PRACTICAL EXAMPLE

For an iron condor, I usually set a 200% rule for Delta Dollars.

Assume you have an iron condor on RUT that is risking $20,000.

If the Delta Dollars figure gets above plus or minus $40,000 you might want to think about adjusting and getting back closer to neutral.

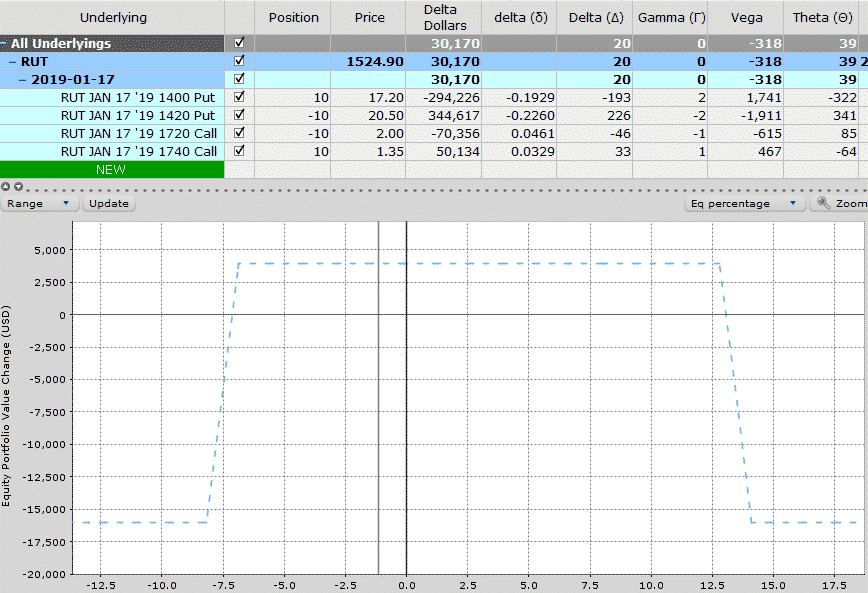

Delta Hedging

Sometimes markets move really quickly and it leaves us little time to adjust our positions.

Here’s a quick and easy strategy I use to cut my exposure and stem the bleeding while I figure out whether I want to adjust or close the main position.

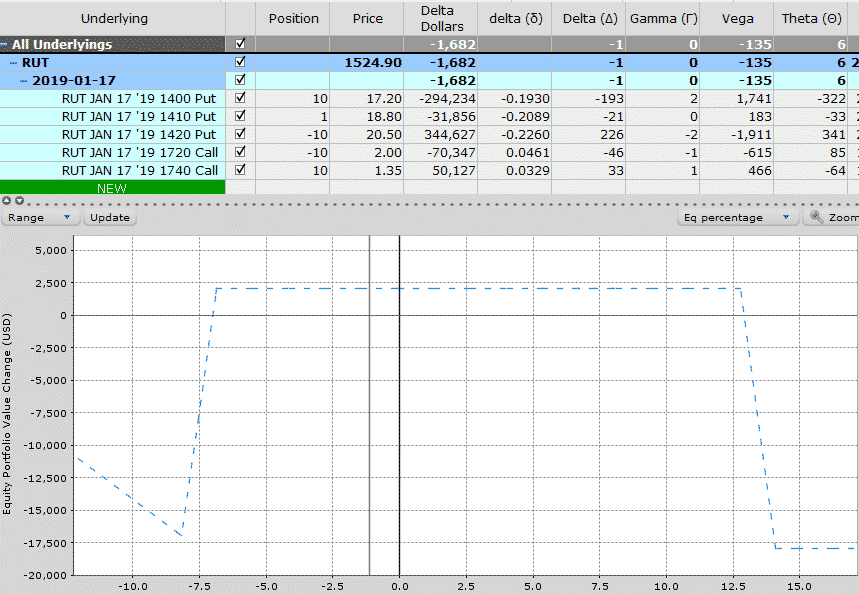

Let’s say we have the following Iron Condor that is showing too much positive Delta as the market is falling.

Assuming we decide we don’t want to adjust the Condor, and we want to give it a bit more time to see if the market will bounce.

But, we are concerned that further downside will see our losses start to pile up pretty quickly.

In that case, we can simply buy 1 put option to neutralize the Delta.

You can see above that the net position Delta is 20.

So we simply buy a 20 Delta put and voila, we’re back to Delta neutral.

If the market continues to fall, the long put acts as a hedge and will reduce the losses on the Condor.

If the market rallies, we can sell the long put for a small loss, it’s done it’s job and it no longer needed.

Delta hedging can get a lot more advanced than this, but this gives you a quick insight into how the process works.

Should You Trade Index or ETF Options?

Trading options on the main US indicies is growing in popularity every year.

But what are the best ways to do this?

There are two very similar assets to choose from – SPY which is an Exchange Trade Fund and SPX which is an Index.

Both are very popular with great liquidity, but what’s the difference?

Let’s take a look at some of the factors when considering “Should I trade index options or ETF options?”

LIQUIDITY

Liquidity is a huge consideration when trading Iron Condors.

Slippage can really eat into your profits and it takes some practice and experience in order to get good fills.

Also, opening a trade is one thing. When markets tank, the bid – ask spread widens significantly and you can get killed trying to get out of a position quickly.

Traders who are worried about liquidity, or are just starting out, should stick to the ETF’s as there will be less slippage.

When comparing liquidity on the major indexes, there is not much difference between index options and ETF options as both are very, very liquid.

SETTLEMENT

Trading Index options occasional provides a risk due to the settlement process. The way it works is this.

The monthly options cease trading on Thursday at 4pm, BUT the final settlement price is calculated based on the prices that each stock in the index opens at on Friday.

So, if there is a big gap up or down on the Friday morning the final settlement value could be significantly different to what you would expect based on Thursday’s close.

This can cause a problem if you are holding an Iron Condor that is close to the money, a big gap up or down could mean that your sold option finishes in-the-money on settlement even though you were nice and safe when the market closed on the Thursday.

The only way to 100% eliminate this risk is to close out the options on the Thursday before the close.

I would usually do this if the index was within 1-2% of my strike prices just to be on the safe side.

COMMISSIONS

There are a lot of brokers offering commission free trading these days so commissions are less of factor than they used to be.

However, there are still option contract fees to consider, so larger traders might prefer to trade SPX rather than SPY so they trade less contracts.

TAX

Indexes have preferential tax treatment and as such may be more suitable for larger traders. Income from index options is treated as 60% long term and 40% short term, regardless of the trade duration.

Income from ETF options is treated the same as stock.

As Iron Condor are short term trades of between 15 and 60 days, index options will be more advantageous from a tax perspective.

CAPITAL LEVEL

The SPY ETF is approximately 1/10 the value of the SPX Index.

Those with a smaller capital balance may be better off trading SPY, as trading SPX may mean their capital at risk is too high.

DIVIDENDS

While not a huge consideration, ETF’s pay dividends while index’s do not. When an ETF goes ex-dividend, the price usually drops by the amount of the dividend.

This is something that you may need to take into consideration when selecting your strikes. ETF traders would also need to keep an eye on this close to expiration due to early assignment risk as discussed shortly.

EARLY ASSIGNMENT

Early Assignment is only an issue for American style options.

Stocks and ETF’s are American style, while indexes are European style.

If you are trading Iron Condors and credit spreads on the indexes (RUT, SPX, NDX and MNX), you don’t even need to worry about it.

For those you trade the ETF’s (IWM, SPY and QQQ) there is a risk of early assignment but the risk is incredibly low and almost not worth worrying about.

The main reason to exercise an option early is to receive the dividend, and the option would have to be deep in-the-money to do that.

If you are trading American style options, the most important thing is to not let your short options go in-the-money and keep an eye on dividend dates.

How To Trade Iron Condors With a Small Account

Beginner traders sometimes shy away from options trading and iron condors in particular because they are worried they can’t do it effectively with a small account.

Ideally, you want to have around $5,000 to $10,000 at a minimum to start trading options.

You can even start trading with as little as $2,000. In fact, in some respects, it’s better to start with a small account while you are learning.

That way, if a trade goes bad you haven’t done too much damage to your net worth.

Even if you have $200,000 available for trading options, just start with $10,000 and get a feel for how things work.

Then, when you’ve been trading for a year or so, SLOWLY build your account from there.

You don’t want to jump from $10,000 to $200,000 overnight.

The psychological aspect of trading a $200k account is much different to a $10k account.

Iron Condors are risk defined trades. The required capital for a trade is equal to the maximum loss.

Unless the market makes a catastrophic move, you are unlikely to suffer a max loss on a trade.

The only time that would happen is if a trader is too stubborn to stick to a stop loss.

Over the long-term, trading an options-based portfolio with a small accounts requires traders to stick to pretty well defined rules and trading plans.

No flying by the seat of your pants please!

Sample Iron Condor Rules

Below are some of the key concepts to consider when trading iron condors with a small account:

- Set the probability of success in your favour to ensure a statistical edge

- Only open Condors on underlying assets with a high IV Rank

- Stick to the most liquid instruments (SPY, AAPL etc)

- Be consistent in your process

- Use appropriate position size to manage risk exposure

- Use ETF’s instead of individual stocks to mitigate earnings risk

- Keep an adequate cash buffer for adjustments (30-40%)

- Avoid weekly options

- Have a strict stop loss. Don’t let losses blow out!

How To Survive a Flash Crash

One of the first things people ask when they learn about Iron Condors (and I had the same question when I first learned about them), is “what happens during a market crash?”

At the end of the day, all trading is risky, no matter the strategy.

Finance 101 tells us that the higher the return we are aiming for, the more risk we must be taking.

If you’re aiming for 5% returns per months, that equates to 60% per year. That’s better than Warren Buffett and most hedge fund managers.

So, the first step is to have realistic expectations of returns and not take on too much some.

Other ways to manage the risk of a Flash Crash are:

- Use stop losses

- Buy VIX call options

- Buy further out-of-the-money puts

- Delta Hedge

You can read about these concepts in more detail here.

Understanding Gamma Risk

Gamma is the ugly step child of option greeks.

You know, the one that gets left in the corner and no one pays any attention to it?

The problem is, that step child is going to cause you some real headaches unless you give it the attention it deserves and take the time to understand it.

Gamma is the driving force behind changes in an options delta. It represents the rate of change of an option’s delta.

An option with a gamma of +0.05 will see its delta increase by 0.05 for every 1 point move in the underlying.

Likewise, an option with a gamma of -0.05 will see its delta decrease by 0.05 for every 1 point move in the underlying.

KEY POINTS REGARDING GAMMA

Gamma will be higher for shorter dated options. For this reason, the last week of an options life is referred to as “gamma week”.

Most professional traders do not want to be short gamma during the last week of an options life.

Gamma is at its highest with at-the-money options.

Net sellers of options will be short gamma and net buyers of options will be long gamma.

This makes sense because most sellers of options do not want the stock to move far, while buyers of options benefit from large movements.

A larger gamma (positive or negative) leads to a larger change in delta when your stock moves.

Low gamma positions display a flatter risk graph, reflecting less fluctuation in P&L.

High-gamma positions display a steeper risk graph, reflecting high fluctuation in P&L.

Personally I prefer a flatter risk graph and therefore prefer low gamma positions. With Iron Condors, this means trading longer-dated positions as discussed earlier.

You can read more about Gamma risk here.

Adjusting Iron Condors

Trading Iron Condors is not always beer and skittles.

Sometimes, the underlying stock or index will make a big move in either direction and you will need to adjust the position.

The decisions of when and how to adjust should all be part of your trading plan and you should know in advance what you are going to do should a big move occur.

What you don’t want to do, is close your eyes, cross your fingers and hope that the position comes back into profit.

Hope is not a strategy.

With and Iron Condor trade, the maximum loss is more than the maximum gain, so it is VERY important that you don’t let small losses turn into very big losses.

Below are nine different ways you can adjust an iron condor, these are discussed in much more detail here.

Are 10% Returns Possible With Iron Condors?

There are a lot of websites out there promising 10% returns per month, so can it be done?

Technically yes, you could potentially make 10% per month returns. The problem is you would have to trade 100% of your account to do so.

If you do that, it’s only a matter of time before you blow up your account.

The way I explain it to people is this – “if you’re trying to make 10% per month, that’s 120% per year.

Finance 101 tells us that higher returns equals higher risk, so you must be taking on a boat load of risk in order to make 120% per year.”

Think about this also, most hedge fund managers don’t achieve more than 25% per year.

So, what makes you think you’re going to do better than guys that went to Harvard, with 20+ years industry experience??

You have to be realistic.

APPROPRIATE ALLOCATIONS TO IRON CONDORS

By now it should be pretty clear that you should never risk 100% of your account on iron condors. Personally, I think about a 20% allocation is good.

Allocation levels depend on risk tolerance so some people may prefer to go higher.

Another thing to consider is to adjust allocation levels depending on the current level of volatility.

When volatility is high, it makes sense to have a higher allocation to iron condors. When volatility is low, it makes sense to reduce exposure.

The most important thing with condors and any trading strategy to be honest, is to have a plan and stick to it!

Iron Condor Examples

Let’s put theory into practice and look at a couple of Iron Condor examples.

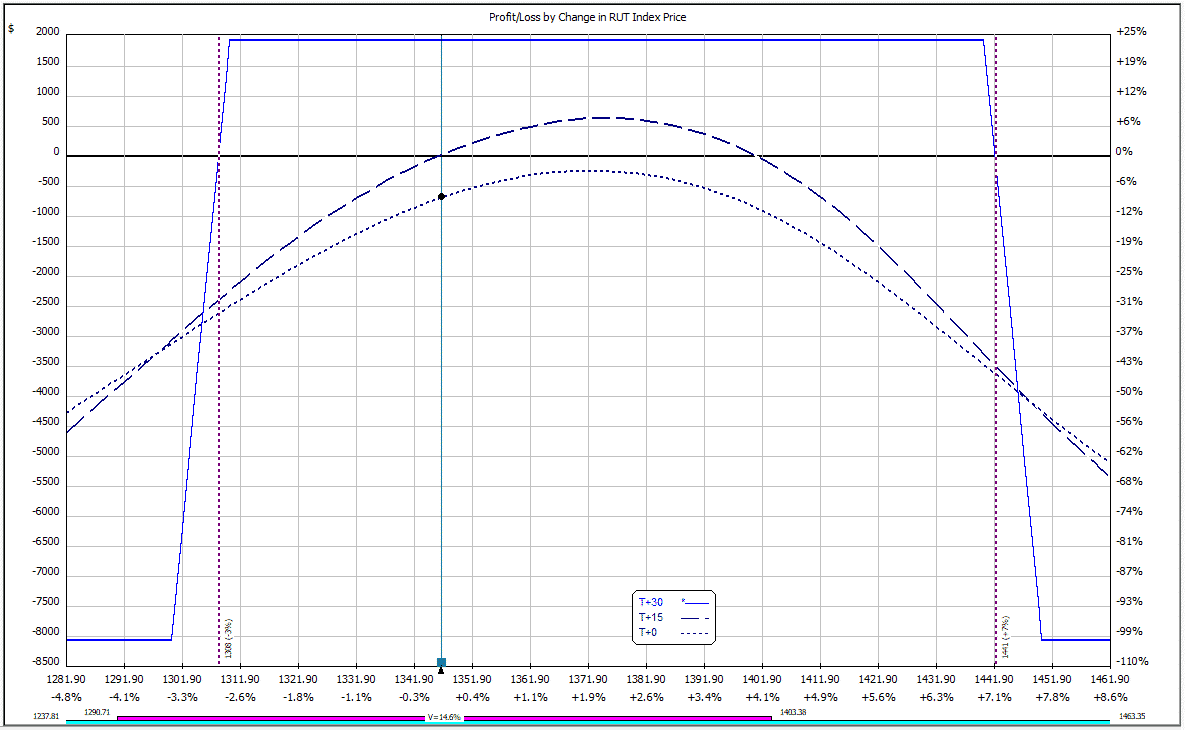

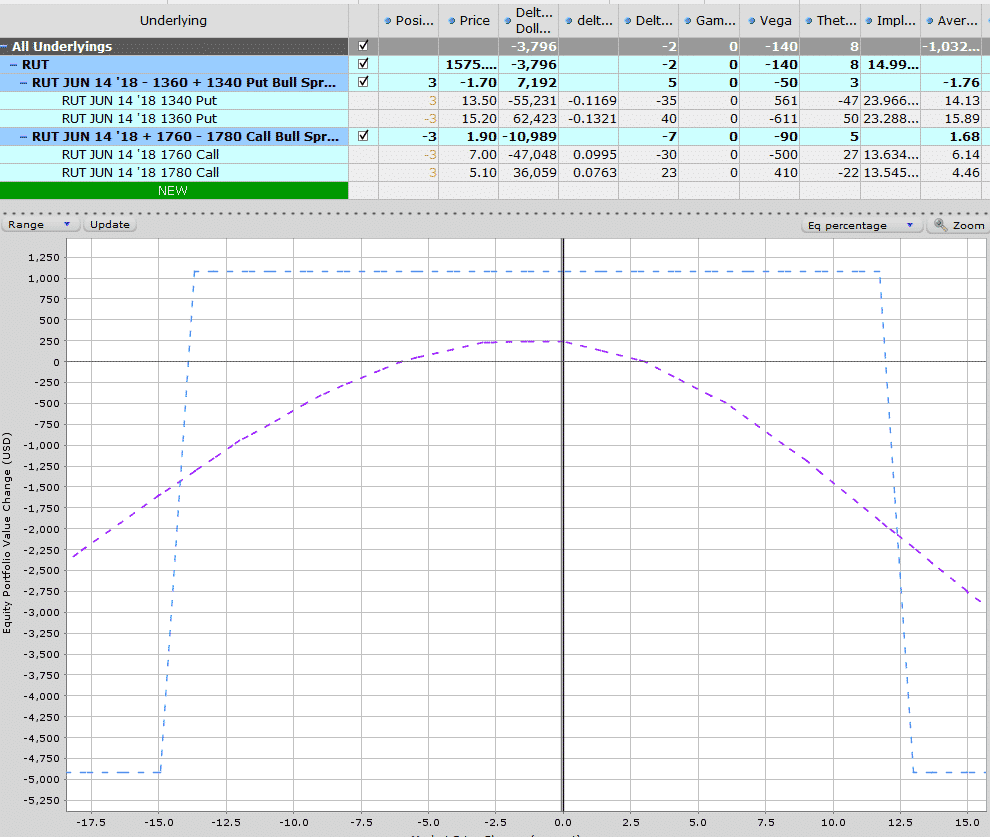

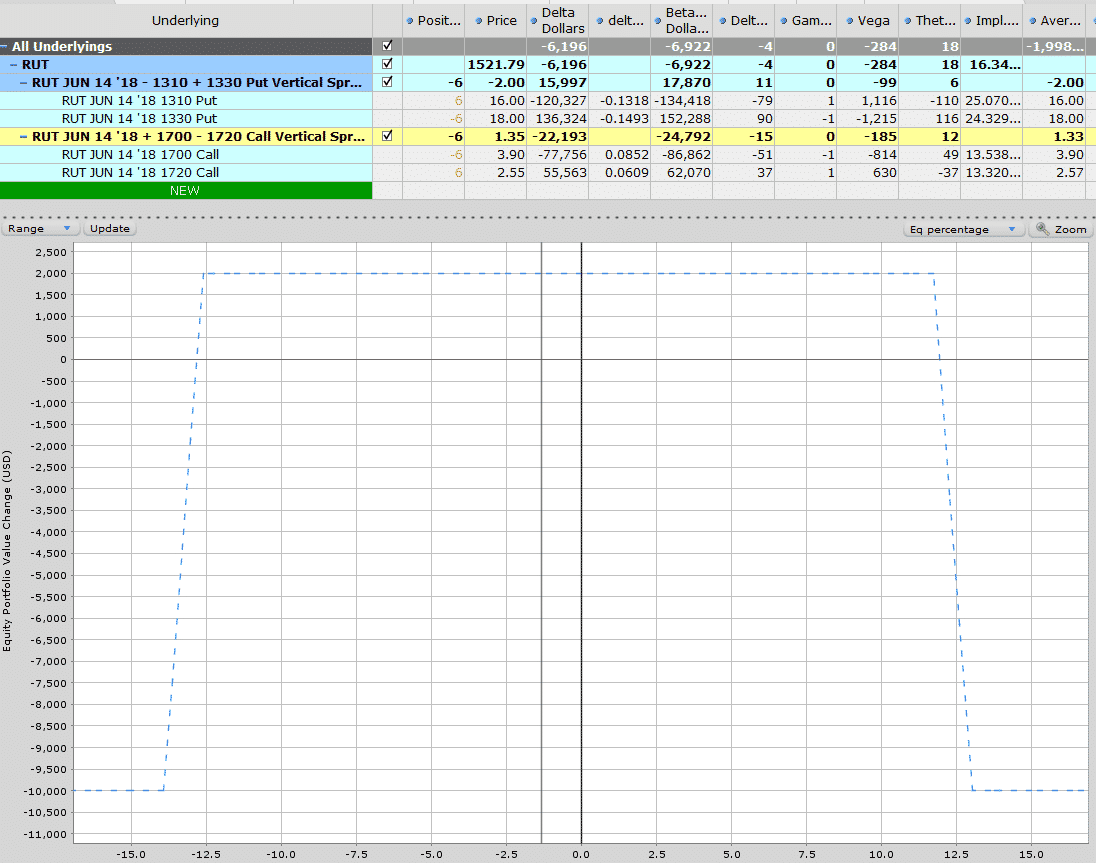

The first one was opened on January 30th, 2018 and was a long-term Condor trading the June expiry.

Here is the initial trade setup:

Within a few days, RUT had dropped from 1575 to 1508 and the trade was becoming skewed with too much positive delta.

The delta of the short put had also hit 20 which was my adjustment point.

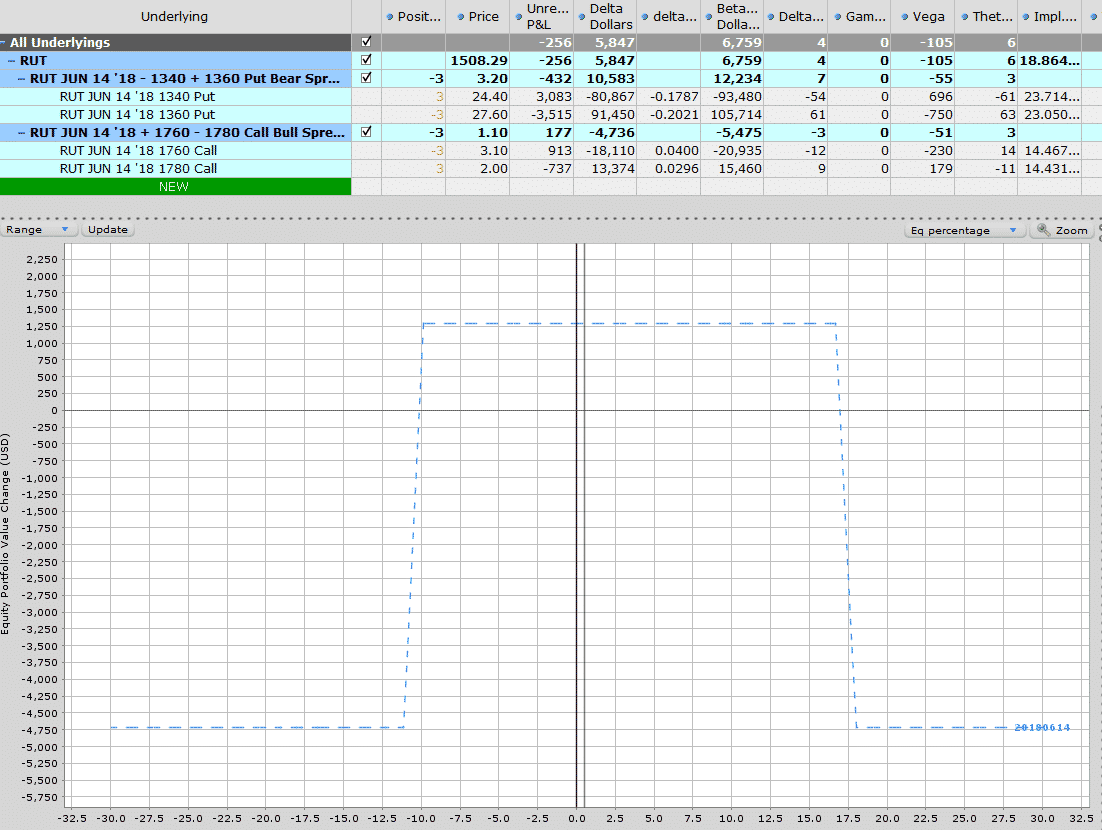

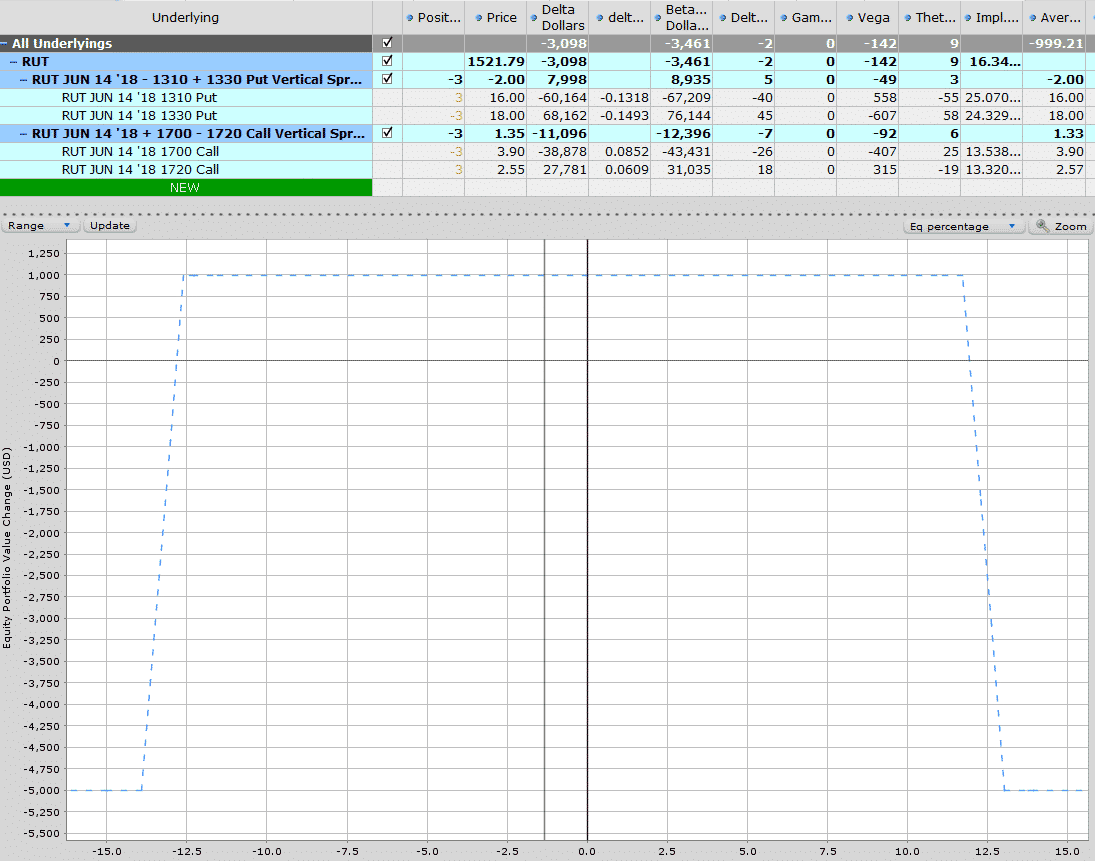

I decided to roll the entire position down so the puts went from 1360-1340 to 1330-1310 and the calls came down from 1760-1780 to 1700-1720.

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

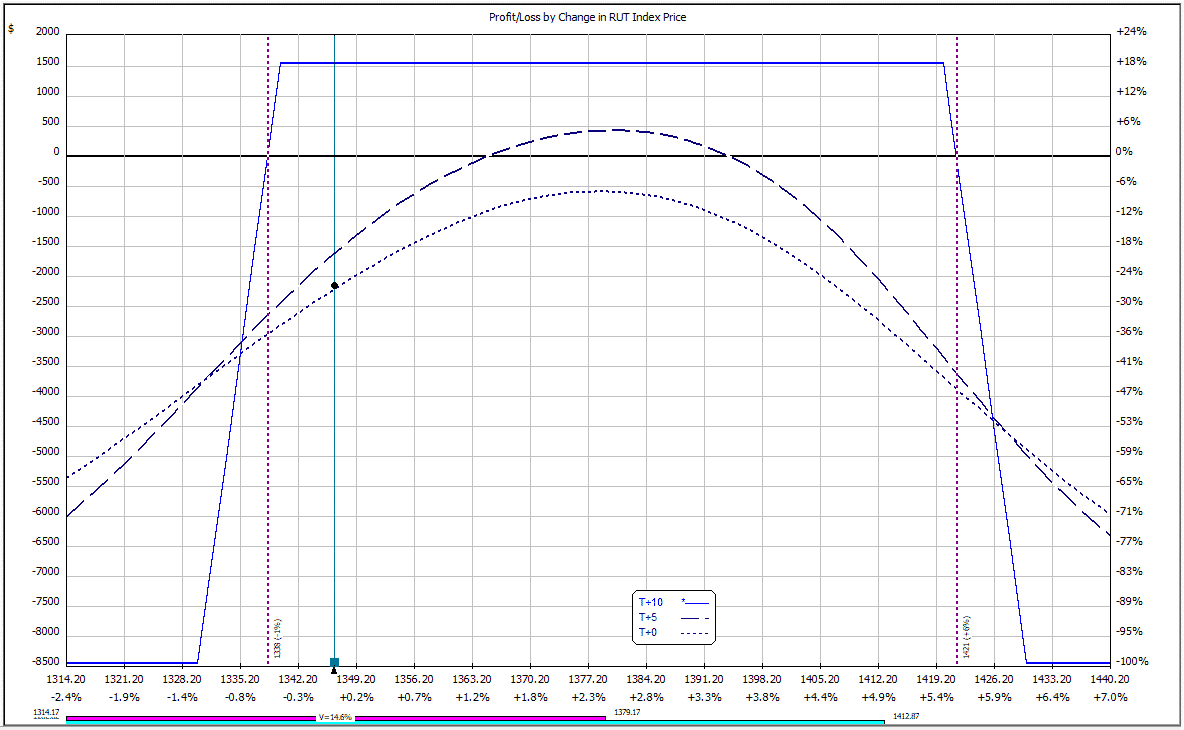

On February 14th, I double the size of the trade from 3 to 6.

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

No further adjustments were needed for the trade and on April 18th I was able to close it out for a $1,075 gain.

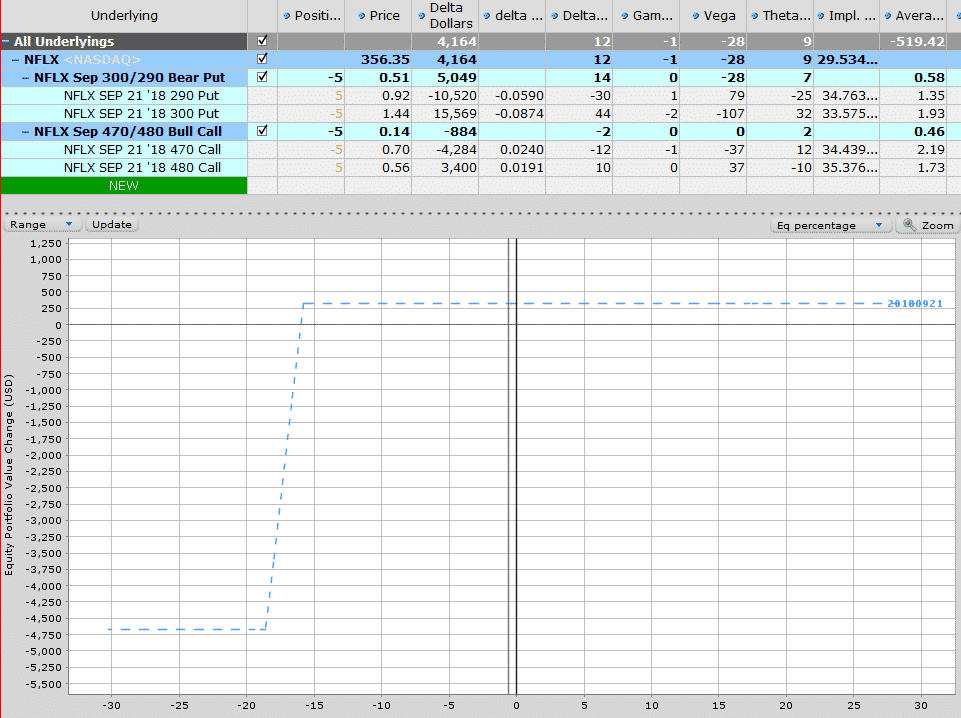

The second Iron Condor example is a trade on NFLX from July 18th 2018 when the stock was trading at $376.

Here is the initial setup:

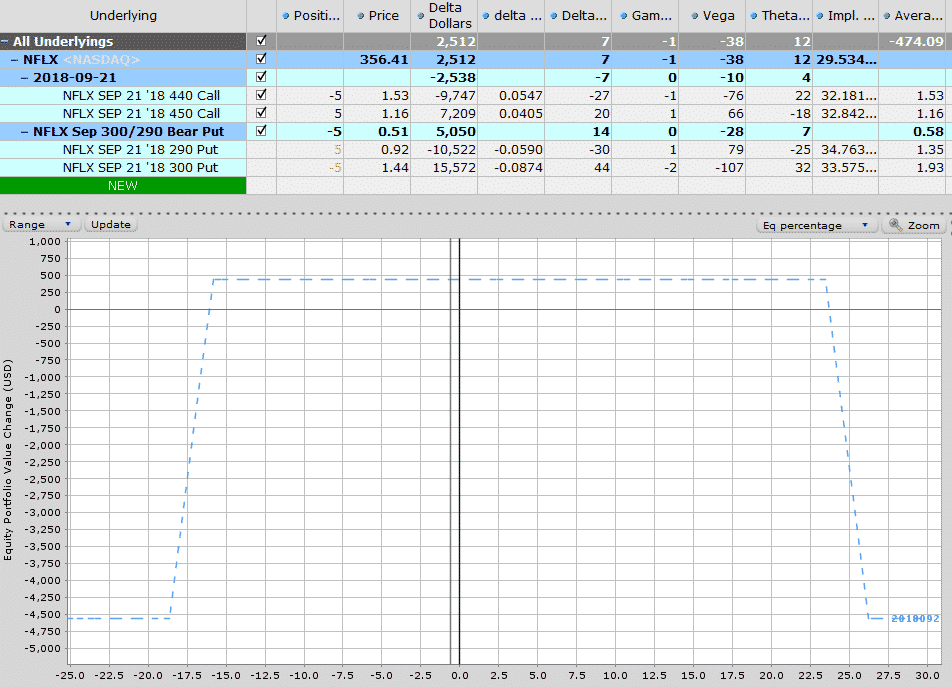

A week later, NFLX had dropped to $356 and the short calls had dropped to a delta of 2 and the spread was only worth $0.14 so wasn’t adding much value to the trade.

As such, I rolled them down from 470-480 to 440-450. The benefits of this were twofold:

- Rolling down generated extra premium

- The adjustment also brought the trade back closer to delta neutral.

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

By August 8th, the trade had made nearly 50% of the potential profit in a short space of time, so I closed the position for a gain of $295.

These two example are fairly straightforward and were both winning trades. Just because they were both winning trades, don’t think that I’m claiming to never have losing trades.

I have a hard stop loss of $1,000 per Iron Condor trade, and that was hit on two of my trades recently during the Coronavirus crash.

Losses happen, it’s a part of the business and you should stay well clear of any trader claiming they never have losing trades.

The key with Iron Condors is not letting the losses get out of control.

Those two trades that I got stopped out on would have gone on to have horrendous losses if I had held on and tried to salvage the trades.

If you’re in a situation like that, just take the loss, lick your wounds and live to fight another day.

FAQ

What Is An Iron Condor?

An Iron Condor is an options trading strategy that involves selling two vertical spreads, one call spread and one put spread, with the same expiration date but different strike prices.

The goal is to profit from the time decay of options and a stable underlying asset price.

How Do You Set Up An Iron Condor?

To set up an Iron Condor, you first select a stock or ETF with a stable price and good liquidity.

Then, you choose a range of strike prices above and below the current stock price for both the call and put spreads. Finally, you sell the call and put spreads for a credit.

What Are The Risks Of Trading Iron Condors?

The risks of trading Iron Condors include losses due to unexpected price movements, assignment risk, and early exercise risk.

Additionally, if the market becomes volatile, the price of the options may increase, which can lead to losses.

What Are The Advantages Of Trading Iron Condors?

The advantages of trading Iron Condors include the ability to profit from a stable underlying asset price, the high probability of success, and the ability to limit potential losses by using stop-loss orders or adjusting the trade.

What Is The Maximum Profit For An Iron Condor?

The maximum profit for an Iron Condor is the credit received when the trade is initiated.

This is the difference between the price of the call and put spreads.

What Is The Maximum Loss For An Iron Condor?

The maximum loss for an Iron Condor is the difference between the strike prices of the call and put spreads, minus the credit received when the trade is initiated.

When Should You Close An Iron Condor Trade?

You should consider closing an Iron Condor trade if the price of the underlying asset moves too close to one of the strike prices or if the options are approaching expiration.

Additionally, if the trade has reached a profit target, you may want to consider closing it.

Can You Adjust An Iron Condor Trade?

Yes, you can adjust an Iron Condor trade by rolling the options, adding or subtracting contracts, or changing the strike prices.

Conclusion

Well done, you made it to the end and you should now have a very thorough understanding of the iron condor strategy.

Theory is one thing though and there really is no substitute for experience, so get out there and start trading, but start small and always keep an eye on risk.

Iron Condors are one of the best option strategies. I’ve been in the options game since 2004 and they still form the core of my trading strategy.

If you have any questions, feel free to reach out and if you enjoyed this article, please share it on social media.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I have a doubt. When you said short strike should be 1 or 2 standard deviations away from current price. Standard deviation calculation take into consideration implied volatility, current price and no of days left to expiry. So while calculating SD, which strike price’s implied volatility we should take into account? Strike which we want to sell or strike near current price? Thanks.

If you’re selling July options, use the July implied volatility figure for the stock. August for August and so on. This post might help you:

https://optionstradingiq.com/everything-you-need-to-know-about-vix-term-structure/

Which strike we should take for standard deviations calculation for deciding which strike to sell.

Hi Mady, Around 1 standard deviation usually works out to be around 15 delta so I like to be around that level.

Hello, looks like good info here.

A quick question, you mention the delta entry point but only mention high IV rank.

What is considered high IV rank to you on to this type of trade, say on a index and then on any particular stocks .

Hi Ray, IV Rank means comparing the current IV for the stock/index to itself for the past 12 months. So an IV Rank of 100% would mean the IV of the stock is currently the highest it has been in the last 12 months. Let me know if that helps.

Hi Gavin,

thanks for this good article. For an option seller, you advocate more a longer time until expiration, because “of smaller risk”, and you give an example with RUT.

I can understand the argument, but with reduced risk also comes significantly reduced profit potential. We must compare risk adjusted profit values, and I have the impression that weeklies will win here.

Can you please elaborate on this?

Hi Martin, weeklies will for sure generate more time decay. It’s just a style thing, I prefer longer-term trades because they move a lot slower and I can take my time in adjusting them, which is helpful for me with the timezone constraints. The other thing with weeklies is they are very hard to adjust if they go against you.

You state you allocate 20% to iron condors. I assume this means on a $100,000 account, the margin required would be $20,000 for your trades. Do you leave the other $80,000 in cash or trade other strategies?

Yes 20% of a $100,000 account would be $20,000. I use the other 80% for other strategies, but usually leave about 20-30% in cash for adjustments etc.

This material was fantastic thanks!

Thanks Jo, glad to hear it!

When selecting Iron Condor strikes, I also like the “1. use delta method” but with a twist:

I would start with 20 delta on either side of the market price, and sort all the available symbols by Return on Capital

After that, filter out the symbols <$10B in market cap to minimise the chance of price manipulation (think GME, AMC)

And filter for high open interests to make sure there's good liquidity in options

Then I get a shortlist of high ROC Iron Condor candidates to check out the fundamentals and tech analysis before entering the trade

This is the scanner I use to find the high ROC Iron Condors

https://slashtraders.com/en/tools/options-scanner/

Hi Tony, nice scanner. Thanks for sharing.

Hey Gavin,

I truly enjoyed reading through this post. The material is outstanding. I noticed that the pictures for your NFLX might have been switched. The after adjustment has the strikes that the initial should, and vice versa. This is a little minor, but may confuse many beginners like myself. Thanks for all the content.

Hi Sean, thanks for letting me know. 13,600 views on that page and you’re the only one that has picked up on that.

Thanks for the in-depth article. I was trading Iron Condors on 0 DTE and the strategy was working relatively well, the only reason it was not profitable was getting bad fills/slippage on stops 3-5x…could not get an answer from TD Ameritrade that I could use to make adjustments. Decided to no longer use them.

Do you have any insight/experience on this?

It depends on the underlying stock/index. Automated stops with options don’t work very well because of the wide bid-ask spreads.

Gavin, I’m missing something in the math (maybe I’m just very “slow”!). Would you break down or detail the math in reaching 147,552 delta dollars in the first above example? (Reference -108 delta for RUT Jun 15 ’17 $1,220 put) Thank you!!!

Hi William, it’s just a case of doing position delta x stock or index price. So -108 x 1371.65 = -148,138 (note there is some rounding as the delta is not exactly -108. More like 107.57)