Delta is one of the four main option greeks, and any serious trader needs to have a thorough understanding of this greek if they hope to have any chance of success in trading options.

If you’re a beginner visit my article to learn more about understanding option delta.

Most serious traders probably have a pretty good grasp of delta.

However, there is one metric related to delta that I use religiously in my trading and that is Delta Dollars.

Contents

What Is Delta Dollars?

Delta Dollars is quite simply the position delta x the underlying price. It is sometimes also referred to as Delta Notional.

We know that delta gives us the share equivalency ratio, so if we own a long call with delta 0.40 it is equivalent to being long 40 shares of the underlying.

Let’s assume the stock is trading at $100. The Delta Dollars figure would be 40 x $100 = $4,000.

This tells us that the option position is equivalent to having $4,000 invested in the stock.

The Delta Dollars figure is going to depend a lot on the price of the stock.

Let’s say that instead of the stock trading at $100, it was trading at $500. Our Delta Dollars figure in this example would be 40 x $500 = $20,000.

Perhaps now you can understand why it’s important to look at the Delta Dollars number and not just the delta.

Why Is It Important?

Delta Dollars tells us our overall directional exposure in the market.

If our account size is $50,000 and our delta is 40, that doesn’t really tell us much.

But if our Delta Dollars exposure is $200,000 then we know that it is too high for our account size.

Personally, I like to set a rule that I don’t let my delta dollar exposure get above 50% of my account size.

More conservative traders might like to set that rule at 25%, whereas more aggressive traders might set it at 100%.

It’s personal preference, but the first step as a delta neutral trader is to start paying attention to Delta Dollars and then develop rules around this metric.

I also have rules regarding the delta dollar exposure for each trade and strategy.

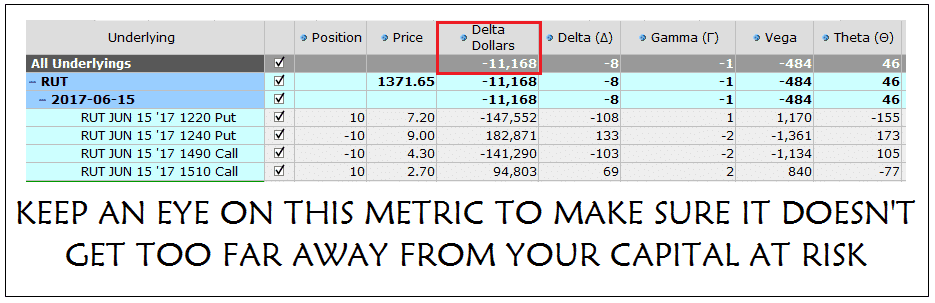

Practical Example

For an iron condor, I usually set a 200% rule for Delta Dollars.

Assume you have an iron condor on RUT that is risking $20,000. If the Delta Dollars figure gets above plus or minus $40,000 you might want to think about adjusting and getting back closer to neutral.

Conclusion

Delta Dollars is a little known, but very important metric when it comes to option trading. Interactive Brokers provides this information as part of their Risk Navigator.

For traders using other platforms, it is very easy to calculate this number yourself. Just take the overall position delta and multiply it by the underlying stock or index price.

For delta neutral traders, it is important to not let the Delta Dollars exposure get too far away from neutral and rules can be created about when to adjust a position depending on trade size and account size.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Dear Gav,

Thanks for the message. Recently I did well on short term LEAP trades, e.g. Visa, in and out for 6 – 7% profit in a couple of days, but there are risks involved . . .

Nice work Jacques. What sort of LEAP trade was it?

Hi Gav,

I recently joined your newsletter and while I wait on your next mentoring program’s opening, I’m going through all your free resources. Such good articles. Thanks so much for the help you’re giving us.

Hi Agnes, Glad you’re enjoying the site. The next course will be in July most likely.

Please help me, friends, tell me which software provides delta dollars data, it seems that none of them provide it. I want to trade commodity options of CME Group and need this data. Thank you, friends

Interactive Brokers is the only one that provides it. You can calculate it yourself easily in Excel though, it’s just Position Delta x Stock Price.

Great article on delta dollars and why it is important. I understand how delta dollars apply to a single option when it comes to risk management. However, I have a question on delta dollars and Iron Condor. Let’s say I have two ICs, one on IWM and the other on SPY. Both have 10 wide wings so max risk is $1000 per contract (disregarding the prem). If delta moves to -0.03 which means position delta moves to -3, then the delta dollars for the IWM@242 would be $726 and SPY@597 is $1791. Assuming my delta dollar exposure limit is $2000, then SPY is about to trigger and IWM is still fine. But is this really true? Both have $1000 max risk and both have a position delta of -3. Also a move to -0.03 in delta is pretty small. Is SPY really at more risk than IWM? Thanks!