Contents

- What Is A Small Account Size For Trading Options?

- Controlling Risk

- Example Of Position Sizing For A Small Account

- Consistency Is The Key To Success

- Stick To Highly Liquid Underlyings

- Stick To Risk Defined Trades

- Let The Probabilities Work In Your Favor

- Trade Management For Small Accounts

- Time Decay Is Your Best Friend But Stay Away From The Weekly Options

- FAQ

- Conclusion

Hi traders, today I want to talk about a really important topic that comes up frequently when talking to beginner option traders and that is how to trade options with a small account.

Most beginners who are starting out don’t have huge account sizes and to be honest, that’s probably a good thing, because it means they can’t do too much damage while they’re learning!

Previously, I’ve talked about how much you need to start trading options, but today we’ll dive into the actual specifics of small account options trading.

What Is A Small Account Size For Trading Options?

I would define a small account as anything less than $20,000.

As previously mentioned, you can get started with as little as a few thousand dollars, but basically anything less than $20,000 I would consider a small account.

Now $20,000 is still a lot of money for most people and I get that. You certainly wouldn’t want to lose 20k would you?

With a small account, the key is to be persistent and consistent in order to let the probabilities work out in your favor.

Then, once you have some experience, a track record and hopefully a slightly higher account balance, you can start to ramp things up from there.

One thing I will mention though, is that if you can’t find success trading a small account, you are very, very unlikely to be successful with a larger account.

For this reason, it is imperative to develop good habits and consistent routines with your small account before you even think about trading a larger account.

Controlling Risk

The first step to controlling risk is to understand position sizing. As a small account holder, trading an appropriate position size is one of the first things you should understand.

Now there are some other sites out there recommending risking no more than one percent of your account per trade.

That’s fine from a risk perspective, but the problem I have with this is that commissions are going to eat into most of your profits.

For example, if you have a $5,000 account and you were to risk one percent on a single trade, that’s a risk of $50.

Let’s say the trade is aiming for a 20% return, that’s a $10 return on the $50 risked.

Even with commission free trading, there are still option contract fees and also issues with slippage (not getting filled at a good price near the mid-point).

Even with a successful trade, most of the $10 is going to evaporate through fees and slippage.

Yes, one percent is a good rule generally and will prevent you from blowing up your account, but it could also cause death by 1,000 cuts.

A better rule of thumb would be risking five percent per trade.

On a $5,000 account that would be $250 at risk.

If you have an account closer to $20,000 then a one percent or two percent allocation would work.

It depends partly on your exact account size.

Even with a $5,000 account risking five percent per trade, you would need ten trades in a row to completely blow up on you before you lost half your account.

That’s fairly unlikely to happy unless you do something really stupid.

For a $5,000 account, risking five percent per trade is fine.

For a $20,000 account, risking two percent per trade is fine.

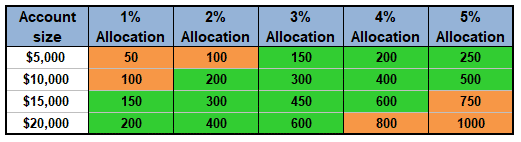

Here’s a quick guide on position sizing for various account sizes.

Example Of Position Sizing For A Small Account

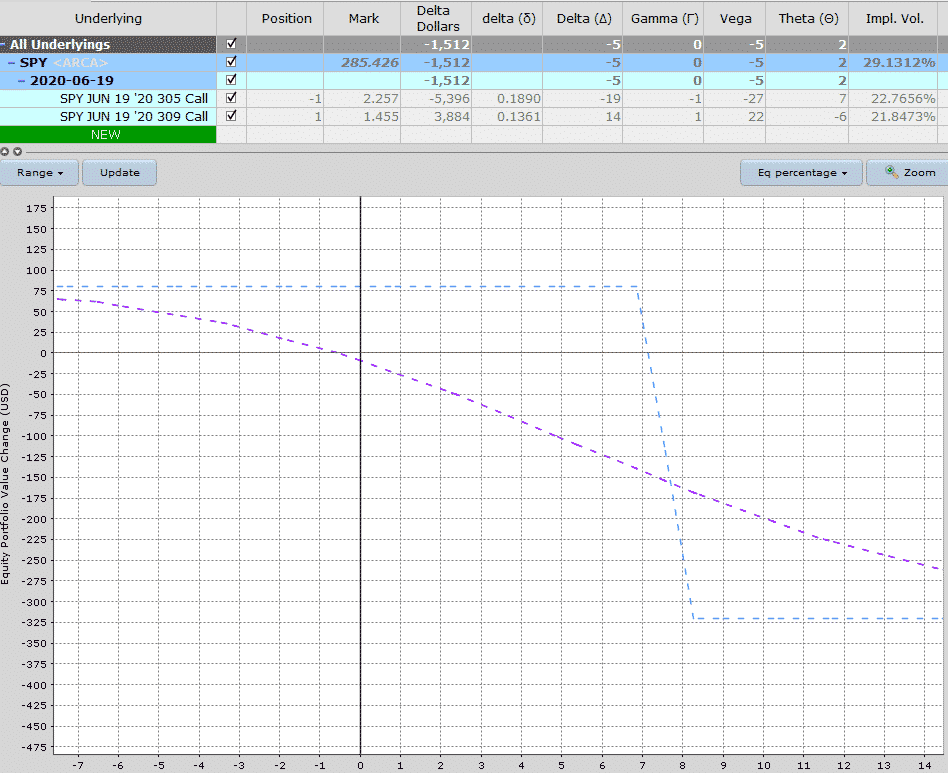

Let’s say we want to make a trade on SPY, we’re slightly bearish and we have a $10,000 account size.

If we use a roughly three percent allocation we would go about four strikes wide on an SPY bearish credit spread.

With a spread that is four strikes wide, the risk would be $400 less any premium received which in this case is $80, leaving us with total capital at risk of $320.

That’s 3.20% of the total $10,000 account so that’s fine.

With a trade like this you might hold to expiry if the trade is working, or you might choose to cap losses at two times the credit received, or $160.

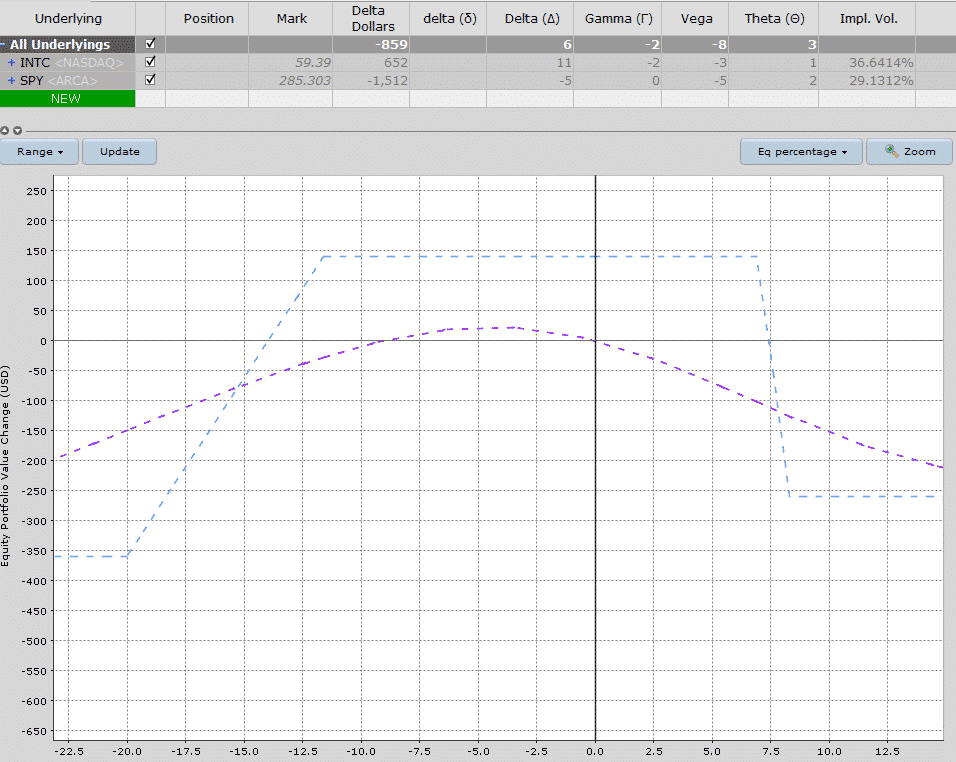

The above position has delta dollars of -1,512, so at some point, you could add a trade with some positive delta to help keep the overall portfolio closer to delta neutral.

Here’s an example of how that might be done.

Selling an INTC June 19th $52.50-47.50 bull put spread generates $60 in premium with $440 capital at risk.

This adds 652 in positive delta dollars, brining the overall portfolio closer to neutral with -859 delta dollars.

You don’t have to enter these two trades at the same time, you may enter them a few days apart and continue placing bullish and bearish trades as you build out your portfolio.

Slow and steady is the key here though.

You don’t want to jump in with twenty position all risking five percent because then your entire account is at risk very quickly.

Take it slow, and scale in to positions over time.

In fact, for beginners I would recommend taking it very slow and not having more than 3-4 positions to start with.

Once you get above that level it can become overwhelming for beginners trying to manage and monitor those positions.

Watch out for correlation as well, there’s no point having four iron condors on SPY, FB, AAPL and MSFT for example because these positions are all going to be highly correlated.

If the market tanks, all of these positions are going to take a hit.

So, have a mix of bullish trades, bearish trades, long volatility trades and short volatility trades.

Consistency Is The Key To Success

Creating a solid foundation through consistency in your thoughts and actions is the key to success.

This is the only way you can grow and scale from trading a small account to trading a larger account.

The only difference is the dollar amounts, the percentage allocations should remain exactly the same.

Focus on the process rather than the dollar result of any one trade.

Stick To Highly Liquid Underlyings

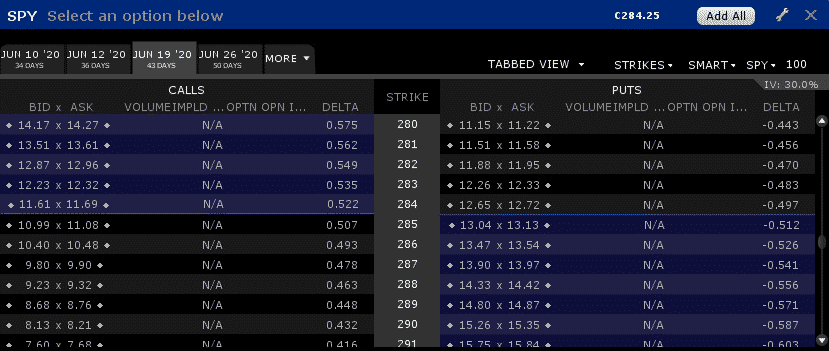

Another key point when trading a small account is to stick to highly liquid stocks and ETF’s.

If you see a stock that has thinly traded options or a wide bid-ask spread, stay well away!

Slippage occurs when you can’t get your trade filled at the mid-point.

If you’re trading a stock with a wide bid-ask spread and you have to go $5 below the mid-point to get filled, that really ads up, especially for a small account.

Remember that’s just getting into the trade and doesn’t include the closing leg or any potential adjustments.

Here you can see the spreads for SPY are very narrow, generally no more than five to seven cents.

They’re usually even closer when volatility is a bit lower too.

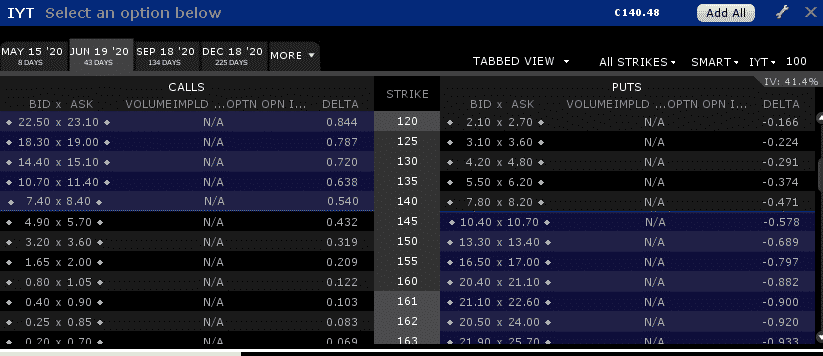

Compare that it IYT, a transportation ETF.

The ETF is quite popular but it is not very active in the options market.

Bid-ask spreads below are $0.50 to $0.70 which will make it very hard to get a good fill price on these options.

Stick To Risk Defined Trades

When starting out with a small account, it’s important to stick to risk defined trades rather than trading naked strategies like short straddles or short strangles.

Naked trades are no suited for beginners and losses can blow out really quickly if the trade moves against you.

Instead of short straddles or short strangles, look at using a calendar spread or an iron butterfly.

Let The Probabilities Work In Your Favor

Options trading is a lot about maths and probabilities, but you don’t need to be a math geek.

The main principle here is that the more trades you make, the closer you will get to the expected value of those trades.

Let’s start with a simple example of flipping a coin.

We know that there is a 50-50 chance of it being heads or tails.

If you start flipping that coin the first time and you get heads, the next flip still has a 50-50 probability.

But what if you get another heads and then another heads?

In a small sample size, it’s entirely possible that we could get four head in a row, or three heads and one tail.

Eventually, the more times you flip that coin – the closer it’s going to come to the expected result, which is basically half heads and half tails.

Once we get to a sample size of 10,000, it’s much more likely that the result is going to end up being close to 50-50.

But with a small sample size it could be 100% heads, or 75% heads.

That could easily happen with only four flips.

The same principle applies to options trading.

If you’re making trades that have a 70% chance of success, there’s every chance that you could be unlucky and have three losing trade in a row right off the bat.

It’s random and it could happen, but it’s a small sample size.

You need a larger sample size before you throw the baby out with the bath water and say “this stuff just doesn’t work!”

Just like the coin example, the larger your sample size, the closer you will get to the expected result.

So stick at it and don’t give up after only a few trades if things aren’t going your way.

Trade Management For Small Accounts

Managing an options trade can be very intimidating for beginners because there are so many factors to consider and it can become overwhelming.

Deciding when to adjust, where to set a profit target and a stop loss are important considerations that need to be given detailed thought before starting to trade.

Getting in to a trade is the easy part, it’s what comes next that’s hard, so let’s talk about some tips for managing a small options account.

Setting A Stop Loss

The first thing to consider is where to set a stop loss.

With a small account, it’s important to make sure no trade experiences a max loss.

So you might think about setting a stop loss at around 30% of the maximum loss which should prevent any one trade doing too much damage to your account.

Thirty percent is a good rule of thumb, but you can adjust that number slightly depending on your risk tolerance and preferences.

Setting A Profit Target

Next you want to think about setting a profit target.

This may vary depending on your account size.

If you have a small account and the maximum profit on any one trade is $150, then setting a 30% profit target probably doesn’t make much sense.

That’s only $45 and after slippage and fees, you’re not going to be left with much, so you may want to look at a 50% or 60% profit target.

Alternatively, you could look to hold the trades to expiry in order to try and achieve the full profit potential.

If a trade is a long way from your short strike, this is generally fine, but if you have a trade that is under pressure and close to your short strike, the profit and loss can move around a lot as you get close to expiry.

This is called gamma risk and is a fairly advanced topic, but something to at least be aware of.

Time Based Exit

Another idea is to incorporate a time component to your profit taking process.

For example, one rule I have is that if 50% of the profit has been achieved in less than 50% of the trade duration, I will close the trade out.

Delta Base Exit

One final consideration is to use a delta based exit.

Let’s say you open a credit spread and the short strike has a delta of 15.

For a trade like this, I might exit the trade if the delta gets to 25.

From past experience, I’ve seen that losses can start to grow exponentially once you get past this point.

If you’re sitting on a profit on the trade, you could also close if the delta of the short strikes gets down to about 2.

At this point there is likely very little profit potential left in the trade and it might be best to close it out, remove the risk and free up the capital for the next opportunity.

These are all things you should consider before you start trading a small account.

Time Decay Is Your Best Friend But Stay Away From The Weekly Options

As a small trader, time decay is going to be your best friend.

Rather than buying options and suffering from time decay, you want to have theta working for you and generate profits through the passage of time.

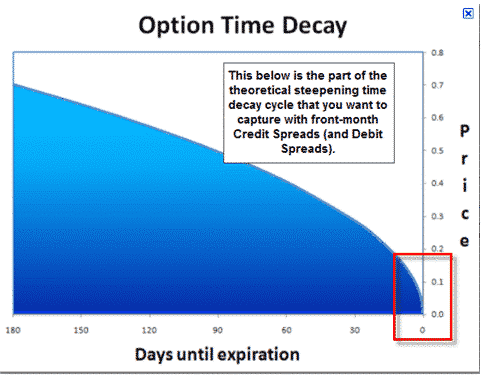

The below image shows how time decay works.

It starts off slow and then accelerates towards the end of an options life.

Looking at this image, most traders automatically conclude that they want to trade short-dated options like weekly options.

Yes, weekly options have a high level off time decay, but with options there is always a trade off and that large time decay comes with huge price risk.

If the price of the underlying makes a small move, the weekly options will have a large change in profit or loss.

That’s great if the trade moves your way, but can be very painful if it goes the other way.

I tend to close out most of my trade before the last week for this very reason and I would recommend that beginners avoid weekly options, at least to start with.

A good philosophy is to start a trade with 60 days to expiry and close it with 30 days to go.

Or start with 30 days to expiry and close with 15 days left.

However, as a small account holder, sometimes you have no choice but to accept a little more risk and hold trades to expiry.

It’s best to paper trade a few different styles and get a feel for each one before committing significant capital.

FAQ

What Are Small Account Option Strategies?

Small account option strategies are options trading strategies designed for traders with limited capital.

These strategies are typically low-risk and aim to generate consistent income through the sale of options.

What Are Some Examples Of Small Account Option Strategies?

Some examples of small account option strategies include selling cash-secured puts, credit spreads, and iron condors.

These strategies involve selling options with limited risk and limited profit potential, which is well-suited for traders with smaller accounts.”

What Are The Benefits Of Small Account Option Strategies?

The benefits of small account option strategies include their low risk and ability to generate consistent income, even with limited capital.

These strategies are also relatively easy to understand and implement, making them well-suited for traders with little experience in options trading.

What Are The Risks Of Small Account Option Strategies?

The main risk of small account option strategies is that they may not generate as much profit as more aggressive strategies, such as buying options.

Additionally, these strategies may be vulnerable to sudden market movements, particularly if those movements are outside the range of the options sold.

Is It Possible To Trade Options With A Small Account?

Yes, it’s possible to trade options with a small account using small account option strategies.

These strategies are designed to be low-risk and can be implemented with limited capital.

What Are Some Tips For Trading Options With A Small Account?

Some tips for trading options with a small account include starting with low-risk strategies, such as selling cash-secured puts or credit spreads, using proper risk management techniques, and avoiding high-risk strategies that can quickly deplete your account balance.

Conclusion

When it comes to trading a small option account, the first key is to be consistent and persistent.

Secondly, you need to have appropriate position size so that if any one trade goes bad, it doesn’t blow up your account.

It is essential to control risk via position size in order to let the probabilities and trade expectancy play out.

Keep an eye on the bid-ask spreads as well because slippage can take a big chunk out of your profits when trading a small account.

For this reason, it is important to only trade the most liquid underlying instruments.

Finally, have strictly defined rules in place for managing trades in terms of profit targets, stop losses and adjustment rules.

Take it slow and build up as you gain some experience.

If you have any questions or comments, please let me know.

If you enjoyed this article please share it and above all, have fun and trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gav, Just a quick question re. small accounts: is it “wise” to open trades with “high” value stocks? Say, you have a $10,000 account and you create a SPY vertical credit spread (currently around $360). If you are short 1 contract, that’s $360 x 100 = $36,000. What happens if you get exercised? Even though, you also have a long position, there maybe a chance that you can’t close your long position, immediately, and you are now stuck with $36,000 worth of SPY. Is this possible, is there a danger here?

Hi Blake,

Yes technically if SPY was between 305 and 309 right near expiry the trader could technically get exercised on the 305 call. You would need to check with your broker how they would handle that but it could involve a margin call. If the trader didn’t put up the funds, most brokers would just close the position automatically.

In any case, with vertical spreads, you would want to close the spread well before SPY reached the short strike.

Hello Gavin, thanks a lot for your articles. Great stuff.

I have a strong background in technical analysis and have made many buying options outright trades. Lately I have been getting into spreads. I know that there are ideal times to either buy or sell options, but considering that many “sell based” strategies have higher win rations, what is your opinion of being focuses exclusively on sell based trading?

Right now I am working with credit spreads (which I love), iron condors, and Broken Wing Butterfly’s. Wondering if going back to directional trades such as debit spreads, or directional butterflies is helpful.

I suppose I am wondering about how mixing both affects win rates, and feasibility of one method over another or integrating both. Any opinion you could share would valued. Thanks!

Hi Ramon,

Having a combination of both is a good idea, but I focus primarily on selling strategies. When volatility is low it’s good to start adding some buying strategies which are typically long vol.

Thanks for all the free info. you give out! I was wondering if you could tell us the list of stocks/ETFs on your watchlist, or how one would go about developing our own watch list.? I want to start looking at RSI divergences to do bear call spreads on. Thank you.

Here is a good starting point for ETF’s:

https://optionstradingiq.com/handy-etf-list/

For stocks, start with the Dow Jones stocks and then S&P 500 stocks with daily volume over 5 million:

https://finviz.com/screener.ashx?v=111&f=idx_sp500,sh_curvol_o5000

Hi Gavin,

Thanks for sharing your knowledge. Which software do you use for the graph of portfolio greeks?

That’s from my broker account – Interactive Brokers.

Hi,

You mention above to watch out for correlation. Can you suggest the best methodology to check if ETFs and Stocks are highly correlated or not?

Loving all information you are providing. Exceedingly helpful for newbie option traders.

Hi Russ, thanks for the kind words. There are plenty of free correlation calculators online if you do a Google search.