Last week I posted a Case Study looking at a couple of Short Strangles on IWM. The idea behind the case study was to see how the trades would perform and follow their progress.

After such a strong rally following the election, we were likely to see some sideways action or some mean reversion.

At the time IWM was trading at $130.45. It since rallied to $134.10 and today came back to $130. 97 which is only slightly higher than when we set up the case study.

This is perfect for the Short Strangle. We’ve had 5 trading days pass and the ETF is basically back where it started.

Let’s see how the trades are working out.

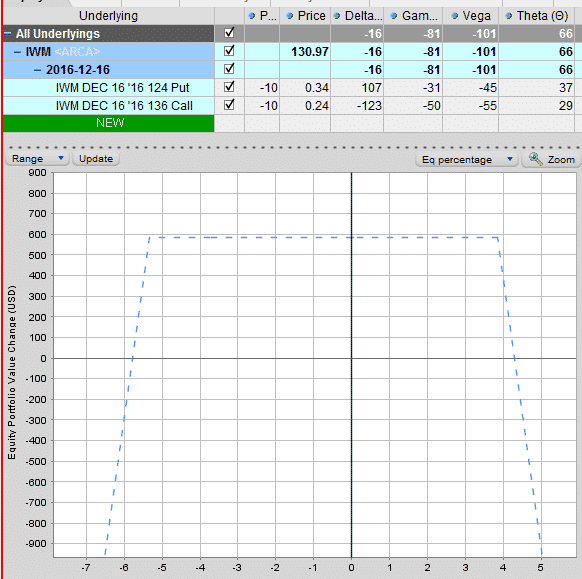

EXAMPLE 1 – 124 Put and 136 Call

Initially, the 124 put was trading at $0.84 and the 136 call was trading at $0.49. The profit potential in the trade was $1,330 for 10 contracts.

As of the close on Dec 1st, the 124 puts are trading at $0.34 and the 136 calls are trading at $0.26.

P&L on the trade so far is $730 out of a possible $1330 or around 55% of the total potential profit. Total return on capital (margin was $47,000) is 1.55%.

This would be a good time to think about taking profits.

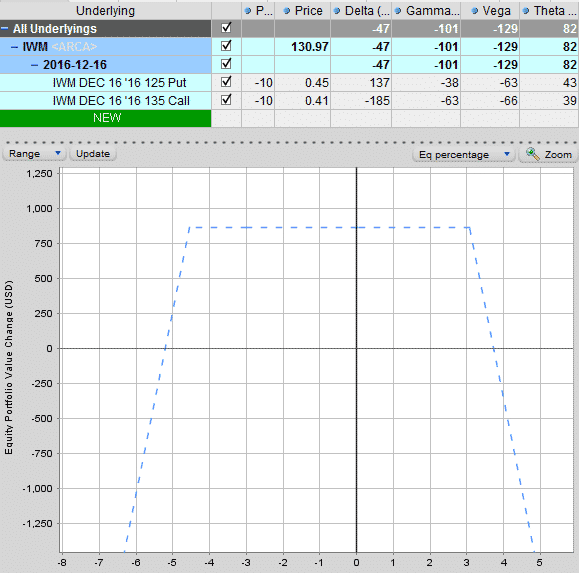

EXAMPLE 2 – 125 Put and 135 Call

The second example was slightly more aggressive by bringing the strikes in a little closer to the money.

The 125 put was trading at $1.01 and the 135 call was trading at $0.71. The profit potential in the trade was $1,720 for 10 contracts.

As of the close on Dec 1st, the 125 puts are trading at $0.44 and the 135 calls are trading at $0.42.

P&L on the trade so far is $860 out of a possible $1720 or around 50%. Total return on capital (margin was $49,000) is 1.43%.

Again, with profits currently at 50% of the potential, this would be a good time to think about taking profits.

What do you think of the above case study? Would you like see more of these going forward on the Blog? Let me know in the comments below.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Gavin, this is great educational material. Thank you for putting this together

Thanks Manuel, glad you liked it. I’ll do some more stuff like this going forward.

Short srangles are a bit risky in my view. I’d rather do an Iron Condor, albeit with less profit potential.

Yes they can be very risky and certainly are not for novice traders.

Gavin, I completely agree with Manuel, this exercise you detailed for us was extremely helpful and enlightening for me. I would certainly enjoy seeing and reading about more trade setups and performance like this one. Thanks!

Thanks for the feedback Kevin.

Hi Gavin,

I disagree with how you calculate profit. In this trade your margin per one contract is approx $4,747.00, total credit $172 so your max profit is 3.6%. This is what really you have at risk. You’re not at 50% but at 1.8% to date. Ten contracts would take $47,470 in margin. I think that is important that people understand the true/risk return.

Hi Steve, completely agree with you there. I meant the profit so far was 50% of the potential profit, not the return on capital. I mentioned the margin requirements in the original article, but forgot to put them in this article. I’m going to update the article now with the return on capital at risk. Thanks for the feedback.