Politics will continue to dominate the investing landscape in 2017. It remains to be seen if Donald Trump will implement all his planned policies, but clearly the market views his victory as a positive for the US economy and stock market. At least in the short term.

Trump’s appointment clearly demonstrates a frustration with the status quo from the middle class who are increasingly being squeezed. Wages are not growning; jobs are being cut due to technological advances and costs of healthcare and education are on the rise.

While Trump’s protectionist policies may help create jobs in the US, it could make the price of goods and services more expensive. For example, I read recently that the cost of an iPhone will jump from around $800 to around $1,200 if it is made in the US.

My concern is that politicians and central bankers continue to peddle voter friendly policies. Monetary and fiscal stimulus may feel great at first, but in the long run it may be counter-productive and simply results in “kicking the can down the road”.

However, for 2017 tax reforms and reductions in regulation will generally be seen as a positive for US companies and could encourage investment which would in turn lead to higher growth.

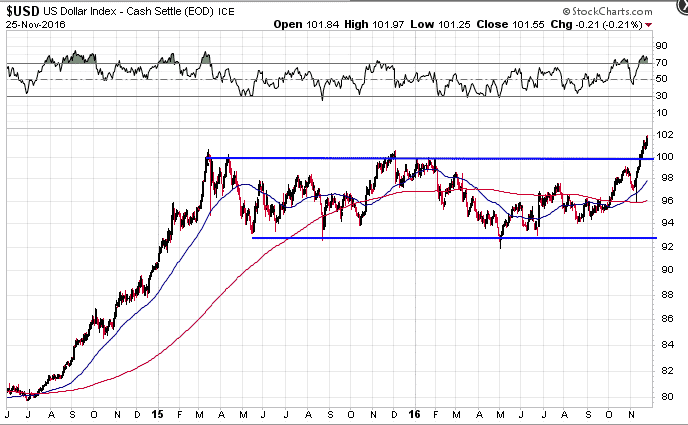

US DOLLAR

According to Deutsche Bank, it is expected the Fed will “carry out modest interest rate hikes in 2017” and that “the European Central Bank will expand its bond purchase programme beyond March 2017. The increasing interest rate differential between Europe and the USA will lead to capital flows towards the USA in the course of the year. This means the US dollar will further appreciate against the euro,”.

Deutsche Bank expects the euro to fall to 0.95 US dollars during 2017.

BONDS

It appears that one of the longest bull markets in history, the 30+ year rally in bonds, has now come to an end. It seems likely that the trend toward higher US interest rates will continue in 2017 but the pace of increase may not be as great as some are predicting following the election result. We would need to see significantly improved growth in the US before rates are ratcheted up too far.

STOCKS

Stocks have been on a tear lately and if you asked most people on the street, they would probably expect that to continue. There is always a recency bias when it comes to the stock market. If the market is rallying, people expect the good times to continue, if stocks are falling, they expect them to continue to fall.

That being said, 2017 has the potential to be a bumper year. For most of mid to late 2016 the S& 500 was bumping up against the 2200 level but struggling to break through. Recently, we have just broken through.

The question is, will the breakout hold?

A failed breakout over the next month could prove to be a strong bearish catalyst. From failed moves come fast moves, so bulls would want to see prices push higher and decisively clear resistance.

This scenario is unlikely though given strong seasonal tailwinds and strong bullish momentum. Holding that 2200 level is the key.

With small caps leading the charge in the latest rally, this may help drag the S&P 500 and Dow higher.

In 2017 we will likely continue to see a lot of inter-market rotation. Small caps instead of large caps, US stocks instead of emerging market and stocks over bonds.

The financial sector has been strong which is a very bullish sign for the economy. Banks will benefit from rising interest rates as they will be able to achieve higher margins. This chart from Investing Haven shows financials relative to the S&P 500 breaking out of a 6 year base. That could be a massive catalyst for stocks going forward.

COMMODITIES

Base metals are also breaking out after a 5 year bear market. It’s important here that the breakout is held in order to see further gains. We should know more over the next few weeks.

The rise in base metals has been led by copper which has risen 28% since mid-October. Dr. Copper is saying the global growth is picking up! Definitely worth keeping an eye on copper given it is a leading indicator of global growth.

Where gold trades in 2017 will depend largely on the US dollar. The greenback has been consolidating for 2 years and is looking like it will break out. That will be bearish for gold if that trend continues. Look for a retest of $100, then a further rally

SUMMARY

2016 had some slow and frustrating times for traders, but we did see some spiciness with a big sellof early in the year another selloff following Brexit mid-year and the fireworks around the election.

2017 should prove to be equally eventful I feel with a marked change in economic and political dynamics. Rates are on the rise, stocks are breaking out to new highs and Trump is the wildcard. Overall the outlook is bullish for stocks, the dollar and base metals and bearish for bonds and gold.