Contents

- How To Determine An Option’s Theta

- What Are The Characteristics Of Theta

- Option Buyers vs Option Writers

- When to Use Theta

- Conclusion

Options Theta is one of the most important tools for predicting how the price of options may change over time.

One of the characteristics of options is that they have a limited existence as they are contracts which contain a beginning and an expiration date. As the expiration date of the options contract approaches, the value of the contract will change.

The Theta value of an option serves to indicate how the price of an option will change as the expiration date approaches. It is important to note that Theta is not always accurate, nor does it have a linear relationship.

Nevertheless it is a highly useful measurement that should form part of every option trader’s toolkit.

How To Determine An Option’s Theta

An option’s Theta is determined as a result of its pricing model calculation. You can either calculate it yourself or you can find it through an option chain which is a listing of all available option contracts for a given security.

Your brokerage provider will usually have this information, but it can also be found for free online through sites such as nasdaq.com.

As this guide is focused on the practical use and characteristics of Theta, we’ve left out the mathematics behind the calculation.

However if you’re interested in calculating Theta yourself, there are many online sites that will walk you through the detail.

What Are The Characteristics Of Theta

Theta Value

The Theta value of an option is expressed as a negative number and indicates the amount by which the price of an option will fall by each day.

For example, say you had a call option with a current price of $4 and a Theta of -0.10 and you wanted to predict the price in five days. A Theta of -0.10 means that every day the option will experience a price drop of $0.10.

So after five days, the price of the option should fall to $3.50, all else being equal.

Note that while this simple example uses a linear relationship, in reality the effect of Theta on an option’s price is non-linear. We will cover this in the next section.

Theta Curve

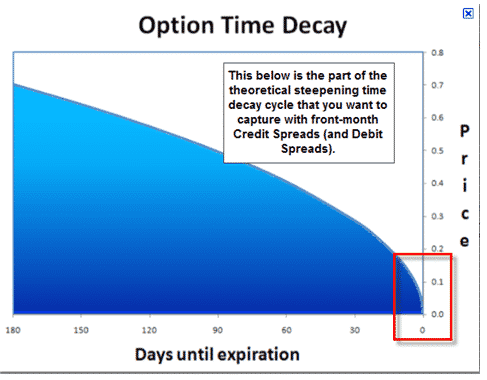

As the relationship between Theta and an option’s price is non-linear, the amount by which the option’s price will reduce each day will vary over time.

As an option’s time to expiration nears, Theta begins to increase exponentially. This is due to the fact that as the expiration date gets closer, an option has less and less time to make a move, resulting in a decrease in the value of that option.

This is an important dynamic to understand as it will influence whether you are in a winning or losing position based on being a buyer or writer of options, as the next section will cover.

Option Buyers vs Option Writers

If you are an option buyer, Theta is an unfavourable dynamic while as an option writer, Theta is a favourable dynamic.

This occurs because options become less valuable over time as the expiration date approaches. So for option buyers, they lose on the value of their option, while option writers benefit as it becomes cheaper for them to buy back the option and close out their short position.

Accuracy

Unfortunately, the use of Theta is not an exact science and should only be used as a rough estimate.

The reason for the lack of accuracy is that as the option gets closer to the expiration date, Theta starts to behave increasingly erratically making accurate predictions incredibly difficult.

As a result, it’s best to use Theta to get a rough understanding of how the option will behave over time and to put less faith in it the closer the option is to expiration.

Theta Over The Weekend

As markets are closed over the weekend, at first glance it would seem that there is an opportunity to open a new short position on the Friday and then close it Monday morning to collect two free days of Theta at low risk of the position moving. In practice however, market makers prepare for this scenario by either adjusting the volatility or time to expiration.

For example, the market maker may drop the volatility on Friday to account for the two days of decay that would normally occur over the weekend, and then drop the volatility back down on Monday. Bear this in mind when you have a position and you’re wondering whether to close it out on the Friday or wait until the following week.

When to Use Theta

Theta is generally best used in two circumstances. The first is when using strategies that rely on small directional movements in underlying securities over a short period of time. In this situation traders want to be trading options with low theta values so that time decay doesn’t wipe out their profits.

The second situation is when using strategies designed for a neutral market. In this situation traders are seeking to make a profit out of the effects of time decay so they will take positions where the overall theta value is sufficient so that they can benefit from the diminishing extrinsic value.

If a trader is using neither of those strategies and is instead seeking to profit from significant directional moves in underlying securities, then they generally will not concern themselves much with Theta as profits from directional moves should offset any loss of extrinsic value.

Conclusion

Option Theta is an important tool for option traders to understand the daily rate of decline in value of an option, leading up to the expiration date. Option writers stand to benefit the most from Theta as the decline in an option’s value means it is cheaper for them to buy it back when closing out their positions. While Theta isn’t always accurate, particularly closer to the expiration date, it is nevertheless useful in providing a rough estimate and is a valuable addition to an option trader’s toolkit.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.