Understanding technical trading signals can go a long way in helping you identify possible entry and exit points for a trade or to identify when a trend is coming to an end. One such signal is the exhaustion gap.

Contents

Introduction

You may already be familiar with a regular gap, which is when a stock opens above or below its prior closing price. This happens very often and is a regular feature of the stock market.

What happens much less often and is much more important, is an exhaustion gap.

This is where not only do you experience a gap up or down, but you also experience a strong counter-trend move that goes in the opposite direction to the way markets have been trending recently.

Exhaustion gaps can reverse daily, weekly and even monthly trends and can be either bearish or bullish in nature.

An exhaustion gap has three main characteristics. First, is that there is a noticeable upward or downward trend in prices over several days, weeks or months depending on the timeframe you’re looking at. Generally speaking the longer the trend has been sustained the better.

The second characteristic of an exhaustion gap is that a very sizeable gap in prices is created from one day to the next. A good rule of thumb is that a gap is at least, if not more than, half the range of an average trading day for whatever stocks you are looking at.

The final characteristic of an exhaustion gap is that there is high trading volume taking place on the day of the gap. This will be unusually high, sometimes in the range of 5-10 times or more than average.

One of the key risks involved in trading an exhaustion gap is that the price could gap more than once in a row. Therefore it’s never a guarantee that as soon as the first exhaustion gap has occurred, that the price will immediately reverse from that point.

It’s usually a good idea to monitor 1-2 bars after the exhaustion gap has occurred to confirm the play.

The Two Types Of Exhaustion Gaps

As mentioned previously, there is a bullish and bearish exhaustion gap. We’ll cover the mechanics of both of these now.

During a bullish exhaustion gap, a stock will have been experiencing a strong, sustained downtrend in prices. Then at some point an event occurs to trigger a sudden surge in selling pressure. For example, overnight a company may release a bad earnings report.

Image Credit: Bulls on Wall Street

With so many investors reacting to the bad earnings report, there is a lot of selling pressure during the following day’s market open so the price gaps downwards strongly.

At the same time, if there is a surge in volume, it means a lot of buyers have come to the party and are willing to buy up the shares being sold.

Eventually, all the shares being sold are bought up by the new sellers, meaning the supply of sellers has become ‘exhausted’. Once all the sellers are ‘exhausted’ (they have no more to sell), a bullish reversal occurs.

This is why it’s important to not only look at the actual gap in prices but to pay close attention to total volume as well.

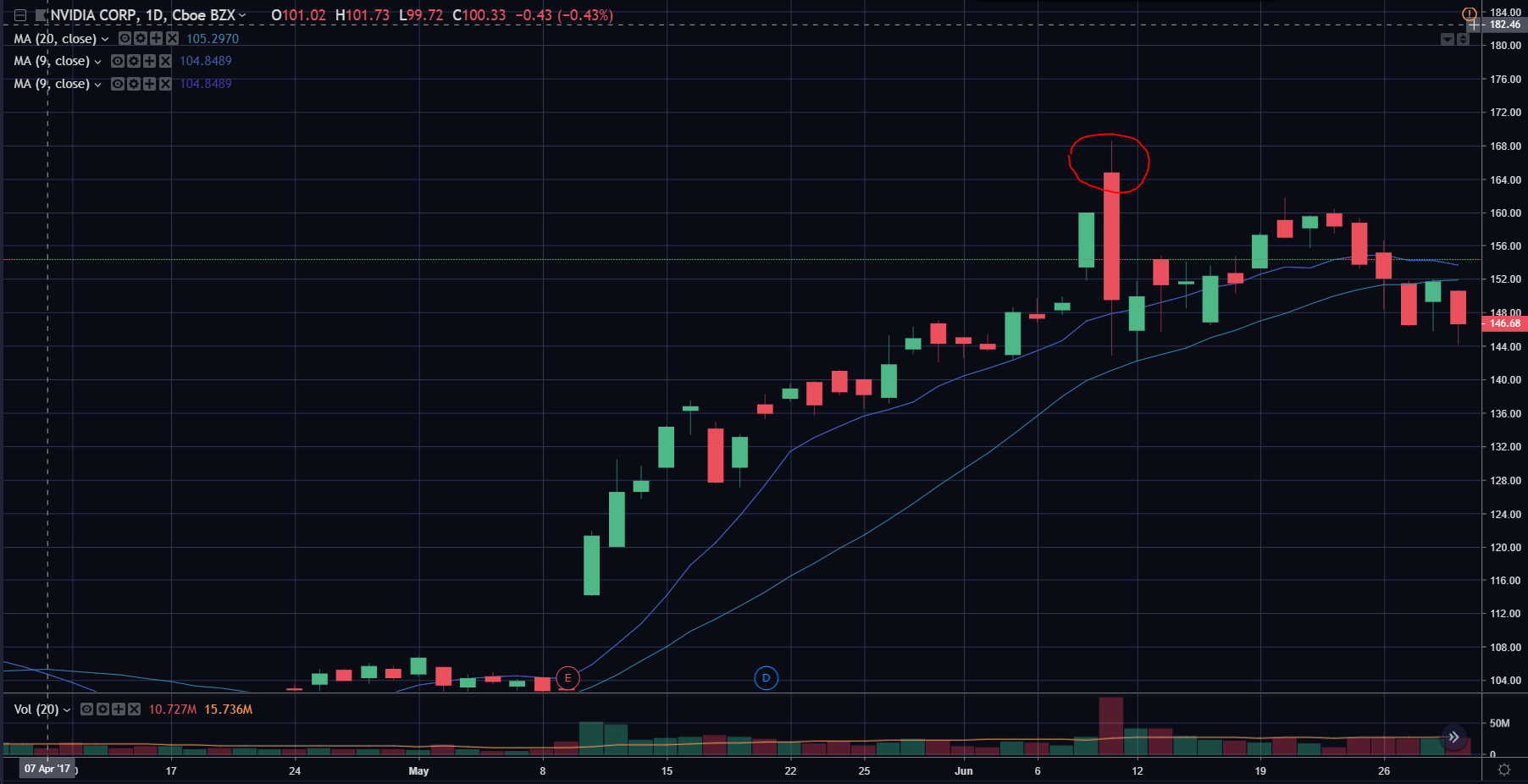

A bearish exhaustion gap works exactly the same way but in reverse. Rather than a strong, sustained downtrend in prices, it is instead an uptrend in prices.

Instead of a surge of sellers, it’s a surge of buyers and when the buyers become ‘exhausted’ the pressure from the sellers drives prices down.

Image Credit: Bulls on Wall Street

When To Use An Exhaustion Gap

You can choose to trade an exhaustion gap in one of two ways.

First, is to trade the exhaustion gap itself as it occurs. This is a very short term trading set up so when you trade it, you want to get in and out of out your position very quickly.

This can be over the course of several hours or at most several days. In this environment, you’re waiting for a sharp pullback occur.

The other way to trade an exhaustion gap is to use it as a signal for counter-trend trading.

For example, if you purchased a stock and enjoyed a long, sustained uptrend, you may use the exhaustion gap as a signal to exit your position in anticipation of the trend direction reversing.

In a similar way, you could use it as an entry point for buying stocks after a sustained fall in prices.

When using an exhaustion gap as a signal for entering a new position, it’s best to wait for several days before you execute the trade as the price could gap more than once in a row.

Conclusion

An exhaustion gap signals a reversal in trend direction and is comprised of three main characteristics:

- A noticeable, sustained trend preceding the move (can be an uptrend or downtrend)

- A sizeable gap in prices between one day and the next

- Much higher than normal trading volume

Traders can choose to trade the exhaustion gap itself or use it as a signal to enter/exit a trade at the end of a trend.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.