ETF’s are a great trading vehicle allowing traders and investors to gain exposure to a certain sector, geographic region or commodity.

This is especially helpful for options traders who want to diversify their trades and not focus on single stock names.

Small traders in particular can be burnt when trading a single stock if there is an adverse earnings report or news item. This risk can be spread out by trading ETF’s. For example, if a trader is bullish on technology, rather than trading AAPL or FB stock, they could trade XLK, which gives them exposure to a diverse range of technology stocks.

For those traders looking to trade ETF’s, there is a handy list provided by iShares that can be found at the link below. On this page, you can filter by Asset Class (Equity, Fixed Income, Commodity, Real Estate), Popular Strategies (Core, Currency Hedged, Sectors, Minimum Volatility etc.), Region (United States, Europe, Global, Asia) and Market (Emerging, Developed).

Very handy indeed if you’re looking to trade a broad based investment thesis.

https://www.ishares.com/us/products/etf-product-list#!type=ishares&tab=overview&view=list

The following list also has a comprehensive list of SPDR ETF’s, although the filtering capabilities isn’t as detailed.

http://etfdb.com/issuer/state-street-spdr/

Or you could visit the SPDR website directly:

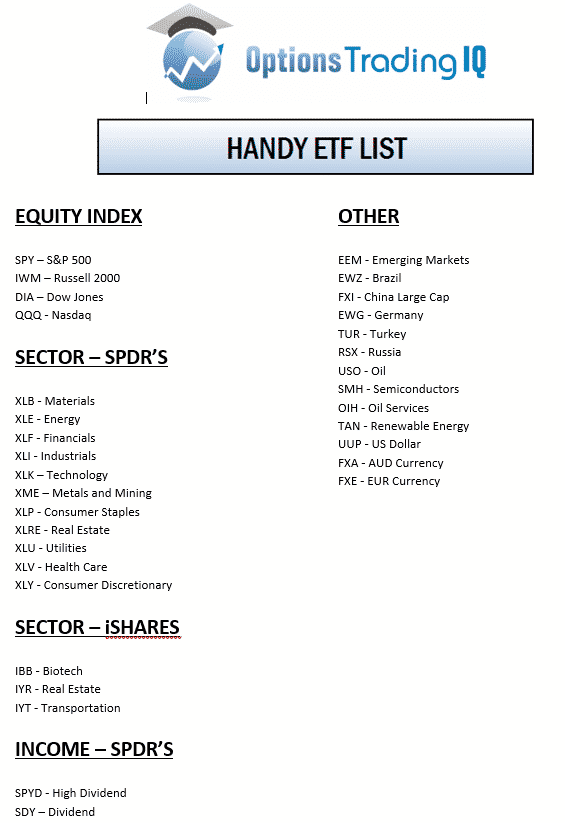

If you don’t want to sort through all the different options, you can just download my handy ETF List by clicking the button below.

I hope this helps you in your trading.

Gav.