To people who haven’t had experience in the financial sector or are first time investors, when they think of investing, their minds land on the concept of long-term investing.

Putting money in now, in the hopes of getting a return in a few years, sometimes even longer.

When I explain to this demographic what short term investing is, I like to refer to it ‘as doing what you would normally do over the space of a year, in a day or a few days’ when It comes to swing trading.

Once put that way people usually understand the outline of the concept in a matter of seconds.

But of course, you already know this – you are here to learn about the two most popular methods of short-term trading, Day trading and swing trading.

Image credit: medium.com

Day trading, as the name indicates, involves making multiple trades for the ‘day’ or when the market you’re trading in is open.

Swing trading shares similarities with Day Trading in that they’re short term positions.

Unlike a Day Trader, a Swing Trader may take multiple days or weeks to close their position on an investment from the date of opening it.

DAY TRADING

As mentioned above, Day Trading involves making multiple trades within a day – opening and closing your positions over the period in which you can exchange them in.

A successful Day Trader will start their day with no open positions or securities and end the day in the same spot having closed all the positions they opened throughout the trading period.

Day Traders base their trades on calculated analysis of market trends as well as relying on complex charting systems which also provides them with the ability to track changes within the market.

A Day Trader’s objective is to bring in an income from trading in various markets such as commodities (gold and silver), currencies, options and stocks.

The primary reason investors get into day trading, and short-term trading in general, is to try their hand in the amazing profits that are there to be made.

With most things in the financial sector those who display traits such as diligence and decisiveness often come out on top – this is true for Day Trading.

Those who can not make a fast decision based on credible information often make losses at the beginning of their trading journey.

Day Traders have an onslaught of competitors with millions of dollars behind them, these competitors can consist of hedge funds and high-frequency traders as well as other experts who gain advantages in the market through their heavy spending.

Professional Day Traders will talk about the adrenaline they receive from engaging in the volatile market every day. It is part of the job that they love the most – the level of excitement reached in Day Trading is hard to replicate in other professions.

A key piece of information to note is that you require no official education to become a Day Trader, you could start tomorrow if you want. It is highly recommended you take a course before to mitigate the risk of significant financial loss.

SWING TRADING

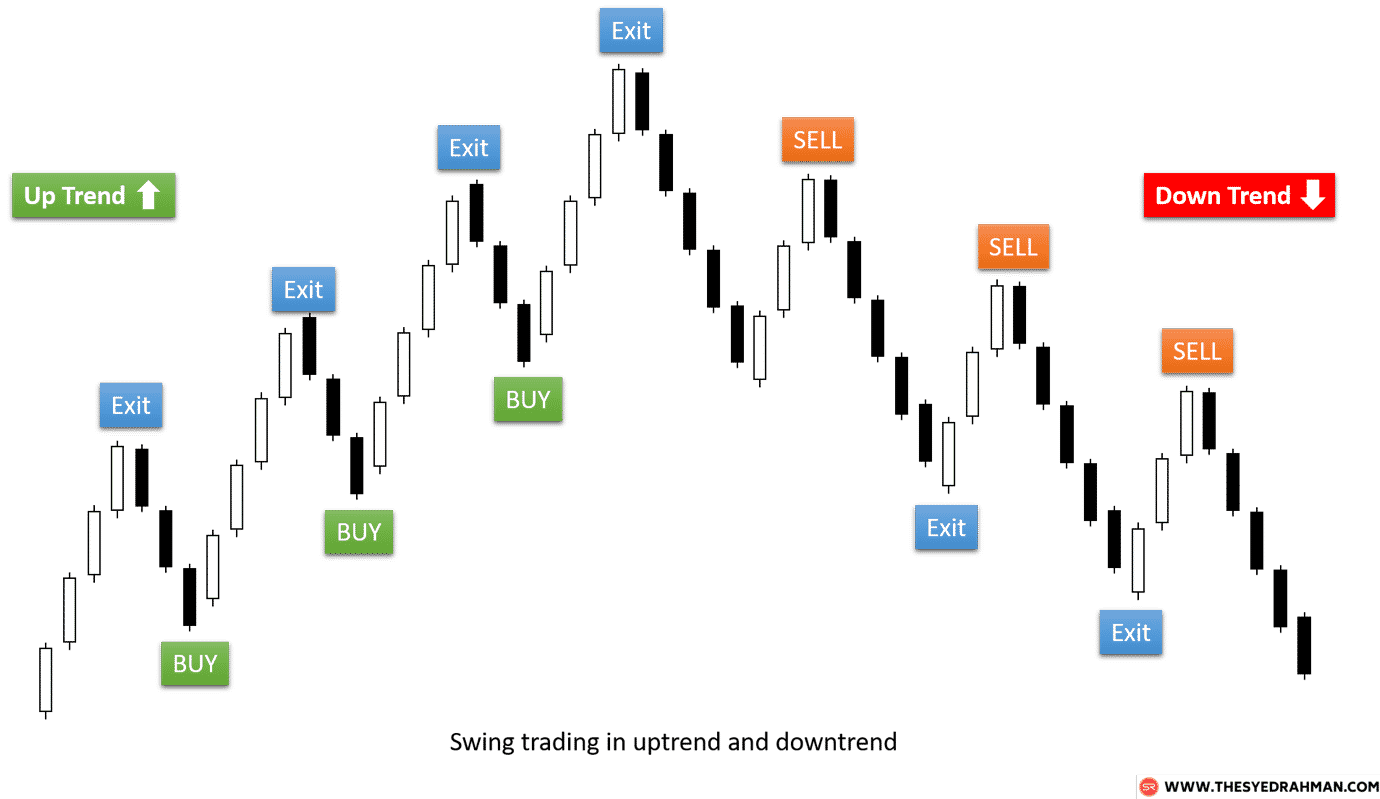

Swing traders track changes in various markets such as currency, stocks, and commodities over multiple days. It is not uncommon for a professional swing trader to take multiple days to make a trade in something they’ve had their eyes on.

A distinguishing feature between a Day and a Swing Trader is the differing goals the two hold.

Swing Traders will not usually seek to rely on their income from their trading to support them whilst a Day Trader will usually rely on their activities as their only source of income.

It takes a more extensive knowledge of the different markets to get a start in Swing Trading, as well as access to a sizeable amount of investment capital. An advantage of Swing Trading is that having your eyes on the screen all day is not required.

Many Swing Traders even have full-time employment outside of their trading activities, which outlines how it can be a ‘side hustle’ for a lack of a better term.

Image Credit: thesyedrahman.com

Swing investments take time – it is important to note this. The idea is that by keeping your position open for a few days or weeks it may result in higher profits for yourself rather than if you were opening and closing that security throughout the day.

The margins required to make a substantial profit in Swing Trading are most often higher than those in Day Trading as positions are held overnight.

When it comes to leveraging with Swing Trading the maximum is often twice the trader’s capital, whilst it can be up to 4 times for a Day Traders capital.

It should be noted that Swing Trading can result in extensive losses as the positions are being held for an extended period.

But, as is the case with all things, there is also a great opportunity to make significant profits if you do your due diligence and make smart trades, not ones based off impulses executed without research.

Conclusion

Both methods have their positives and negatives and the idea that one is better than the other is fundamentally flawed. They’re just different – that’s all.

Investors should choose the strategy that works best for them based and their skills.

However, as a rule of thumb, Day Trading is more suitable for those investors who have strong self-discipline, whereas Swing Trading does not require the same level of discipline, this allows the investor to gauge how the market is going over some time, rather than being pressured to sell at the slightest downturn.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.