One of the most consistent, easiest to understand and easiest to implement option strategies is covered calls.

Investor sell or write a call options over stocks they own in exchange for collecting a premium. 1 call option contract represents 100 shares, so investors can sell multiple call options if they have a particularly large stock holding.

Over time, covered calls have the potential to add extra returns while also decreasing the volatility of a portfolio.

I like to trade this strategy on blue chip, low volatile stocks. This way you can generate a tidy sum from selling the call options and also receive a healthy dividend while you own the stock.

PFE is one stock that meets that criteria.

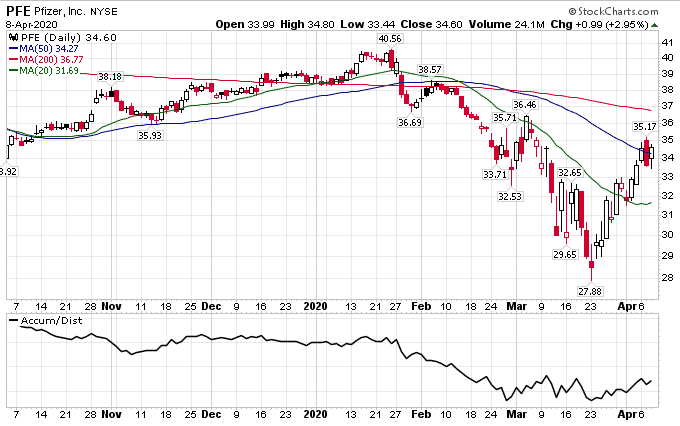

Pfizer, Inc.

Since hitting a high of $40.56 back in January, PFE stock dropped but in only 14.69% from that level.

Earnings are set for April 28th and the company is expected to post earnings per share of $0.57 down 32.94% from the prior year quarter.

Full year EPS estimates are coming in around $2.80 on revenue of $46.10 billion which would represent year-over-year changes of -5.08% and -10.93% respectively.

Not stellar numbers by any means, but PFE is a defensive play that should hold up well during a recession. Defensive stocks might be a good idea in this environment.

Add that to the fact the stock pays a chunky 4.52% dividend it can be a worthy addition to any portfolio.

Despite the stock decline, the company has continued to increase the dividend payout. With quarterly payments being raised to $0.38 las quarter.

By combining stock ownership with covered call trading, investors can further boost the income potential from this healthcare giant.

Implied volatility is elevated across the board currently due to the coronavirus situation. That means juicy premiums for option sellers.

PFE implied volatility is currently around 35%, not as high as the 70% we saw recently, but still higher than the 15-20% at which is usually trades.

With the stock currently trading at $34.60, traders could sell a September 18th $36 Call for $1.60.

Such a trade would provide potential for a little bit of capital growth and would increase the income potential by another 10.42% per annum.

If PFE closes above $36 at expiry, the trade would return 8.67% or 19.54% annualized.

The $1.60 in premium received also gives downside protection to the tune of 4.62%. That means, the stock could be 4.62% lower at expiration and the trade would still be at breakeven.

The total capital at risk in the trade is $3,480 and if the stock went to zero, that’s how much the trade would stand to lose.

Covered calls are a fantastic way to generate extra income for a stock holding while also providing some downside protection.

The downside is that any gains above $36 are capped and the investors shares would be called away at that price, not matter how high PFE goes.

Looking at the chart, the stock has just crossed back above the 50-day moving average, but might find strong resistance from the 200-day moving average which is just above at $36.90.

On the downside, the 20-day moving average around $31.80 would provide a nice level for a stop loss and a good line in the sand to get out of the trade if it’s not working out.

Brian from 10 Factorial rocks has some good information on dividend investing if you’re interested.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.