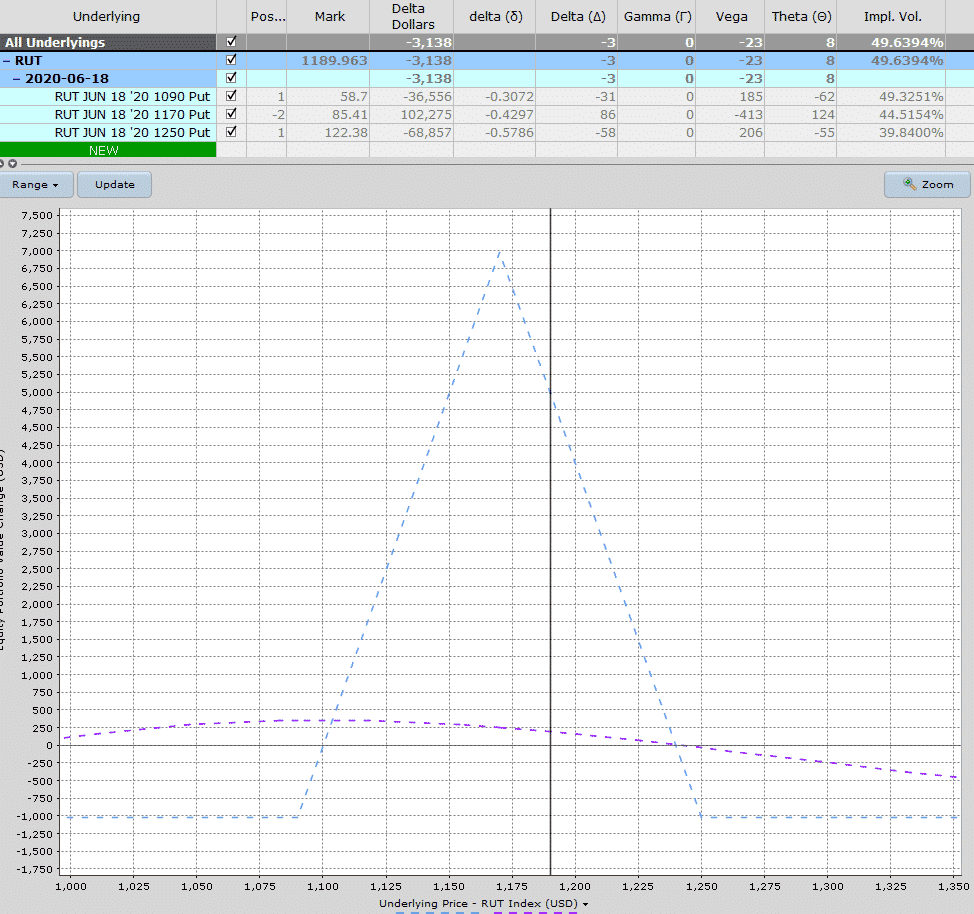

Think this trade might work well in this environment, nice profit potential on the downside and not giving up too much on the upside.

If we hit the upper wing at 1250, I will add a second butterfly centered at 1230.

If we hit the lower wing at 1090, I will add a second butterfly centered at 1110.

Normally I would center the initial trade 40 points below the RUT price, but I went slightly off plan this time because I liked the payoff graph of this version better. Basically I wanted to have a bit more margin for error on the upside in case the market continues rallying.

You can learn more about bearish butterflies in my free butterfly course.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.