A bear call spread is a very common trade for options traders. It has a directional bias as hinted in the name and also benefits from time decay, so it is popular with income traders.

Contents

- What Is A Bear Call Spread?

- Maximum Loss

- Maximum Gain

- Breakeven Price

- Payoff Diagram

- Risk of Early Assignment

- Bear Call Spread Calculator

- How Volatility Impacts Bear Call Spreads

- How Time Decay Impacts Bear Call Spreads

- Delta

- Gamma

- Risks

- Bear Call Spread vs Bear Put Spread

- Trade Management

- Short-Term vs Long-Term Bear Call Spreads

- Bear Call Spread Examples

- Frequently Asked Questions About Bear Call Spreads

- Summary

What Is A Bear Call Spread?

A bear call spread is a type of vertical spread, meaning that two options within the same expiry month are being traded.

One call option is being sold, which generates a credit for the trader. Another call option is bought to provide protection against an adverse move.

The sold call is always closer to the stock price than the bought call.

As the name suggests, this trade does best when the stock declines after the trade is open.

However, there can be many cases where this trade can make a profit if the stock stays flat and even if it rises slightly.

We’ll look at lots of examples later in this post, including how to manage the trade when it goes against you.

Bear call spreads are risk defined trades, there are no naked options here, so they can be traded in retirement accounts such as an IRA.

Maximum Loss

The maximum loss on a bear call spread is limited.

The worst-case scenario is known in advance so there will be no surprises for the trader If disaster strikes.

If the stock rallies and moves above the bought call the trader will be sitting on an unrealized loss.

If this move occurs early in the trade, the loss may be less than the maximum because of the time premium remaining in the options.

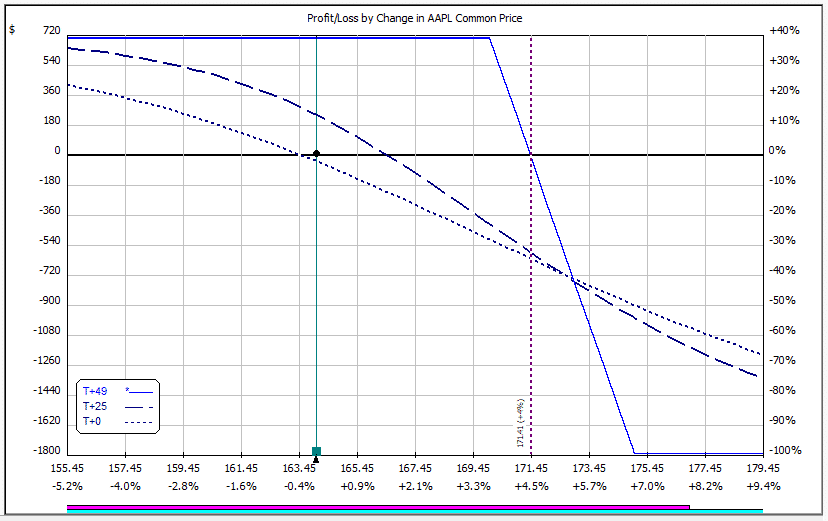

This is shown in the example below.

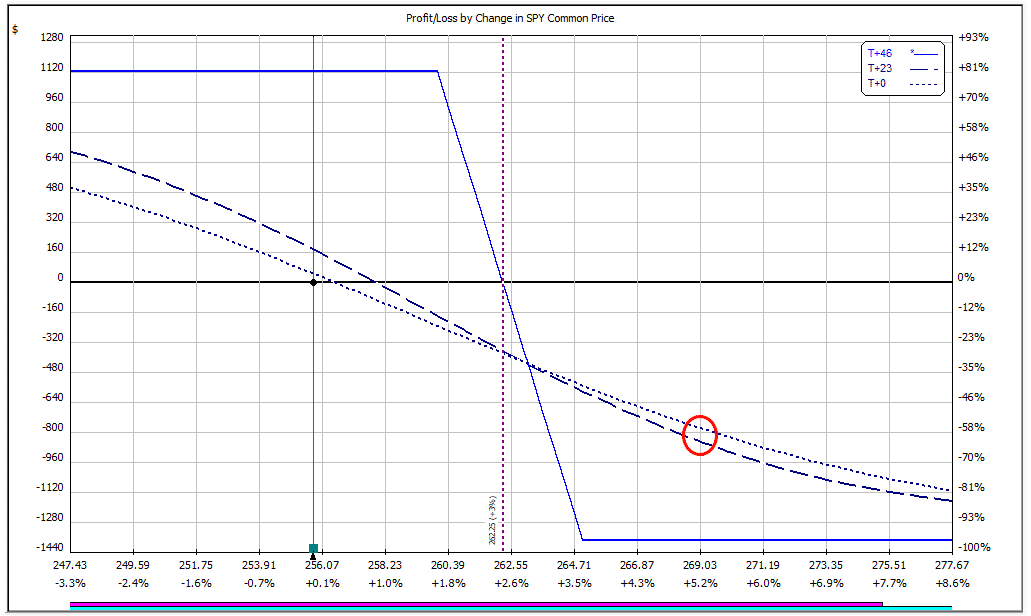

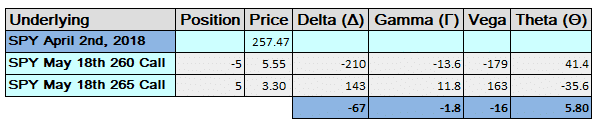

Trade Date: April 2nd, 2018

SPY Price: 255.78

Sell 5 May 18th, 2018 260 Call @ $5.55.

Buy 5 May 18th, 2018 265 Call @ $3.30.

Spread Price: $2.25

Net Credit: $ 1,125 (2.25 x 500)

At initiation, this trade was slightly out-of-the-money with SPY trading around $255 and the spread placed at $260-$265.

The trader was expecting that SPY would stay below $260 over the course of the trade.

Max Loss: $1,380

Breakeven: $262.25 (260 + 2.25)

On the payoff diagram, we can see that halfway through the trade’s duration, if SPY rises to 269, the maximum loss is not yet incurred.

However, if SPY stays at that level, the losses will continue to get larger heading towards expiry, eventually suffering the full max loss.

Maximum Gain

The maximum gain on a bear call spread is also limited and it is a bit easier to calculate.

It is simply the amount of credit, or premium, received at trade initiation.

The best-case scenario is that the stock stays below the sold call for the duration of the trade and finishes below on expiry day.

Both options expire worthless and the options are removed from the traders account and he keeps the premium.

In the above example, $1,120 in premium was received at trade initiation and this is the maximum gain that can be achieved from the trade.

Like the maximum loss, the maximum gain can only be achieved at expiry.

In our example, if SPY drops to $250, but it happens half way through the trade, only about half of the potential profit will be made if the trader closes out the position.

Time decay will work in his favour in this case and the position will continue to gain profit as time passes if SPY stays below the $260 level.

Trade management is very important, and we’ll look at that later in this post.

Breakeven Price

The breakeven price for a bear call spread is calculated as the short call strike price plus the net credit received.

In our example this would be 260 + 2.25 = $262.25

If SPY finishes exactly at $262.25 at expiry, the short call will be exercised.

The investor will be forced to buy the stock in the open market at $262.50 and then use those shares to cover the assignment of the $260 call.

Buying at $262.25 and selling for $260 results in a loss of $2.25 per spread, but this is exactly offset by the $2.25 premium received initially.

Therefore, the net result for the trader is $0.

Of course, this ignores commissions and slippage. Some brokers will charge a fee for assignment.

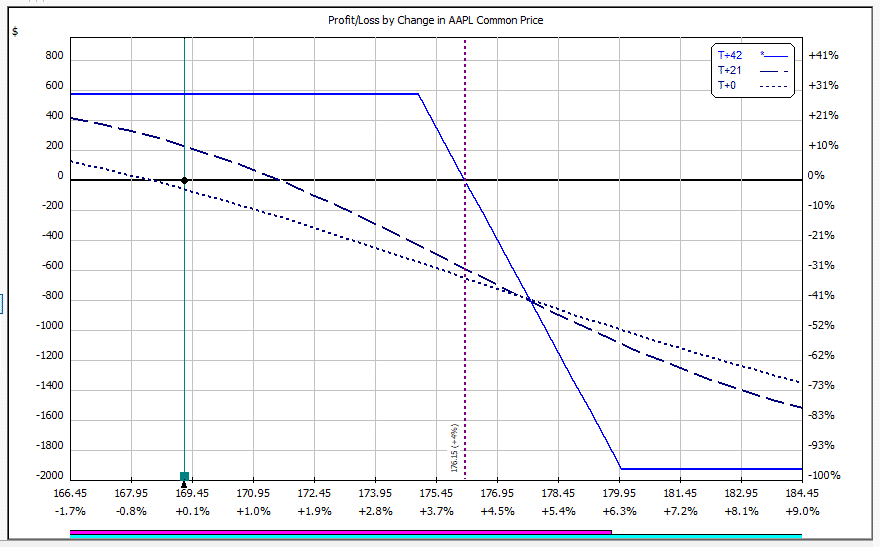

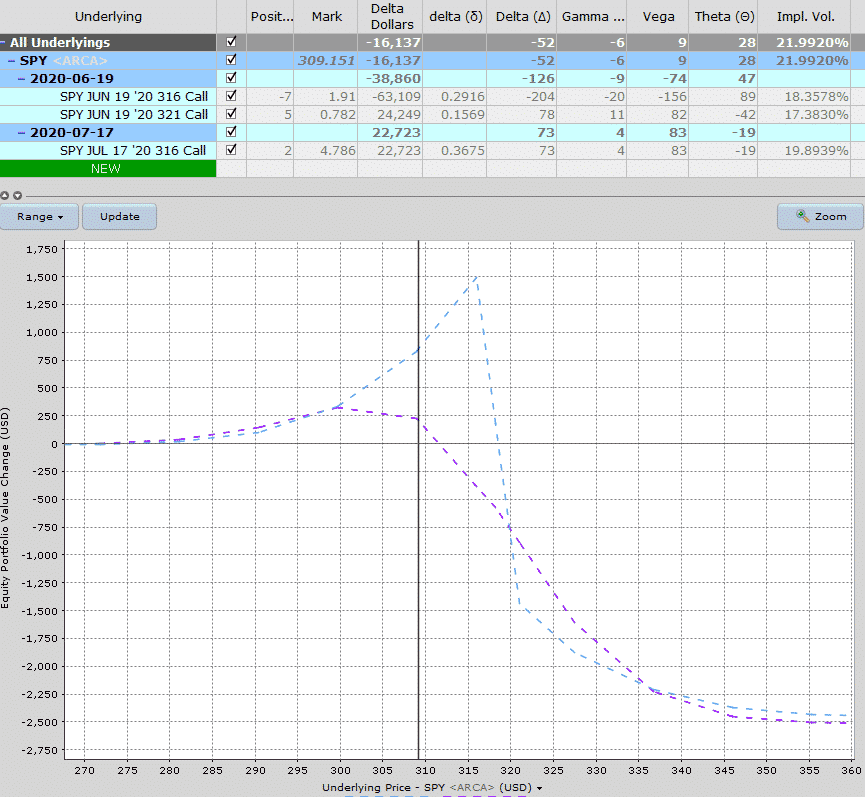

Payoff Diagram

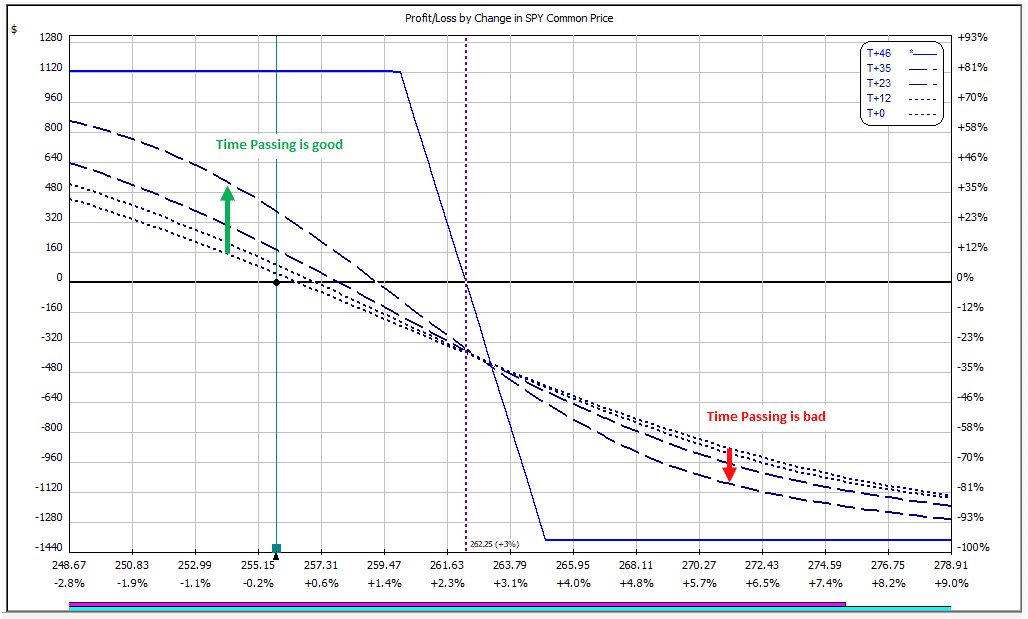

We’ve already looked at an example of a bear call spread payoff diagram above, so I won’t go into it in too much detail here.

The key point to remember is that the maximum profit and maximum loss are not going to occur until right at expiry.

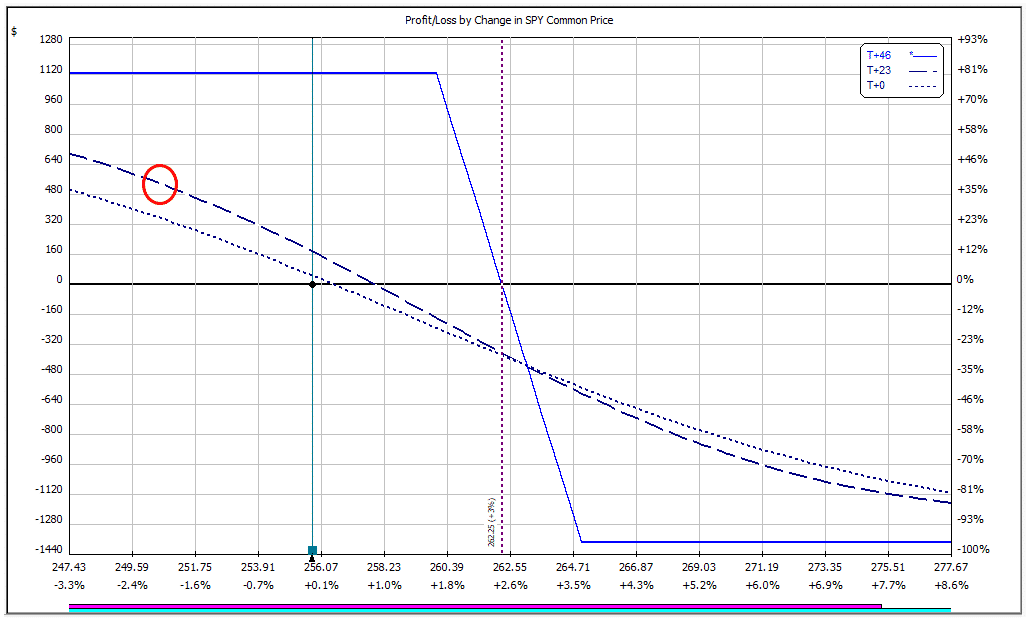

In the image below you can see multiple step through dates which gives you an idea of how the trade progresses over time.

Keep in mind this does not take into account any changes in implied volatility.

Notice that even with only 2 days to expiry (T+44 line), the trade is still a decent way from achieving max profit or max loss at prices close to the spread.

Risk of Early Assignment

In this case, if SPY stays above the bought call, there is a huge risk of early assignment which can occur at any time but tends to happen close to expiry when there is little time premium left in the trade.

If this was to occur, the trader will be assigned on the short call, and can simultaneously exercise the long call.

This process will mean selling the stock at the lower strike and buying the stock at the higher strike.

The maximum loss is the difference between the two strikes, but it is reduced by the net credit received at the outset.

Therefore, the maximum loss is the difference between the strikes x the number of contracts x 100 – the premium received. In our example above that works out as:

5 x 5 x 100 – 1120 = $1,380

It’s a pretty simple calculation once you get the hang of it, but you can download a simple calculator below if you need some help.

Bear Call Spread Calculator

Bear calls spreads are a very popular trading strategy for beginners and I always have a lot of people asking me for a calculator that gives the max profit, max loss, breakeven, percentage return on capital and distance to the short strike.

I’ve created a very simple excel based calculator that can be used for both bear call spreads and bull put spreads.

If you want a copy just click the button below, put in your email and you will get a copy straight away.

If you have any questions on the calculator, just send me a return email and I’ll be happy to help.

How Volatility Impacts Bear Call Spreads

Volatility will not have a huge impact on bear call spreads.

The short call will benefit from falling volatility and the long call will benefit from rising volatility.

Therefore, the two tend to mostly offset each other.

That being said, the impact of volatility can depend on where the stock is trading in relation to the strikes in the bear call spread.

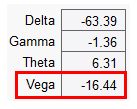

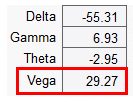

Vega is the greek that measures a position’s exposure to changes in implied volatility.

If a position has negative vega overall, it will benefit from falling volatility.

If the position has positive vega, it will benefit from rising volatility.

You can read more about implied volatility and vega in detail here.

Looking at our example trade again, at trade initiation the position has a negative vega exposure. All things being equal, the trade will do well if volatility drops.

Vega exposure at trade initiation – SPY at $255.78

Here we can see the initial position has a vega of -16.44 to start with.

The vega exposure will change as time passes and as the stock price moves.

If we fast forward to April 18th, SPY has risen to $270.82 and is above the level of our bought call.

In this case, the vega exposure has flipped from negative to positive, so at this point in time the trade will benefit from rising volatility.

Generally speaking, bear call spreads will have negative vega when the stock is below the short call and positive vega when the stock is above the bought call.

How Time Decay Impacts Bear Call Spreads

Like volatility, time decay can vary depending on where the underlying stock is trading.

Traders placing a standard out-of-the-money bear call spread will start their trade with positive theta.

This means they will make money from time decay as time passes, with all else being equal.

If the stock trades above the bought call, the position will switch to having negative time decay and the passage of time will hurt the trade.

Thinking about it logically this makes sense.

If the stock is below the short call, we want time to pass as the trade will move slowly towards the maximum gain.

If the stock is above the bought call, the trade will move closer to the max loss as time passes.

You can see this in the diagram below.

Delta

Being a bearish trade, the delta of a bear call spread will always be negative no matter what stage of the trade you are in or how it is set up.

The trade does well when prices decline. Pretty obvious, right?

What else do we need to know about delta when it comes to trading bear call spreads?

Well, delta can be used as a rough approximation of the probability of the underlying stock reaching a certain level.

For example, if we sell a 10-delta call, there is a roughly 10% chance of that call option expiring in-the-money.

Now, unfortunately it’s not quite that simple, that’s why I said roughly a 10% chance. It’s not an exact science and there are many different variables that go into the options pricing model.

Delta can be used as an estimate of probability and is certainly useful to know.

But, don’t assume that if you sell 20 delta puts you are going to win 80% of the time. It doesn’t work out that way in real life.

Be aware of the limitations of using delta as a probability.

Gamma

Gamma is one of the lesser known greeks and usually, not as important as the others.

I say usually, because you’ll see further down in this post why it can be really important to understand gamma risk.

I won’t go into too much detail on gamma here, because it will be explained in more detail below when we compare long-term and short-term bear call spreads.

Risks

It goes without saying that as a bearish trade, we have a risk that the price of the underlying will rise causing an unrealized loss, or a realized loss if we close the trade.

Some other risks associated with bear calls spreads:

Assignment Risk

Another risk of the trade is the risk of early assignment. While this doesn’t happen often it can theoretically happen at any point during the trade.

The risk is most acute when a stock trades ex-dividend.

If the stock is trading well below the sold call, the risk of assignment is very low.

For example, a trader would generally not exercise his right to buy SPY at $260 when SPY is trading at $250 purely to receive a $0.50 dividend.

The risk is highest if the stock is trading ex-dividend and the short call is in the money.

One way to avoid assignment risk is to trade stocks that don’t pay dividends, or trade indexes that are European style and cannot be exercised early.

However, this should not be the primary factor when determining which underlying instrument to trade.

Otherwise, think about closing your bear call spreads before the ex-dividend date if they are close to being in-the-money.

Expiration Risk

Leading into expiration, if the stock is trading just above or just below the short call, the trader has expiration risk.

The risk here is that the trader might get assigned and then the stock makes an adverse movement before he has had a chance to cover the assignment.

In this case, the best way to avoid this risk is to simply close out the spread before expiry.

While it might be tempting to hold the spread and hope that the stock drops and stays below the short call, the risks are high that things end badly.

Sure, the trader might get lucky, but do you really want to expose your account to those risks?

Bear Call Spread Vs Bear Put Spread

No prizes for guessing that these are both bearish trades and that one uses puts and the other users calls.

The other major difference between the two is that the bear call spread is a credit spread (we receive option premium) whereas the bear put spread is a debit spread (we pay option premium).

Traders sell a bear call spread and option premium is received into the traders account.

For a bear put spread, traders buy the spread and therefore have to pay money out of their account.

So, how do you determine which trade is right for you?

To be honest, it really doesn’t matter because they are both almost identical trades.

Example:

Let’s use our SPY bear call spread example.

We used the $260-$265 spread and received $1,120 in premium with a max loss of $1,380.

If instead we bought a $265-260 bear put spread, it would have cost $1,410 with a max gain of $1,090.

In this case we would be slightly better off trading the bear call spread to the tune of about $30.

If we compare the payoff graphs, we could also say that the bear put spread performs better during the interim dates vs the bear call spread.

If we move forward in time to April 18th when SPY hits $270.82 the bear put spread is -$1,045 and the bear call spread is -$1,010. So again, not a whole lot of difference.

The main thing to keep an eye on when deciding on a bear calls spread vs a bear puts spread is the implied volatility skew.

If the calls have a high level of implied volatility compared to the puts, then a bear call spread may be more advantageous and vice versa.

Just check the max gain and loss for each and see if there is any major difference. In practice, most of the time, there is not going to be much difference.

Typically, traders will use bear call spreads as an income generating trade and therefore place the spread out of the money.

Traders using the bear put spread, would usually take a more speculative view.

They might buy an out-of-the-money bear put spread, something they can do fairly cheaply with the aim of making a large profit.

For example, rather than buying the $265-$260 spread, they might be more likely to buy the $245-$240 spread which costs only $480 and has a max profit of $2,020.

Trade Management

Honestly, I could do a month-long course purely on trade management for bear call spreads, but I’ll cover some of the basics here as best I can.

A lot of the principals are the same as for iron condors which is covered in my free 10-part course.

The best idea, especially when starting out, it to keep things simple.

You don’t want to overcomplicate things with too many different rules and adjustment techniques.

There are plenty of adjustment techniques available, and I could list out 15 or so, but sometimes it’s best to pick one or two and really master those.

Let’s look at a few ways we can manage bear calls spreads.

Profit Target

First and foremost, it’s important to have a profit target.

That might be 50% of the credit received, 80% of the credit, or your plan may involve holding until 100% is achieved.

That’s the first decision.

One nice rule of thumb that I use – if I’ve made 50% of the profit in less than 50% of the duration of the trade, I take the profit.

Another profit taking rule you might consider is – closing when the spread value drops to $0.10 or $0.05.

Sometimes the opportunity cost of tying up your margin for the sake of squeezing the last few dollars out of the trade is not worth it.

Stop Loss

Having a stop loss is also important, perhaps more so than the profit target.

Here you can set a stop loss based on percentage of the premium received OR percentage of capital at risk.

Some traders like to set a stop loss at 20% of capital at risk.

Others might set it as 50% of the premium received.

If your profit target is 50% of premium received and your stop loss is 50% of premium any success rate greater than 50% will see you come out ahead.

Then it’s just a numbers game and making sure you have enough trades to make sure the statistics play out.

Another way to set a stop loss would be to look at delta.

For example, if you sell the 10 delta call as part of your bear call spread, you might close the trade if the delta of that option hits 25.

Each to their own, but this is all something that should be written down and mapped out in your trading plan.

Adjustment Techniques

The first adjustment technique most traders learn is to Roll Up.

This involves buying back the spread that was initially sold and selling a new spread further out-of-the-money within the same expiry period.

There is a cost involved with this because the spread that is being bought back will cost more than the new one that is being sold, sometimes significantly so.

Let’s look at an example:

Trade Date: February 14th, 2018

SPY Price: 269.66

Sell 5 Apr 20th, 2018 275 Call @ $3.68.

Buy 5 Apr 20th, 2018 280 Call @ $1.93.

Spread Price: $1.75

Net Credit: $ 875 (1.75 x 500)

Max Loss: $1,625

Breakeven: $276.75 (275 + 1.75)

If we move forward to March 12th, SPY has risen to 278.50 so the underlying is sitting above the short call.

The spread is trading at $3.11 and we are sitting with a $680 unrealized loss.

What we can do in this case is buy back the five 275-280 spreads for a total of $1,555 and sell the 280-285 spreads for $1.96 per spread or a total of $980.

The net cost of the adjustment is $575 or $1.15 per spread.

We have reduced out profit potential in the trade, but we have given ourselves a bit more room to move and once again placed our call spread out-of-the-money.

New Maximum Gain: $300

New Maximum Loss: $2,200

New Breakeven: $280.60

Roll Out Adjustment

The next adjustment technique we’ll look at is a Roll Out where we keep the strike prices the same, but we move them to a future expiry month.

The spread can be rolled to the following month, or it can be rolled out multiple months.

Using the same example, we buy the April 275-280 spreads for $3.11 and we roll out to the May 275-280 spread which is trading at $3.23.

This adjustment doesn’t cost us anything and actually brings in a little bit of extra income.

For 5 contracts this represents a total increase in premium of $60.

While we have brought in some extra income, using this adjustment means we are stuck in the trade for another month.

New Maximum Gain: $935

New Maximum Loss: $1,565

New Breakeven: $276.87

Roll Up And Out Adjustment

Our final adjustment strategy is a Roll Up and Out. In this example we’ll Roll Up to 280-285 and Roll Out to May.

We buy the April 275-280 spread for $3.11 and sell the May 280-285 spread for $2.43.

The net cost is $0.68 per spread or $340.

The adjustment has cost a bit less than simply rolling up, but we need to hold the trade for another month.

New Maximum Gain: $535

New Maximum Loss: $1,965

New Breakeven: $281.07

These are three simple adjustment techniques, all with positives and negatives.

There are many more ways to adjust bear call spreads but these three are the most common and easiest to understand.

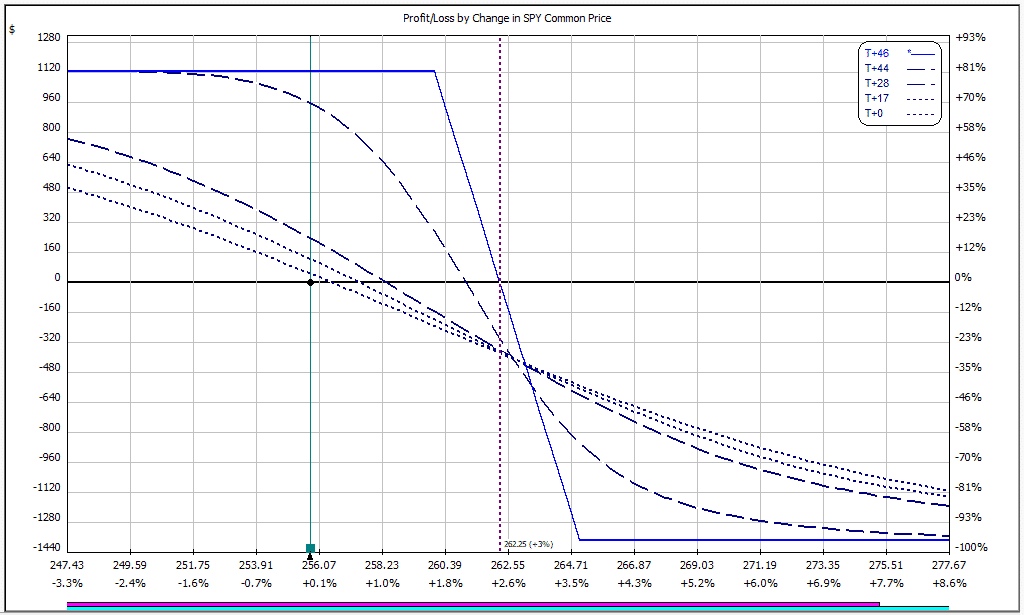

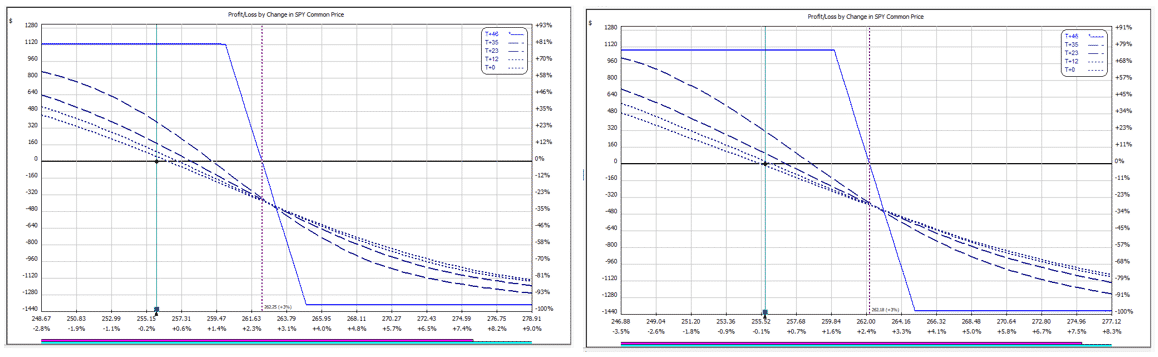

Short-Term Vs Long-Term Bear Call Spreads

I harp on about this quite a lot with my mentoring students, but short-term trades of any kind are very risky.

The reason is because of gamma as I alluded to earlier.

Short-term trades have very high gamma, which means they are very sensitive to changes in price.

Trades with high gamma will see their delta change at a much faster rate than low gamma trades.

If you want a full tutorial on gamma, you should read this article.

Long-term trades have a much lower gamma and therefore are not as sensitive to changes in price.

Let’s compare a short-term and a long-term bear call spread:

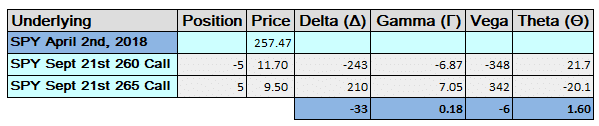

Taking our SPY example from April 2nd, we’ll use the May 18th expiry trade as our short-term trade and a Sept 21st trade using the same strikes as our long-term trade.

SHORT-TERM – 46 DAYS TO EXPIRY

LONG-TERM – 172 DAYS TO EXPIRY

You can see above, some key differences in the greeks.

While the two trades are using the same strikes, the delta exposure on the short-term trade is much higher than the long-term trade.

Gamma is almost non-existent in the long-term trade.

We can see quite clearly that short-term trades have higher greeks across the board and will therefore see much higher P&L movement than longer-term trades.

We can see this in practice when we roll forward to April 18th when SPY had risen to 270.82 and both spreads were fully in-the-money.

The short-term trade had lost $1,010.

The long-term trade had lost only $530.

The trade-off of course is that the longer-term trade will see profits accrue much slower than the short-term trade.

Bear Call Spread Examples

Alrighty. Well done for sticking with me till now.

We have covered a lot and things are about to get a little more intense as we go through some detailed bear call spread examples.

1. Bear Call Spread on a Falling Stock

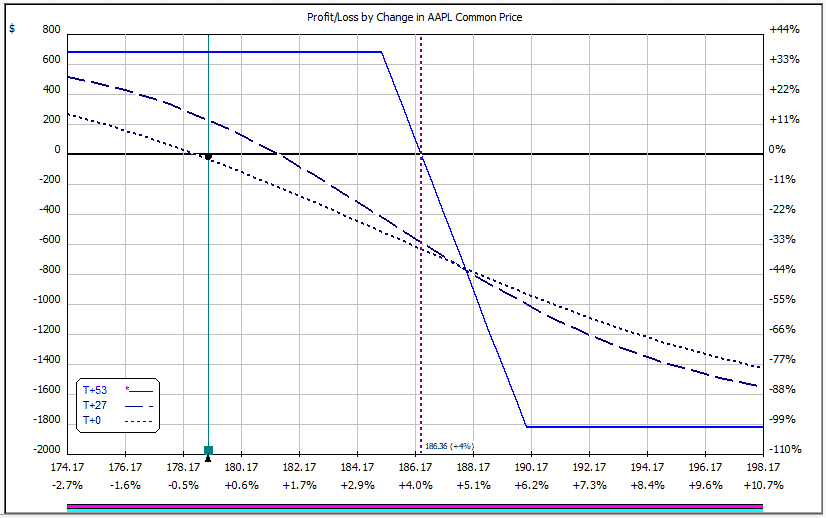

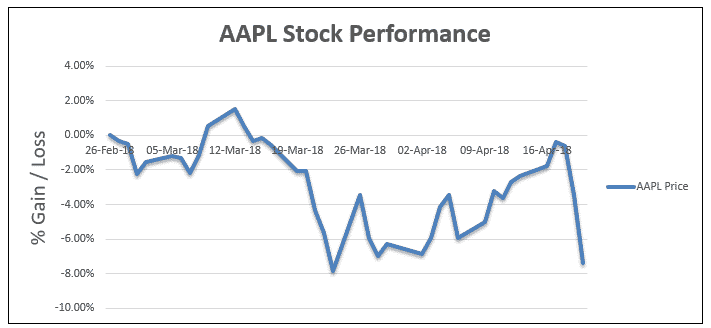

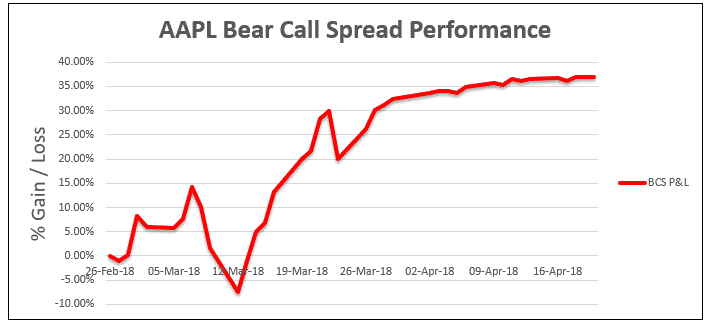

The first example we’ll look at is on AAPL stock. Here are the details:

Trade Date: February 26th, 2018

AAPL Price: 179.05

Sell 5 Apr 20th, 2018 185 Call @ $2.95.

Buy 5 Apr 20th, 2018 190 Call @ $1.60.

Spread Price: $1.35

Net Credit: $ 675 (1.35 x 500)

Max Loss: $1,825

Breakeven: $186.35 (185 + 1.35)

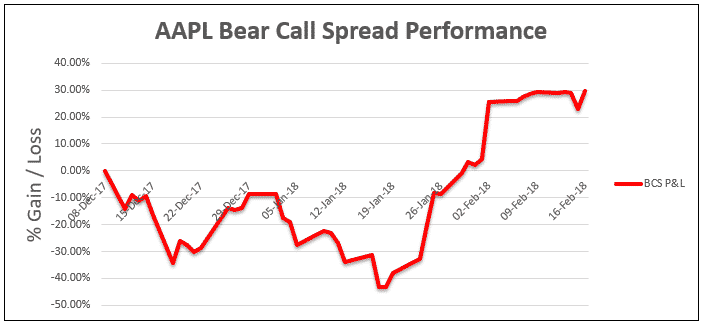

The following graphs show the P&L over the life of the trade:

In this example, the trade starts well then briefly dips into a loss scenario as AAPL rallies. From there, profits accrue quickly as AAPL stock drops quite significantly.

After this AAPL recovers and rallies slowly, but profits continue to accrue on the bear call spread because the spread remains out of the money and time decay is picking up steam.

The trade has achieved almost the full profit potential by April 2nd ($615 out of a potential $675). At this point, there is little reason to hold the trade.

The small remaining profit is not worth the risk of keeping the position open for another 18 days which also ties up margin in the account.

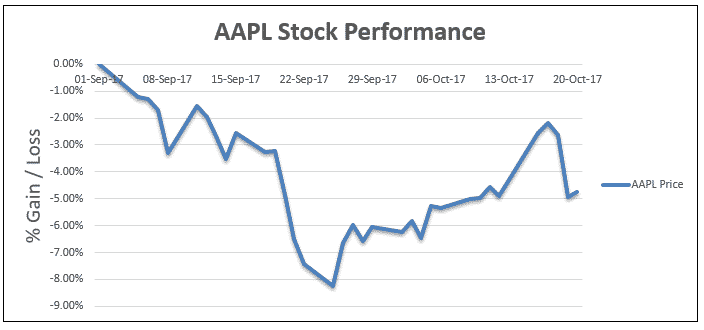

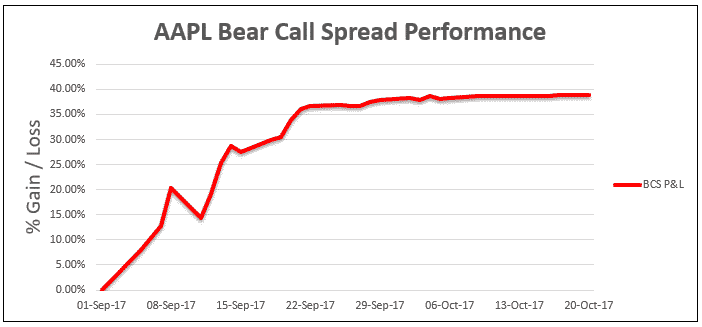

2. Sharply Falling Stock

Let’s use AAPL again and look at a period when the stock dropped straight after trade initiation:

Trade Date: September 1st, 2017

AAPL Price: 164.03

Sell 5 Oct 20th, 2017 170 Call @ $3.25.

Buy 5 Oct 20th, 2017 175 Call @ $1.85.

Spread Price: $1.40

Net Credit: $ 700 (1.40 x 500)

Max Loss: $1,800

Breakeven: $171.40 (170 + 1.40)

The following graphs show the P&L over the life of the trade:

In this example, you can see that the majority of the profits have been made very early in the trade.

In fact by September 21st, only 20 days into the trade, $650 of a possible $700 has been made.

At this point there is no point holding the trade for another month just to make the last $50. It’s much better to close the trade, free up the capital and look for the next opportunity.

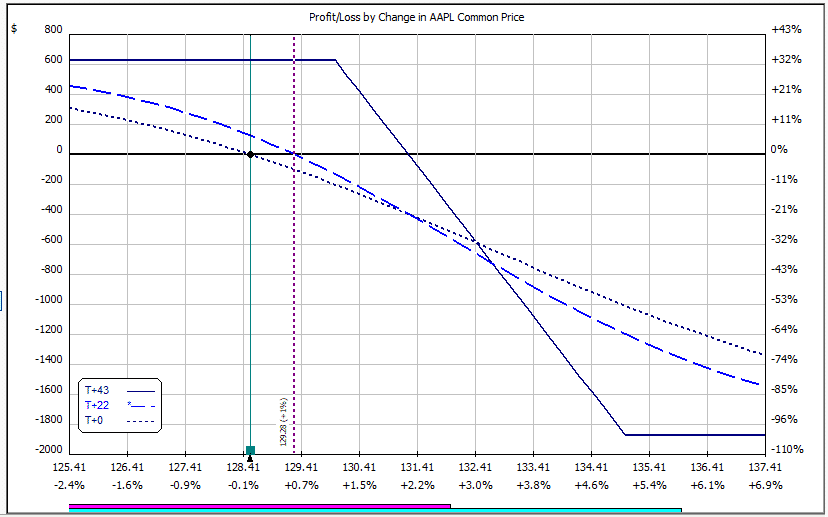

3. Max Loss Scenario

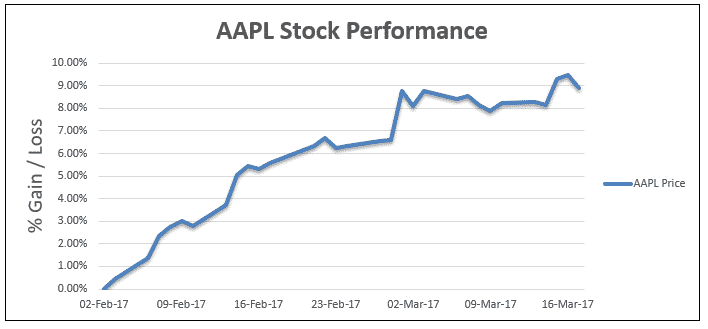

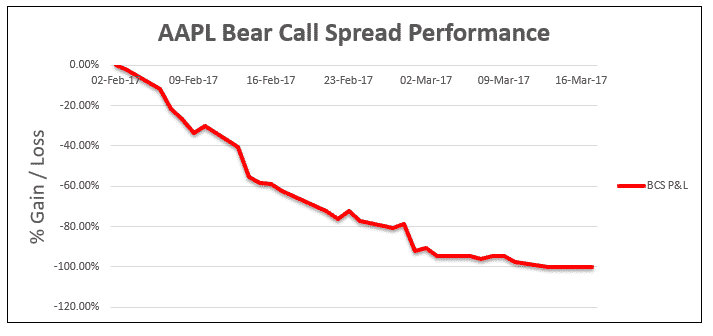

In early February 2017, AAPL had experienced a huge run up in price and traders would be forgiven for thinking that the run couldn’t go much further.

Unfortunately, that view would have been completely wrong, and a bear call spread trader would have suffered the maximum loss.

Trade Date: February 2nd, 2017

AAPL Price: 128.53

Sell 5 Mar 17th, 2017 130 Call @ $1.73.

Buy 5 Mar 17th, 2017 135 Call @ $0.49.

Spread Price: $1.24

Net Credit: $ 620 (1.24 x 500)

Max Loss: $1,880

Breakeven: $131.24 (130 + 1.24)

The following graphs show the P&L over the life of the trade:

Here we see an example of the trade going completely wrong from day 1.

In this instance, it’s important to realize the trade is not working early and stick to your stop loss.

If the trader set a stop loss of 20% of capital at risk, they would have been out of the trade within 3 days for a roughly $400 loss.

If they had taken the hope and pray approach, that $400 loss would have turned into $1,050 loss by day 8 and then a max loss by early March.

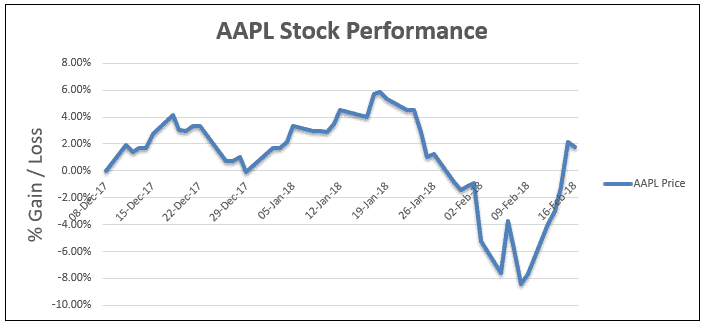

4. Rolling Out to Next Month

In this example, a bear call spread is opened on December 8th, 2017 with AAPL trading at $169.25. This is a straight forward example of how to adjust a bear call spread by rolling out in time.

Trade Date: December 8th, 2017

AAPL Price: 169.37

Sell 5 Jan 19th, 2018 175 Call @ $2.20.

Buy 5 Jan 19th, 2018 180 Call @ $1.06.

Spread Price: $1.14

Net Credit: $ 570 (1.14 x 500)

Max Loss: $1,930

Breakeven: $176.14 (175 + 1.14)

In this example, we hit a 35% loss on December 18th.

Some traders would be stopped out at this point.

But let’s assume that instead of closing the trade for a loss, we roll it out to February.

The January spread is trading at $2.48 so we buy to close 5 contracts for a total cost of $1,240.

We simultaneously sell to open 5 contracts of the February 175-180 call spread which is also trading at $2.48.

This generates $1,240 in premium.

Zero Cost Adjustment

The net cost of the adjustment is $0 (not including commissions) so the adjustment has cost us nothing and bought us more time.

Note: This is fairly rare to be able to adjust at no cost. Normally when rolling out in time, there will be some cost involved.

In this case AAPL was due to release earnings on February 1st, which meant the option premiums for February were elevated compared to January.

We can see that the trade suffered an initial loss and was rolled out to the next month eventually achieving a full gain.

At one point the trade was down over 40%. Some traders would have been stopped out of the trade.

The decision whether to hold on to a trade like this comes down to the individual.

As we saw in the previous example a 40% loss can very quickly turn into a 100% loss.

Some traders will continue to roll out, sometimes for many months until the trade comes back their way.

I tend not to do this because it ties up capital for a long period of time and can be mentally draining to carry a losing trade for a long period of time.

For this trade, once AAPL did eventually drop, P&L moved very quickly with the trade going from an $830 loss to a $500 gain in the space of 11 trading days.

Frequently Asked Questions About Bear Call Spreads

HOW TO CLOSE A BEAR CALL SPREAD?

The best way to close a bear call spread is via a combination or spread trade rather than closing the two calls individually.

The original trade when opening the spread would have been a sell to open trade, so when closing we enter the order as a buy to close order.

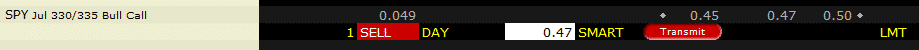

Here’s an example of the opening and closing orders for a bear call spread on SPY using Interactive Brokers.

Unfortunately, with IB it’s a little counter intuitive, because you set the spread up as a bull call spread, and the you sell that spread.

OPENING ORDER – Sell to open bull call spread

CLOSING ORDER – Buy to close bull call spread

![]()

With SPY, the bid-ask spread is quite narrow so it should be easy to get filled near the mid-point, but what I usually do is enter my order slightly below the mid-point first and then slowly lift the price until it gets filled.

For closing this spread, I might put the buy to close order with a price of $0.45 and leave it for a few minutes to see if it gets filled at a slightly better price than $0.47.

Here’s how the buy to close order would look in TastyWorks:

WHAT TO DO IF MY BEAR CALL SPREAD GETS ASSIGNED?

Getting assigned on an options contract can be scary for beginners but there really isn’t anything to worry about if you understand the process and know what to do.

Single leg options are easier to deal with, but what about if one leg of a bear call spread gets assigned?

Firstly, the only leg that would ever get assigned is the short leg or the sold call which is the one that is at the lower strike price.

If that happens, you could exercise your long call which would result in you buying 100 shares which would offset the short 100 shares from being assigned on the short call.

The net position would then be zero shares and no option contracts remaining in your account.

Doing this would only make sense if the long call was also in-the-money and had little time value left.

The issue with this process is that it can be expensive in terms of fees and commissions. Exercising option contracts can result in commissions of around $10 – $15 at most brokers.

A better process is to simply buy back the shares in the open market and sell the long call.

The result is the same and means much lower commission costs.

Either way, the loss will be about the same so I would go for the second process and keep the costs down.

HOW TO EXIT A LOSING BEAR CALL SPREAD?

If you have a losing bear call spread, the process is the same as mentioned above for closing the spread. Simply buy to close the original spread.

I usually try to limit the loss on spread trades to around 2 times the premium received.

WHAT TO DO WHEN A BEAR CALL SPREAD IS IN THE MONEY?

Typically, I will try not to let my bear call spread go in-the-money. When this happens, they can be hard to recover from.

Some people will recommend constantly rolling out in time and / or price and waiting for the stock to eventually drop and the spread to expire worthless.

That is certainly one option, but it’s not my preference.

The losses can start to get pretty big and from a psychological perspective, I hate carrying losing trades in my account for an extended period.

Try to limit losses to two times the credit received, and this should ensure that you are out of the trade before it goes in-the-money.

If your spread does go in-the-money, you will need to watch out for early assignment if there is little time value left.

HOW DO YOU ADJUST A BEAR CALL SPREAD?

There are many, many ways to adjust a vertical spread. Check out this post if you want some detailed ideas.

If you’re a beginner, the best philosophy is to keep it simple.

I set a defined point where I will adjust my trade if it starts going against me.

Things I consider when deciding and adjustment point:

1. Delta of the short call – I this starts around delta 10, I usually adjust when it gets to 20-25.

2. Stock price – I’ll decide on an adjustment point based on the chart. This could be a resistance level or a moving average.

3. T+7 line – On the option payoff graph, I will look at the T+7 line and pick a point where the loss is equal to the credit received.

The easiest way to adjust a bear call spread is to roll out in price.

This gives the trade more margin for error, but also reduces the profit potential in the trade.

Other adjustments that I use frequently include:

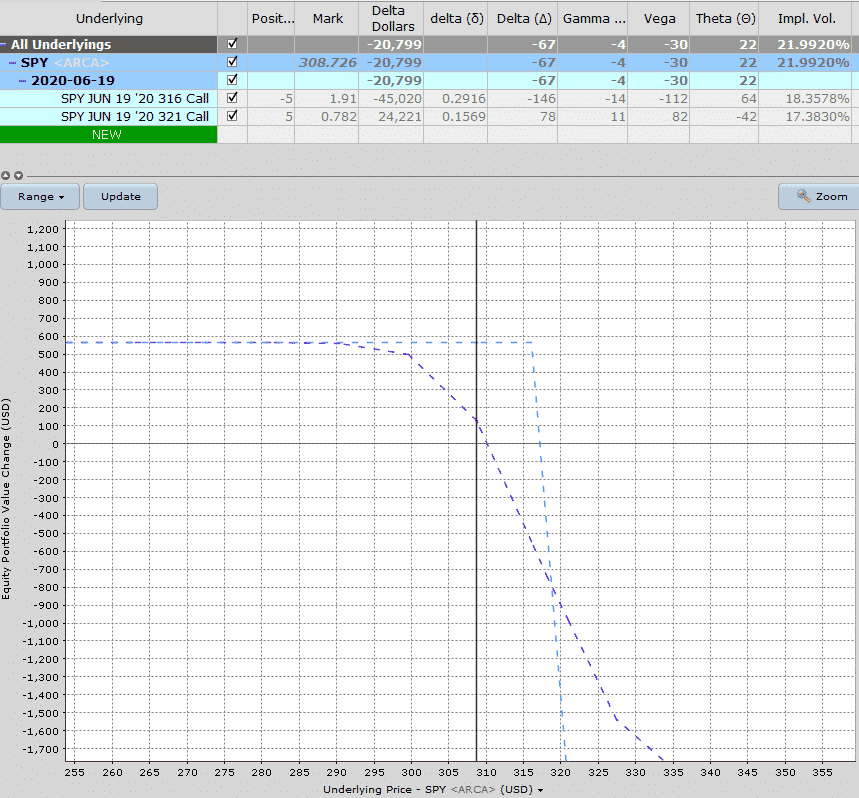

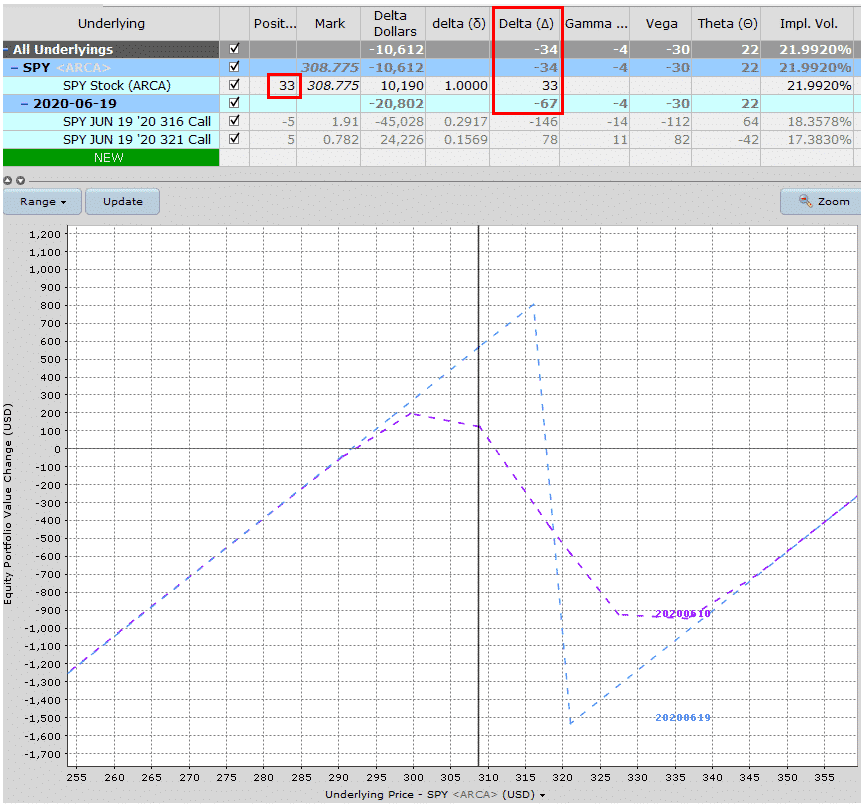

Using long stock or long calls to hedge some of the delta exposure:

Here is a bear call spread that is under pressure with the short call delta rising to 29.

With the overall position delta at -67, we can buy 33 shares of SPY to hedge half of the delta exposure. The new delta is -34.

You can choose how much of the delta to hedge based on how much protection you want against a further adverse move.

This gives the position a funny looking expiration graph but a much better T+7 line.

If the stock starts to drop, I then sell the shares back at a small loss and continue holding the original call spread.

Adding a calendar spread over the short call

Instead of hedging the SPY short call spread with shares, let’s look at using a calendar spread to create a profit zone around the short call.

This can be a good adjustment strategy if you are very confident that the underlying stock will not rise above the short call.

It doesn’t reduce the delta exposure as much as the previous example but will give some protection and has the added benefit of adding positive vega and increasing theta.

There are lots of other ways to adjust bear call spreads that are under pressure, but these are two that I use quite frequently.

Summary

- Selling bear call spreads is a popular trade with income investors who have a neutral to bearish view on a stock.

- Bear call spreads are defined risk, defined profit trades.

- The impact of volatility and time decay can vary depending on whether the trade is in-the-money or out-of-the-money.

- P&L on short-term trades will fluctuate much more than on long-term trades.

- Adjustment strategies can be used to turn losing trades into winning trades, but they don’t work every time and can involve more risk.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thank you for a very well written and fairly comprehensive article. I have a question about “Try to limit losses to two times the credit received”. Does this mean you exit when the spread is worth 3x initial credit, so that net loss is 2x initial credit? (I suspect you actually meant to exit when spread is worth 2x initial credit, so net loss is 1x initial credit).

Thanks Jai. I usually exit at 1.5-2x loss.

Great post!! Questions: So if the initial credit on the trade was say $0.50, you would look at the P/L graph and see where stock XYZ would have to go by T+7 to have the credit equal $1.00 and then set a contingent order so when XYZ stock hits that price, it automatically triggers the close of the bear call spread? With an overall loss of $0.50 on the trade? But set an upfront profit target of 50-90% of the initial credit, like $0.25-$0.45? But if if hits 50% of the initial credit in < 50% of time to expiration then exit the trade altogether?

Yes, pretty much.

Thanks. What delta do you use for the short call?

Very Informative and Super Well Written

Thank You For the Tutorial!!

You’re very welcome. Reach out any time if you have any questions.