Position delta is an important concept for option traders to understand as it shows them how their overall position will change, relative to changes in the price of the underlying stock.

Before we go into further detail, it’s worth reviewing what delta is to ensure you’re familiar with the basic concepts.

Contents

Delta is one of the Greeks, meaning it is one of four major measures that are routinely used by traders to understand their risk exposure.

Put simply, the delta of an option measures how much the option’s price is expected to change, relative to changes in the underlying stock price.

For example, a call option that has a delta of +0.45 is expected to increase by $0.45 in value for every $1 increase in the underlying stock price.

By the same token, the option value will decrease by $0.45 for every $1 decrease in the underlying stock price.

The value of delta always falls between 1.0 and -1.0 such that at the extremes (such as being further in the money), an option can even have a 1:1 relationship with the price of the underlying stock, effectively mirroring any changes in the underlying’s price.

Unfortunately delta is complicated by the fact that delta does not remain constant as changes occur in implied volatility.

Also, as an option gets closer to expiration for near or at-the-money options, the delta is likely to increase.

When trading complex positions that use more than one option, understanding your delta becomes a even more complex – that’s where position delta comes in.

Understanding Position Delta

Understanding position delta is best illustrated by building upon regular delta concepts using an example.

We’ll start by looking at how delta informs a change in value.

Say you have a simple position where you are long 10 call contracts at a price of $50.

The option delta has been calculated to be 0.6, which means that for every $1 change in the underlying stock price, you can expect a $0.6 change in value.

While this information is useful, it doesn’t tell you how much profit or loss you will make on your overall position – this is where position delta comes in.

Recall that an options contract represents 100 shares, so since we have 10 call contracts, that means our overall position is comprised of 1,000 shares.

Applying the $0.6 change in value outcome we calculated earlier, this means that every time the underlying stock changes by $1 we will make a profit/loss of $600 (1,000 shares times $0.6).

It is this profit/loss of $600 which represents the position delta.

We can see that while delta is useful, on its own it doesn’t help us understand how much profit or loss an overall position will make – that’s why position delta is so useful.

To summarise, position delta can be calculated using the following formula:

Option Delta x Number of Contracts x 100

Note when going short, the convention in the trading industry is to use negative numbers for the ‘Number of Contracts’, which in turn will give you a negative position delta.

Working Out Position Delta For A Complex Position

In the previous example, we had a pretty straightforward scenario of 10 call contracts being purchased.

But what happens when we want to know the position delta for a more complex position, one with multiple options?

Let’s use an iron condor as an example, which uses four different options – two puts and two calls.

Say we choose to trade three contracts and our four options are as follows:

- Put 1 has an option delta of -0.15

- Put 2 has an option delta of -0.30

- Call 1 has an option delta of 0.40

- Call 2 has an option delta of 0.15

To determine our position delta, we apply the formula for each option which results in:

- Put 1: -0.15 x 3 x 100 = -45

- Put 2: -0.30 x -3 x 100 = 90 (notice how the number of contracts are negative as put 2 is a short in an iron condor)

- Call 1: 0.40 x -3 x 100 = -120

- Call 2: 0.15 x 3 x 100 = 45

Now that we know the position delta of each option, our overall position delta is found by simply adding them all together.

Therefore we get an overall position delta of: -45 + 90 + (-120) + 45 = -30.

Since the value is negative, it means that when the stock price decreases by $1 we will have an expected profit of $30.

Conversely, for every $1 increase in stock price, we would have an expected loss of $30.

Whenever making any decisions based on position delta, it is worth bearing in mind that it provides an expected value and the final, real value is likely to differ.

Factors such as theta decay and changes to implied volatility can impact the final result so only rely on position delta as a guide.

Examples

Thankfully, you don’t have to do all the calculations yourself as most brokers will give you the overall position delta.

That can be found on the Risk Navigator in Interactive Brokers or the Analyze tab in ThinkorSwim.

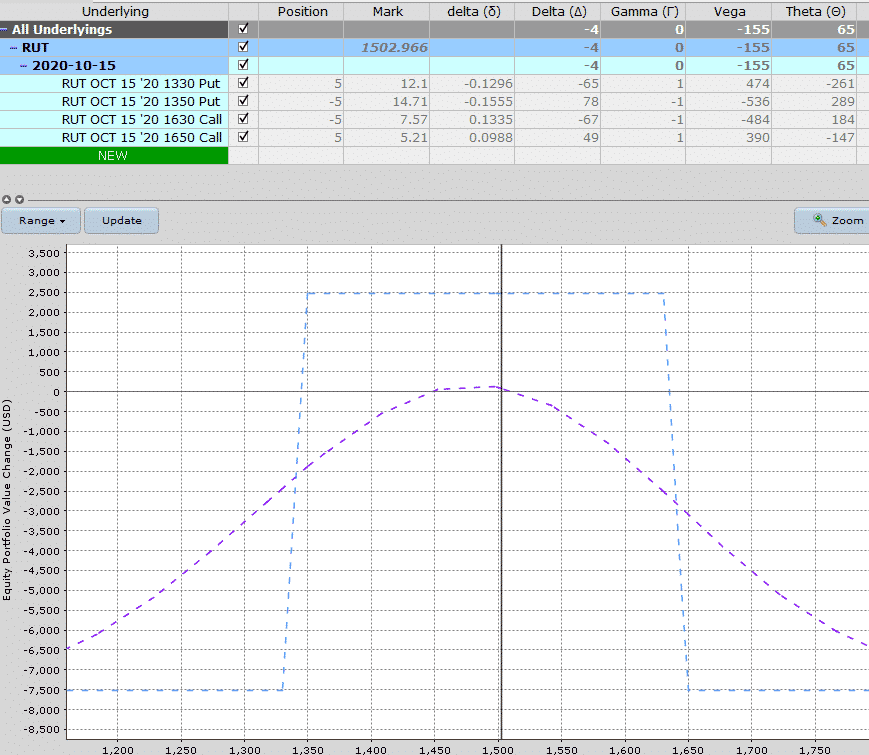

Let’s look at an example of position delta for a live Iron Condor on RUT using Interactive Brokers.

Here you can see an iron condor with four legs of five contracts for each leg.

The first delta column shows the delta of the individual strike and if we multiply that by 5 and then 100, we get the position delta for that strike (keep in mind there is some rounding).

Then we add the four position delta’s to get the overall iron condor position delta.

1330 put = 5 x 100 x -0.1296 = -64.8

1350 put = -5 x 100 x -0.1555 = 77.75

1630 call = -5 x 100 x 0.1335 = -66.75

1650 call = 5 x 100 x 0.0988 = 49.40

TOTAL POSITION DELTA = -64.80 + 77.75 – 66.75 + 49.40 = -4.40

Conclusion

Position delta is a useful concept for traders to understand as it gives them a view of the change in value of their overall position, relative to changes in the price of the underlying asset.

Position delta is determined by taking the option delta and multiplying it by both the number of contracts and by the number of shares per contract (100).

When using the formula, the standard convention in trading communities is to represent short positions with a negative value for the number of contracts.

To determine the position delta for a complex position with multiple options, add up each individual option’s position delta for a net value.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

if the position sizing is different ? then how to calulate position delta ?

Just multiply by the number of contracts. E.g. Option Delta x Number of Contracts x 100

Does the calculated position delta also provide a representation of the probability of expiring in, at, or out of the money similar to the single position?

Also, at what position delta for credit spreads (puts & calls) should the decision be made to make adjustments to prevent a loss?

Thank you.

No it doesn’t affect the probability. In terms of a position delta to adjust, that depends on the strategy and also your personal risk tolerance.