What’s better, being long gamma or short gamma? Today, we will answer that question, plus a lot more.

Contents

Introduction

Option gamma indicates how an options delta is expected to change when the underlying stock price changes.

Gamma is one of the least understood greeks so I want to try and help you gain a much better understanding today.

One of the main things to understand about gamma is that the exposure and risks increase the closer you get to expiry. You can read about that in detail here.

That’s an important concept, but let’s look at the difference between long gamma and short gamma.

Long Gamma Vs Short Gamma

Long gamma (also called positive gamma) indicates that the trade’s delta will increase as the stock rises and decreases as the stock falls.

Traders that are long gamma want the stock to continue trending in the same direction

Short gamma (also called negative gamma) indicates that the trade’s delta will decrease as the stock rises and increases as the stock falls. Short gamma traders want the stock to revert back towards the starting price.

Think about the difference between a long straddle and a short straddle.

Long straddles have positive gamma and the trader want the stock to keep moving in the one direction (either up or down)

Short straddles have negative gamma and as the stock moves, the trader wants the stock to revert back to where it started.

We’ll look at some specific examples shortly, but let’s use a theoretical example first to illustrate the concept.

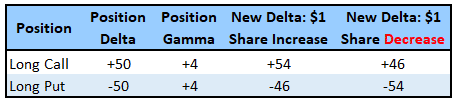

Long Gamma Example

Let’s use a simple example of a long put and a long call.

The long call has positive delta and positive gamma (long gamma). As the stock price rises, the delta increases. It like a snowball effect, the position exposure grows in the same direction as the stock.

If the stock decreases, the delta exposure also decreases.

The long put has negative delta and positive gamma (long gamma). As the stock price decreases, the delta becomes more negative. In this case the position exposure also grows in the same direction as the stock.

In both these cases the exposure is getting bigger as the position is moving for the trader.

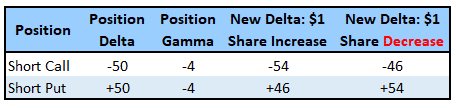

Short Gamma Example

Now we’ll look at a short call and a short put.

The short call has negative delta and negative gamma (short gamma). As the stock price rises, the delta becomes more negative indicating that the trader wants the position to revert back to where it started.

If the stock decreases, the delta exposure becomes less negative.

The short put has positive delta and negative gamma (short gamma). As the stock price decreases, the delta becomes more positive indicating that the trader wants the stock to rally back up.

In both these cases the exposure is getting bigger as the position is moving against the trader.

Real Life Examples

It’s always good to look at some real-life examples to help solidify the concepts

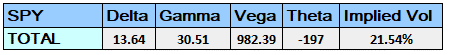

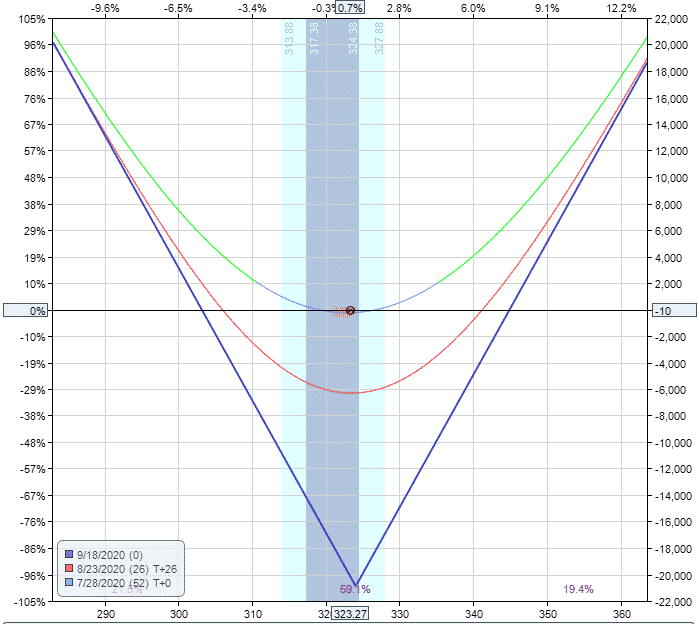

SPY LONG STRADDLE TRADE

Date: July 27, 2020

Current Price: $323.27

Trade Set Up:

Buy 10 SPY Sept 18th, 324 call @ $9.75

Buy 10 SPY Sept 18th, 324 put @ $11.16

Premium: $20,910 Net Debit

Notice that the trade has positive gamma of 30.51.

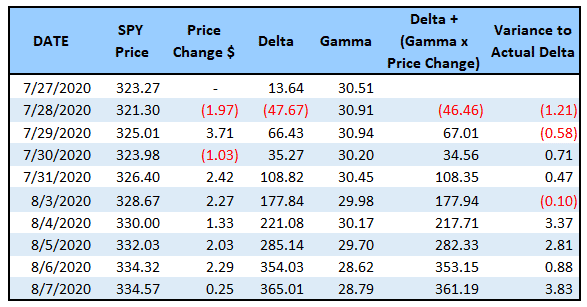

Below you can see how the trade changes over the first 10 days of the trade.

Notice that as the prices rises, delta becomes more positive just as we would expect with a long gamma trade.

I’ve also included two columns on the right hand side after gamma. The first column takes the previous day’s ending delta and adds the sum of gamma and the price change.

Notice that the delta moves very much inline with what we would expect. It’s never going to be perfect because there are a lot of moving parts and delta will also be impacted by changes in vega and theta.

But, you can see that our calculated delta is very close to the actual delta.

Let’s look at a short gamma example.

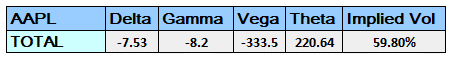

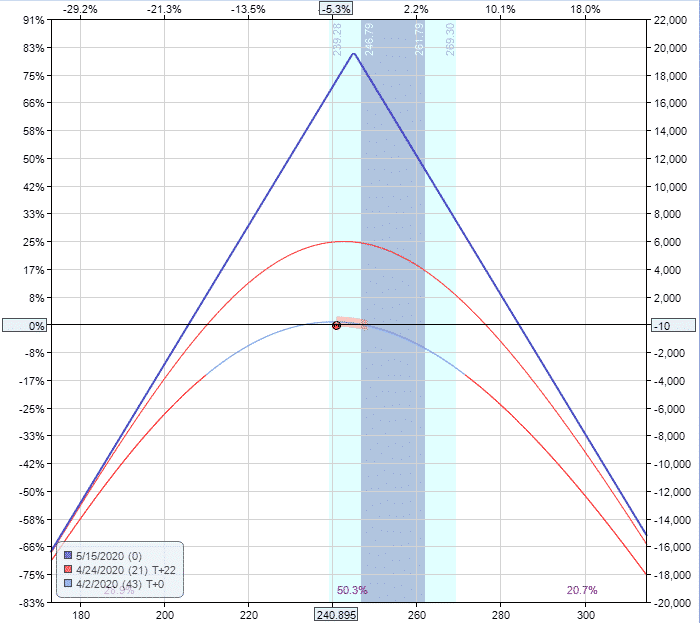

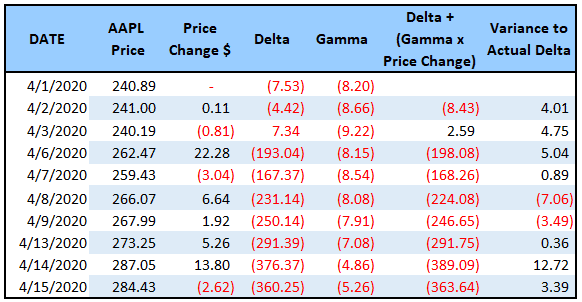

AAPL SHORT STRADDLE TRADE

Date: April 1, 2020

Current Price: $240.89

Trade Set Up:

Sell 5 AAPL May 15th, 245 call @ $17.32

Sell 5 AAPL May 15th, 245 put @ $21.90

Premium: $19,610 Net Credit

Here we are seeing the exact opposite of the previous example as you would expect. As AAPL stock rises, the delta becomes more and more negative.

This is because the trader wants the stock to drop back down into the profit zone.

Interestingly in this example, the manual calculation of delta isn’t as accurate.

I think it’s because volatility was so high at the time and moving around a lot, from a high of 59.80% to a low of 38.41%.

It’s safe to assume that other factors were also impacted the change in delta in addition to the gamma, but gamma still would have been the major factor.

FAQ

What Is Gamma In Options Trading?

Gamma is a measure of how much an option’s delta changes in response to a $1 move in the underlying stock or index.

It is important to understand because it can affect an option’s risk profile and potential profits.

What Is Long Gamma In Options Trading?

Long gamma is a position in which an investor has bought options with a high gamma value.

This means that the delta of the options will increase quickly as the underlying stock or index moves in the desired direction, leading to potentially large profits.

What Is Short Gamma In Options Trading?

Short gamma is a position in which an investor has sold options with a high gamma value.

This means that the delta of the options will change quickly and lead to potentially large losses if the underlying stock or index moves against the investor’s position.

How Can Gamma Affect Options Trading Strategies?

Gamma can affect options trading strategies by changing the delta of the options and the overall risk profile of the position.

For example, a long gamma position can be used to profit from a large move in the underlying stock or index, while a short gamma position may require more active management to avoid large losses.

What Are Some Common Options Trading Strategies That Involve Gamma?

Some common options trading strategies that involve gamma include delta-neutral trading, gamma scalping, and the gamma squeeze.

Each strategy aims to profit from changes in the underlying stock or index while managing the risks associated with gamma.

How Can I Learn More About Options Trading And Gamma?

There are many resources available to help you learn more about options trading and gamma.

Some good places to start include online forums, books on options trading, and professional options trading courses.

Summary

While gamma is one of the lesser known greeks and arguably least important of the “big 4”, it’s important to have at least a basic understanding of the difference between long gamma and short gamma.

The easiest way to remember gamma is this:

Gains on long gamma trades will grow exponentially as the stock continues to trend. Long gamma traders want trending stocks.

Losses on short gamma trades will grow exponentially as the stock continues to trend. Short gamma traders want stocks to stay in a tight range.

I hope you enjoyed this tutorial.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi, Gavin

It looks like a mistake here:

“Long gamma (also called positive gamma) indicates that the trade’s delta will increase as the stock rises and decreases as the stock falls. Long gamma traders want the stock to continue trending in the same direction

Short gamma (also called negative gamma) indicates that the trade’s delta will increase as the stock rises and decreases as the stock falls.”

Thanks Vitaly, fixed.