Today, we are looking at four iron condor examples.

Iron Condors are one of the most powerful strategies for option traders.

If you’re new to iron condors, you’ll want to check this post out first.

I’ll use a random number generator to pick a trade date and then walk through how the trade would have gone.

By using a random number generator it makes it completely random and means I haven’t cherry picked the best entry points.

Contents

Iron Condor Examples

For these iron condor examples, I’ll be using Option Net Explorer for the back test. These will be the parameters:

– Don’t enter if VIX futures are in backwardation (just remember the saying “bad things happen in backwardation”)

– Sell a 30-45 day Condor with short strikes around delta 10-15

– Stop loss 2x premium received

– Adjust if either short strike hits delta 25

– Profit target 50% of premium received in less than 50% of the duration, otherwise hold until 7 days to expiry.

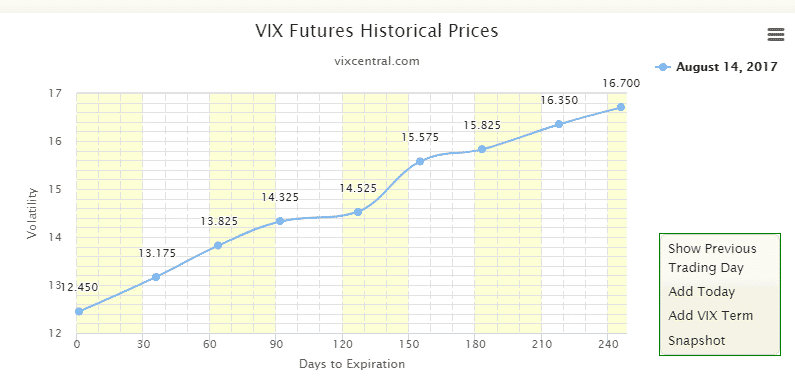

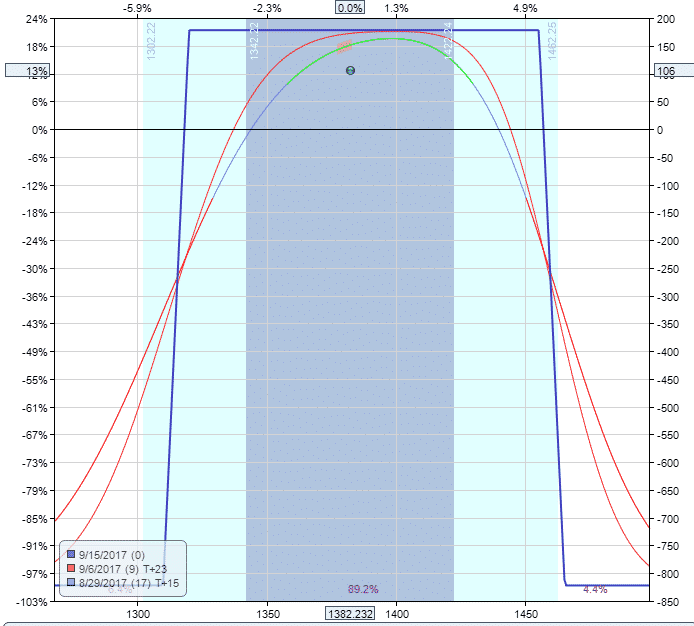

The first example provided by the random number generator is from August 14th, 2017.

First, let’s make sure the market wasn’t in backwardation. All good there, so let’s proceed.

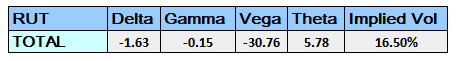

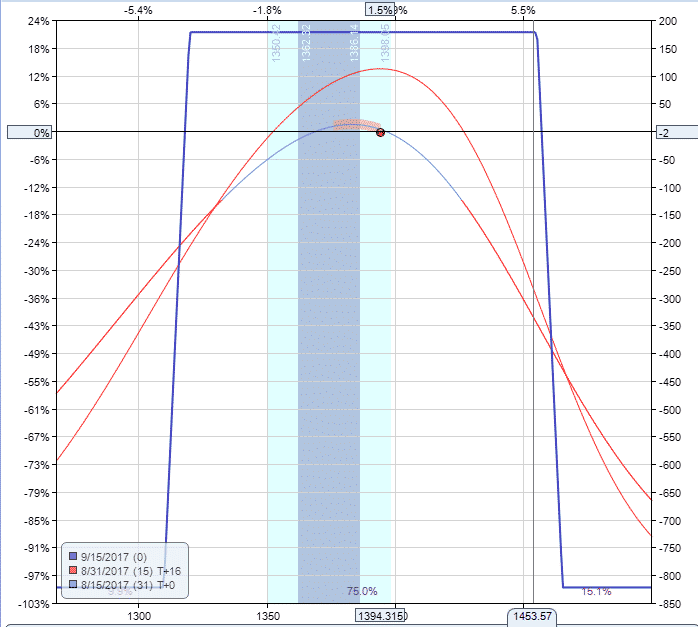

Rut Iron Condor Example

Date: August 14, 2017

Underlying Price: 1394.31

Trade Details:

Sell 1 RUT Sept 15th, 1320 put @ $6.70

Buy 1 RUT Sept 15th, 1310 put @ $5.85

Sell 1 RUT Sept 15th, 1455 call @ $2.10

Buy 1 RUT Sept 15th, 1465 call @ $1.15

Premium: $180

Max Loss: $820

Return Potential: 21.43%

Let’s see how the trade progressed. You can see below this was a pretty low stress example, the trade was only in the red for 3 total days and the 50% of profit in 50% of the time rule was triggered after 14 days.

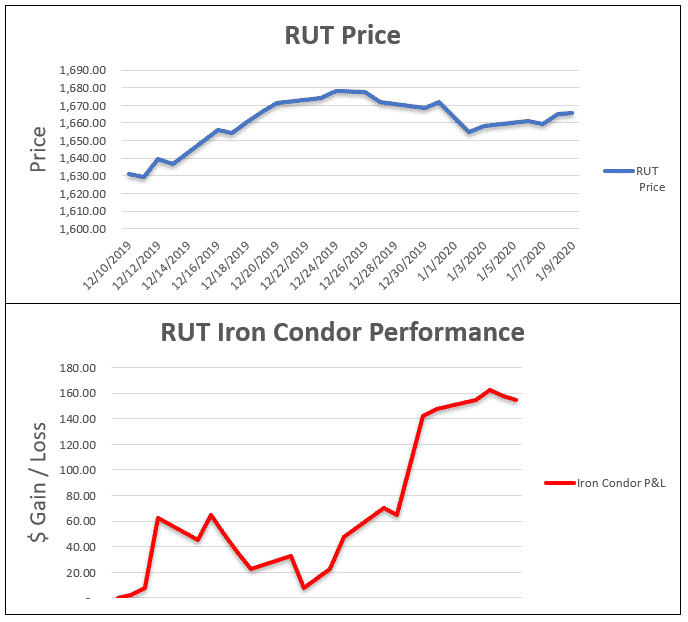

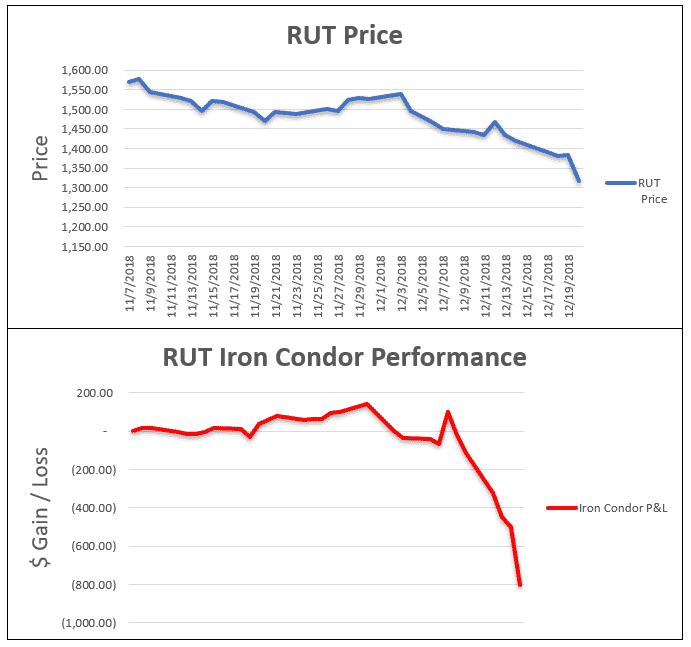

Below you can see a comparison of the RUT Index price and the Iron Condor P&L.

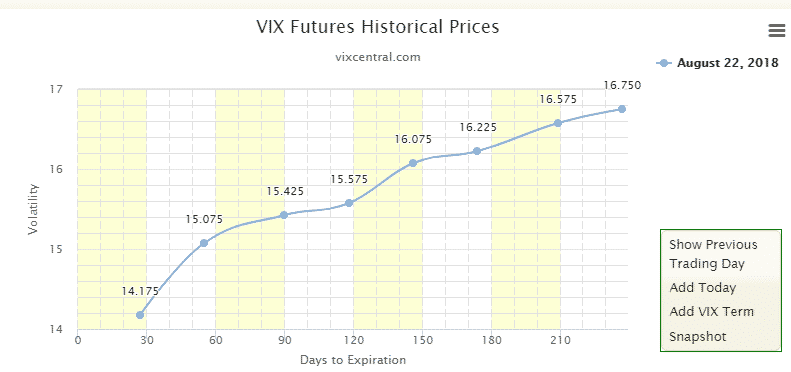

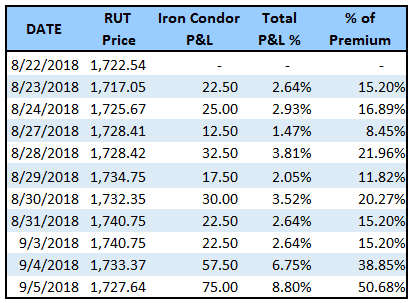

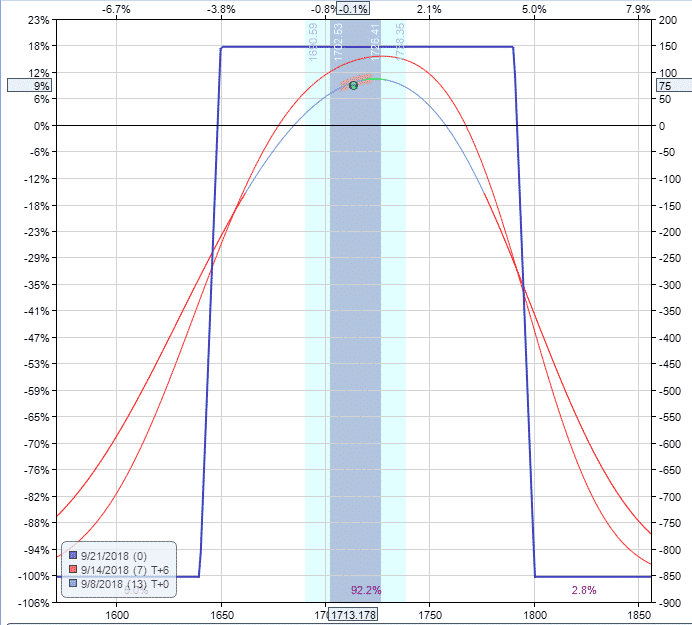

Let’s look at another example. This time the random number generator gave me a trade date of August 22, 2018.

With the September 2018 options expiring on September 21st, that just gives us enough days (30) to use the September expiry rather than October.

Let’s check the VIX futures curve first.

Looking good, so let’s proceed with the backtest.

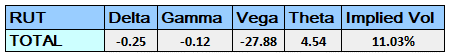

Rut Iron Condor Example 2

Date: August 22, 2018

Underlying Price: 1722.54

Trade Details:

Sell 1 RUT Sept 21st, 1650 put @ $6.15

Buy 1 RUT Sept 21st, 1640 put @ $5.30

Sell 1 RUT Sept 21st, 1790 call @ $2.25

Buy 1 RUT Sept 21st, 1800 call @ $1.62

Premium: $148

Max Loss: $852

Return Potential: 17.37%

Once again, this was another straightforward example, with zero adjustments. Trust me, they aren’t all this easy!

Once again within 2 weeks the 50% of profit in less than 50% of the time condition has been met, so we close it out and take profits.

This trade was even easier than the first one as it never had any periods were it was in a loss situation.

Here is the graph comparing the RUT price to the iron condor performance:

As I said, iron condors aren’t always this easy, but let’s try a third example and see if we can find a trade that was a bit more challenging.

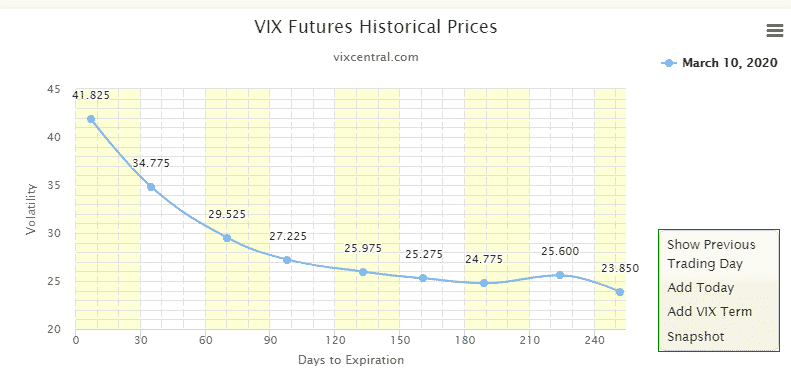

Ok the random number generator has given me March 10th, 2020 which is right around the time of the corona virus meltdown, so this should be interesting!

Actually, when checking the VIX futures curve, we were in heavy backwardation so that excludes us from trading condors on that date.

Let’s try again.

April 6th, 2020. Nope still in backwardation.

December 10th, 2019. Yep we’re in contango, so let’s take a look at the example.

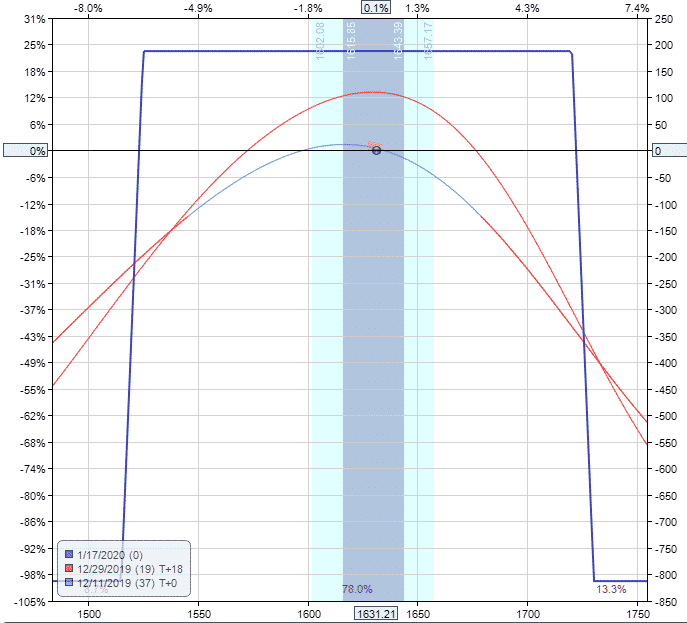

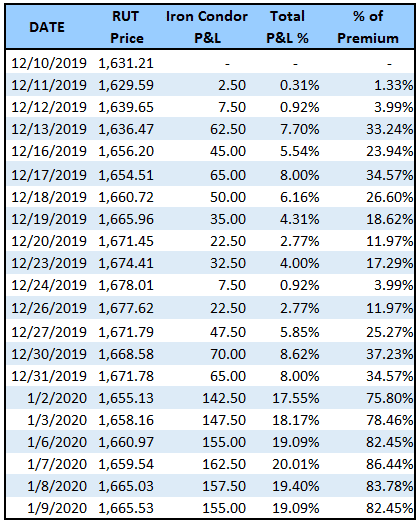

Rut Iron Condor Example 3

Date: December 10, 2019

Underlying Price: 1631.21

Trade Details:

Sell 1 RUT Jan 17th, 1525 put @ $8.80

Buy 1 RUT Jan 17th, 1515 put @ $7.90

Sell 1 RUT Jan 17th, 1720 call @ $3.20

Buy 1 RUT Jan 17th, 1730 call @ $2.22

Premium: $188

Max Loss: $812

Return Potential: 23.15%

Wow, another example of a trade that was never threatened and never in the red.

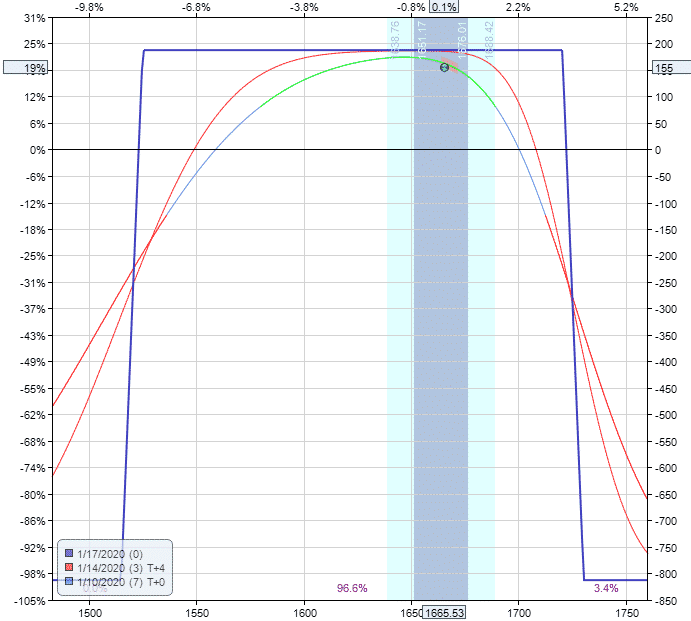

For the final example, I’ll find one that is either a losing trade or at least needs adjusting.

Ok after a few attempts, I finally found a good example of a losing trade and the trade date is from November 7th, 2019.

We were in contango and there were only 9 days until the November options expiry, so I had to use December options.

Here are the details:

Rut Iron Condor Example 4

Date: November 7, 2018

Underlying Price: 1570.99

Trade Details:

Sell 1 RUT Dec 21st, 1445 put @ $10.60

Buy 1 RUT Dec 21st, 1435 put @ $9.50

Sell 1 RUT Dec 21st, 1685 call @ $3.85

Buy 1 RUT Dec 21st, 1695 call @ $2.90

Premium: $205

Max Loss: $795

Return Potential: 25.79%

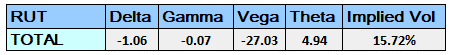

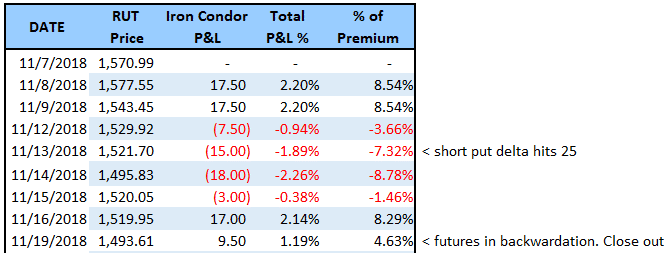

This example gets into a very interesting situation only a few days into the trade.

In terms of P&L, it’s fine at -$15 which is no big deal, but the index has dropped 50 points and the short puts are at delta 25 which is our adjustment point.

I’ll process a really simple adjustment of rolling down the put spread and also rolling down the call spread.

Adjustment date: November 13, 2018

Buy to close 1 Dec 21 1445-1435 put spread @ $1.95

Sell to open 1 Dec 21 1400-1390 put spread @ $1.25

Buy to close 1 Dec 21 1685-1695 call spread @ $0.25

Sell to open 1 Dec 21 1640-1650 call spread @ $0.95

The two buy to close trades cost a total of $2.20 and the new sell to open trades bring in $2.20 so the adjustment costs nothing and we have re-centered the condor.

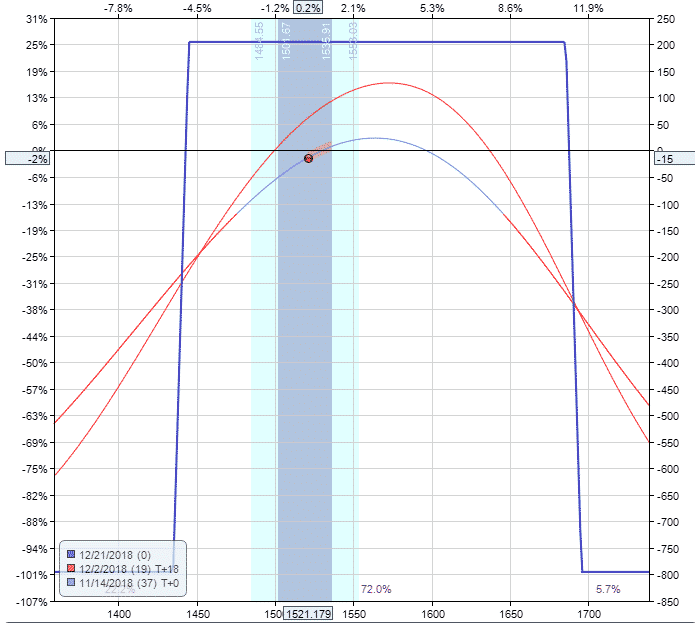

BEFORE ADJUSTMENT

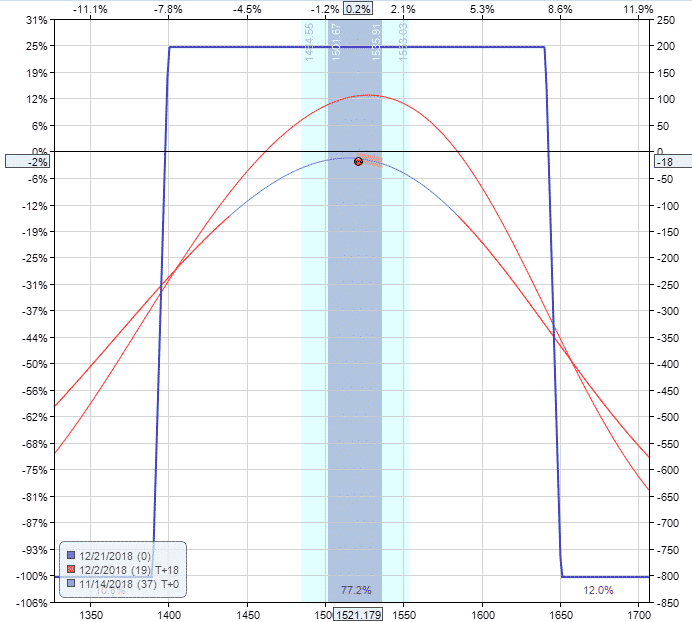

AFTER ADJUSTMENT

A few days later, on November 19th, VIX futures went into backwardation which was a signal to close the trade early.

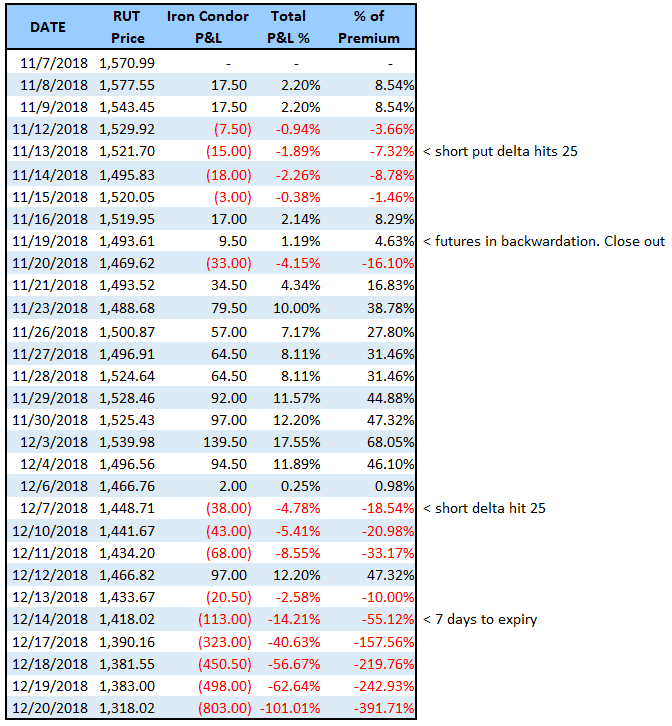

What If We Stayed In The Trade?

Out of interest, I decided to follow the trade through to expiration to see what would have happened from here.

On December 7th, the P&L went negative again and the short delta hit 25 again.

Assuming the trade wasn’t adjusted, it would have then been closed with 7 days to expiry per the rules with a loss of $-113.

Following it through all the way to expiry would have seen the trade suffer a max loss.

This example is important for a couple of reasons:

- Trade management is crucial with condors.

- The backwardation rule would have got us out of the trade for a small gain. Even though higher profits came a week or so later, we avoided all of the big drawdown towards the end of the trade.

- The last week of a trade is very risky and P&L can shift rapidly. Losses jumped from $113 to max loss in just a few days. Hence why closing condors when there is 7 days to expiry makes a lot of sense.

I hope you enjoyed these examples. If you have any questions let me know, and if you want to see more backtests like this, just ask!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hello, I just sold an iron condor in Rut today

2350

2355 call sep 24

2140

2135 Put sep 24

1.24 credit

33% return on risk

I do not understand how to see the vix on it . How do I see it? Also do you think it is a good spread?

Looks ok, just have a plan for how to manage it if it goes against you. The Russell Volatility Index is ticker RVX

Ok thank you

What would be the volatility index for iwm

The same ?