Contents

- What Is A Short Straddle

- Maximum Loss

- Maximum Gain

- Breakeven Price

- Payoff Diagram

- Risk of Early Assignment

- How Volatility Impacts The Trade

- How Theta Impacts The Trade

- Other Greeks

- Risks

- Trade Management

- Examples

- Summary

What Is A Short Straddle

A short straddle is an advanced options strategy used when a trader is seeking to profit from an underlying stock trading in a narrow range.

To execute the strategy, a trader would sell a call and a put with the following conditions:

- Both options must use the same underlying stock

- Both options must have the same expiration

- Both options must have the same strike price

Since it involves having to sell both a call and a put, the trader gets to collect two premiums up-front, which also happens to be the maximum gain possible.

Due to the two premiums collected upfront, beginners are often attracted to this strategy without realizing the risks they face.

A short straddle can result in unlimited loss potential whenever a substantial move occurs so it should be used with caution, particularly around significant market events like an earnings announcement.

The opening position of this strategy means that you will start with a net credit and you will profit if the stock trades between the lower break-even point and the upper break-even point.

Losses accrue if the underlying stock makes a substantial move to either the downside or the upside which as mentioned previously, can result in unlimited losses.

Given its nature, the strategy is generally used when the market is experiencing low volatility and no events are expected prior to expiration.

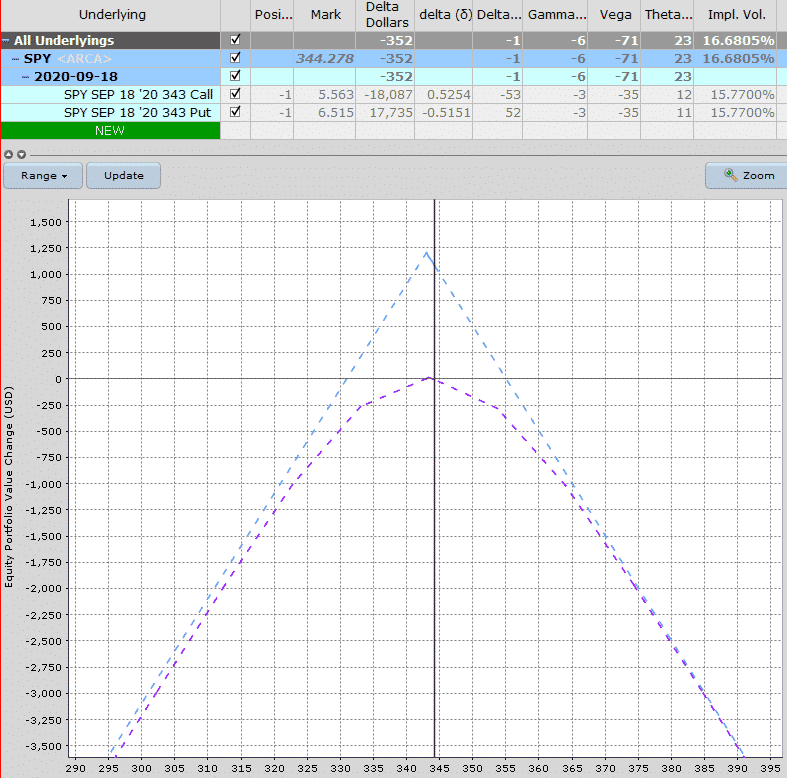

Here’s an example of how the trade looks and this is the example we will use for the next few sections.

Maximum Loss

The maximum loss is unlimited and occurs when a significant movement occurs to either the upside or the downside as the stock can potentially rise indefinitely.

Technically, the maximum loss on the downside is not actually unlimited, because the stock can only fall to zero.

Short straddles involve naked options and are definitely not recommended for beginners.

In the example above, the trader received $1,171 in premium for selling the at-the-money call and at-the-money put.

Let’s assume SPY drops to $0 (never going to happen, but humor me here).

The 343 call would expire worthless and the 343 puts would see a loss of 343 x 100 = $34,300.

Subtracting the credit received, we get a maximum potential loss on the downside of $33,129

The loss potential on the upside is theoretically unlimited. Wherever the stock finishes, take the ending price, less the call strike price x 100 and add back the premium.

Maximum Gain

The maximum gain occurs when the underlying stock price is trading at the strike price when the expiration date is reached.

When this occurs, both options will expire worthless and your gain is equal to the credit you received when entering the position.

Using our SPY example, the maximum gain is $1,171 and would occur if SPY closed right at 343 on expiration.

In reality, this is unlikely to happen and most traders will close out their position well before expiry.

We’ll talk about profit targets and stop losses shortly.

Breakeven Price

A short straddle has two breakeven prices, which can be found by applying the following formulas:

Upper Breakeven Price = Strike Price of the Short Call + Net Premium Paid

Lower Breakeven Price = Strike Price of the Short Put – Net Premium Paid

So in our SPY example we have 331.29 and 354.71 as the breakeven prices.

Payoff Diagram

Short straddles have a tent shaped payoff graph and as such will experience high gamma, particularly when they approach expiration

The ideal scenario for short straddle traders is stable stock prices and / or a fall in implied volatility.

Risk of Early Assignment

There is always a risk of early assignment when having a short option position in an individual stock or ETF.

You can mitigate this risk by trading Index options, but they are more expensive.

Usually early assignment only occurs on call options when there is an upcoming dividend payment.

Traders will exercise the call in order to take ownership of the stock before the ex-date and receive the dividend.

For this reason, it’s important to watch out for ex-dividend dates.

Otherwise, make sure to close the trade if either of the options are significantly in-the-money and do not have much time value remaining.

How Volatility Impacts The Trade

Short straddles are short vega trades, so they benefit from falling volatility after the trade has been placed. Volatility is a huge driver for this style of trade.

Our SPY example has a vega of -73 compared to 23 theta and -1 delta, so vega is by far the biggest driver of the trade.

Vega is the greek that measures a position’s exposure to changes in implied volatility. If a position has negative vega overall, it will benefit from falling volatility.

If the position has positive vega, it will benefit from rising volatility. You can read more about implied volatility and vega in detail here.

Looking at the SPY example above above, the position starts with a vega of -73.

This means that for every 1% drop in implied volatility, the trade should gain $73.

The opposite is true if implied volatility rises by 1% – the position would lose $73.

How Theta Impacts The Trade

A short straddle is positive theta meaning that it will make money with each passing day, with all else being equal.

With this style of trading, the trader is hoping that the stock stays flat while time decay does its thing.

In our example, the SPY trade had theta of 23 meaning it will make around $23 per day, with all else being equal.

Theta will increase the closer the trade gets to expiry.

Other Greeks

Delta

A short straddle that is placed at-the-money is going to start delta neutral or very close to neutral.

The delta of the trade will change throughout the course of the trade as the stock moves.

If the stock rallies, the spread will become negative delta as the trader wants the stock to move back towards the center of the profit graph.

If the stock falls, the spread will become positive delta as the trader wants the stock to move back towards the short strikes.

Gamma

Short straddles are negative gamma meaning they will benefit from stable stock prices.

This also means that delta will become more negative as the stock rallies and more positive as the stock falls.

Gamma is one of the lesser known greeks and usually, not as important as the others.

I say usually, because you’ll see further down in this post why it can be really important to understand gamma risk.

In our SPY example, the short straddle had gamma of -6.

Risks

Price risk and volatility risk are the main risks with this trade type.

Big moves in the underlying stock will result in the stock moving out of the profit zone.

Naked options are very risky and losses could be substantial.

As mentioned on the section on the greeks, this is a negative vega strategy meaning the position benefits from a fall in implied volatility.

If volatility rises after trade initiation, the position will likely suffer losses.

Changes in volatility is one of the main drivers in the trade and could have a big impact on P&L.

Short straddles held over earnings could result in big losses if the stock makes a big price move.

Trade Management

I could spend an entire month talking about trade management for short straddles, but let’s at least look at some of the basics here.

As with all trading strategies, it’s important to plan out in advance exactly how you are going to manage the trade in any scenario.

What will you do if the stock rallies? What about if it drops? Where will you take profits? Where and how will you adjust? When will you get stopped out?

Lot’s to consider here but let’s look at some of the basics of how to manage short straddles.

Profit Target

First and foremost, it’s important to have a profit target.

For a straddle that might be if profits equal 30% of the premium received. That’s the first decision.

You may also want to think about including a time factor in your trading rules.

How long do you plan on holding the trade if neither your profit target or stop loss have been hit?

Another good rule for taking profits here is if 50% of the premium has been achieved in less than 50% of the time.

Stop Loss

Having a stop loss is also important, perhaps more so than the profit target.

With short straddles, you can set a stop loss based on the premium received.

Some traders like to set a stop loss at 1.5x or 2x the premium received.

Whatever you decide, make sure it is written down and mapped out in your trading plan.

Adjustments

Some traders will adjust short straddles by adding to them when either of the breakeven prices have been hit.

This widens out the profit zone but also increases the capital at risk in the trade.

Examples

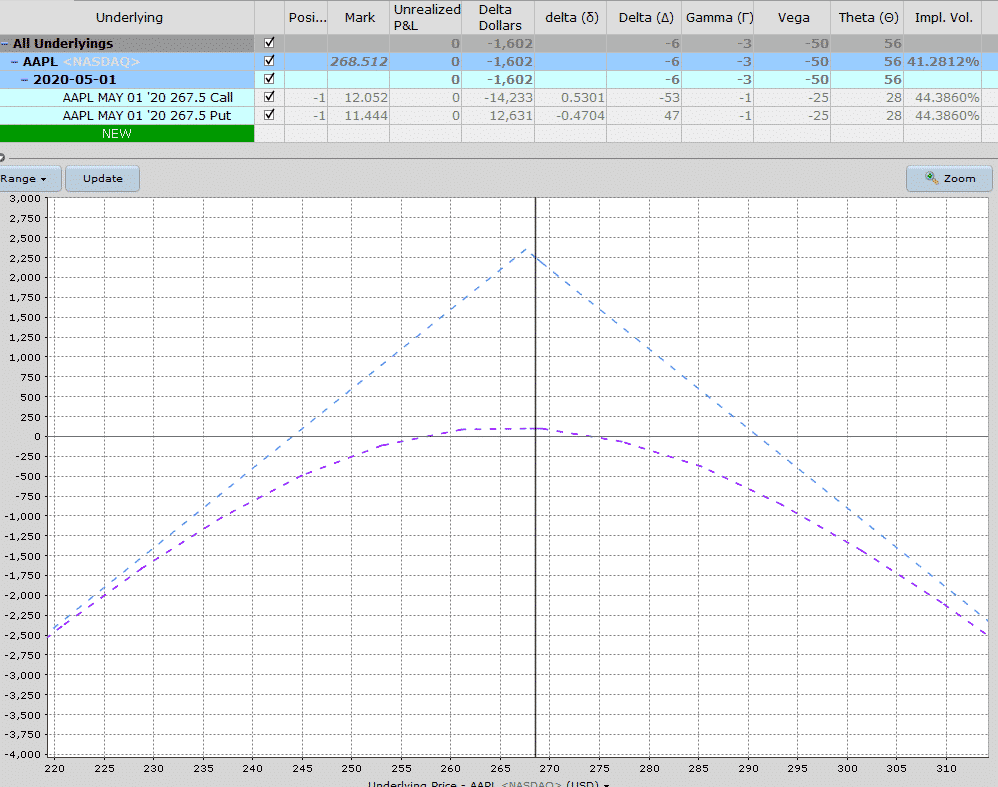

The first example we’ll look at is on AAPL stock from April 9th, 2020,

Date: April 9, 2020

Current Price: $268.51

Trade Set Up:

Sell 1 AAPL May 1st, 267.50 call @ $12.05

Sell 1 AAPL May 1st, 267.50 put @ $11.44

Premium: $2,349 Net Credit

By April 22nd, the trade was sitting on profits of $257.

By April 28th, the profit has risen to $768 and it was time to close out the trade. This is a nice easy example, but trust me, they don’t always work out this easy.

One interesting thing to note with this one is that implied volatility on the options has actually risen from 44% to 61%, but the trade was still profitable thanks to the time decay.

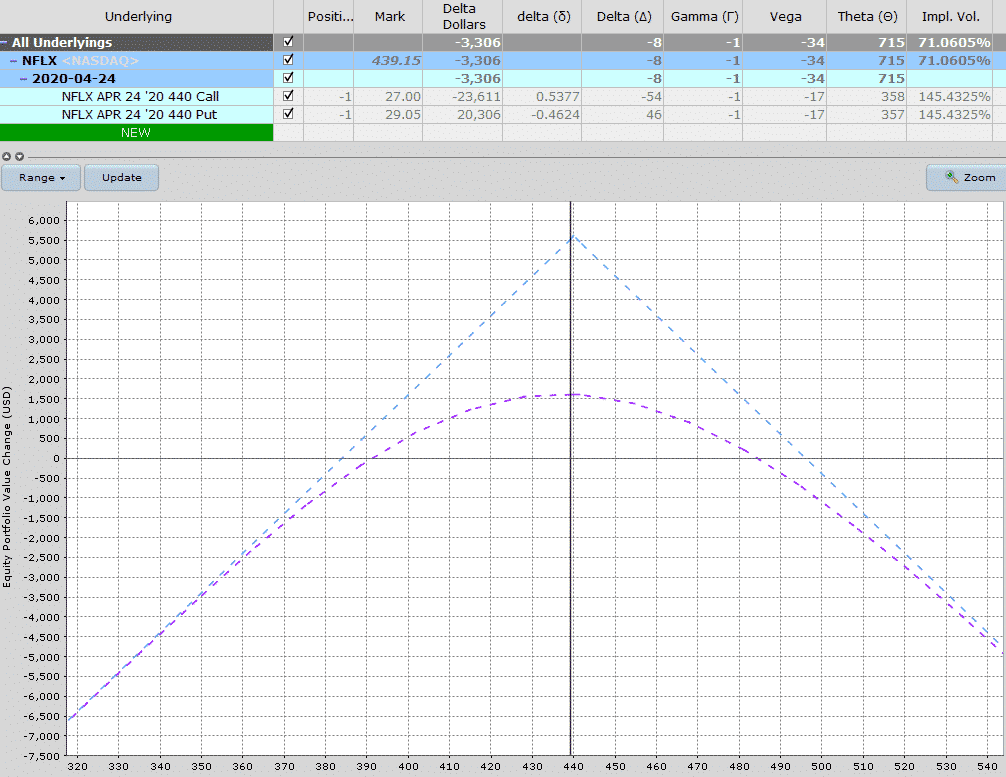

Here’s another example from NFLX which benefitted from a massive IV crush after an earnings announcement.

Date: April 20, 2020

Current Price: $439.15

Trade Set Up:

Sell 1 NFLX April 24th, 440 call @ $27

Sell 1 NFLX April 24th, 440 put @ $29.05

Premium: $5,605 Net Credit

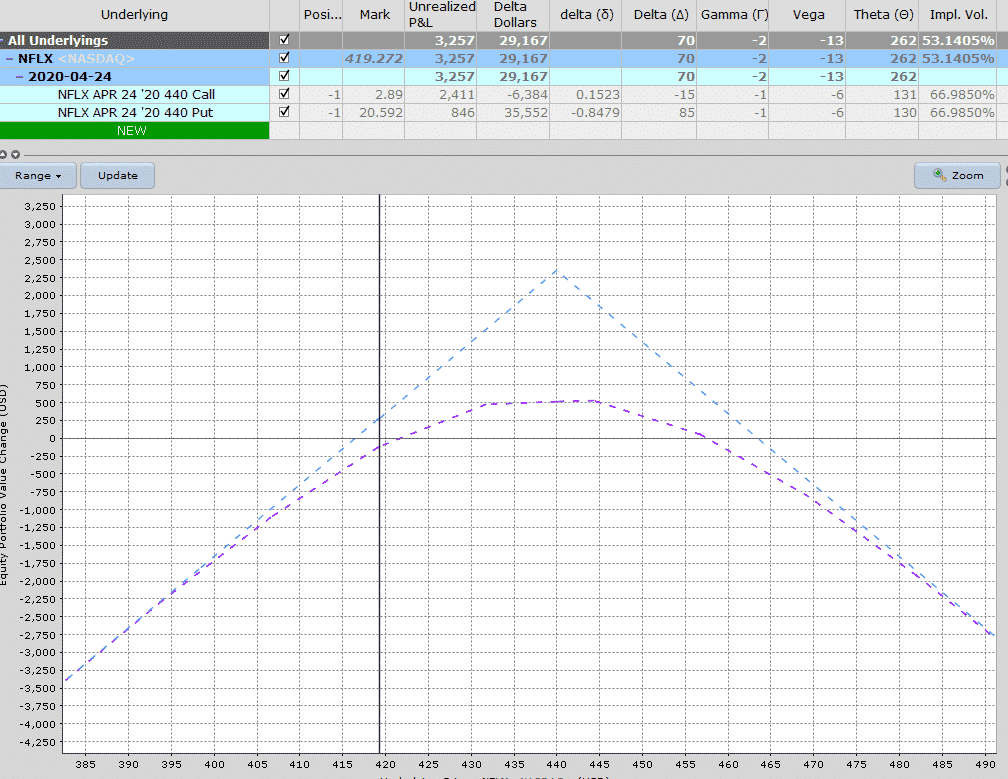

After earnings, the stock dropped to 419 which was a pretty big move, but the price of the straddle declined significantly due to the IV crush.

Notice that before the earnings announcement the 440 calls and puts had implied volatility around 145% and then in the image below (after earnings), the IV has dropped to 67%.

Selling short straddles like this over earnings is very risky and I’ve seen many times a stock move 15-20% after earnings which would result in significant losses for this strategy, even with the IC crush.

Summary

Short straddles are very popular with theta traders due to the high level of time decay. However, traders need to weigh up that benefit with the risk of the stock making a big move.

This trade strategy has very high gamma which means big moves in the price of the underlying will have a significant negative impact on P&L.

When it comes to short straddles, a good rule of thumb for taking profits is if 50% of the premium has been made in less than 50% of the time.

Stop losses should be set at around 1.5x to 2x the premium received.

This option strategy is not recommended for traders with less than 12 months experience trading real capital.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Great insight! The information was very helpful and we’ll organized. Thanks for your contribution!

You’re welcome.

How would you manage if post-earning stock opens the gap up or down?>

Not a lot you can do.