Contents

- What Is A Pre-Earnings Straddle

- Pre-Earnings Straddles Don’t Decay As Much

- How To Calculate The Expected Move

- Why Buy A Straddle Pre-Earnings?

- Other Reasons To Buy A Straddle Before Earnings

- Pre-Earnings Straddle Greeks

- The Risks Of Buying Straddles Before Earnings

- Watch Out For Pre-Announcements

- Conclusion

In the lead up to earnings, options tend to hold their value quite well and the effect of time decay is limited. This is because the uncertainty around the earnings announcement.

A popular strategy with traders is to buy a pre-earnings straddle as a way to add gamma to a portfolio.

If the stock price stays flat, the straddle doesn’t lose too much value because of the increase in implied volatility in the lead up to earnings.

If the stock makes a big move, the straddle buyer can achieve a nice profit.

For this reason, pre-earnings straddles are a nice way to protect an iron condor portfolio against big moves.

What Is A Pre-Earnings Straddle

A long straddle involves buying an at-the-money call and an at-the-money put.

If this is done in the lead up to earnings (i.e. a few days to two weeks out from the earnings date), it could be considered a pre-earnings straddle.

A long straddle is a strategy that’s used to profit from a significant movement in the underlying stock price in either direction (expressed by positive gamma), or an increase in implied volatility (expressed by positive vega).

The main problem with straddles is that the at-the-money options are usually the most expensive!

When the stock doesn’t make that explosive move you were anticipating, the position’s negative theta eats away at the options, especially in the final days before expiration.

As you can see, if a stock doesn’t move much a long straddle starts to decay exponentially and the theta burn is a killer.

Pre-Earnings Straddles Don’t Decay As Much

One way to avoid that theta burn is to place the straddle in the lead up to earnings and then sell it before the announcement.

The key here is to sell the straddle before earnings.

We don’t want to hold the straddle over earnings and take that risk.

Yes, sometimes the stock will make a huge move after earnings, but it will also experience a massive volatility crush and if the stock stays relatively flat, the straddle value will absolutely tank.

We don’t want that risk, so we sell it before earnings.

In the lead up to a company’s earnings report date, the market tends to keep the stock’s option prices propped up to the expected stock price movement.

The expected move can be estimated as the at-the-money straddle price (in the earnings expiration cycle) divided by the stock price.

How To Calculate The Expected Move

You can read the above article for full details, but the simplest way is to take the price of the at-the-money straddle and divide it by the stock.

For example, if a stock is trading at $80 and the straddle centred at $80 costs $6, the implied earnings move is 7.5%.

In the last few days before the earnings announcement, the $80 straddle is likely to hold it’s value well, even if the stock stays flat.

You would think that a straddle with only a few days to expiry would suffer from horrendous time decay, but that is not the case before earnings.

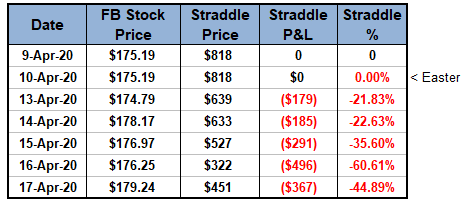

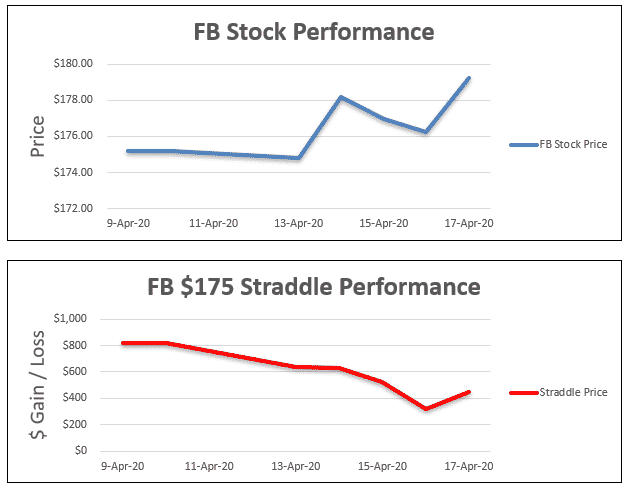

Earlier we saw a Facebook straddle decay 60% over six days leading up to expiration as the stock traded flat.

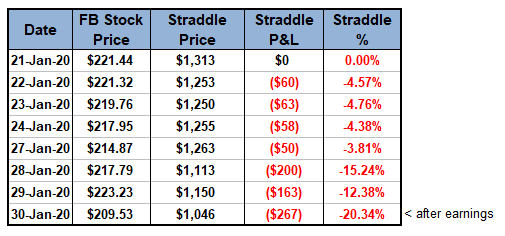

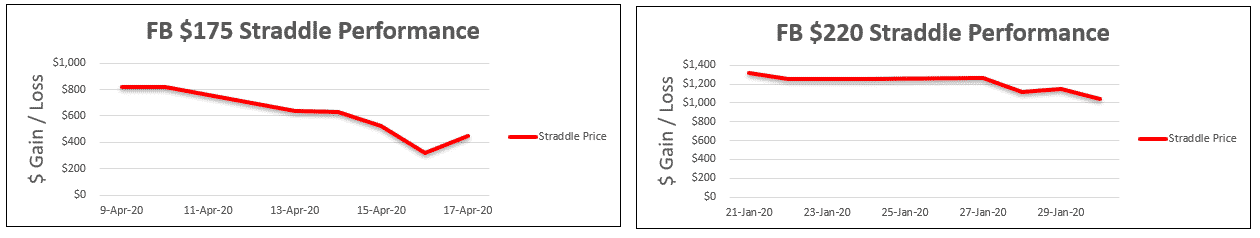

Let’s compare that to another period where the stock traded flat but this time, the period was in the lead up to earnings.

Do you see how the straddle hasn’t decayed nearly as much in this case? Yes, it has decayed because the stock stayed flat, but in this case the straddle only declined by 12% over six days rather than 60%!

Let’s compare the two straddle results side by side so you can see the difference.

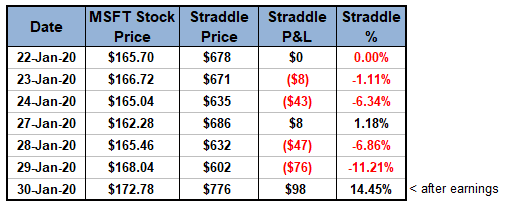

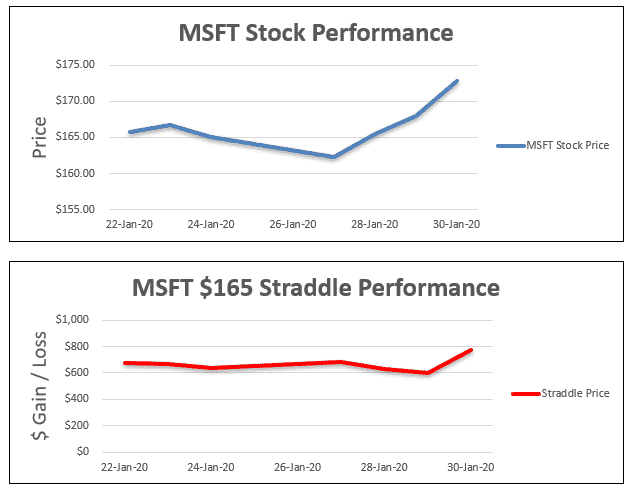

Here is another example with MSFT stock. As you can see, the stock barely moves for a few days before earnings, yet the straddle doesn’t decay very much.

If this was a period that didn’t include earnings, the straddle would have suffered horrible losses from time decay.

You get the idea now, right?

Why Buy A Straddle Pre-Earnings?

A pre-earnings straddle is an inexpensive way to add positive vega and positive gamma to an options portfolio without the usual side effect of time decay.

As mentioned before, it’s crucial to close out the straddle via a sell to close order, BEFORE the earnings announcement, otherwise the strategy become an actual earnings play with significant loss potential.

Since we now know that options don’t experience standard decay before earnings, buying a straddle might be a good strategy to implement if you anticipate a run in the stock. If you’re right, the potential profits are theoretically unlimited.

If you’re wrong, it’s still possible to profit if the expected move increases.

In the FB and MST examples we saw that the drawdown was about 11-12% over six days on stocks that were flat.

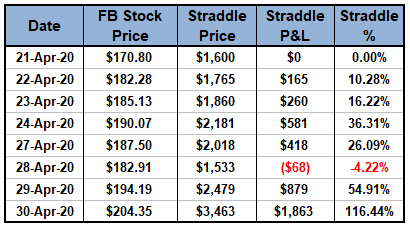

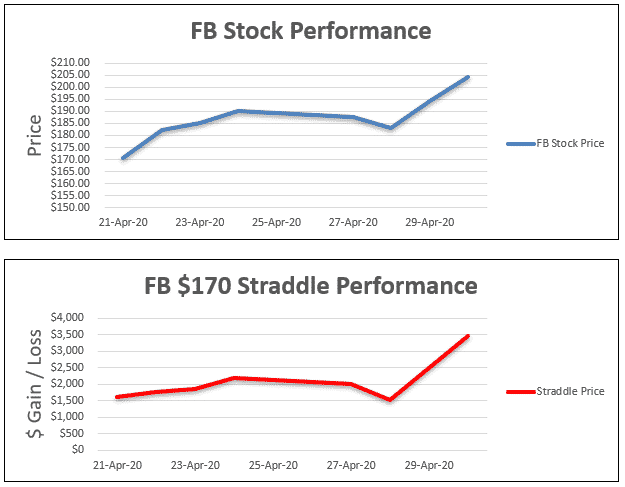

The following example demonstrates how a long straddle can generate profits from a pre-earnings run in the stock price.

In this example, FB made a move from $170.80 to $204.35 in just a few days which saw the straddle gain 116%.

If the downside is limited to 11-12% and the upside is 116%, then that’s the type of trade I like!

Other Reasons To Buy A Straddle Before Earnings

If you’re not anticipating a run in any stocks with upcoming earnings reports, there are still scenarios where purchasing a pre-earnings straddle can be strategic:

- You’re running a portfolio with a lot of negative vega and want to offset that risk for a short period.

- You like the idea of buying straddles on market indices but don’t want all of the usual decay risk. As an alternative, you can buy pre-earnings straddles in stocks that are highly correlated to the market index of your choosing.

As a result, you’ll essentially own a straddle on the market index with minimal decay exposure.

Pre-Earnings Straddle Greeks

Long straddles start as a delta neutral trade and need a big move in the stock to offset the effects of time decay.

The are negative theta because and suffer from time decay. As discussed, the pre-earnings straddle will suffer from less time decay than a regular long straddle.

Long straddles are also positive vega and positive gamma so they can be a great way to offset trades like iron condors.

The Risks Of Buying Straddles Before Earnings

While there are many benefits and uses of long straddle before earnings, there are still risks to be aware of before implementing the strategy. Here are the primary risks to be conscious of when buying straddles before earnings:

- The market revises the earnings movement expectations downwards after news surfaces, resulting in a decrease in the straddle price.

- Earnings data is leaked prematurely, leaving you with long premium that will disintegrate if the stock remains flat. While earnings leaks are extremely rare, they’re still worth a mention.

So, like any options trading approach, this is not a strategy to bet the whole farm on. There are still risks involved, but not as much as buying straddles without an upcoming stock price catalyst.

Watch Out For Pre-Announcements

Another major risk for this strategy is when the company makes a pre-announcement of their financial results.

This is typically done to give Wall Street and high-level understanding of what the company’s quarterly performance will be.

It’s a way to soften the blow a little bit if the results are going to be bad and this gives investors a chance to digest the new information before the full release and conference call.

A website called AlphaSense has some good information on this and provided the following information:

- 37% explicitly stated that they were issuing preliminary results because they were updating their previous guidance

- 19% had not provided guidance, but our research showed us that they had missed or beaten analyst expectations and were presumably providing a warning to the Street

- 17% preannounced in conjunction with an acquisition announcement

- 12% issued the release prior to an investor event (conference presentation, 9%; investor day, 3%)

- The remaining 5% of the sample offered no information as to the catalysts behind the release.

So a pre-release has the potential to cause trouble for this strategy because some of the uncertainty around the release has been removed which would result in a drop in implied volatility.

Of course that could be associated with a big move in the stock which could potentially help the trade.

Conclusion

Pre-earnings straddles are a nice way to add some positive vega and gamma to a portfolio without costing too much in the way of time decay.

When comparing pre-earnings straddles with regular straddles, we can see that the pre-earnings version decays at a much slower rate.

There are some risks with the trade so it is best not to allocate too much of a portfolio to this strategy and as always paper trade first!

Additionally, corporate earnings reports only occur four times per year, so the strategy’s availability is limited.

At the very least, it’s another strategy available to you as an options trader.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I had a question from a reader about this article, so I wanted to see if I could summarize the concept a little bit:

So the idea with the trade is this:

– If you have a portfolio with a lot of short vega, buying a long straddle gives you some long vega to offset.

– If you buy the straddle a few weeks out from earnings, it shouldn’t decay too much given that vol slowly rises into earnings.

– You sell the straddle before earnings, so that you don’t get hit by the vol crush.

– You don’t want exposure to the earnings result, the key is to sell the straddle before earnings.

Let’s say you own the long straddle for 2 weeks and during that time the market is flat.

– That’s great because your short vega trades (condors etc.) perform really well.

– You take a loss on the long straddle, but hopefully the loss isn’t too much given that vol has increased. i.e. the straddle tends to hold it’s value.

If the market makes a big move

– That’s bad for your condors etc.

– But, it’s potentially really good for the long straddle so that helps offset the losses on the condors.

Gavin, this is a great summary of what the strategy aims to accomplish. I agree, it’s not a strategy you want to implement on every stock in every earnings season. At the end of the day, you’re still long premium.

But, if you’re going to buy premium, this is one of the times I’m willing to do so.

-Chris

Just a few clarifications:

1. The strategy is not an earnings play. Buying the straddle a few days before earnings and selling the straddle immediately before earnings is done in an attempt to “catch” a run in the stock price before earnings. Since the options decay minimally (if at all), it presents an opportunity to buy premium without paying the usual theta decay (as demonstrated in the first chart). Even if the stock price trades at the long straddle strike, the options won’t decay much because the market is keeping the options propped up for the upcoming binary event.

2. Like almost all long premium strategies, the strategy almost certainly won’t perform well if it is implemented on every single stock in each earnings season. In my opinion, this strategy would be best-suited for highly volatile stocks, especially ones with a history of breaching the expected earnings move. If you stick to such stocks, there should be a lower probability of decay before earnings because the market is less likely to crush the expected move on a stock that has breached the expected move in recent earnings reports. So, stocks that fit these parameters could be NFLX, GOOG, AMZN, AAPL (a few years ago), GMCR, LNKD. Basically, any stock that is heavily covered in the news before earnings as a potential “big mover” would be better than low volatility stocks (KO, JNJ, MSFT, etc.).

Is this strategy ATM Straddle pre earnings a means to profit from the IV increase on volatile stock, or are we looking for price movement in the underlying prior to earnings or essentially both?

Is this more viable play on volatile earnings stock than selling IC, Strangles?

Hi John, looking for either or both. In the lead up to earnings it’s a better way to play almost any stock. Because of the uncertainty, the option premiums don’t decay much in the lead up to earnings so iron condors are not as good in my opinion.