Contents

What Are Naked Puts?

Let’s start with “What Are Puts?”

A put option is a contract that gives the purchaser the right to sell an underlying asset at a certain price on or before a certain expiration date.

If you buy a put option it means that you are betting that the value of the underlying asset will go below the strike price before the expiration.

If this happens, you’ll be able to purchase the asset at the market rate and then sell the asset immediately at the higher strike price to the entity that sold the option.

If you sell a put option it means that you are betting that the value of the underlying asset will go up or at least remain above the strike price of the option.

If this happens, the option expires worthless and you get to keep the premium that you collected.

When you buy a put option your risk is limited to the premium that you pay the seller of the contract.

If the price of the asset increases to infinity, your loss is only the premium that you paid upfront.

If the price of the asset decreases to 0, your profit is the strike price of the contract minus the premium that you paid.

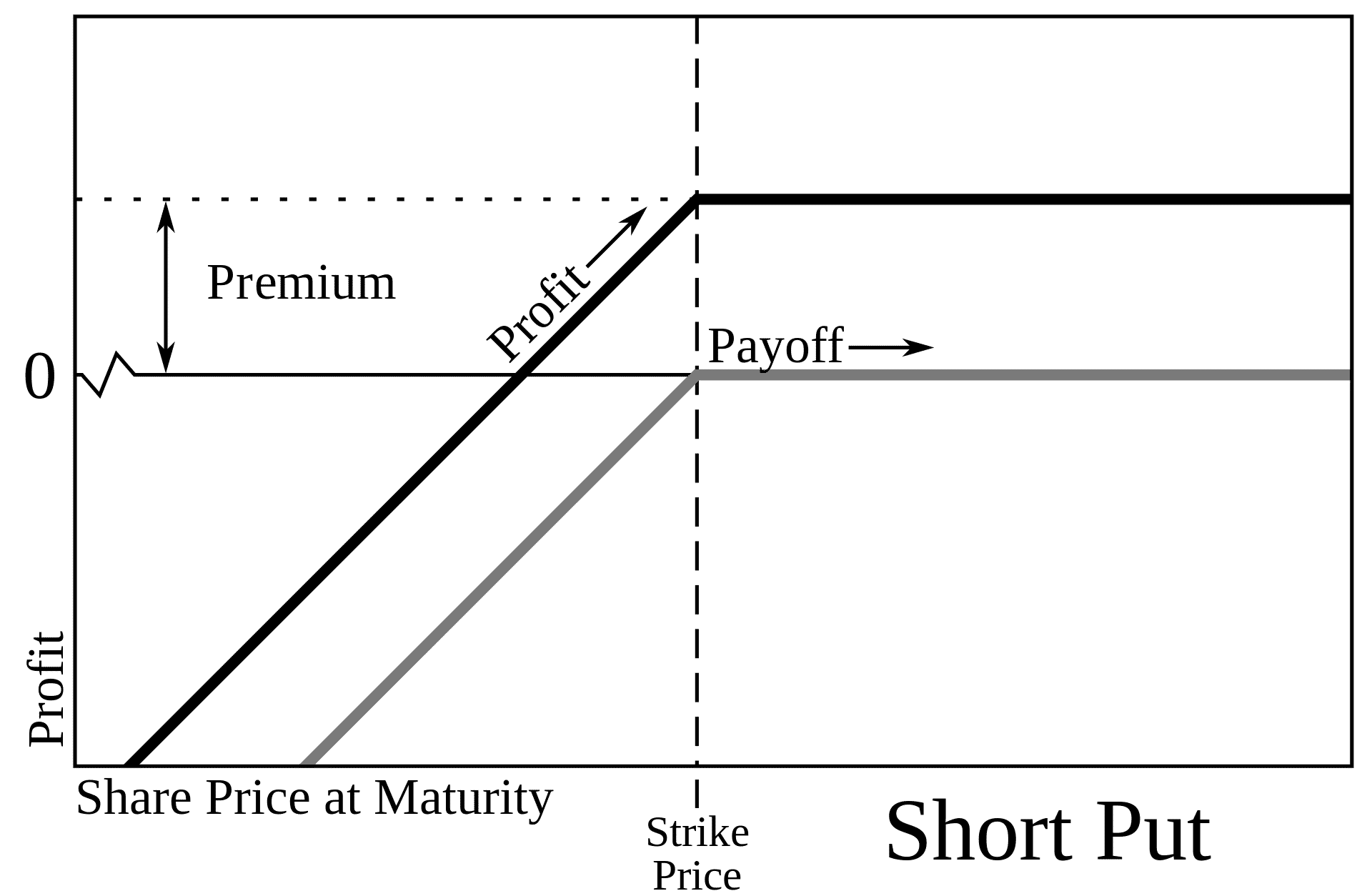

There’s a similar dynamic when you sell put options.

If the price of the asset increases to infinity, your profit is only the premium that you collect upon selling the contract.

If the price of the asset decreases to 0, your loss is the strike price minus the premium that you collected.

As you can see, selling puts can be extremely risky.

This is why a seller of puts is typically using them as a part of some larger strategy.

If you sell credit spreads or iron condors, you will be selling puts.

However, they will always be hedged in case the market moves dramatically against your position.

A Naked Put is when you sell a put option without also holding a short position in the underlying asset or a downside hedge like a long put at a further out of the money strike price.

If you are selling a Naked Put, you must have a very strong opinion about the price of the underlying asset and are willing to accept the risks associated.

What Are the Risks?

When you sell a Naked Put, the downside can be catastrophic if the price moves too quickly for you to exit your position with an acceptable loss.

Naked puts are great in bull markets, but don’t get sucked in to thinking it’s easy money. The bear market of 2008 was a tough period for naked put sellers with the stocks of most companies dropping significantly and some companies going bankrupt.

How Does It Work?

Each option contract is associated with 100 shares of the underlying asset.

For example, let’s say $ABC is trading at $100 and you sell a $95 put and collected $1 premium.

This means that your account will be credited a total of $100.

If the stock is trading above your strike price at expiry, the put expires worthless and is removed from your account.Your profit is limited to the premium that you collect.

If the stock is below your strike price at expiry, you will be assigned and forced to take ownership of 100 shares at the strike price.

You net costs basis will be the strike price less the premium received.

If I get assigned on a naked put, I then like to sell covered calls against the shares. I call this The Wheel trade.

For a full guide on how to sell naked puts, you should visit this reference article.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.