Contents

- The Wheel Strategy Flowchart

- Theoretical Example

- Four Real Trade Examples

- GE Wheel Trade Strategy

- AVDL Example

- BHP Example

- New 2025 Wheel Examples

- FAQ

- Conclusion

The Wheel Strategy is a systematic and very powerful way to sell covered calls as part of a long-term trading strategy.

The process starts with a selling a cash secured put.

Investors also needs to be willing, and have the funds available to purchase 200 shares.

After selling the initial put, the put either expires or is assigned.

If it expires, they keep the premium and start again if they are still bullish on the stock, or they move on to another stock.

If they are assigned, they take ownership of 100 shares.

At this point they sell a call to turn it into a covered call and they also sell a new put.

From here, if the stock goes up through your call, you are assigned and the stock is called away leaving you flat.

As the stock went up, your sold put expires worthless.

If the stock goes down, you are assigned on the second put, and you now have your full allocation of 200 shares.

As the stock went down, the call expires worthless.

Now that you own 200 shares, you sell two calls.

If the stock goes up through the calls, the stock is called away and your position is flat again.

Through the process you have collected 5 option premiums, plus any dividends while holding the shares, plus potentially some capital gains, depending at which strikes you sold the calls and puts.

If the stock continues down, you can continue to sell 2 covered calls each month.

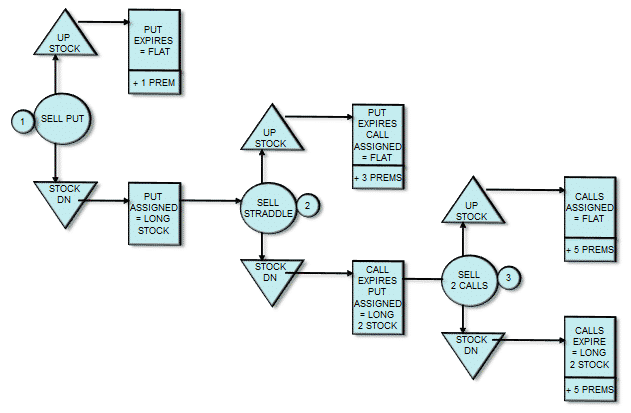

This process is best explained in the following diagram.

The Wheel Strategy Flowchart

This is just the theory of course, and in practice, things don’t always work out so smoothly.

One trap investors can fall in to is continuing to hold on to shares as the stock falls due to the attraction of generating option premium.

Stop losses are important. Have a think how this strategy would have performed on a stock like Lehman Brothers during the Financial Crisis.

If a stock has dropped 10%, it might be time to cut and run. You don’t want to keep adding to a losing position by buying more shares.

In this case you end up selling calls for less than your cost basis, meaning that even if your stock goes up through your calls, you are still left with a loss.

Here are some things you might want to consider when looking at this strategy:

- Sell the first put when implied volatility is in the higher end of the 6-month range

- Wait for a 5% pullback before selling the first put

- Place a stop loss 10-15% below where the stock was trading when the put was first sold

- Adjust your stop loss lower when multiple puts have expired worthless

- Will you sell the first put slightly out-of-the-money or at-the-money?

- Will you sell the calls slightly out-of-the-money or at-the-money?

- Sell the first put when RSI is below 30

- Stick to low beta, high dividend stocks. Think of stocks you would be happy to own in your retirement account

- You can also use this strategy on ETF’s to reduce the bankruptcy risk

- If the stock continues to fall, it’s ok to sell a call below cost only if you have received enough put premiums to offset the cost basis

- If you have sold numerous puts, your actual cost basis can be very low

Theoretical Example

Let’s look at a theoretical example to see exactly how the strategy works and then I’ll share some trades from my own account.

In April, 2014 JNJ was trading at $98.

We start by selling a June $95 put for $1.50.

JNJ then falls below $95; we are assigned on the put and take ownership of 100 shares with a cost basis of $93.50 (95 less the 1.50 option premium).

Now we sell an October $97.50 Call for $1.50 and an October $90 Put for $1.50.

So far we have received a total of $450 in option premium (3 x $150) and we have paid $9,500 for the 100 shares.

The cost basis is $9,050 or $90.50 per share.

As October expiry, JNJ falls below $90.

We are assigned on another 100 shares at $90.

We now sell two January $95 calls for $1.50.

We have been assigned on the shares at $95 and $90 totaling $18,500.

We’ve received 5 x $150 in premium from call and put sales.

Our net cost basis is $17,750 or $88.75 per share.

If JNJ is below $95 at January expiry, we sell two more calls and continue to collect the dividends.

If JNJ is above $95, our 200 shares are called away leaving our position flat.

The total profit is $95 – $88.75 x 200 = $1,250.

Not bad for a stock that has fallen from $98 to $95 over the course of the trade.

Four Real Trade Examples

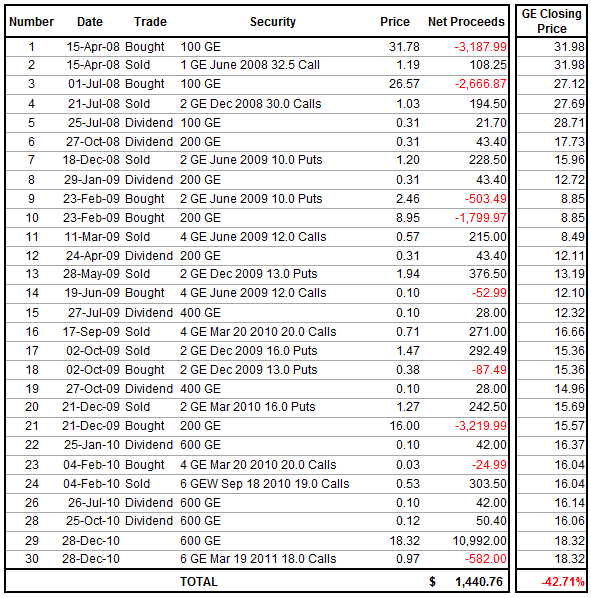

The following is an example that I like to share with coaching clients.

It’s a good example because it occurred during the 2008-2009 financial crisis.

On a stock that dropped 42%, I made a profit of $1,440.

However, I was lucky, and at one point I was in a pretty big hole.

Realistically I should have been stopped out of the trade in mid to late 2008 but I stuck with it and rode it out.

If someone tried this on Bear Sterns, Lehman Brothers or AIG, they wouldn’t have been so lucky.

Here is the trade history.

You can see that I started the trade via a covered call on GE when it was trading at $31.98.

Over the course of the trade I bought stock as follows:

100 shares at $31.78 in April 2008

100 shares at $26.57 in July 2008 average cost now $29.18

200 shares at $8.95 in February 2009 average cost now $19.06

200 share at $16.00 in December 2009 average cost now $18.04

In total I generated $981.28 in option premiums after commissions and received $342.30 in dividends after tax.

To close the trade, I ended up buying back the $18 calls in December 2010 and selling the shares for $18.32.

All up the trade made a profit of $1,440 while the stock declined by 42% over the course of the trade.

Even though I’ll freely admit the trade wasn’t managed very well, you can see how powerful this strategy can be.

GE Wheel Trade Strategy

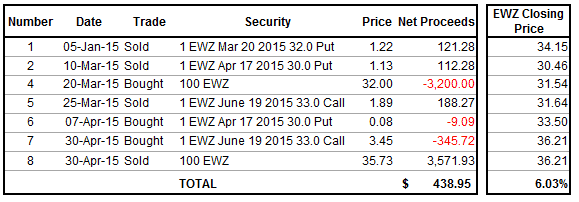

Here is another trade example that worked out a little more smoothly than the GE trade.

You can see that in this case, EWZ rose by 6.03% over the course of the trade.

The profit on the wheel trade was $438 on capital at risk of $6,200 which equates to a 7.08% return.

AVDL Example

This trade was started in September 2020 with the stock trading at 6.41. I initially sold the puts in-the-money because I wanted to be assigned.

In December 2020, I was assigned at had to buy 200 shares at $7.50 or $1,500 in total.

Since then, I’ve been selling more puts at $7.50 and calls at $10. All up I’ve generated $1,460 in option premium, so effectively own the shares for a net cost of $40.

If I were to close the position today (Sept 29, 2021), the net profit would be $1,482 or close to 100%.

BHP Example

Winning trades are great, but what about losing trades?

Yeah, I’ve had my share of those too. Here is a recent example, although it is still ongoing.

On June 23, 2021 with BHP trading at $76.43, I sold a February 2022 put with a strike price of 65 for $4.70.

If the put expired worthless, I would achieve a 11.85% annualized return.

If the stock dropped and I got assigned, I would hold the shares forever and collect the roughly 5% dividend.

Since opening the trade, news of Evergrande and China’s troubles have hit the stock, seeing it drop to 52.62.

At the time of writing, I’m down $845 on the trade and it looks like I might get assigned in a few months.

I’m not bothered though because the plan was always to take ownership of the stock and hold for the dividend.

Eventually, I’ll be able to sell covered calls if / when the stock gets back above $65.

New 2025 Wheel Examples

FAQ

What Is The Wheel Strategy?

The Wheel strategy is an options trading strategy that involves selling cash-secured puts and covered calls on a stock with the goal of generating income and potentially acquiring shares of the stock at a discounted price.

The strategy is also known as the Triple Income Strategy or the Sell-Put-Sell-Call strategy.

Does The Wheel Strategy Work?

Yes, the wheel strategy can work incredibly well.

However, it will not work in all market conditions.

We saw above that when a stock suffers a large decline, the wheel trade will suffer losses.

Selling the second, third or fourth put is effectively doubling down on a declining stock.

Doubling down is generally considered a cardinal sin in trading.

That being said, we also saw in the GE example, that the strategy can work in the long run, even when a stock suffers a large decline.

One method to help ensure success, is to only trade the wheel strategy on quality, blue chip companies.

Generally speaking, these companies will eventually bounce back from a temporary decline.

We would not recommend the wheel strategy on high risk tech stocks or anything that has a risk of going bankrupt.

If a company goes bankrupt, wheel strategy traders stand to lose large sums of money.

What Are The Risks Of The Wheel Strategy?

The risks of the Wheel strategy include the potential for the stock to decline in value, which could result in losses if the put option is exercised or if the stock is called away at a lower price than you bought it for.

Additionally, if the stock doesn’t move much, the premiums collected may not be sufficient to offset any losses.

Finally, there is always the risk of assignment if the stock price drops sharply and the put option is exercised, requiring you to purchase the stock at a higher price than it is currently trading.

Is The Wheel Strategy Safe?

The wheel strategy is safe in that it is similar to owning stock.

There are risks with owning stocks and therefore there are also risks with the wheel trade.

Investors need be smart with position sizing and stock selection in order to improve the level of safety.

The wheel trade is not safe if traders take positions that are too large for their account, or trade high risk stocks.

The wheel strategy is best done on ETF’s and blue chip companies to improve the level of safety.

Who Is The Wheel Strategy Suitable For

The Wheel strategy may be suitable for investors who are comfortable owning and potentially accumulating shares of a stock over time, have a moderately bullish or neutral outlook on the stock, and are looking to generate income from options trading.

The strategy may not be suitable for investors who are looking for quick profits or have a bearish outlook on the stock.

Is The Wheel Strategy Bullish?

The wheel strategy is bullish, but slightly less bullish than owning a stock directly.

With stock ownership, the investor has unlimited upside.

With the wheel strategy, the potential gains are limited to the premiums received and any dividends paid by the company.

We would class the wheel trade as slightly bullish.

What Are The Best Stocks For The Wheel Strategy?

The best stocks for the wheel strategy depends on an investors risk tolerance.

We believe in sticking with blue chip companies and highly liquid ETF’s.

Consumer staples stocks and stocks with a high dividend yield are also fairly low stress trades for the wheel.

It’s also important to look for companies that have good option volume and tight bid-ask spreads in order to reduce slippage.

Some examples of companies we would consider for the wheel trade include:

Coca-Cola (KO)

Verizon (VZ)

Kellogg Co (K)

Kimberly Clark (KMB)

3M Company (MMM)

Cisco (CSCO)

Kraft (KHC)

Merck (MRK)

Pfizer (PFE)

Procter and Gamble (PG)

AT&T (T)

Bristol Myers Squib (BMY)

Abbie Vie (ABBV)

Gilead (GILD)

Amgen (AMGN)

Colgate Palmolive (CL)

And most stocks in the Dow Jones Industrial Index.

We also like sector and country ETF’s:

Materials (XLB)

Energy (XLE)

Financials (XLF)

Industrials (XLI)

Technology (XLK)

Consumer Staples (XLP)

Utilities (XLU)

Healthcare (XLV)

Consumer Discretionary (XLY)

Emerging Markets (EEM)

Brazil (EWZ)

Australia (EWA)

Germany (EWG)

United Kingdom (EWU)

Eurozone (EZU)

Gold (GLD)

Aerospace and Defense (ITA)

Real Estate (IYR and VNQ)

Some specific real estate companies we also like:

Realty Income (O)

Arbor Realty Trust (ABR)

Omega Healthcare (OHI)

Conclusion

The wheel strategy is a really powerful income strategy that can enhance your long-term returns.

There are risks and it’s important that investors are careful not to get sucked in to averaging down on losers.

Wheel trades can be very straight forward as we saw in the EWZ example, or they can be very painful and tie up capital for a long time as we saw in the GE trade.

What do you think about this strategy? Let me know in the comments below.

from your example

Now we sell an October $97.50 put for $1.50 and an October $90 Put for $1.50. So far we have received a total of $450 in option premium (3 x $150) and we have paid $9,500 for the 100 shares. The cost basis is $9,050 or $90.50 per share.

As October expiry, JNJ falls below $90. We are assigned on another 100 shares at $90. – See more at: https://optionstradingiq.com/the-wheel-strategy/?utm_source=getresponse&utm_medium=email&utm_campaign=optiontradertest&utm_content=The+Wheel+Strategy#sthash.nGUq0KiN.dpuf

What happened to the Oct 97.50 put, why didn’t it get assigned?

Hi Charles, sorry that should say $97.50 Call. I’ve updated the article now. Thanks.

Hi Gavin,

This is the most sensible way I have so far seen in the way options strategies coud be presented: Flow Charts. Love it.

To make the analysis more complete, what about including the potential losses.

For example at straddle #2 if the price moves sideways, there is a loss.

To allow an apples for apples comparison with the profits, you’d indicate worst case loss as a fraction of premiums.

Everyone should be using Flow Charts to present Options Strategies.

Geo.

Hey Geo! Regarding the straddle, if you sell both the CC and CSP contracts slightly out of the money, trading sideways would actually result in both contracts expiring worthless. (:

Hi Gav,

Nice article. I’ve been doing something very similar this year with XLE and XLU. One tweak I’ve made is to close the short put at 0.1 rather than wait for it to expire. This has given rise to a dilemma that I wasn’t expecting at the outset of what should be a pretty systematic process. With XLU, I was expecting this to be a slow and steady kind of stock/ETF but it has had a few big daily moves. On one of these big up moves the short put hit the closing 0.1 limit order but then the question arose, do I immediately sell a higher strike put and feel like you are chasing it, or wait a few days for stock to retrace – which it may never do. No right answer of course, you can only follow your trading plan!

Cheers,

Will

Hi Will,

Yes big moves (both on the upside and downside) can be a pain with this strategy, but you’re right that following your plan is the most important thing! I like using sector ETF’s and also country ETF’s for this strategy rather than individual stocks.

G.

As you say…

•”Stick to low beta, high dividend stocks. Think of stocks you would be happy to own in your retirement account”

This strategy works well for me! Thank you

I’m retired (but I like to call it “Self Employed”!

Way to go Neil! Glad the strategy is working well for you.

I live in Argentina and this exchange DO NOT allow me to sell puts, neither covered nor naked.

I tried to syntesize the short put, but I do not like owning shares,

I think i’ll open an account on TDAmeritrade, small accounto to use this kind of options at low priced stoks, to start learning and practicing

Good plan. Best to start small until you have some experience. Good luck on your journey and if you ever need any help, just reach out to me.

Great article. May only comment is a minor correction: a straddle is when the put and the call have the same strike price.

A strangle is when the options are different strikes.

I believe your examples demonstrate strangled vs straddles are used.

Hi Chuck, yes you’re right. Sometimes I will do a straddle, sometimes a strangle.

Using a straddle seem like a good idea if the price ends up very Close to the assigned stocks entry price especially if the current price of the stock is Oversold.

Nice article, thanks Gavin!

A question about “Stick to low beta….”: I heard that low beta (is same as low IV?) can be risky as you may collect low premium and IV can potentially go higher, but when IV is higher, you collect more premium while more likely IV will go lower.

Do you agree? based on your extensive experience, is this also true?

Thanks

Hi George, I guess it’s all relative. High IV stocks are ok as long as you’re prepared for the big moves and willing to accept big fluctuations in P&L. Maybe where you’re getting confused is comparing IV from one stock to another. TSLA is going to have way higher IV than JNJ, but it’s also going to move a lot more.

What’s important when selling options is to be selling options with a high IV Rank or IV percentile. So JNJ can have high IV relative to itself, and that’s a good time to sell puts on JNJ.

More details here:

https://optionstradingiq.com/iv-rank-vs-iv-percentile/

Hope that helps. Any questions, let me know

Hi Gavin, I want to do the wheel on spy with the 40k I have. Could you advise me on how I should go about this and what potential risks i should worry about?

Hi Nick, that’s tricky with only 40k. If you get assigned on the first 100 shares, that about $35k. Then you’ve got nothing left to sell the second put unless you trading on margin which I wouldn’t recommend. Why not start with a sector ETF like XLK or EEM to get a feel for things. The risks are similar to stock ownership, if the stock drops hard you’re going to lose. You’re only protected by the premium received which can sometimes only be a few percent. Any other questions, let me know.

Any optionable and low-price ETF of MSCI World or SP500 or Nasdaq in order to implement this strategy with not much money? SPY is too expensive because 100 SPYs are almost 30k$!!!!!! Thank you very much for your great blog!

Can think of any low priced World ETF’s, but I use EEM a lot for emerging markets, FXI for China, IYR for real estate, XLU for utilities, GDX for gold miners, XLF for financials. That should give you a few ideas to get started.

how far out do you usually go with the expiration? i see in one of the examples up there you sold a june option in the month of april. is that pretty typical?

Yes, I’ll usually go out 2-3 months

Hi Gavin,

I first saw this strategy in the LEAPS Harrison Roth book from where you got that diagram. Or, I should say, wherever you found the image on Google, first game from that LEAPs book.

This is a good strategy in a slightly down, sideways, slightly up, and strong up markets. Where it fails is when you are hit with a down market. I’ve wrapped my head around how to fix that “problem”:

Do a LEAPS Put Diagonal? Well, this sounds good, unless the market keeps marching up, then that expensive Long LEAPS put is losing too much money and then gets increasing less effective as a downward hedge the further the market rises. Add a Call or Call Debit Spread to this to help with this problem? Yes, but then you are wiping out any gains with that new debit.

Start off as a Put Credit Spread? Yes, well, this helps, but then you cut down on your gains, and you can still get whacked with losses if the underlying falls through your short strike.

Have a stop loss on your Short Puts? Sure, but, of course, you get hit with a loss.

Mitigate the problem by selling “less risky ETFs, Dividend stocks, etc. Yes, but they will fall too if in a down market.

Etc.

And so, like you mentioned as an option, merely pick a Dividend stock you would not mind owning at the put strile-ish where you are short. Sure, you will get hit with losses if the market falls, but you said to yourself, you wouldn’t mind owning the stock anyway. You can also wait a bit for a dip/gets closer to it’s Tangible Book value, etc, to make this trade even safer.

I am still turning my head around that LEAPS diagonal idea though. This idea may still be the best solution, IF you are at a market top, or you are at a place where the market is running out of steam.

Perhaps you have the trading idea that in an up market, simply do the Wheel Strategy on Defensive Dividend Stocks, then switch to the LEAPS diagonal method when you think the market has gotten tired.

You get my point.

Gavin,

The Wheel Trade strategy you offered was very comprehensive. I learned several valuable points not only from you, but also your followers. And, compliments have been paid to you in the above article…and they are well deserved! In fairness you must be sharing trading information to your followers that “everyone else” is trying hard to sell. There certainly is a cost to you for your assistance. Maybe you should have a portal set-up for “donations” to support your continued goodwill to all comers. I know I would contribute something. Best regards, Jay Berger

Thanks Jay, much appreciated. Just your comment is donation enough.

Recently am doing the wheel stragedy. I add one more thing. I bought protective puts from 10 to 52 weeks out.

Nice. Good idea to protect the downside.

This strategy also possible to instead buying stock to sell ITM Put? And what protection – maybe OTM Call, would you sugest? Many thanks for your great content.

Selling a deep ITM put would be very similar to owning the stock, but it could get assigned at any time. I sometimes buy a further OTM put as protection against a market crash and to limit margin requirements.

Gavin,

I truly enjoy reading your material and realizing there are so many ways to use options in building a successful portfolio.

However, I am concerned with the number of “choices” we have with #options#.

I did not try to count the ways but it’s nice to know they are out there. For me, I want to stick with puts and calls.

Likewise, as to overall portfolio development. I’m from the finance/insurance side of corporate life and, by necessity, needed to keep all my proposals very simple and clean – not 100 optional ways to go on an investment but a more manageable 4-5 different scenarios. Otherwise, clients and employees get glassy-eyed very quickly.

I don’t want you to change – but I would like to see the “top 5 or 6 methods” that are easy to remember and therefore, more frequently used. In my day it was called KISS – “keep it simple stupid” – I’m sure you’ve heard of it.

I made money selling puts (the base method) and was very pleased with it.

So a big thank you – had I known about this some 55 years ago it might have clicked – so if you’ve got more like simple – basic puts and calls I’d love to see them. You are by far the most prolific, trainer/coach a person could have and so much better than any other coach, trainer, or guru out there.

Thank you!!

Thanks for the kind words GT. Yes there are some articles on basic calls and puts:

https://optionstradingiq.com/long-call-option-strategy/

https://optionstradingiq.com/long-put/

How about using a Jade Lizard to enter the trade, if assignment is no issue?

Yep that’s a good idea. I like the Jade Lizard.

https://optionstradingiq.com/trading-the-jade-lizard-options-strategy/

Would a vertical option saved you some heart ache on the big stock price drop, you could still be exercised but sell the buy side of the vertical..???

Yes, the two would cancel each other out. There would still be a loss overall, but not nearly as bad.

Hello Gavin,

How are you determining Capital at Risk (the denominators) to calculate your % return?

For example, on your EWZ trade, you state a $6,200 risk; how did you come up with that number?

Thanks.