Chances are if you are an average investor you have not considered selling in the money puts.

Though ironically, you may have already placed similar trades in the past.

This article will explain the basics of the trade.

After that, we will delve into some intricacies on the best times to strategically sell ITM puts in a portfolio.

Contents

- Basics Of Selling In The Money Puts

- Why Should I Sell In The Money Puts?

- Tail Risks

- Picking between a Covered Call And An In The Money Put

- Advanced Strategies

- FAQ

- Concluding Remarks

Basics Of Selling In The Money Puts

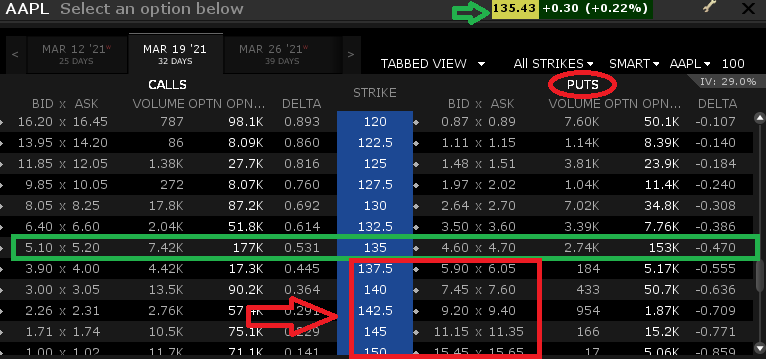

Selling an in-the-money put is incredibly simple. All we do is look at the current price of the stock and find the at-the-money strike (shown in green).

We then look further up the chain on the put side.

These are the options we sell when we sell an ITM put (shown in red).

Comparing Apples to Apples (Covered Call vs ITM Put)

Lots of retail investors have a bias against selling puts.

I recently talked to a middle-aged investor.

Let’s call him Dan.

We were chatting about a stock Dan liked.

I asked him candidly if he would sell an ITM Put on it based on his thesis.

Dan scoffed…

“Selling puts?! Are you Crazy! I only implement covered calls in my portfolio. I invest my account with low-risk income strategies.”

That made me smile.

After a bit of banter back and forth Dan was still bewildered.

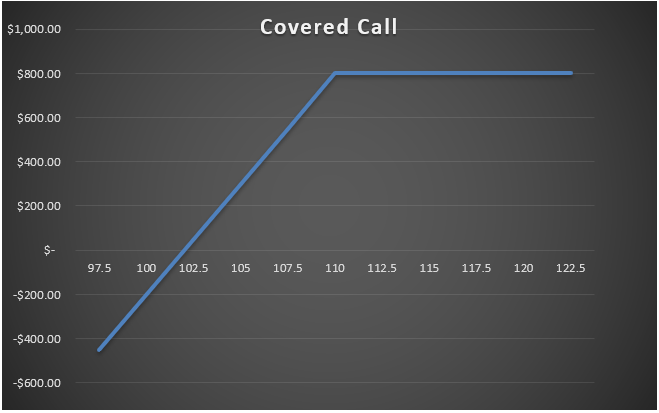

To straighten it out I showed him the risk profile of a covered call against an ITM put.

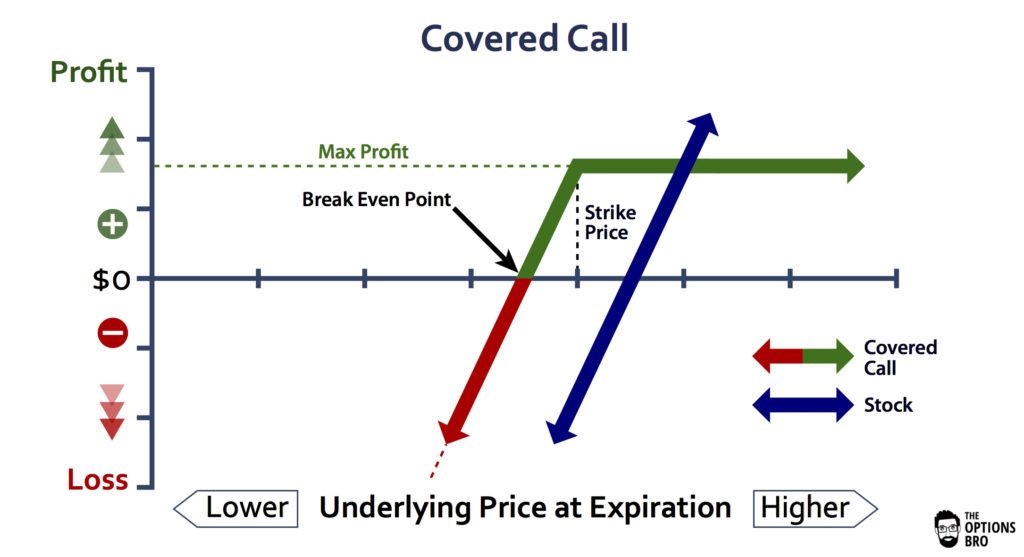

Before you think I missed a second graph I assure you I did not. The graphs are the same.

Buying 100 shares of stock and selling 1 OTM call is the same as Selling 1 ITM put

Turns out Dan was a closet put seller!

Why Should I Sell In The Money Puts?

We have defined an in-the-money put as the same thing as a covered call.

Now it is important to justify the benefits and costs of selling them.

For this, it’s easiest to go back to the covered call.

With a covered call, we have 100 shares of a stock.

We decide that to generate income we can sell an OTM call against those shares.

By selling the call we reduce our risk of the shares.

This is because if the stock sells off, we are on the hook for the losses but we get to keep the premium from the call we sold.

If the stock stays unchanged, we also benefit as we collect the premium from the call we sold and are flat on the shares.

It is only the last option that if the stock rallies substantially our gains are capped at the strike we sold our call + our premium collected as shown below.

Image Credit: The Options Bro

The key selling point for covered calls and hence ITM puts is the reduced variance and comparable long term returns to simply buying and holding shares.

Our structure takes advantage of two premiums to generate long term returns. The Equity Risk Premia (for buying equities) and the Variance Risk Premia (for selling volatility).

Tail Risks

With an ITM put our biggest risk is delta.

What happens if the stock crashes?

We do receive a premium by capping upside gains.

Despite this, that premium is almost immaterial in a quick stock crasdelth (as seen in March of 2020).

Our delta, which may start around 70, quickly becomes 100.

At that point, we are simply holding long synthetic stock.

As such, stressing an ITM put or covered call can be done in the same way as stressing a stock position for a move to the downside.

I would recommend stressing it for a 5 standard deviation move to the downside.

It might be painful to look at, but it’s a lot more painful having it happen and being unprepared.

Picking between a Covered Call And An In The Money Put

Picking between a covered call and selling an in-the-money put is akin to picking one apple over another.

They are the same.

Some investors prefer covered calls because they see the premium vs. with the ITM put the premium (while larger) is embedded in the contract.

This while visually appealing is no advantage.

Others like the dividend they receive with the shares.

This is also embedded so aside from potential tax nuances they are identical.

Here are my thoughts.

1. If the contract is liquid and you have no position, selling an ITM put is one transaction vs two in making a covered call so you may pay less in commission and spreads.

2. If you are already long the shares selling a call against them is easier than selling the shares and subsequently selling a put.

3. Potential tax differences may favor one over the other.

4. Sometimes ITM puts are more illiquid making covered calls a better bet.

Expanding on the fourth point.

ITM puts may seem more illiquid but there is often hidden liquidity.

This is because a market maker sitting at Citadel can easily buy the ITM put and sell a covered call for an arbitrage.

When you have not only Citadel but multiple market makers competing against each other for your free money, whoever is there and willing to do it for less will be served.

The result for the consumer is a fill price virtually identical to that of a covered call as long as you are placing nonaggressive orders.

Advanced Strategies

For investors who want to manage their retirement portfolio while spending 10 minutes a day, selling ITM puts is a reasonably good long-term strategy.

For those of you who are more advanced, this section is for you.

When you sell an ITM put you are expressing this exact view.

Long Delta, Short Vega, Long Theta & Short Gamma

In other words, I am bullish on the underlying but do not expect a major price appreciation.

I think implied volatility and skew are overpriced against my expectations.

Let’s look at Tesla as an example

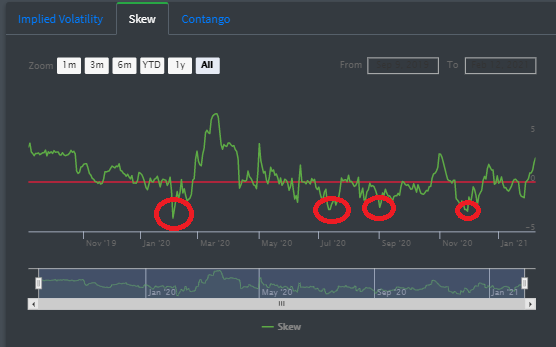

One metric I like to look at is skew.

The key thing to see with skew is significant call skew (or less put skew than normal).

This means that the OTM calls and hence ITM puts, are trading with higher volatilities than normal against their at-the-money counterparts.

By selling this skew at its extremes we are making potentially better trades and selling higher implied volatility.

This is working on the basis that skew mean reverts and is historically overpriced.

Below is Tesla’s skew plotted.

Selling ITM puts when we see the extremes in call skew as indicated in the red circles could be a good start.

In terms of implied volatility, there are a lot of things we can look at to determine the best selling point.

One of my favorites is the implied volatility vs. realized volatility spread.

By focusing on the points where implied volatility is the highest relative to realized volatility we can bet on the spread converging.

These are a few examples of a few metrics I use personally to determine when it is most advantageous to sell an ITM put.

Neither is foolproof.

Implied Volatility vs Realized Volatility When Selling In The Money Puts

Maybe implied volatility is high against realized as earnings are approaching. In the case of Tesla perhaps it was the risk of movement on S&P inclusion.

As is usually the case you can find information to contradict your view.

It is important to analyze both sides and see if the trade still makes sense.

The key here is that your information supports the original view above of a short ITM put.

Yet if you do some digging and come to some different conclusions, then the short in-the-money put is now not expressing your view correctly and needs to be taken off.

Conversely, as the stock moves and your ITM put is now OTM well you now have a different view and exposure.

At this point, you can either roll the position (if you want to maintain the same view you originally had) or simply take off the position.

Most important is your delta position.

At the end of the day, it doesn’t matter what volatility data you are looking at if you sell ITM puts on a dog.

If we are not moderately bullish on the underlying there is no need to place an order or continue to hold a position.

FAQ

What Are In-The-Money Puts?

In-the-money puts are put options where the strike price is higher than the current market price of the underlying asset.

Being in-the-money means traders that have sold the put could have assignment risk.

In-the-money puts trade with higher premium than out-of-the-money puts because they have intrinsic value.

Why Would I Sell In-The-Money Puts?

You might sell in-the-money puts if you believe that the underlying asset will increase in value or remain stable.

By selling the put option, you can earn income from the premium and potentially buy the asset at a discount if the option is exercised.

However, there is also a risk of significant losses if the underlying asset’s price drops sharply.

How Do I Sell In-The-Money Puts?

To sell in-the-money puts, you would need to have a margin account with a brokerage that allows options trading.

You would then select an option contract with a strike price that is below the current market price of the underlying asset and sell the contract for the premium.

If the option is exercised, you would be obligated to buy the asset at the strike price.

What Are The Risks Of Selling In-The-Money Puts?

The main risk of selling in-the-money puts is that the underlying asset’s price could drop significantly, resulting in a substantial loss if the option is exercised.

Additionally, there is also the possibility that the option may not be exercised and you would miss out on potential profits if the asset’s price increases.

Can I Use Selling In-The-Money Puts As A Strategy For Generating Income?

Yes, selling in-the-money puts can be a strategy for generating income through options trading.

By selling the put option, you receive the premium, which can be a source of income.

However, it’s important to understand the risks involved and have a solid understanding of options trading before implementing this strategy.

Concluding Remarks

Selling in-the-money puts are often overlooked as a strategy despite being a simple alternative to a covered call.

For regular investors, they offer an income stream and reduced variance without compensating long-term returns.

For more advanced investors it is yet another option strategy in your toolbox. One to express a moderately bullish view on price while taking advantage of overpriced volatility and skew.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

There is a parallel way to use puts for poor man coverd call?

Yes, the Poor Man’s Covered Put:

https://optionstradingiq.com/poor-mans-covered-put/

I’m with Fidelity and its difficult to extract the skew data that you outline above in your very nice article. Is there a good source for this sort of data without needing (another) subscription? I currently subscribe to IBD and thats how I became familiar with your writing.

Hi Peter, it’s from a site called Predicting Alpha.

Another use of selling DITM Puts, is if your short put got assigned and you’re negative cash, you can “reset” your position by doing a custom sell-write; wherein you sell the shares and you sell a DITM put (could be same strike price or higher/lower). Just do the math for the credit amount. It’s the same effect of rolling out

For example:

My MDB 300p was assigned, which resulted in a $30K cash out.

Subsequently, I sold-write — sold shares and sold MDB 300p with a later DTE, with a credit of AT LEAST $300.

If I get $300, then I’m back to my original position (turned out to be simply a rolled-out trade). If I get more than $300, then I would net + money if it gets assigned again.

If it expires then same situation as the original.

If the price goes down, you can unwind your position (doing the opposite) for a potential “gain” — stock price normally decreases faster than premium increasing.

Excellent idea. Well done.

and what happen with ITM BULL PUTS credit spreads?

Ex: META, short put 220, long put 210, DTE 2025? (to more credit and time value)