Contents

Options get a bad rap sometimes and for good reason.

If you don’t know what you are doing you can really lose your shirt.

However, when you do understand them and have enough experience, you will realize they are an incredibly flexible tool to enhance your portfolio.

Covered calls are a reasonably low risk way for investors to get started with options.

There is a natural progression for an investor who is already accustomed to share ownership to begin to explore the fabulous world of covered calls.

The key is to educate yourself, and practice, practice, practice.

Why Don’t People Know About Covered Calls

Covered calls are not something you learn about in school.

In fact, schools don’t really teach you anything about personal finance or investing.

This is one of the great failings of our education system.

Someday I hope I can help rectify that.

Covered calls are one of the greatest wealth creation tools you can find.

How Do Covered Calls Work?

One way to teach investors about covered calls is to use property as an example.

Most people understand the property market very well so this makes it an easier introduction into the world of covered calls.

Assume Investor A just bought a house for $200,000.

Investor A then turns to Investor B and says he will sell the house to him anytime in the next 6 months for $210,000.

Investor A is selling an option on the house to Investor B.

For selling this option Investor A receives a fee of $5,000.

Investor A still owns the house and Investor B has the right to buy it for $210,000 any time in the next 6 months.

Investor A gets to keep the $5,000; that’s his no matter what happens over the next 6 months.

The property value could go to $250,000 or it could go to $150,000, but either way, Investor A pockets the $5,000.

Let’s look at how things would play out in these examples:

If the property value drops to $150,000, do you think Investor B will want to exercise his right to buy it for $210,000?

You bet your bottom dollar he won’t.

Not unless he wants to be $60,000 in the hole.

Instead, Investor B will walk away and thank his lucky stars he only lost $5,000 which is a lot better than the outcome for Investor A.

Investor A is still the owner of the house, but it’s now worth $50,000 less than he paid for it. But, that loss has been cushioned slightly by the $5,000 he received from Investor B.

Investor A is slightly better than someone else who bought an identical property.

Investor A can potentially sell another option on the house, but in order to receive a similar fee of $5,000, he might have to agree to sell the house for $155,000 rather than $210,00 which isn’t a very attractive proposition.

If he wanted to sell an option on the house at $210,000 I don’t think many investors would want to pay much more than about 5 bucks for that right!

If the property does not change in value over the next 6 months, Investor B will not want to buy it for $210,000.

Investor A maintains ownership of the property and Investor B is left with a worthless option that has expired.

Investor A has made a handy return of 2.5% on a house that has not changed in value.

AND, he can potentially sell another option for $5,000 provided there is a willing buyer.

If the property value rises to $250,000 will Investor B want to exercise his right to buy at $210,000? Of course he will.

He will be sitting on some nice equity of $35,000 from the word go.

Upon closing, Investor B’s total outlay to purchase the house will be $210,000 plus the $5,000 he paid for the option.

What happens if Investor B doesn’t want to take ownership of the house?

Maybe he can’t get a mortgage for a $210,000 property.

What happens in this case?

Would he just miss out?

What he could do rather than exercise his option, is sell it on to another investor.

In this case, if the house is valued at $250,000 and he can buy it for $210,000 then a fair price for his option would be $40,000.

Investor B’s profit is the same either way: $35,000.

Investor A has made a decent return as well, but he might be kicking himself for selling the option.

If he hadn’t sold the option, he could sell the house on the open market for $250,00.

Instead, he has an obligation to sell to Investor B for $210,000.

Investor A has still made a profit of $15,000 due to the $10,000 of capital gain and $5,000 received for the option premium.

But this return of 7.50% is less than the 25% return he would have achieved had he not sold the option.

Why Sell An Option On Your House?

Why would Investor A sell the option on his house? Well, there are a few reasons:

- Income – By selling the option, he is generating income on his asset. The ideal scenario for Investor A would be for the house price to rise to $210,000. In this case, the cost for Investor B of exercising his option would outweigh the benefits. Investor A has made a $15,000 profit and still owns the property over which he can sell another option.

- Some Capital Protection – By selling the option, Investor A has limited his downside risk, but only by a little bit. When the house price dropped to $150,000, Investor A lost $45,000. That’s still a painful loss, but it was cushioned somewhat by the $5,000. The breakeven price for Investor A is $195,000. At the end of the 6 months, he can sell the house at that price at walk away with zero loss.

Investor B’s motivation in this transaction is capital gains.

He’s looking for the house price to go up significantly in value so that he can make a tidy profit having only had to put down $5,000.

Covered Calls On Stocks

Hopefully now you’ve grasped the key concepts.

Covered calls on stocks work exactly the same was an in our property example.

With stocks you even get the added benefit of being paid dividends! Let’s look at an example.

XYZ stock is trading at $100. You own the stock and don’t think it’s going much higher.

You want to increase your income potential so you decide to sell a call option with a strike price of $100.

The buyer of the option, takes the other side of your trade and is bullish on the stock.

They think it’s going up beyond $100.

For the right to buy the stock for $100, the option buyer pays you a premium of $5.

Let’s look at some scenarios:

- Stock goes to $85

The buyer of the option will walk away and lose 100% of his $5 investment.

You will still own the stock, but are sitting on a loss of $10 which is better than the $15 loss you would have if you hadn’t sold the call option.

- Stock stays at $100

The buyer of the option will walk away and lose 100% of his $5 investment.

In theory he could exercise the option if he wants to own the shares, but it is easier to just buy them directly in the market.

Note: Most brokers will automatically exercise an option if it is 1 cent in the money.

So, if the stock closes at $100.01 the option would be automatically exercised.

You are happy because you have made a $5 return on a stock that has gone sideways thanks to the option premium.

- Stock goes to $105

The option buyer will either exercise his option and buy the shares for $100 or sell the option in the open market.

If he buys the shares for $100, he can turn around and sell them in the market for a $5 gain.

But, he paid $5 for the option, so his profit is zero.

Alternatively, he can sell his option for $5 in the open market.

Either way, he has made a breakeven trade.

You are happy because you have made a 5% return, the same as if you had just held the stock.

- Stock goes to $115

If the stock goes to $115, both investors are happy, although you are a bit disappointed you didn’t just hold the shares outright.

You still make your $5 profit and 5% return, but you have left another $10 on the table.

The option buyer is happy because he can purchase a $115 stock for only $100 (don’t forget he also paid the $5 in premium, so his total cost is $105).

Or he can sell the option for $15. That’s a $10 profit on a $5 investment.

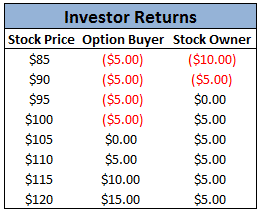

The table below shows the outcome for each investor at different stock prices.

Remember to multiply these amounts by 100 given that each option contract controls 100 shares.

FAQ

What Is A Covered Call?

A covered call is an options trading strategy in which an investor sells a call option on an underlying asset that they already own.

The call option provides the buyer with the right, but not the obligation, to purchase the underlying asset from the seller at a predetermined price (strike price) before a specified expiration date.

By selling the call option, the investor receives a premium, which provides some downside protection in case the underlying asset’s price falls.

What Are The Benefits Of Covered Calls?

The benefits of covered calls include generating additional income through option premiums, reducing downside risk on an underlying asset, and potentially realizing gains on the underlying asset’s appreciation up to the strike price.

What Are The Risks Of Covered Calls?

The risks of covered calls include potentially missing out on additional gains if the underlying asset’s price rises above the strike price, being forced to sell the underlying asset at the strike price if the call option is exercised, and potentially losing money if the underlying asset’s price falls below the breakeven price.

How Do You Select The Right Strike Price For A Covered Call?

Selecting the right strike price for a covered call depends on your goals and risk tolerance.

A lower strike price will typically provide a higher premium and more downside protection, but also limit the potential upside if the underlying asset’s price rises significantly.

A higher strike price will typically provide a lower premium and less downside protection, but also allow for greater potential gains if the underlying asset’s price rises significantly.

What Are Some Tips For Implementing A Covered Call Strategy?

Some tips for implementing a covered call strategy include selecting an underlying asset that you are comfortable holding long-term, considering the impact of taxes and transaction costs on your returns, and regularly monitoring the underlying asset’s price and the option’s expiration date to decide whether to roll the option forward or let it expire.

Related Articles

Selling Covered Calls – A Detailed Guide

How To Write Covered Calls: 2024 Ultimate Guide

Weekly Versus Monthly Covered Calls

How To Make Money With Covered Calls

When to Roll Covered Calls

Selling Deep In The Money Covered Calls: Why Do It?

Covered Calls For Dummies

Covered Calls With LEAPs Options Strategy

Supercharge Your Covered Calls Using LEAPS

Selling Weekly Covered Calls

Covered Calls: How to Adjust to Changing Market Conditions

The analogy of the property was very helpful. The property represents the underlying (XYZ stock). Since investor A owned the property, the property is the covered property (covered stock). The owner of the property wrote the contract — he is the seller of a call option, which means, he wants the price to go down. The seller(writer) wants the value of the property to decrease. The buyer of the call option wants the value of the property to increase

Yep spot on.

It doesn’t necessarily seem like I would want the stock to go down. Wouldn’t I have lost the option to bail on the stock?

If the stock goes down below your stop loss, you can still sell the shares and buy back the short call to close the entire position. Hope that helps. If you have any other questions, let me know.

Confusing, as I am trading options.

Hi Tom, what were you finding confusing? Happy to help if I can.

It has to do with confusion with the LONG CALL vs. Covered Call.

The LONG CALL is covered w/DEEP MATH. Although the math is not complicated, it requires several “inputs” from sources that change frequently.

I believe this since (I accidentally sold one recently and it looks like I will make a small profit). You have done a lot to help me and others which is very much appreciated. I’ll keep working on the LONG CALL and hope a calculator (or computer program is quickly constructed), again, THANKS!!!

in your examples above, if the stock is $ .01 above the strike price. the option will be exercised… if it is at the exact strike price, $ 100, it will not exercise, correct?

Yes, that’s right.

Attn: Gavin

To your reply in Todd’s case. How do you go about buying back the short call to close the entire option?

Hi T.j, you simply place a Buy to Close order. Basically the opposite of what you did to open the position (sell to open). Send me an email if you need more details.

What would i do in this case I’m Canadian so my stocks are Canadian my option is 1 BB September 15 strike 7.00 stock is now 7.22 my date is closing soon I think I should sell option @.50 then buy back to close how would that look with strike price and expiration

Not sure I can provide much help in this situation. Sorry.

Now that I have joined your class and benefited from your presentation on Zoom all of this is definitely becoming clearer, – phew! and Thank you!

Glad to hear it Betsy! Lots more good stuff to come over the coming weeks too!

How About rolling up as. The sold call gets in the money?

Yes you can do that, particularly if you want to hold on to the stock.

i would like to attend an option class. Where do I search?

Hi Marty, the next course will be open very soon. If you sign up to my email list, that is the best place to get notified. You can sign up here:

https://optionstradingiq.lpages.co/best-of-iq/

Hi Gavin,

I generally trade options on a daily basis and have a few stocks where I own 100 or more shares. I want to supplement my trading with covered calls. Is there an optimal stock price to focus on for covered calls as I am seeing very low premiums for stocks that are <$20.

many thanks!

Tough to get much premium on low priced stocks. In order to get any premium, you might have to look at longer-term options, maybe 6-9 months in duration.

What tool do you use to find the best premium/company for cc’s?

Barchart.com scanners are the best