What exactly is a deep in-the-money covered call? Today we will answer that question ask and why traders sell deep in the money covered calls.

Contents

-

- Introduction

- Why Sell Deep In The Money Covered Calls?

- Rolling An In The Money Poor Man’s Covered Call

- In The Money Covered Call Example

- Going Deeper In The Money

- AMAT Example

- Selling In The Money Calls To Reduce Cost Basis

- Difference Between Deep In The Money Covered Call And Regular Covered Call

- FAQ

- Conclusion

- Related Articles

Introduction

Well, there is no definitive answer as to what a deep in the money call is.

If you look at this webpage, you will get the definition of a deep in-the-money option according to the Internal Revenue Service (IRS).

Essentially, the IRS definition says that a deep in the money option has two components.

The first is how many strikes an option deviates from the price of the underlying financial instrument.

For example, an in-the-money call option will have several strikes below the price of the underlying instrument.

A put option that is in the money will have a certain number of strikes that are above the price of the underlying instrument.

The second factor the IRS looks at in determining whether an option is deep in-the-money is how far out in time the expiration date of the option is from the date of purchase.

The IRS defines this as an option that is:

– More than one strike away from the price of the underlying if the expiration date is less than ninety days

– Or more than two strikes away if the expiration date is more than ninety days.

Essentially, if the option has less that ninety days until expiration, only the first strike is not deep in the money.

If the option has more than ninety days, only the first two strikes in-the-money are not considered deep-in-the-money.

While the IRS definition of a deep in-the-money option might be the one used in a court of law, most option buyers and sellers tend to look at an options delta as the determinant of what constitutes deep in-the-money.

Most traders would tend to agree that an option goes deeper in-the-money as the call delta approaches 1.00 and the put delta approaches -1.00.

Traders should also consider portfolio margin when selling options.

Portfolio margin issues are discussed here.

The simple fact is that traders won’t sell deep in-the-money options without a corresponding long position because of the effect on buying power.

Why Sell Deep In The Money Covered Calls?

The reasons why you might sell a deep-in-the-money option can vary from individual to individual, but they generally tend to fall into three primary categories.

First, buyers who like to use covered calls can sell deep in-the-money options if they are looking to get out of the stock.

By selling a deep in-the-money call, it is highly likely the stock will get called away.

Traders employing this strategy are not overly bullish on their stock position.

Second, if someone who is long an optionable stock wants to maximize their down-side safety they can sell deeper in-the-money options to allow for more down-side safety.

Third, there are times when you can reduce the cost of a stock by using deep in the money options to help buy it at a reduced cost. The rest of this article will discuss these strategies.

Rolling An In The Money Poor Man’s Covered Call

A poor man’s covered call is a diagonal spread that involves buying an in-the-money call and selling an at-the-money or out-of-the-money call.

Often, when a stock goes up in value, the short option goes deeper in-the-money, and you find yourself selling deeper and deeper in-the-money calls to continue rolling the short option forward.

Now let’s look at another scenario.

In The Money Covered Call Example

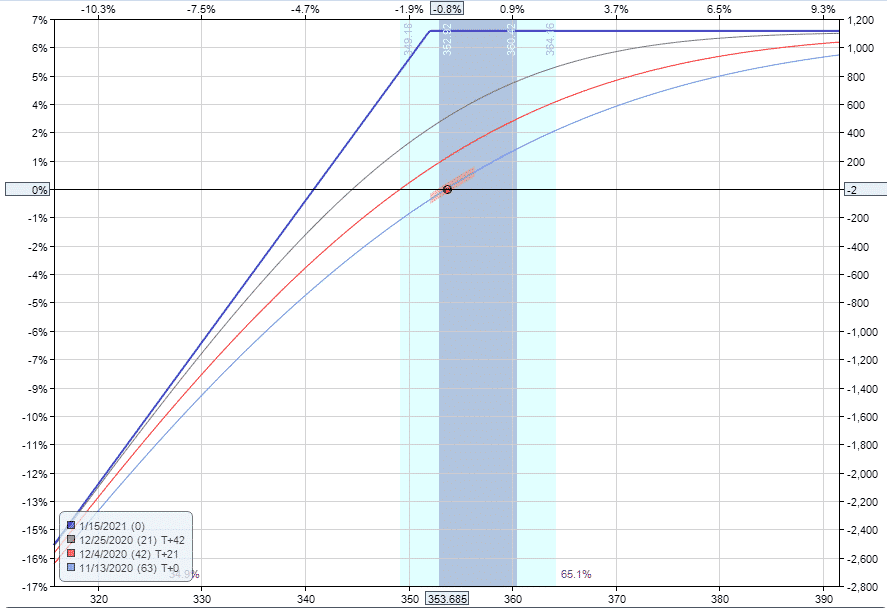

Let’s work through an example of an in-the-money covered call.

Trade Date: November 12, 2020

Underlying Price: SPY at 353.68

Trade Details:

Buy 100 SPY shares @ $353.68

Sell 1 Jan 15, 2021, SPY 352 Call @ $12.86

Capital At Risk: $34,082

Max Gain: $1,118

Time Premium Sold: $11.18 (12.86 – (353.68 – 352))

Fortunately, this was the lowest close for SPY over the next 64 days, so the option never goes out-of-the-money.

On the expiration date of January 15, 2021, SPY closes at $375.70 and the shares get called away for a total return of $1,118 or 3.28%

Without the option sale, the return would have been slightly higher at $2,490 or 7.04%

Going Deeper In The Money

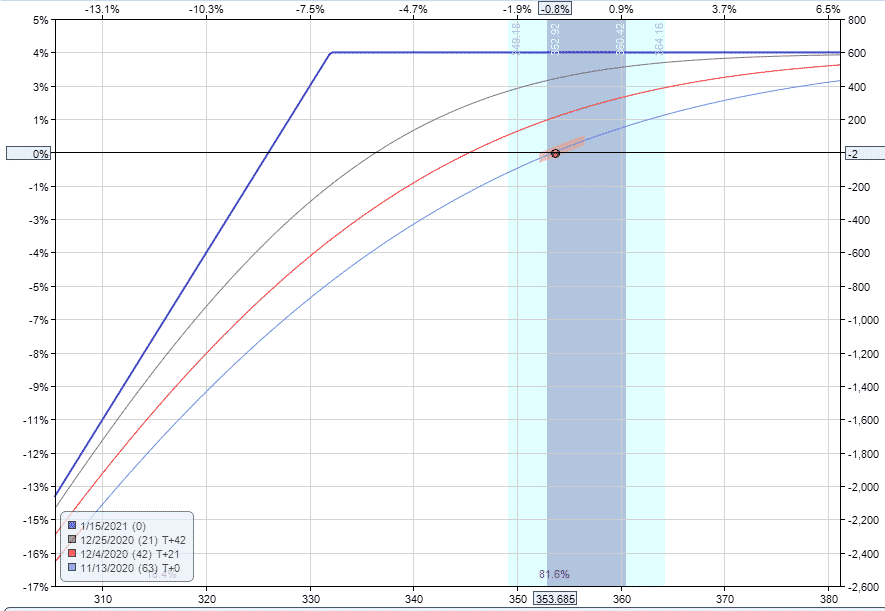

Now let’s see what happens if we sold an even deeper ITM call.

Trade Date: November 12, 2020

Underlying Price: SPY at 353.68

Trade Details:

Buy 100 SPY shares @ $353.68

Sell 1 Jan 15, 2021, SPY 332 Call @ $27.70

Capital At Risk: $32,598

Max Gain: $602

Time Premium Sold: $6.02 (27.70 – (353.68 – 332))

Note here that the return potential is lower, but the breakeven price is also much lower.

In the first example, the breakeven price was around 340.82 and, in this example, the breakeven price is 325.98.

At expiry, the trade received the full profit of $602 or 1.85%.

You can see that selling a deeper in-the-money call is a much more conservative trade with a lower return potential and more margin for error on the downside.

AMAT Example

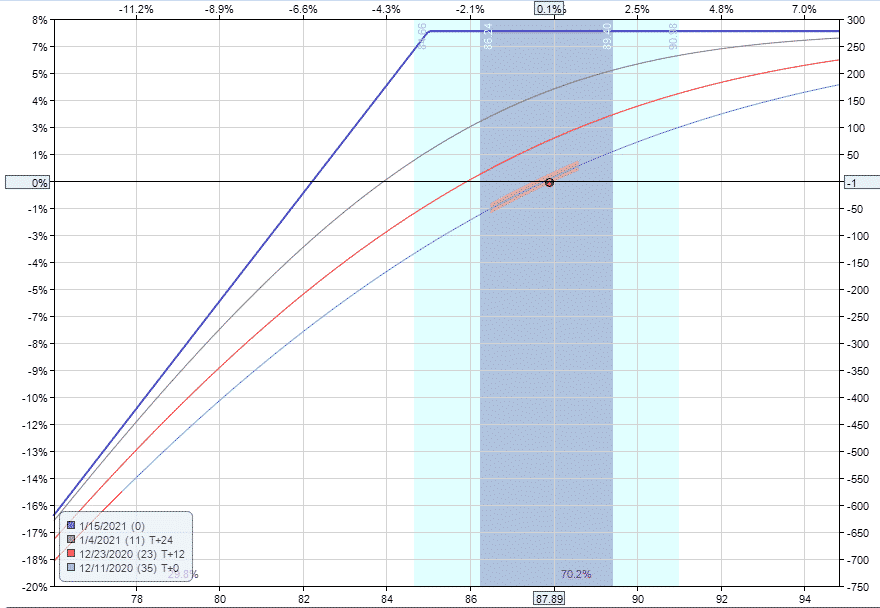

Let’s look at another real-life scenario. On December 11, 2020, you notice that AMAT has gone up almost 60% in the last twenty-eight market days.

You get a bad case of fear-of-missing-out (FOMO).

You decide to buy 100 shares at $89.89 at the close of the day.

An 85-strike call with 36 days to expiration is then sold for $5.68.

Trade Date: December 11, 2020

Underlying Price: AMAT at 87.89

Trade Details:

Buy 100 AMAT shares @ $87.89

Sell 1 Jan 15, 2021, AMAT 85 Call @ $5.68

Capital At Risk: $8,221

Max Gain: $279

Time Premium Sold: $2.79 (5.68 – (87.89 – 85))

The next day, AMAT starts to tank.

By December 29, 2020, the price of the stock has dropped to $84.27.

Without the short option the trade would now be down $3.62 or 4.12% on the stock.

However, the short option has fallen to $2.13, meaning that the covered call position is down only $0.09 or 0.11% on a cost basis of $82.21.

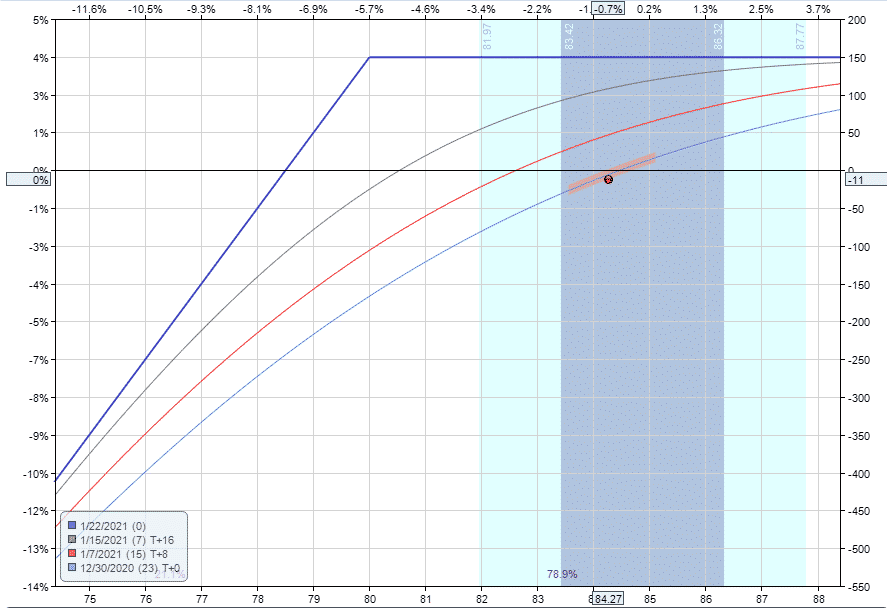

At this point, we roll the option out one week and drop the strike to 80 for more safety.

Trade Details:

Buy 1 Jan 15, 2021, AMAT 85 Call @ $2.13

Sell 1 Jan 22, 2021, AMAT 80 Call @ $5.87

Net Credit: $3.74

The cost basis gets reduced to $78.47, and we have the obligation to sell the stock at 80 if called upon to do so.

This gives a profit potential of $1.53 or $153 in total.

AMAT recovers its upward climb and by the expiration date of January 22, 2021, has reached a price of $106.33.

At this point the shares are called away for $80 leaving a total profit of $153 or 1.95%

If the investor had just bought and held the 100 shares of AMAT stock, then the total return would have been $1,844 or 20.98% so we can see in this example the deep in-the-money call strategy has significantly underperformed.

However, the purpose of selling deep in-the-money calls is to generate income and reduce downside risk.

So, by those criteria, the trade has achieved its goal.

Selling In The Money Calls To Reduce Cost Basis

Another reason to sell deep on the money options is to reduce your cost on stocks that you want to own.

Many investors want to try and accumulate stocks that pay great dividends.

Great dividend paying stocks are stocks that pay a better than average dividend and have done so consistently for a relatively long time.

Ideally the company has also consistently increased that dividend during that time.

Can selling deep in the money calls help investors get bargain basement prices on good stocks?

Difference Between Deep In The Money Covered Call And Regular Covered Call

In a typical covered call where you own 100 shares of stock, you are selling a call option with a strike price above the current price. This is selling an out-of-the-money call option. It could, for example, be sold at around 40-delta, 30-delta, 10-delta, etc.

For in-the-money covered calls, you are selling at the 60-delta, 70-delta, 80-delta, etc. The calls sold at the high deltas (such as 70 or above) are known as deep-in-the-money covered calls.

This is when the call option’s strike price is lower than the stock’s current price.

FAQ

What Are Covered Calls?

A covered call is a trading strategy that involves selling call options on an asset that you already own.

It is considered a conservative strategy that generates income through option premiums.

What Are Deep In-The-Money Covered Calls?

Deep in-the-money covered calls are covered call options where the strike price is significantly lower than the current market price of the underlying asset.

This means that the call option has a high intrinsic value and low time value.

What Are The Benefits Of Selling Deep In-The-Money Covered Calls?

Selling deep in-the-money covered calls can provide higher premiums and greater downside protection compared to traditional covered calls.

It can also be a way to generate income from stocks that have limited potential for capital appreciation.”

What Are The Risks Of Selling Deep In-The-Money Covered Calls?

The main risk of selling deep in-the-money covered calls is that you may be obligated to sell your stock at a lower price than the current market price.

This can result in missed potential profits if the stock continues to rise in value.

How Do You Choose Which Stocks To Sell Deep In-The-Money Covered Calls On?

When choosing stocks for deep in-the-money covered calls, it’s important to look for stable, high-quality companies with low volatility.

You should also consider the overall market conditions and the stock’s potential for capital appreciation.

What Is The Best Way To Manage Risk When Selling Deep In-The-Money Covered Calls?

One way to manage risk when selling deep in-the-money covered calls is to use stop-loss orders to limit potential losses.

You can also consider using other hedging strategies, such as buying protective puts or diversifying your portfolio.

When Would You Sell Deep In The Money Covered Calls?

You would want to sell deep-in-the-money covered calls when you think the stock price will go down.

The deeper the covered call (, the higher delta at which it is sold), the more premium you will receive from selling it.

Because of this higher premium collected, the stock can fall in price much lower before you start losing money.

The breakeven price is lower for deep-in-the-money covered calls.

The breakeven price is the price the stock can be upon expiration and still not lose money. You lose money if the stock price is lower than the breakeven price at expiration.

If the stock price is higher than the breakeven price at expiration, you make money.

What To Do If You Have A Deep In The Money Covered Call?

One strategy when holding a deep-in-the-money covered call is to hold to expiration and see if the call option is assigned or not.

If the call option is assigned, you would have sold the shares of stock at the strike price.

This will occur if the stock price exceeds the call option strike price at expiration.

You would likely have been bearish on the stock to have had a deep-in-the-money covered call. So you would not have minded selling your bearish stock.

The assigned call would have given you an extra amount of money in terms of the extrinsic value of the option you have collected.

If the call option is not assigned, that would have meant the stock price had dropped in price and ended up lower than the call option’s strike price at expiration.

Either way, by selling in-the-money covered calls and holding to expiration, you collect the option’s extrinsic value.

That is not to say that you would always make money.

The stock price can drop more than the extrinsic value collected, which results in a net loss.

Can You Sell Covered Calls In The Money?

Yes, you can sell covered calls in-the-money.

This is often done by investors who are bearish on a stock and wants to collect the extrinsic value of the call option sold.

An in-the-money covered call (compared to the out-of-the-money covered call) has a lower breakeven point at which the stock price can drop before losing money.

What Is A Poor Man’s Covered Call?

A poor man’s covered call is when you use a long call option to replace the shares of stock you would normally have in a covered call.

A typical poor man’s covered call consists of a longer-dated long call option and a shorter-dated short call option.

The structure is that of a diagonal option structure.

Can You Buy Back Your Covered Call?

Yes, you can buy back the call option that you had sold.

This can be done at any time before the expiration of the option.

When you have a short call option, you have an obligation to sell your shares at the strike price at expiration.

If and when you decide that this is not a good idea, you can buy back the short call option, closing out the option position, and you will no longer have this obligation.

Should I Roll ITM Covered Calls?

You can roll ITM covered call options.

This is the same as buying back the original option you sold and then selling another call option at a different strike price or different expiration.

In rolling, the two actions are performed as one transaction.

To avoid having shares of stock be called away, some investors will roll ITM call options when it is near expiration.

Conclusion

Selling deep in the money options can be a great income strategy that gives more downside protection than a regular covered call.

However, this strategy will underperform in strong bull markets.

There is a time and a place for selling deep in-the-money covered calls and that is when the investor has a neutral outlook and wants to generate some additional income.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Related Articles

Selling Covered Calls – A Detailed Guide

How To Write Covered Calls: 2024 Ultimate Guide

Weekly Versus Monthly Covered Calls

How To Make Money With Covered Calls

Covered Calls 101

When to Roll Covered Calls

Covered Calls For Dummies

Covered Calls With LEAPs Options Strategy

Supercharge Your Covered Calls Using LEAPS

Selling Weekly Covered Calls

Covered Calls: How to Adjust to Changing Market Conditions

Theory is plausible, I guess, but looking at QQQ option table bids on 9/10/’21, for

DITM 280s and then 319s expiring 9/17/’21 no profit is possible.