Today, we are looking at selling covered calls and will provide a detailed guide of everything you need to know.

Starting a covered call is the easy part.

Trade management is much harder and we will cover all that and more in this detailed guide.

Contents

- Introduction

- Example Of A Covered Call

- The Greeks

- When The Stock Goes Up

- At-The-Money Covered Call

- Exiting The Covered Call

- In-The-Money Covered Call

- Covered Calls Myths And Truths

- Conclusion

- Related Articles

Introduction

There are almost as many ways of selling covered calls as there are investors.

You can sell covered calls out-of-the-money or in-the-money.

You can sell monthlies or weeklies and all timeframes in between.

Some hold to expiration, and others roll their calls.

This detailed guide will look at the different approaches and their pros and cons.

Example Of A Covered Call

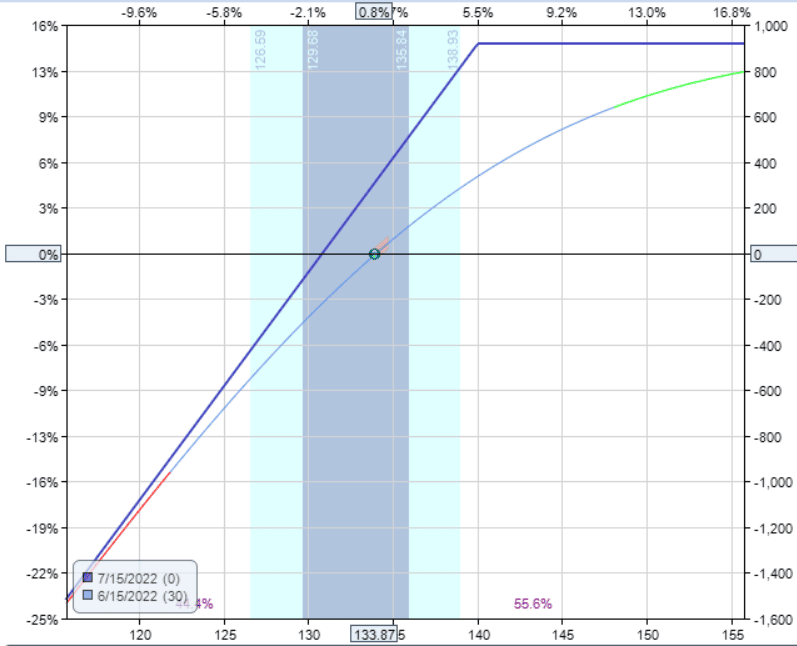

Let’s start with a prototypical example of a covered call on Apple (AAPL), of which we suppose that we own 100 shares.

We will sell a call option with one month to expiration.

Date: June 15, 2022

Price: AAPL @ $133.87

Buy 100 shares of AAPL @ $133.87

Sell one July 15 AAPL $140 call @ $3.05

Net Debit: –$13,082

We can see from the payoff graph that covered calls are bullish trades.

source: OptionNet Explorer

We want the price of the underlying to move up.

The Greeks

The Greeks of this trade are:

Delta: 64.75

Vega: -14.24

Theta: 8.61

Gamma: -2.56

Stocks do not have vega, theta, or gamma. But they do have delta.

The majority of the delta of this trade is from the stock. One hundred shares of stocks will have 100 deltas.

We have only 65 deltas in the overall position because the short call gave us some negative delta (about -35 deltas).

The fact that the delta is positive means that we benefit if the price of the underlying goes up.

The short call had a 35 delta when we sold it. We say that this is an “out-of-the-money” call at 35 delta.

It is out of the money because the strike price of $140 is above the current price of the stock at $133.87.

The short call gave us the negative vega, which means that if the stock’s implied volatility drops, it will benefit the trade a little.

The short call gave us some positive theta which means that if everything else stays the same, we will benefit from the passage of time.

The gamma tells us that the delta of the overall position will not stay at 65. It will change as the underlying price moves.

The gamma is from the option.

The option changes the delta of the position as the trade progress.

If we only had stock and no options, then there would be no gamma, and the delta of the stock will not change.

When The Stock Goes Up

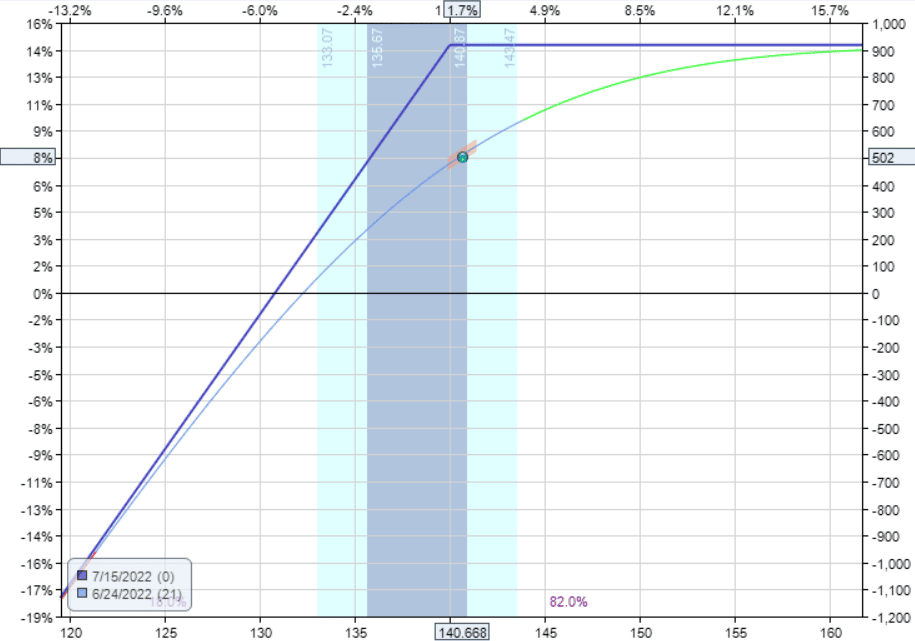

On June 24, our example trade showed a profit of $502 because the price of Apple had gone up to $140.67 (near the strike of the short call).

source: OptionNet Explorer

We can decide to close the covered call and take profit at this point.

Or we can roll the short call up since there are still 21 days to expiration.

If there were fewer days left till expiration, we could roll the short call up and further out in time at a later expiration.

Suppose we still want to hold the stock and decide to just roll the call up in strike, keeping with the same expiration of July 15.

Trade Details:

Date: June 24, 2022

Price: AAPL @ $140.67

Buy to close the July 15 AAPL $140 call @ $4.83

Sell to open the July 15 AAPL $145 call @ $2.41

Net Debit: –$242

We had to pay a debit of $242 to perform this adjustment.

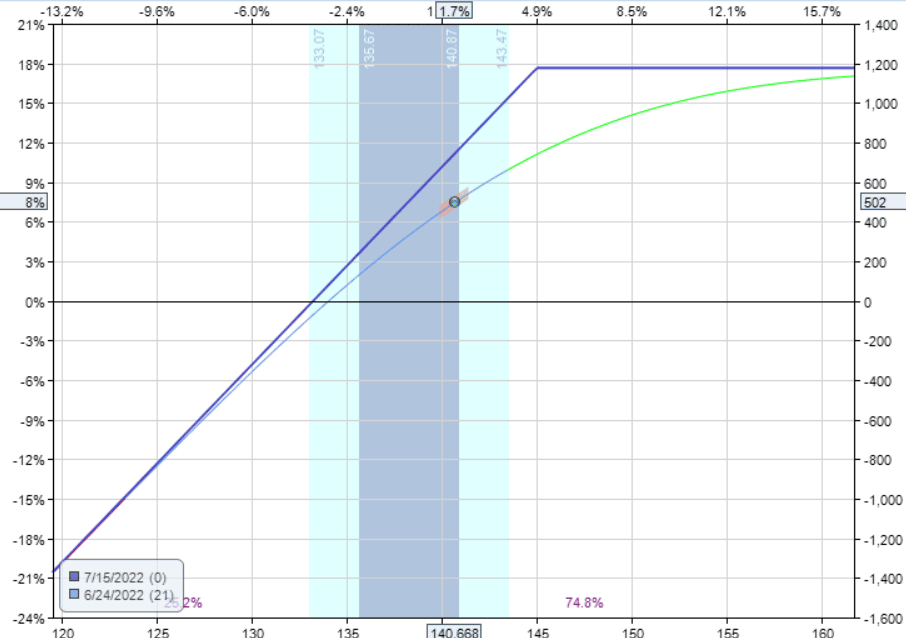

But that gave us more room for the stock to move up, as we can see from the new expiration graph:

source: OptionNet Explorer

One might think that we lost money on the call option.

We initially sold the $140 call for $305, and now we had to buy it back at $483. This is true.

We lost on the option. In order for us to achieve stock appreciation, we had to lose a little on the option.

The rise in the stock value more than offsets the loss in the option.

Don’t just look at the call option’s P&L (profit and loss).

Look at the entire trade with both the stock and the option combined.

The stock is the primary driver of the profits or losses.

If the stock goes up, we profit. If the stock goes down, we lose.

In fact, if we see that our option has a loss, that usually means that the price of the underlying is going up, and the overall trade is making money.

At some point, as the stock goes higher and higher, the profits from the stock appreciation will be capped.

This is why we roll the call up to give the stock more room to continue to go up.

You can think of it as closing the first covered call and opening a new covered call with a new strike price.

At-The-Money Covered Call

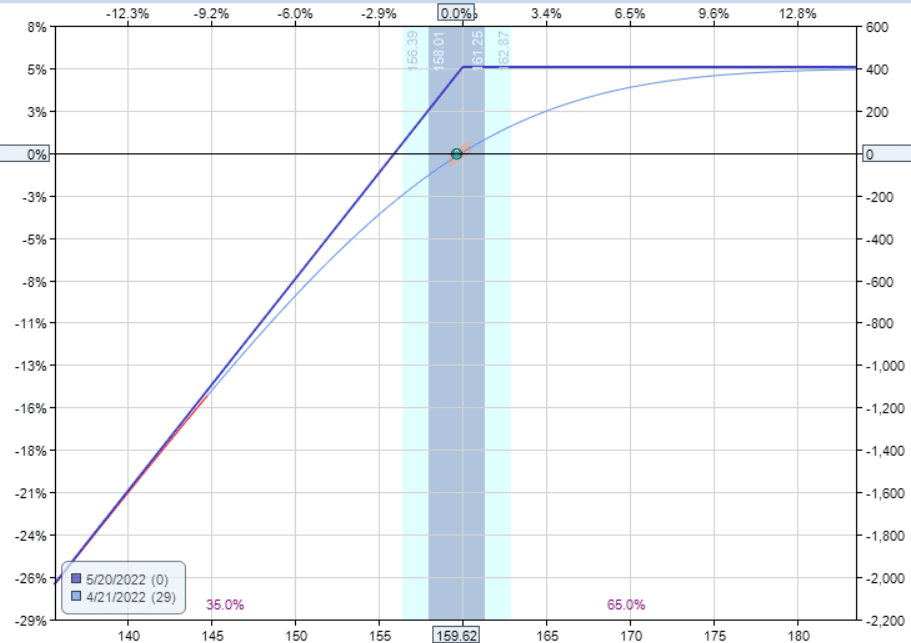

Next, we will look at selling an at-the-money covered call.

On April 21, 2022, Walmart (WMT) traded at $159.62 per share.

We buy 100 shares and then sell the $160 call option — the option with a strike price closest to the current price.

This is what is known as an “at-the-money” option.

Date: April 21, 2022

Price: WMT @ $159.62

Buy 100 shares of WMT @ $159.62

Sell one May 20 WMT $160 call @ $3.68

Net Debit: –$15,595

The payoff graph looks similar.

We still want the price of Walmart to go up.

If Walmart’s stock price is higher than $160 at expiration on May 20, the short call will be exercised, and our 100 shares of stock will be “called away.”

Regardless of how high WMT would have gone, we would have to sell 100 shares of WMT at $160 per share.

The maximum that we could make on the stock is $0.38 per share, or $38.

Our only consolation is that we got a credit of $368 for putting the trade on.

This gives us a net max potential profit of $406 on the covered call.

We can see that on the payoff graph, it never goes higher than $406.

Let’s see what actually happens to this Walmart covered-call trade.

On Friday, April 29, WMT went down to $154.24, down 3.4%.

The net P&L on the covered call position is –$331.50.

The call option is now valued at $1.61, which is less than half its original value.

The call option is at a profit of $207 because we sold the call at $368, and now we can buy it back at $161.

However, this small profit is not enough to offset the loss from the stock.

Good Till Cancelled Orders

Some investors will put in a good-till-cancelled order to take profit on the call option as soon as the call option value drops to 20% of its original value.

In our example, it will be when the call option value drops to $74.

This occurred on Friday, May 6, when the order was triggered, and the short call was bought back at $74.

The profit on the call option is $368 – $74 = $294.

Unfortunately, in order for that to occur, WMT stock price had to drop to $151.06 — clearly not what we wanted.

That is a loss of $856 on 100 shares.

Net loss on the covered call right now is –$562 (calculated by taking $294 from $856).

The WMT stock had dropped 5.3%.

This is too big of a drop for this covered call to be profitable.

Let’s calculate the breakeven price in this example.

The call option sale gave us a credit of $3.68 per share.

That means that the WMT price can drop by $3.68 per share without us losing money.

The breakeven price is $159.62 – $3.68 = $155.94

If WMT is above $155.94 at expiration, we make money from the covered call.

If WMT is below $155.94 at expiration, we lose money from the covered call.

The current price of WMT is $151.06, which is below the breakeven point.

What To Do At This Point?

1. We can close the trade and say we don’t want to hold WMT anymore.

2. Since we already bought back the original call, we can sell another call immediately to take in some credits.

3. We can wait for the stock to rebound in price and then sell another call.

Let’s sell another call at the $155 strike for the May 20 expiration.

This gives us a credit of $194.

The stock continues to drop a bit more.

On the morning of May 17, WMT gapped down significantly after its earnings announcement.

WMT’s price is down to $132.50. Net loss on the covered call trade is –$2224.

Walmart continued to drop a couple more days post-earnings.

On expiration, on May 20, WMT closed at $119.20, down 25% from where we bought it at.

The call option expired worthless.

We decided to sell the 100 shares of stock at $119.20 and exit the covered call trade.

The net loss of the covered call trade is –$3554 as tallied by the spreadsheet:

When we back-tested this trade in OptionNet Explorer, we see the same loss number.

Exiting The Covered Call

Two lessons are to be learned from this example. Investors should decide when they place the trade how far down they are willing to let the stock price drop before they call it quits.

As we saw, it is possible for a stock to drop and keep dropping.

The covered call is considered an unlimited loss trade, but in reality, there is a max loss.

It is when the stock price goes to zero, in which case you lose the entire value of the 100 shares and are only compensated by the credits received from the sale of the call options.

Obviously, we don’t want to lose the max loss.

Investors should only do covered calls on a stock they don’t mind owning.

They should decide at what point, if the stock drops too much, they no longer want to own it.

This could be, for example, if the stock drops 7%.

It is different for each investor because it depends on how long the investor plans to hold the stock, how much the investor likes the stock, whether the investor thinks the stock will rebound, etc.

What About Stop Losses?

However, don’t just put a stop loss on the stock.

In fact, in some IRA accounts, a stop loss is not allowed on covered call positions.

This is because if you exit the stock without exiting the call option, you will have a risky short naked call option — too risky to be allowed in some retirement accounts.

To exit a covered call position, exit the short call by buying the call option back to close it. And then sell the underlying shares.

Alternatively, you can put the two transactions into one single order. But do not sell the stock before exiting the short call.

The second lesson from the Walmart example is to know if the covered call will cross an earnings announcement and decide if one wants to hold through the earnings.

In-The-Money Covered Call

The in-the-money covered call is sometimes used in a bear market or when the investor wants more protection from a down move by the stock.

I say sometimes used because there are investors that will not do covered calls in a bear market.

After all, the covered call is a bullish trade.

Let’s look at an in-the-money covered call.

Suppose we sell a call on Johnson and Johnson (JNJ) at around 75 deltas with 44 days to expiration.

This is a deep-in-the-money call. The higher the delta of the call option, the deeper in the money it is.

Date: August 3, 2022

Price: JNJ @ $173.22

Buy 100 shares of JNJ @ $173.22/share

Sell one Sep 16 JNJ $165 call @ $9.68/share

Net Debit: –$16,355

Here is the payoff graph:

The max potential profit on this trade is $146. You will see how we arrived at this number later.

An in-the-money covered call is still a bullish trade but less bullish than the other two previous examples.

The position delta for this trade is 25.

The overall position has a less positive delta than the other two examples.

Also, note where the initial price dot is in relation to the expiration graph in all three examples.

Did you see how much that call option was selling for?

We collected $968 from the sale of that call option.

Most of the value of that call option is intrinsic value.

We are obligated to sell at $165/share when stock is currently trading at $173.22/share.

This represents a loss in stock value of $8.22/share.

The call option must compensate us for this difference.

The $8.22 of the $9.68 is the intrinsic value of the call option.

The remaining $1.46 is the option’s extrinsic value or time value.

When selling a call option in a covered call, we are selling the extrinsic value.

This value will dissipate to zero at expiration.

It’s All About Probability

Since the call option is already in the money, it has a higher probability of exercise and a higher chance that our stock will be called away from us at expiration.

In fact, this is what we want.

Many investors who sell in-the-money covered calls are not doing it for stock appreciation.

They are holding to expiration to collect the call option’s extrinsic value.

An in-the-money covered call has the greatest downside protection.

You can see this when you calculate the breakeven price.

The JNJ stock can go down by $9.68/share, and the investor still would not have lost any money.

The breakeven price is $163.54.

That is a drop of 5.6%.

This covered call has a downside protection of 5.6%.

Let’s see what happens on expiration on September 16. The stock JNJ closed at $167.60.

This is above the breakeven price, which means that the investor is profitable.

This is also above the strike price, which means that the investor must sell 100 shares at $165/share.

The net profit made by the investor is $146, despite the stock falling from $173.22 to $167.60.

Intrinsic and Extrinsic Value

Recall that $1.46 was the extrinsic value of the option.

The investor collected the full extrinsic value of the option.

When the stock price is above the strike price, the full amount of the intrinsic value is collected.

This only occurs if the option is exercised, and the stock is called away.

So, in this sense, the investor wants the option assignment and stock to be called away.

If the price of JNJ closed lower than the strike price of $165 but above the breakeven price of $163.54, the investor would still be profitable but would not have collected the full amount of the extrinsic value.

If the price closed below $163.54, the covered call position would start losing money.

The extrinsic value of $1.46 on a $173.22 stock is about 0.8%.

For the AAPL example, the extrinsic value of the call option sold is $3.05, representing 2.3% of the stock price.

An out-of-the-money call option has no intrinsic value. It is all extrinsic value.

For the WMT example, the extrinsic value of the call option is also 2.3% of the stock price.

Alan Ellman, known as the Blue Collar Investor, specializes in covered calls and has written many books on the subject and lectured on public social media.

He says he likes to sell covered calls that can collect from 1% to 3% of extrinsic value.

In our JNJ example, the extrinsic value is a bit low.

We could have sold a call that was closer to the money or a call with an expiration that is further out in time.

Both would have given us more extrinsic value.

The deeper in the money we go and the further out of the money we go for picking our strikes, the less extrinsic value we can collect.

Covered Calls Myths And Truths

Myth: You cannot lose money by selling a covered call.

Truth: By selling a covered call, you cannot lose more money than if you just held the stock. But if the stock price falls enough, you will lose money either way.

Myth: You don’t want your stock to be called away.

Truth: This is not always true. There may be other reasons why one might not want the stock to be called away, but from a profitability point of view, whenever a stock is called away at expiration from a covered call, this is when you would have made the most money.

Just look at the expiration graphs.

The max profit is achieved at expiration when the stock price is higher than the call option’s strike price.

It is, in this case, that the stock will be called away.

Conclusion

There is more than one way to be successful in selling covered calls.

Since there are many investors selling covered calls in a wide variety of methods, there is clearly no one best way to do covered calls.

Covered calls have been sold since the first days when options were invented.

If there were one best way to do covered calls, everyone would be doing it that way by now.

Hopefully, this article gave you some approaches so that you can find your best way.

We hope you enjoyed this article on selling covered calls. If you have any questions, please send an email or leave a comment.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Related Articles

Covered Calls 101

How To Write Covered Calls: 2024 Ultimate Guide

Weekly Versus Monthly Covered Calls

How To Make Money With Covered Calls

When to Roll Covered Calls

Selling Deep In The Money Covered Calls: Why Do It?

Covered Calls For Dummies

Covered Calls With LEAPs Options Strategy

Supercharge Your Covered Calls Using LEAPS

Selling Weekly Covered Calls

Covered Calls: How to Adjust to Changing Market Conditions