Today, we are looking at options earnings strategies.

There are many earning trade ideas and even pre-earning strategies out there.

But not many post-earning strategies. In this article, we will give you a post-earnings options strategy, including adjustment rules.

Better yet, we will even run through simulated trades of some Dow stocks crossing over earnings to see how this strategy performs.

Contents

- The Plan

- Taking Profits At 20%

- Exit 7 Days Till Expiration

- Adjustment On the Upside

- Adjustment On The Downside

- The Results

- Conclusion

The Plan

Since implied volatility (IV) has just dropped after earnings, time spreads such as calendars and diagonals make sense, and even double calendars.

For this strategy, we will use the simple at-the-money direction neutral calendar.

The key is in the entry, exit, and adjustments.

As with most direction neutral trades, we do not trade them when the VIX futures term structure is in backwardation.

As an additional filter, we wait for one full day’s trading session to complete after the earning announcement to decide if we will initiate the trade.

We want to see where that session closes.

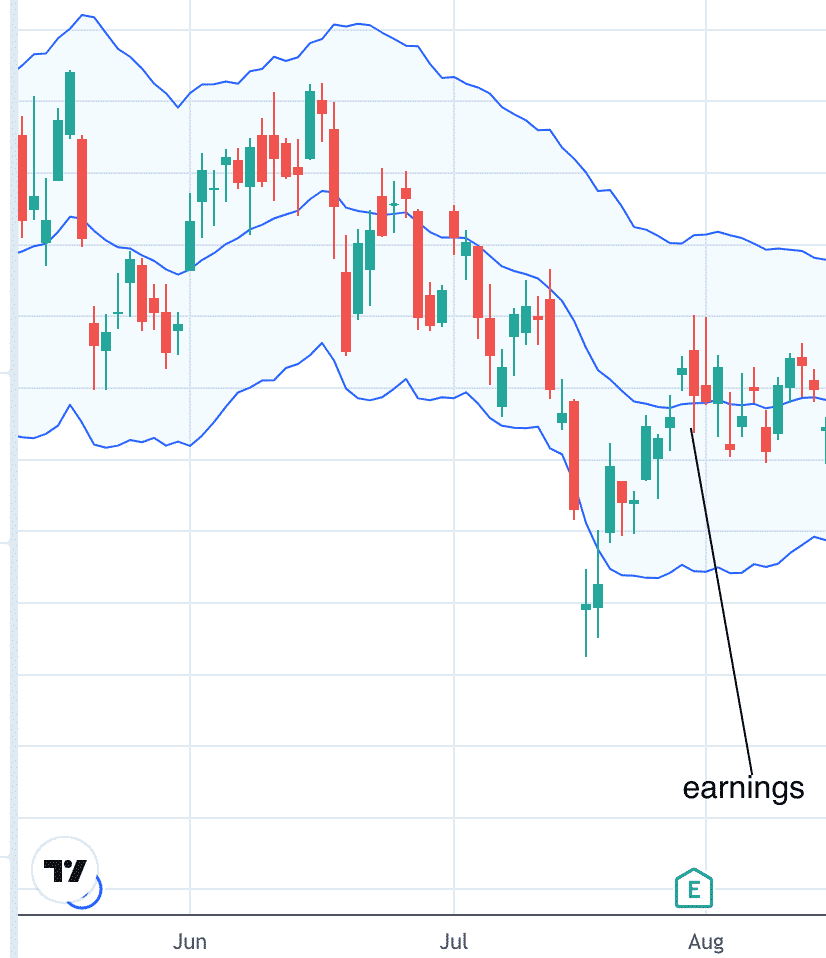

If the close is inside the Keltner channel, we will trade in the following day, provided that the open is still inside the Keltner channel.

Taking Profits At 20%

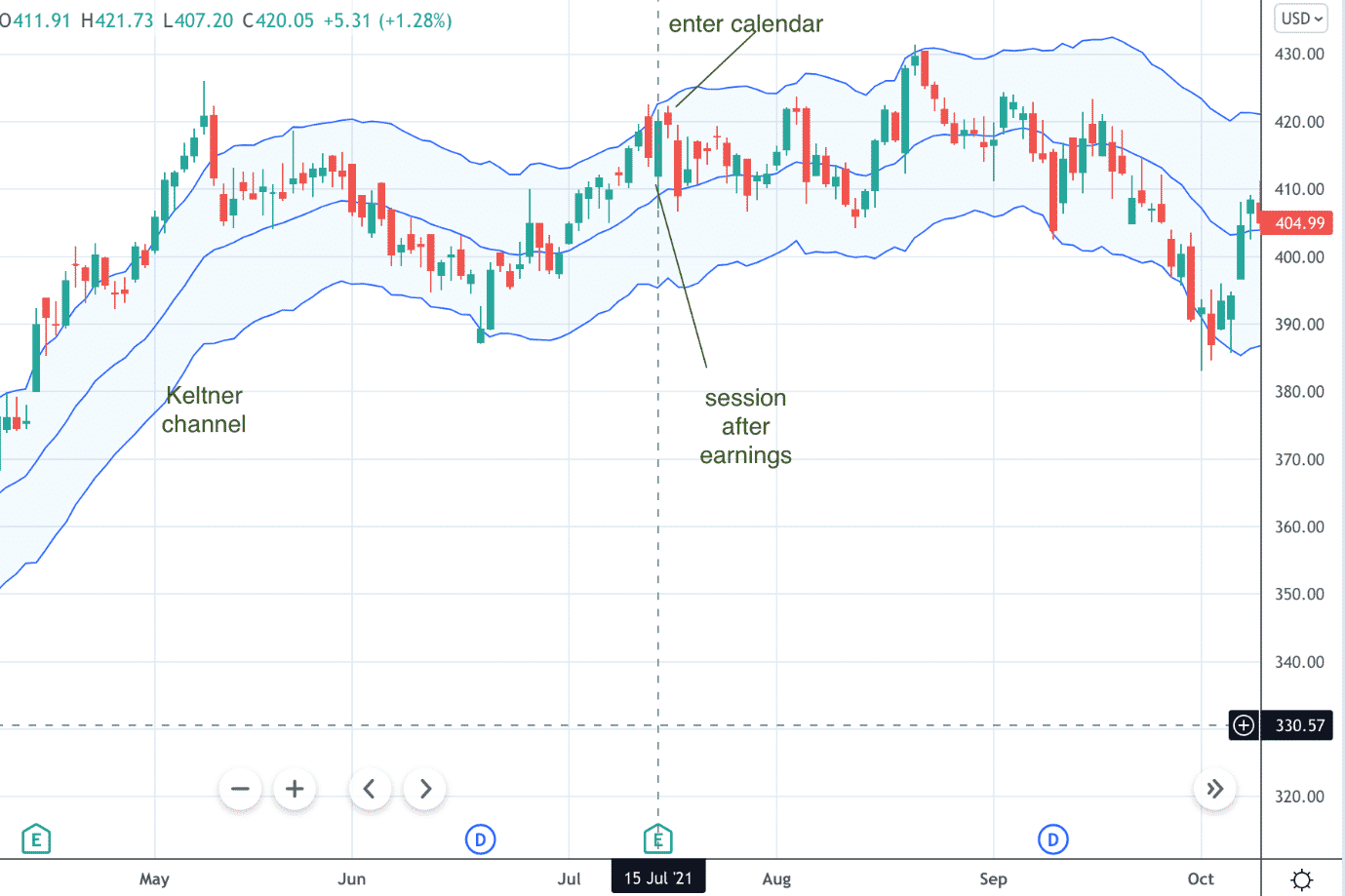

United Health Group (UNH) had earnings before the market opened on July 15, 2021.

We let UNH trade that whole day to see where it closes.

It closed inside the Keltner channel at $420.05.

The next day July 16, it also opened inside the Keltner channel.

We are good to initiate the calendar anytime on July 16.

The trades were entered two and half hours after the open using historic intraday options data from OptionsNet Explorer for the backtest.

Date: July 16, 2021

Price: UNH @ $420.64

Sell 5 Jul 30 UNH $420 put at $5.43

Buy 5 Aug 13 UNH $420 put at $7.53

Initial Debit: $1050

We buy five calendars with the front-month expiration about two weeks out on July 30.

The back month will be two weeks further out from the front month on August 13.

The $420 puts are the strikes closest to the current price.

For at-the-money calendars, it doesn’t matter if we use puts or we use calls.

By using puts, we can take assignment on the stock if things go wrong and turn it into a wheel trade — although you might need to sell off some contracts before taking assignment.

Immediately after entering the trade, we put in a standing limit order to exit the trade to sell the five calendars for a credit of at least $1260.

This will give us a profit of $210, or 20% of the initial debit of $1050.

The value of the calendars will fluctuate in value as price moves, volatility changes as time passes.

If we are lucky, the trade value can reach a value that would automatically trigger our order and exit the trade.

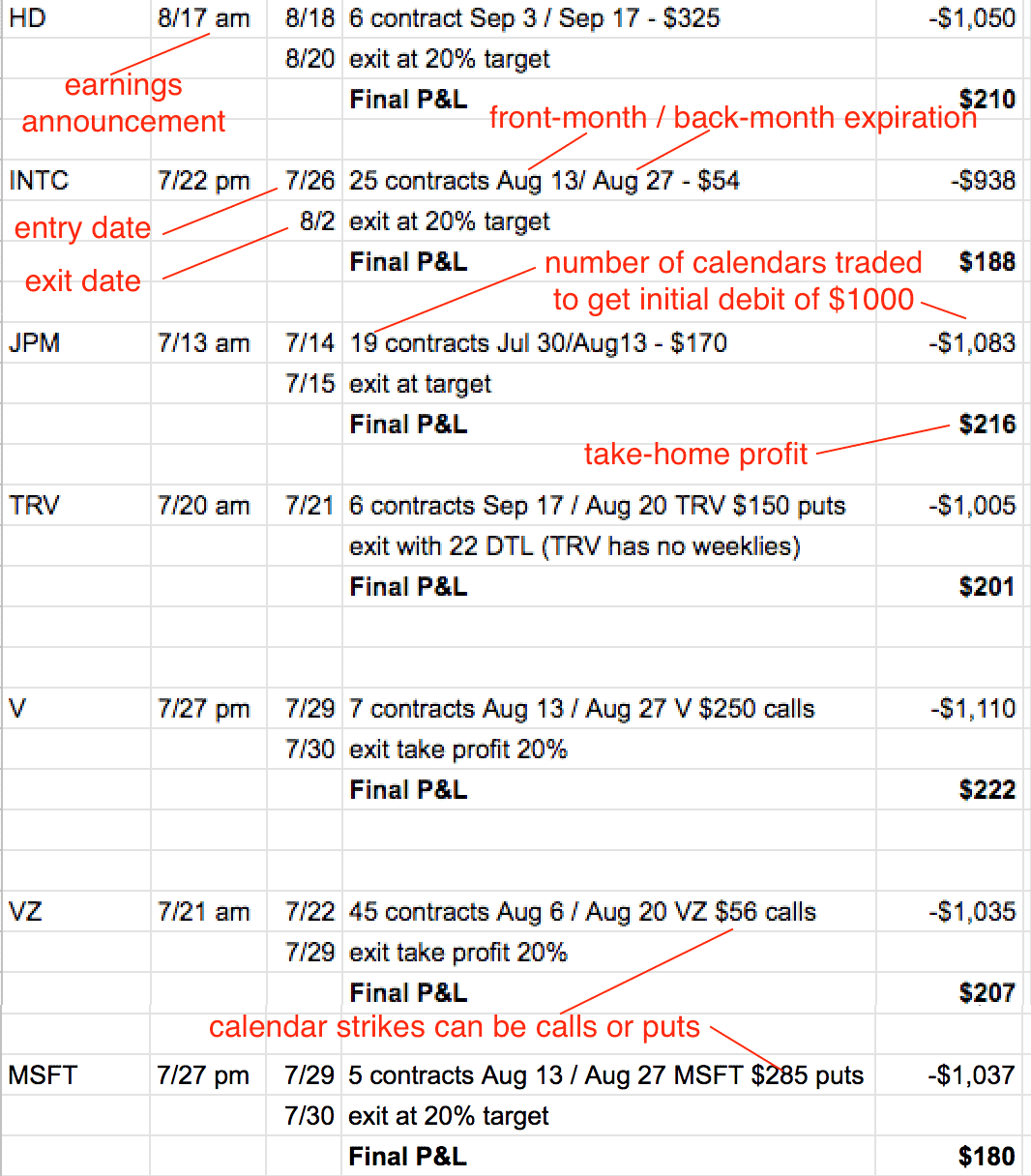

We picked this as the first example because this trade reached 20% profit without any adjustments.

A few other DOW stocks during that earning season reached the 20% target without obstacle…

Exit 7 Days Till Expiration

If the trade does not reach the 20% target, we will exit the trade when it nears seven days left until expiration.

Take the example of Apple (AAPL), which had earnings after the market closed on July 27, 2021.

The following day on the 28th, we do nothing.

This pause gives time for volatility and price discovery to settle.

On the 28th, AAPL closed inside of its Keltner channel.

On July 29, AAPL opens inside its Keltner channel (use the default settings usually bands at 2 ATR above and below the 20-period moving average).

We are good to initiate the calendar on July 29.

Date: July 29, 2021

Sell ten Aug 13 AAPL $146 put at $2.63

Buy ten Aug 27 AAPL $146 put at $3.73

Debit: $1095

While we immediately put in a standing limit order to sell the ten calendars for a credit of $1314, this order is never hit.

On Friday, August 6, with only seven more days till the expiration of the short option, we see that the P&L of the trade is $160, we cancel the standing order, and we exit the trade taking whatever profits the market was able to give us.

While not quite 20%, this 14.6% profit on the initial debit is quite good.

We don’t want to risk losing this profit with the weekend risk, and who knows what price will do on Monday.

The Greek gamma is high during that last week of expiration, and even a modest price change in AAPL can have a large effect on the P&L.

These are rather shorter-term trades with a holding time of around one week.

The less time the trade is exposed to the market, the less chance for the price to make a big move against us.

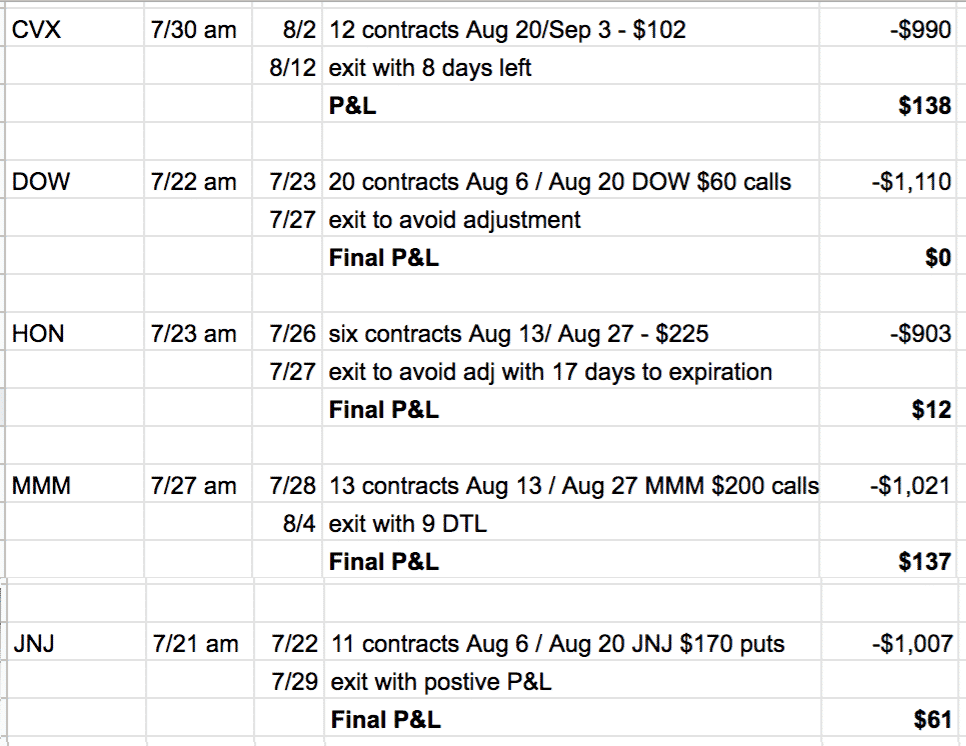

The following trades were exited profitably by taking whatever the market was able to give us.

3M Company (MMM) had 13% profit, but it doesn’t have much time left with only nine days till expiration. So we took the profit.

Calendars take time to accrue profits.

On the one hand, we want to hold the trade as long as we can.

On the other hand, we don’t want to hold it too close to expiration or let profits be taken away.

There are no hard rules; this is part of the art of trading.

See that the Honeywell (HON) trade was exited with barely a $12 profit with 17 days to expiration.

Why?

This is because the price action was not behaving well.

At this point, the trade needed adjustment. Instead of adjusting, we decided to exit at breakeven.

We did similarly for Dow Inc (DOW).

If you can get out profitably without having to adjust the trade, or even for a small loss, then it might be wise to do so.

You will find out later.

Adjustments do not always work.

Adjustments have an even lower chance of working the closer you are to expiration.

Adjustment On the Upside

So far, we have seen the trades that were easy and didn’t need any adjustment.

The following trades will not be as easy.

Consider Caterpillar (CAT), where the price rallies up.

Date: August 2, 2021

Price: CAT at $207.53

Sell six August 20 CAT $210 puts at $5.90

Buy six September 3 CAT $210 puts at $7.58

Initial debit: $1005

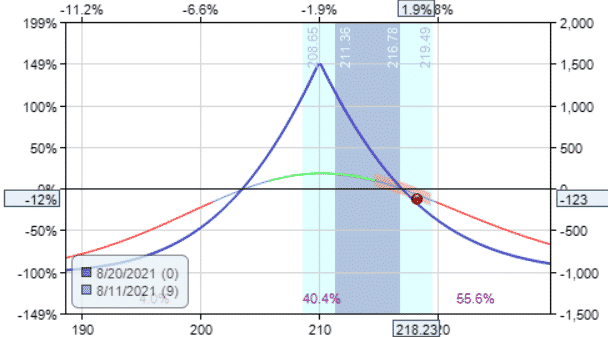

On August 11, with nine days till the short put expiration, the price went outside of the calendar tent on the payoff diagram:

Ideally, this should have been adjusted earlier as the price approached the edge of the risk curve.

However, the day before, the price was still well within the tent.

This goes to show that these shorter-term trades have to be monitored more closely — at least daily.

To adjust, we will roll the short strike vertically as described in Adjusting Calendar Spreads method #1.

Date: August 11, 2021

Buy to close six August 20 CAT $210 puts

Sell to open six August 20 CAT $215 puts

Credit: $705

When the trade requires an adjustment, it already means that trade is going as we would have liked.

We are no longer looking to capture 20% of the initial capital invested or even 10%.

With so little time left, we are just expecting to get out at breakeven or at a small loss.

On August 13, the P&L turned positive.

We thanked the market and exited the trade with a profit of $48.

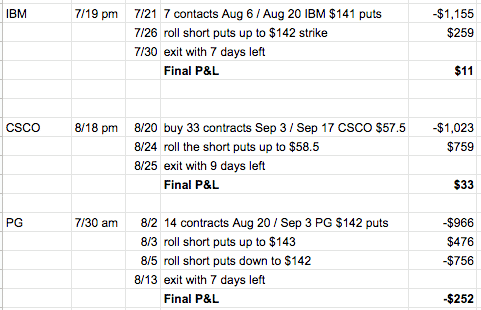

We made similar adjustments on IBM, CSCO, and PG.

We took a loss on Proctor and Gamble (PG) because the price rallied up to trick us into rolling up our short put only to come back down, forcing us to roll our short down again.

Adjustment On The Downside

What if the price of the stock drops down to the lower edge of the calendar tent?

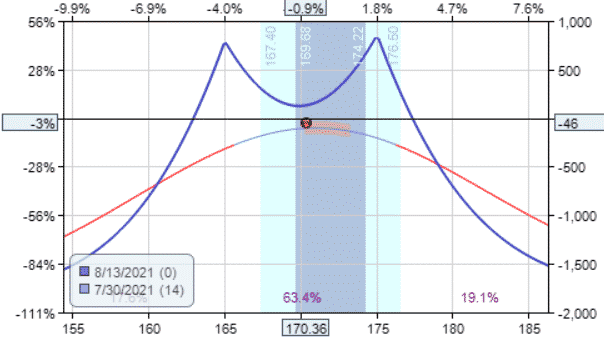

While we can use the same technique of rolling the short strike vertically, we will introduce another technique which is to add another set of calendars below the current price.

When a stock price is falling, implied volatility can sometimes (but not always) increase.

Since calendars benefits when implied volatility (IV) increases, adding a set of bearish calendars might make sense.

Let’s see.

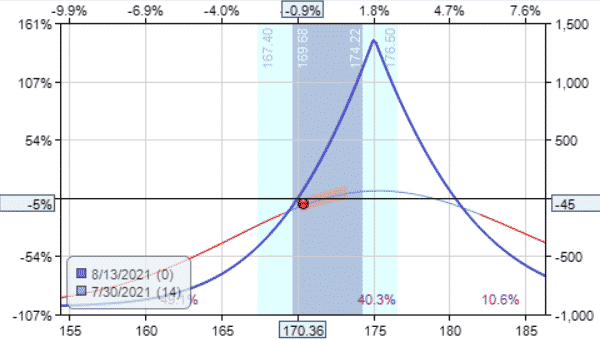

In our backtest, we entered American Express (AXP) on July 26, 2021, by buying seven calendars at the $175 calls.

The front month expires August 13, and the back-month expires August 27.

The initial debit was 931 dollars.

On July 30, the payoff diagram shows that adjustment is needed.

Since we still had 14 days till the expiration of the front-month, we bought 7 put calendars at the $165 strike for an additional debit of –$865.

The payoff diagram shows the new trade to be a double calendar.

On August 3, the P&L came back to positive.

And we exit the trade with a profit of $70.

We used the same technique in the following trades:

We have to be mindful that this technique requires additional capital and doubles the risk in the trade.

Investors who are not comfortable with this can stick with the first technique of rolling the short strike vertically.

The Results

Tallying the P&L of the 23 trades mentioned above, we get a total profit of $1786.

Eight out of the 23 hit the 20% profit target: UNH, HD, INTC, JPM, TRV, V, MSFT, and VZ.

Six more exited profitably or breakeven without adjustment: AAPL, CVX, DOW, HON, MMM, and JNJ.

The remaining nine required some adjustments.

Four of them we rolled the short put up as the stock rallied: CAT, IBM, CSCO, and PG.

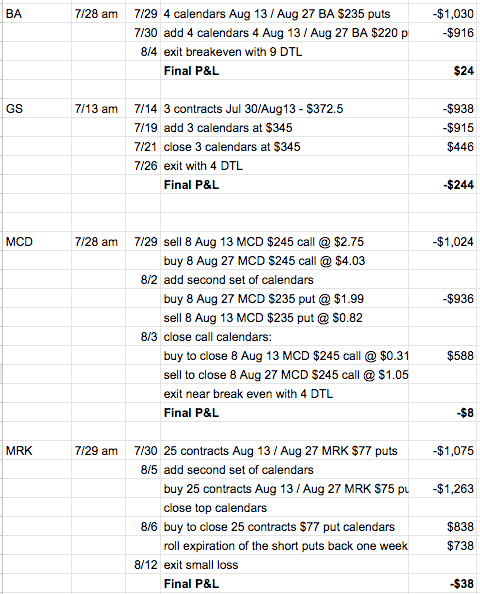

And five of them added a second set of calendars on the downside: AXP, BA, GS, MCD, and MRK.

We only had 23 trades because the remaining 7 of the DOW stocks closed outside the Keltner channel, so they did not apply this strategy.

We are not saying that those events are not tradable.

They probably are if you can find the right strategy.

But for today’s calendar strategy, we are looking for stocks that did not make a huge outsized move on earnings.

If earnings could not push the price outside the Keltner channel bands, then we are good to use the calendar.

It means both the sellers and buyers agree on the fair value of the stock.

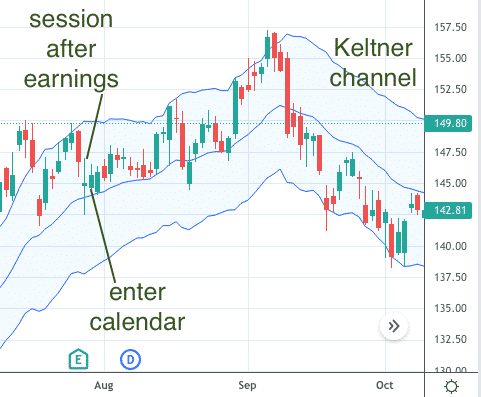

Let’s take a look at Chevron (CVX) after its earnings announcement.

If the earnings date was not pointed out, you wouldn’t even have known it went through earnings.

It was just another day in the life of a Chevron stock.

This would be the perfect candidate for the calendar.

Indeed, the backtest showed that this CVX calendar resulted in a 14% return in 10 days with no adjustment needed.

Now, if only all trades were like this.

Conclusion

Overall, we are satisfied with the results.

Applying a $1000 calendar position on a Dow stock after earnings will yield an average profit of $78 — calculated by dividing $1786 by 23 trades.

For the trades that did not require any adjustments, this is a 7.8% return on risk while holding the trade for only one or two weeks.

For trades that did require adjustment, this return on risk percentage will be somewhat different because we had introduced new capital into the trades and altered the risks.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gavin,

do you happen to know how to set in interactive brokers the order to close a calendar(both legs) ?

Yes, just set up the calendar spread as normal, then sell it rather than buying it.

Hi Gavin,

I’m sorry I meant how to set the stop loss for the options ?

Stop losses don’t work very well for option trades if there is a large bid-ask spread. But you could try using a Sell Stop order or a Sell Stop Limit order.

Hi Gavin,

I’m sorry, I meant if there is a way to set the automatic stop loss for a calendar spread? You mean a sell order for a maximum loss ?