The relationship between an option strike price to the underlying stock price is the concept of “moneyness” of options.

One of the first things to learn in option trading is the definition of in-the-money, out-of-the-money, and at-the-money.

Contents

- Example of In-the-Money

- Intrinsic Value versus Extrinsic Value

- Example of Out-of-the-Money

- Example with Calls

- Time Premium

They are often abbreviated ITM and OTM and ATM.

In short, a put option is in-the-money if the stock price is below the strike price of the option.

Otherwise it is out-of-the-money.

A call option is ITM if the stock price is above the strike price.

Otherwise it is OTM.

Technically speaking, ATM is if the price and the strike price happens to coincide exactly.

However, loosely speaking it is the two strike prices in the option chain that is closest to the price.

Example of In-the-Money

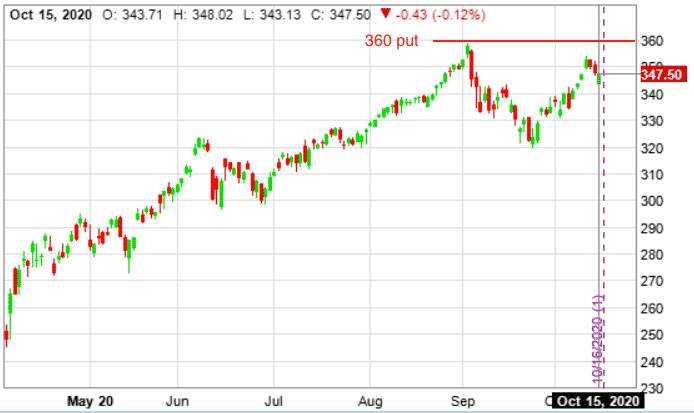

Suppose that SPY is trading at $347.50 on October 15, 2020.

If we have the $360 put option of SPY, that option will be ITM.

At this point, the 360 put has $12.50 per share of intrinsic value.

Intrinsic Value versus Extrinsic Value

If the 360 put is trading for a price above 12.50 then any extra vale is extrinsic value which is sometimes referred to as time value or time premium.

It does not make sense to exercise OTM options because there is no intrinsic value.

The $360 SPY put with November 20, 2020 expiration costs $16.43. Of that, $12.50 is intrinsic value. And the remaining $3.93 is extrinsic value.

Example of Out-of-the-Money

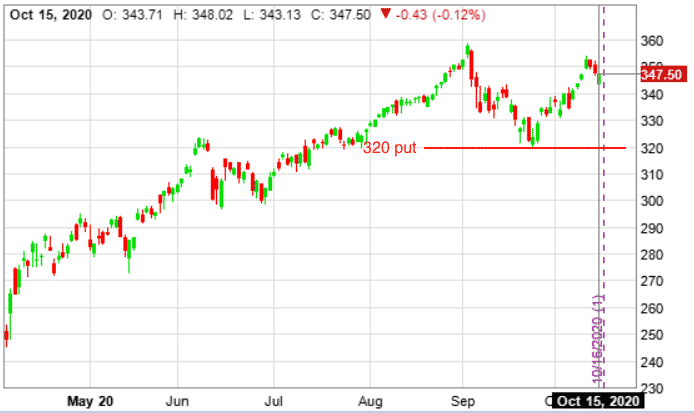

Now suppose that we have the $320 put option on SPY.

This option is out-of-the-money because it doesn’t make sense to exercise it.

We wouldn’t want to sell SPY at $320 when the current price of SPY is $347.50.

If we look at the price of this option at the Nov 20 expiration, we see that it costs $3.51.

The entire cost is time premium.

There is no intrinsic value in this option at this time.

Keep in mind that options and go in the money and out of the money from day to day and from minute to minute depending on the price movement of the stock and where that price is relative to the strike price of the option.

Example with Calls

Now suppose we have the $320 call option instead of the put option.

That call option will be in-the-money.

To exercise a call means to buy 100 shares of SPY at the strike price of $320.

Since SPY is at $347.50, the 320 call contains $27.50 of intrinsic value.

Just like puts, it makes sense to exercise ITM calls (at expiration) and does not make sense to exercise OTM calls.

The $320 Nov 20 call costs $31.08.

Most of it ($27.50) is intrinsic value.

The remaining $3.58 is extrinsic value, or time premium.

Time Premium

Extrinsic value is called time premium because there is time still remaining until the expiration of the option.

In this example, we have 36 days of time remaining.

This time has value, because it give us possibility — the possibility that the stock price and the option value moves in a way that would be advantageous to us.

Why do people buy OTM options? (not something I would recommend by the way)

OTM options have no intrinsic value at the moment.

But people are buying possibilities and buying time.

They are hoping that the option would move ITM within the time period.

If it does, the option will have intrinsic value and they benefit.

Conversely, sellers of OTM option are selling time.

The time to expiration decreases each and every day (not just trading day, but calendar day).

Hence the value of OTM options decreases with time (with all other things being equal).

This is known as time decay and is measured by the Greek theta.

Sellers profit when they sell options at high price and buy them back when option value drops.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.