Contents

There are two types of diagonal put spread. The first type is what I would call a poor man’s covered put.

This is initiated by buying a long-term in-the-money put and selling a short-term out-of-the-money put.

This long dated put option will have a high delta and behave similar to a short stock position.

The second type is where the trader sells a near term out-of-the-money put and then buys a longer-term put that is further out-of-the-money.

Here’s an example of how that looks and this is the type we will discuss in detail in this article.

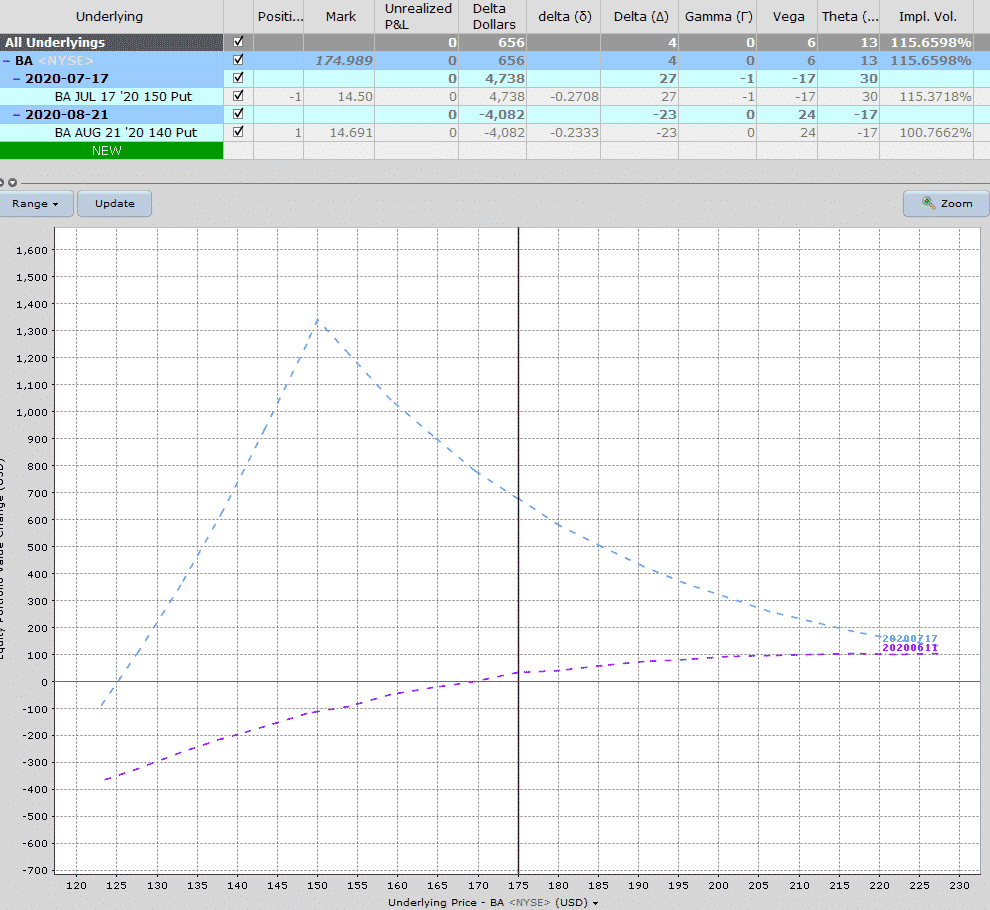

Trade Date: June 11, 2020

Stock Price: $175

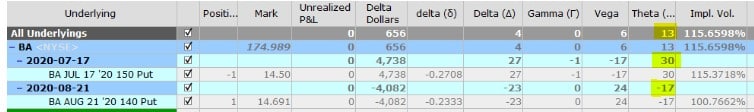

Trade Details: BA Diagonal Put Spread

Sell 1 BA July 17th 150 Put @ $14.50

Buy 1 BA Aug 21st 140 Put @ $14.69

Premium: $19 Net Debit.

Maximum Loss

If the stock rallies, the maximum loss is equal to the premium paid. In this case we actually received a credit of $19 for the trade, so there is no loss potential on the upside and in fact the worst thing that can happen is a $19 gain.

If the stock drops, the maximum loss on the downside is equal to the difference in the strike prices plus / minus the option premium paid / received.

In the BA example above, the strikes are $10 apart and there is one contracts, so that makes a $1,000 potential loss, less the $19 in premium received for a total maximum potential loss of $981.

Maximum Gain

The maximum gain on a diagonal spread can’t actually be worked out in advance because it’s impossible to know what the back-month option will be trading for when the front-month option expires. This is due to changes in implied volatility.

The best we can do is use our broker platform or software such as Option Net Explorer to estimate the maximum gain.

In our BA example, the maximum gain is estimated at just over $1,300.

The ideal scenario for the trade is that the stock ends near the short strike at the expiration of the near-term option.

Ideally this would be associated with an increase in implied volatility in the back-month option. The increase in implied volatility in the back-month helps to offset any negative effects from time decay.

Some traders like to hold the long put as a stand-alone trade after the short put expires. The expired short put helps offset the cost of the long put.

Breakeven Price

Like the maximum gain, the exact breakeven price can’t actually be calculated but we can estimate it. As our BA trade is entered for a credit, there is no breakeven price on the upside.

On the downside, the breakeven price is estimated at about $125.

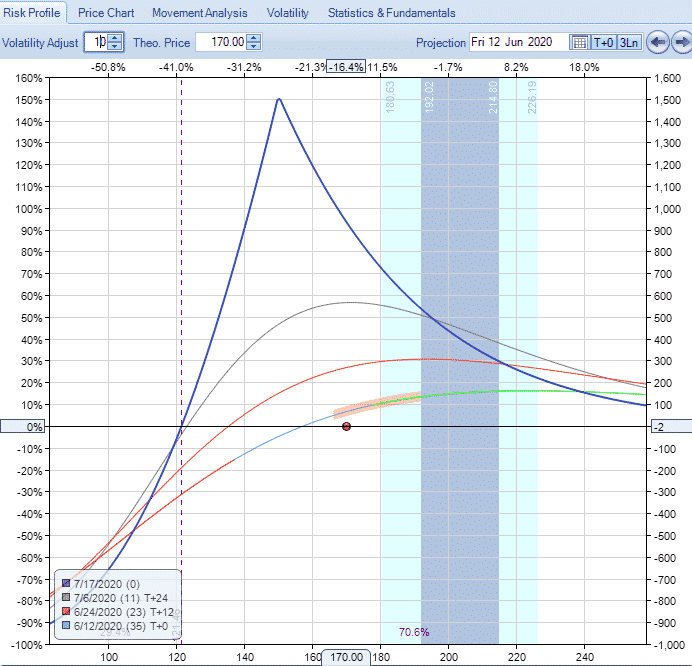

Payoff Diagram

Diagonal put spreads have low risk on the upside and a tent shaped profit zone on the downside, with all the risk in the trade being below the profit tent.

For this reason, a big drop in the stock early in the trade is the worst case scenario.

Using our BA example, we can see how the trade performs over different time periods by looking at the T+0, T+12 and T+24 lines.

Notice that an initial drop to $140 will see the trade in a loss situation, but if that level is reached after about day 14, the trade is actually in profit.

Losses start to accelerate if the stock breaks through the short strike, so for this reason, it is best to close the trade before the stock breaks below that level.

Risk of Early Assignment

There is always a risk of early assignment when having a short option position in an individual stock or ETF. You can mitigate this risk by trading Index options, but they are more expensive.

Usually early assignment only occurs on call options when there is an upcoming dividend payment. Traders will exercise the call in order to take ownership of the share before the ex-date and receive the dividend.

Short puts would generally only get assigned if they are in-the-money and there is very little time value left.

How Volatility Impacts Diagonal Put Spreads

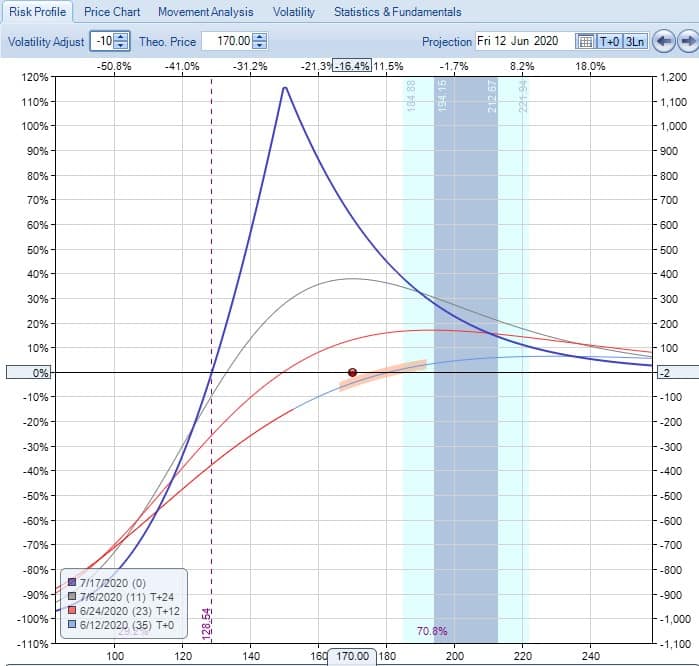

Diagonal spreads are long vega trades, so generally speaking they benefit from rising volatility after the trade has been placed.

Vega is the greek that measures a position’s exposure to changes in implied volatility. If a position has negative vega overall, it will benefit from falling volatility.

If the position has positive vega, it will benefit from rising volatility. You can read more about implied volatility and vega in detail here.

Our BA example starts with a vega of 6. This means that for every 1% rise in implied volatility, the trade should gain $6.

The opposite is true if implied volatility drops 1% – the position would lose $6.

Here’s how the BA trade looks assuming a 10% rise in implied volatility. Notice that the expiration line maximum profit has rises from around $1,300 to over $1,500 and all three of the interim lines have also been lifted up.

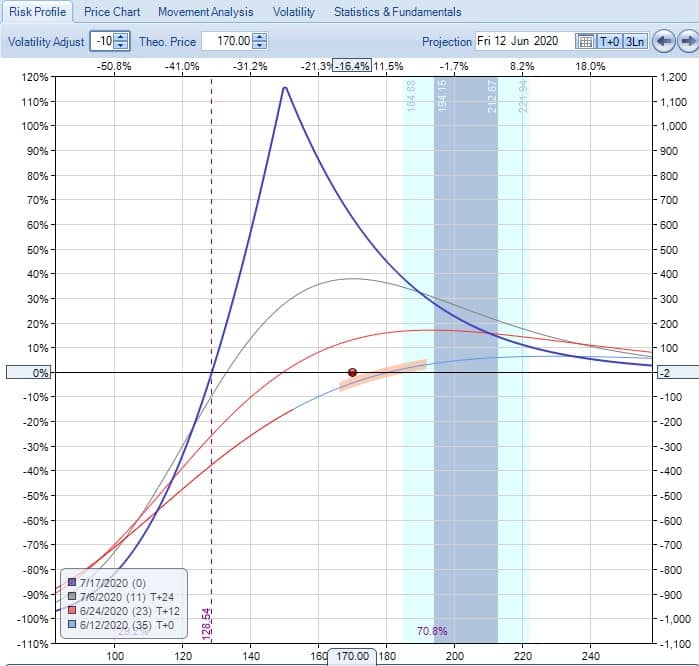

The opposite is true if we estimate a 10% drop in volatility, the whole payoff graph has now moved downwards with a maximum potential profit of only $1,150.

How Theta Impacts Diagonal Put Spreads

Diagonal Spreads are positive Theta trades in that they make money as time passes, with all else being equal.

This is due to the fact that the short put suffers faster time decay than the bought put.

This is especially true if the bought put is much further out in time (I.e. more than just one month).

In our BA example, the trade has positive Theta of 13. This means that, all else being equal, the trade will gain $13 per day due to time decay.

Notice that the positive time decay on the short-term sold put is higher than the time decay being suffered on the longer-dated long put.

Other Greeks

DELTA

Delta on a diagonal put spread is generally going to be positive to start with and we can see that in our BA (+4) example.

As the trade progresses, the delta will change. For example, if BA rises above $230, the trade actually flips to be slightly negative delta, because the trader wants the stock to head back down towards the profit zone as the trade gets closer to expiry.

GAMMA

Diagonal spreads are negative gamma. Generally any trade that has a profit tent above the zero line will be negative gamma because they will benefit from stable prices.

Gamma is one of the lesser known greeks and usually, not as important as the others. I say usually, because you’ll see further down in this post why it can be really important to understand gamma risk.

Diagonal spreads maintain a bit of a natural hedge because they are negative gamma, but positive vega. The ideal scenario is that implied volatility rises (good for positive Vega) but realized volatility remains low (good for negative gamma).

In other words you want the stock to stay relatively flat, but show a rise in implied volatility (the expectation of future big price moves).

In our BA example Interactive Brokers is showing the gamma as 0, but it’s more like-0.14 so it’s very low in this example.

Risks

The main risk with the trade is a sharp drop in the underlying stock early in the trade.

A drop late in the trade can be ok, provided the stock doesn’t break through the short put.

ASSIGNMENT RISK

We talked about this already so won’t go into to much detail here and while this doesn’t happen often it can theoretically happen at any point during the trade. The risk is most acute when the short put is in-the-money and has very little time value left.

One way to avoid assignment risk is to trade stocks that don’t pay dividends, or trade indexes that are European style and cannot be exercised early. The risk is also very low if the short puts are out-of-the-money.

To reduce assignment risk consider closing your trade if short put is close to being in-the-money, particularly if it is close to expiry.

EXPIRATION RISK

Leading into expiration, if the stock is trading just above or just below the short put, the trader has expiration risk.

The risk here is that the trader might get assigned and then the stock makes an adverse movement before he has had a chance to cover the assignment.

In this case, the best way to avoid this risk is to simply close out the spread before expiry.

While it might be tempting to hold the spread and hope that the stock rallies and stays above the short put, the risks are high that things end badly.

Sure, the trader might get lucky, but do you really want to expose your account to those risks?

VOLATILITY RISK

As mentioned on the section on the greeks, this is a positive vega strategy meaning the position benefits from a rise in implied volatility. If volatility falls after trade initiation, the position will likely suffer losses.

The other risk with volatility relates to the volatility curve.

Generally speaking, when volatility rises or fall it has a similar impact across all expiration periods.

However, you could potentially run into a scenario where volatility in the front month rises (bad for the short put) and volatility in the back month drops (bad for the long put). That would result in a double whammy for the trade.

That scenario may not be that common but it could happen and it’s important that trades understand volatility term structure when placing trades that span different expiration periods.

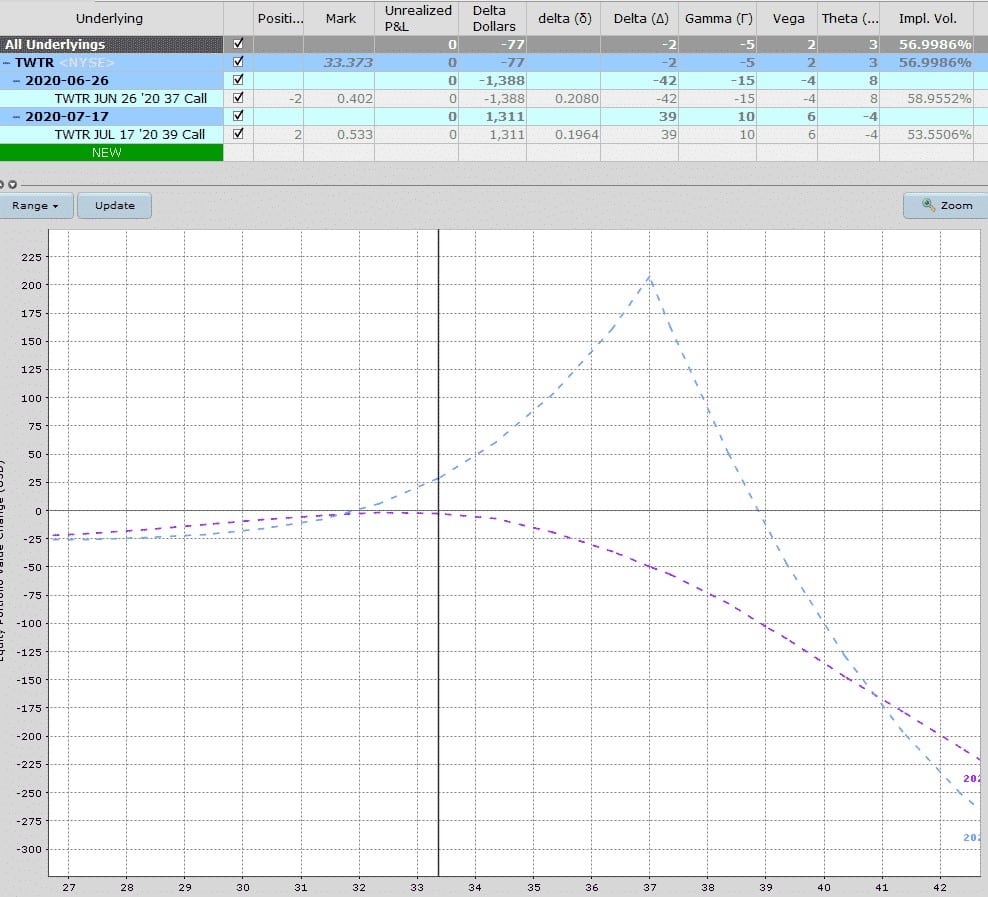

Diagonal Put Spread vs Diagonal Call Spread

The opposite of a diagonal put spread is a diagonal call spread. With a call spread, the risk and also the profit tent are on the upside.

Here’s what a diagonal call spread would look like. You can read more about diagonal call spreads here.

Trade Management

As with all trading strategies, it’s important to plan out in advance exactly how you are going to manage the trade in any scenario.

What will you do if the stock rallies? What about if it drops? Where will you take profits? Where and how will you adjust? When will you get stopped out?

Lot’s to consider here but let’s look at some of the basics of how to manage diagonal spreads.

PROFIT TARGET

First and foremost, it’s important to have a profit target. That might be 10% of capital at risk or you may plan on holding to expiration provided the stock stays within the profit tent. Ten percent is a good target for a trade like this.

STOP LOSS

Having a stop loss is also important, perhaps more so than the profit target.

With diagonal spreads, you can set a stop loss based on percentage of the capital at risk. In this case it might be closing the trade if the loss reaches 15-20%.

Examples

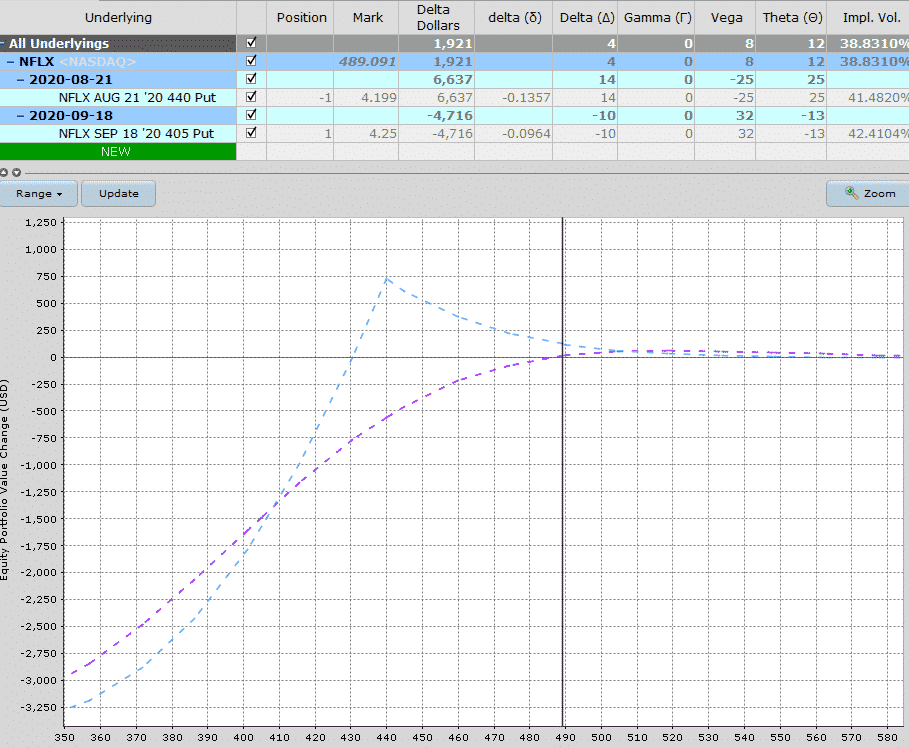

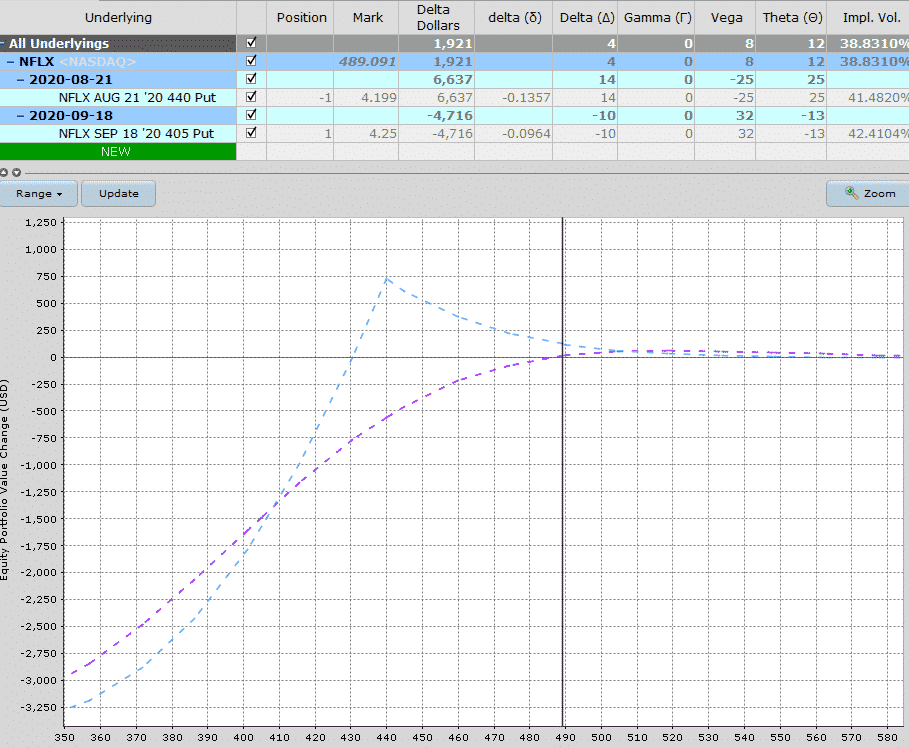

Let’s take a look at an example on NFLX stock from August 2020. Here are the trade details:

Date: July 30, 2020

Current Price: $489.09

Trade Set Up:

Sell 1 NFLX Aug 21th, 440 put @ $4.20

Buy 1 NFLX Sept 18th, 405 put @ $4.25

Premium: $5 Net Debit

Max Loss: $5 on the upside and $3505 on the downside

Stop Loss: 20%

By August 13th, NFLX had dropped to 481.71 and the trade was in profit to the tune of $126 or about 3.88%.

That’s a little less than I was looking for but decided to close it out given there was only one week left to expiry.

In hindsight, I could have held it another few days.

Below is another example on MA stock.

You can also find another 2 examples here.

Summary

Diagonal put spreads are a neutral to slightly bullish trade that can handle a move lower in the stock provided the move isn’t too big or too early in the trade.

For this reason they should only be placed on stocks the trader thinks might move slightly lower but not too much lower.

A good time to enter this type of trade is at the end of a strong down move where further downside is likely to be limited.

Given that the position contains options across multiple expiration dates, it’s important to have a solid grasp of implied volatility including how volatility changes impact options with different expiration periods.

One nice feature of the trade is that there is very little risk on the downside and in some instances, even the ability to generate a small amount of premium if both puts expire worthless.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.