IV crush is a phenomenon that tends to catch many beginners off guard.

It is a situation where the extrinsic value of an option contract declines sharply because of a significant event occurring.

For example, the reporting of corporate earnings or a regulatory announcement.

Contents

To understand what an IV crush is, we first need to cover implied volatility (IV).

What Is Implied Volatility?

Implied volatility is a metric used by traders to provide a forecast for the likely future change in a security’s price.

When we trade options, we take on two views.

One view is on the direction of the stock, the other on its implied volatility.

As implied volatility increases, it results in options having a higher premium.

This is because the price of options are valued based on intrinsic value (the value of the option if exercised today) and extrinsic value (the time value of an option).

Therefore, an increase in implied volatility means an increase in the options extrinsic value.

A decrease in implied volatility lowers the options extrinsic value.

As a company’s earnings date approaches, there is a rise in the uncertainty of the company’s future stock price.

This translates into a higher extrinsic value for the options on the company.

You can read a full guide on implied volatility here.

What Is IV Crush?

Yet once the event has occurred the options will lose the extrinsic value of that event.

This will typically occur right after an event has occurred.

We go from an environment where there is unknown information to an environment where the information is now known.

Put simply, it means the market is moving from uncertainty to certainty.

As alluded to earlier, this is something like an earnings announcement.

Market participants speculate on the results and then react once the results are released.

This can also happen with any significant event, e.g., an FDA approval date, the outcome of a legal battle, etc.

Let’s work through a conceptual example to see how this plays out.

When Does IV Crush Occur?

An IV crush typical occurs when a company goes from having unknown information to having known information.

The best example of this is when a company releases their quarterly earnings numbers.

In the lead up to the event, there is a lot of uncertainty which leads to high implied volatility.

Once the announcement has been made, the uncertainty is removed and implied volatility drops back down.

IV Crush Example

Say that a company is due to report earnings soon, and several market participants believe that actual earnings will end up being higher than what is currently expected.

To capitalize on this forecast, the market participants buy a few calls ahead of the announcement.

At the same time, some market participants believe actual earnings will end up being lower than expected and so they buy puts.

With no consistent view of the future, a sudden surge in demand for both puts and calls is created which pushes up volatility as both sides hope to make a profit from the announcement.

Eventually earnings day arrives, and the company releases its results, which means the market now has certainty on the company’s true earnings.

As a result, traders rapidly re-evaluate their positions and decide whether to hold or close their positions.

With the market having increased certainty, volatility drops very quickly, resulting in an IV crush and a steep decline in the extrinsic value of options.

This dynamic occurs even when company earnings reports are bad, because ultimately what matters is not what the results were, but that there are now results which allow for an increased level of certainty for investors.

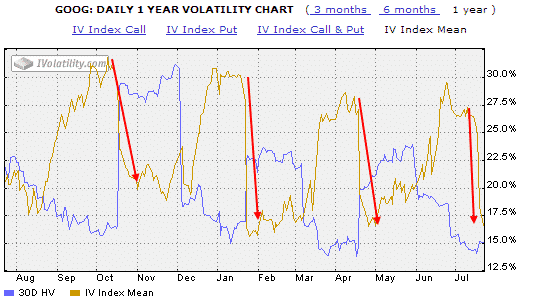

Below you can clearly see the effects of iv crush on GOOG after each quarterly earnings announcement.

IV Crush And Option Prices

Not all options are affected equally by an IV crush.

Short-dated options will be affected the most.

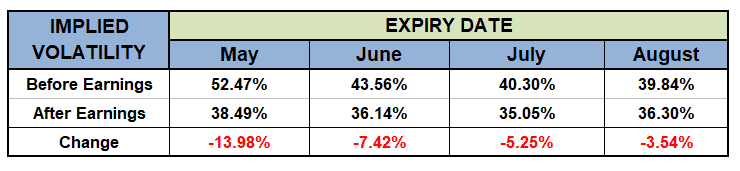

Let’s look at an example using the most recent GOOGL earnings from April 26, 2022.

Here we can see that the IV crush has been most pronounced in the short-term options.

The May expiry options have dropped from an implied volatility of 52.47% to 38.49%.

The August expiry options have only dropped from 39.84% to 36.30%.

Therefore, we can say that IV crush affects short-term option prices more than long-term option prices.

Best Strategies For IV Crush

The best strategies for IV crush will be anything that is short volatility, provided the stock stays within the expected range.

Short volatility strategies include:

- Iron Condor

- Short Straddle

- Short Strangle

- Butterfly Spread

- Bear Call Spread

- Bull Put Spread

- Put Ratio Spread

- Call Ratio Spread

Protecting Yourself Against IV Crush

To protect yourself against volatility crush, there are you two key actions you can be taken.

The first is to avoid trading options where the expiration month contains an earnings announcement.

It is in the expiration month containing an earnings announcement that traders are at the highest risk of a volatility crush as stocks are re-priced because of the announcement.

The final way is to pay close attention to an option’s historical volatility, to compare whether implied volatility is relatively high compared to historic norms.

If you discover implied volatility is higher than historic norms, avoid buying options on that stock until implied volatility settles back down.

Despite this it is important to note IV crush is not a free lunch for options sellers or something that must be avoided when buying options.

This is because an IV crush is accompanied by a realized move in the stock. New information comes out and the stock reacts to that information.

This is known as gamma risk and affects the intrinsic value of the option.

Imagine Facebook is trading at $120, and we sell the $130 options expiring Friday for $4.35. At the point of our trade the option has 0 intrinsic value and $4.35 in extrinsic value.

Facebook has their earnings after hours, and the stock blows out.

It opens the next day at $140. The 130 call is now trading at $10.10.

It now has $10 of intrinsic value and only 10 cents of extrinsic value.

IV crush happened but the realized move outpaced it and we lost money.

Conclusion

An implied volatility crush is when the extrinsic value of an options contract declines sharply because of a significant event occurring, such as the reporting of corporate earnings or a regulatory announcement.

It occurs due to the increasing uncertainty in the lead up to a significant event, followed by the sudden and sharp drop in uncertainty as the event occurs and the general market digests the results.

Traders can protect themselves by avoiding options with high implied volatility, avoiding options with an event occurring in the expiration month, and avoiding options that have a higher implied volatility compared to historic norms.

However, by doing so, they risk missing out on potentially lucrative short-term trades if the realized move is larger than the market expects.

As with any trading approach, ensure you exercise appropriate risk management strategies and use it as part of a well-thought-out strategic approach.

FAQ

What is an IV crush?

IV crush is when implied volatility, and therefore option prices, drop in response to unknown information becoming known.

This typically occurs when a company releases their quarterly earnings reports.

What is IV and IV Crush?

IV refers to implied volatility which is a metric used by traders to provide a forecast for the likely future change in a security’s price.

IV crush refers to the fall in options prices following unknown information becoming known.

The most common form of IV crush occurs after a company’s quarterly earnings announcement.

How Does IV crush benefit you?

IV crush will benefit traders that employ short volatility strategies such as iron condors and short straddles, provided the stock stays within the expected range.

How do you prevent an IV crush on puts?

IV crush will affect all options differently. For put option buyers, the best way to prevent IV crush is to buy in the money puts with very little time premium.

Another thing to consider is buying longer-dated puts.

We saw above that long-dated options are less impacted from IV crush than short-dated options.

How do you trade IV crushes?

Most traders will sell short term iron condors, short straddles and short strangles to trade IV crushes.

These trades have a high probability of success, but require the stock to stay within the expected range to achieve a profit.

Iron condors, short straddles and short strangles will all benefit from IV crush because they are short volatility trades.

They benefit from falling IV.

However, potential losses can be large if the stock makes a larger than expected move.

Netflix (NFLX) was expected to stay within a 10.9% range for their April 2022 earnings announcement.

The stock actually dropped 35.1% which was much greater than the expected move.

The significant move in the stock price would have outweighed the gain from the IV crush for condors and straddle traders.

How do IV crushes make money?

IV crushes make money when traders employ short volatility option strategies, and the stock stays within the expected range.

Is high volatility good?

High volatility means a stock will experience large daily price fluctuations.

This can be a good or a bad thing.

High volatility means high option premiums which can be great for option sellers.

However, high volatility generally means high risk.

It is a good idea to use IV percentile as a measure of whether a stock has high volatility or not.

Does IV crush affect LEAPs?

IV crush does affect LEAPs, but to a much lesser extent than short-term options.

Weekly options are affected by IV crush the most.

How do you find high IV stocks?

The best way to find high IV stocks is through your broker account.

Most brokers will have a scanner that can scan for high IV stocks.

If not, you can use web based scanning tools such as Barchart or MarketChameleon.

Does IV go down after earnings?

Yes, generally speaking IV goes down after earnings.

Even if the stock makes a huge move, IV will typically go down after earnings.

For example, when NLFX dropped 35.1% after their April 2022 earnings, you might think volatility would rise.

When a stock makes a huge move, IV usually rises.

But in this case, IV actually dropped from around 66% to 58%.

How Can I Protect Myself From IV Crush?

There are several ways to protect yourself from IV Crush, including avoiding trading options during high IV periods, using option spreads to limit your risk, and adjusting your trading strategy to take advantage of IV Crush when it occurs.

Is IV Crush Always A Bad Thing?

Not necessarily. If you are a seller of options, IV Crush can be beneficial as it can decrease the value of the options you have sold. However, if you are a buyer of options, IV Crush can result in significant losses.

How Can I Learn More About IV Crush?

You can learn more about IV Crush by reading articles and books on options trading, following experienced traders on social media, and practicing trading options on a demo account before risking real money.

Consider using a backtesting tool such as OptionNet Explorer to understand how IV Crush affects option prices.

Related Articles

IV Crush After Earnings

Another IV Crush Example

How to Capitalize on IV Crush Over Earnings

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks for teaching me what Iv crush is found u on Google

You’re welcome. Glad we could help.

Thanks Mike from Stockwits

Thanks Mike and On1

The most knowledgable and honest advice from the author.

Very kind. Thanks Phil.