Contents

Market Chameleon Overview

Market Chameleon is a trading research website that offers a suite of different products for different types of investors at different price ranges.

They start with free basic subscriptions that allow access to features like newsletters and basic screeners.

They also offer very detailed and technical tools that are helpful for options traders and strategists.

Their biggest strength is in helping traders navigate earnings season.

Features

Newsletters/Starter

Fortunately, Market Chameleon offers some of their products for free.

This will allow a trader to get a feel for the service before leaping to a paid subscription.

At this stage, I have not tried any of their paid products, but I’ll keep you updated if that changes.

Market Chameleon has three different newsletters, all of which are free.

They have a newsletter for Premarket Movers, Earnings Alerts, and Option Order Flow Sentiment.

You can build Custom Watchlists and receive alerts and newsletters based on the symbols in your lists.

Other information included in the newsletters is Intraday Price Alerts and Mid-Day Investor Sentiment.

The Starter Subscription, in addition to newsletter access, will grant access to features like personalized watchlist, earnings charts, option volume data, implied volatility data, and option chain breakdowns.

Though one should be careful about consuming too much information and confusing noise and signal, Market Chameleon is providing great value here.

Stock Trader

The Market Chameleon Stock Trader claims to be the last financial website you will ever need.

They offer the basics offered by other research sites but also unique stock research and trading ideas.

Traders can also find other interesting features like event-driven stock screeners, threshold lists, and dividend updates.

Another interesting tool that they offer is Big Money Stock Flow which is a statistical summary that will help determine support and resistance levels.

Market Chameleon also offers a summary for Market-on-Close Stock Order Imbalance Inflows & Outflows.

Imbalances from market-on-close orders help provide clues about whether institutional investors are pulling out of the market or are being more cautious.

They are currently offering a free 7 Day Trial to new subscribers.

After the first 7 days, the subscription costs $39 per month.

This seems to be a good value if you are regularly using the more in-depth tools and analytical features.

They offer some unique features but if you don’t think you need them, then just stick with the free tools.

Options Trader

The theme of the Options Trader subscription is similar to what’s offered in the Stock Trader subscription, which offers all the tools and information you’ll ever need, in one place.

The Options Trader subscription offers a suite of features such as:

– Unusual Option Volume

– Implied Volatility Movers

– Implied Volatility Rankings

– Option Volumes

– Option Snapshot

– Options Broad View

– Put Protection and

– Buy Writes Search.

Premium tools include backtesting, open interest analysis, and order flow sentiment.

There is also a new feature that reports on “catalyst-driven” moves in Biotech stocks presumably looking to capitalize on the Coronavirus vaccine frenzy.

Covered Call Screener

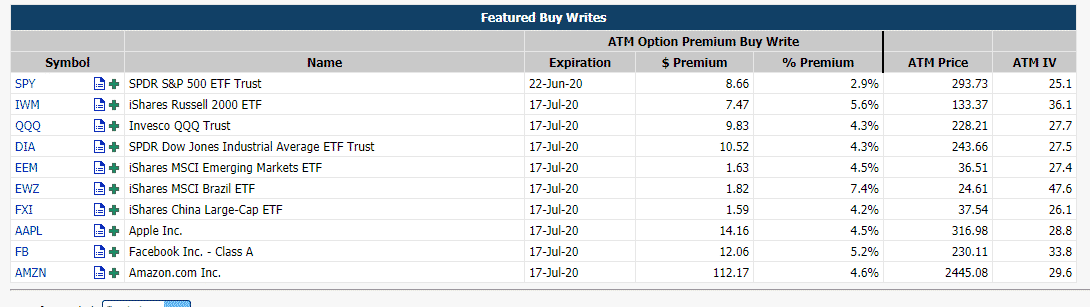

The Buy-Write or Covered-Call search provides a list of curated opportunities to take a long equity position and sell a call/s on the corresponding underlying.

These are nice opportunities but unless you’re using margin you’ll need a substantial bankroll to  place any of these bets.Below is a screenshot of the featured opportunities.

place any of these bets.Below is a screenshot of the featured opportunities.

If you want to do a Buy-Write for $AMZN at the suggested expiration you’ll be able to collect over $11,000 in premium–nice!

However, keep in mind that you’ll need over $244,000 to make the initial purchase of the underlying! You could always try a Poor Man’s Covered Call instead.

Put Protection Screener

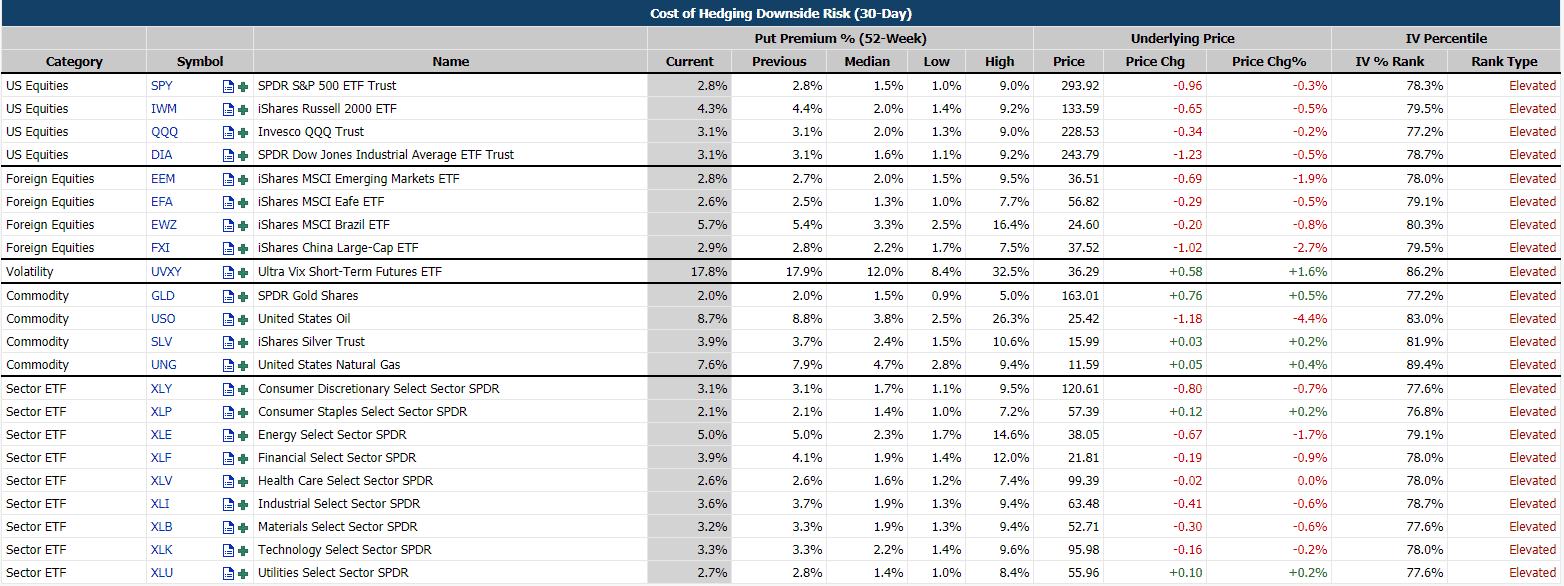

Put Protection Cost Analysis is another helpful feature offered by Market Chameleon’s Option Trader subscription.

As Market Chameleon summarizes, “Put options are a convenient way for investors to protect against investment losses in the event that an existing held equity position may be exhibiting increased volatility or risk of downward movement.

Unlike setting a Stop Loss order on the equity, the purchase of a put option allows the equity price to move below a certain strike price without inducing the sale of the equity itself.

This allows the investor to protect against a further loss and still maintain the originally purchased equity position.”

Below is a view of their table. I like this view as it helps visualize exactly what your insurance policy is costing you and also provides several different options.

I like this view as it helps visualize exactly what your insurance policy is costing you and also provides several different options.

The VIXis a great way to hedge downside risk broadly, though be aware here that if you purchase a put option tied to a volatility instrument, you’re betting that the market is going to become less volatile.

If you are overweight risk assets in your portfolio, you’ll want to hedge that with a long call on volatility.

Portfolio Insurance

This way, if there is some major disturbance in the market, your portfolio will take a hit but your insurance policy (long volatility) will payout.

If you thought you were hedging downside risk in your portfolio with a long put on volatility, you’ll be sadly mistaken.

The same applies for some of the symbols in the commodity section here as well.

They have different correlations to the overall market in different scenarios.

For example in the recent pandemic/market downturn, if you “bought insurance” with puts on $GLD, you have not done well.

Alternatively, if you bought puts on $USO you’ve done quite well with that trade.

So if you use this tool, either be very careful with what puts you use to protect your portfolio or only use puts to protect equities or instruments that you own shares of. This is the best way to be sure that your puts are actually protecting you.

The subscription costs $69/month and they are currently offering a 7-day free trial for new subscribers.

The Options Trader is definitely more robust than the Stock Trader and that’s reflected in the price.

However, because of the nature of options and the tools that Market Chameleon offers you wiil get your money’s worth if you use the subscription regularly in any capacity.

Earnings Trader

The Earnings Trader is their most expensive subscription at $79/month.

Their system collects and organizes data from earnings statements and serves it to you in an understandable format.

During earnings season, there is an absolute deluge of information, so if you’re trying to identify unique opportunities it can be difficult to sort through everything.

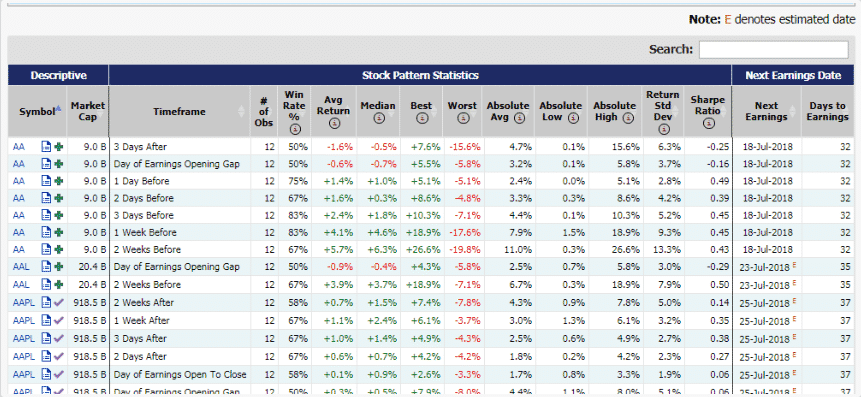

Market Chameleon’s Earnings Trader provides a pipeline of trading opportunities in one organized table.

All the features except the earnings calendar and exclusively available to premium members.

There is a very detailed search option and screener that will allow you to filter through stocks based on the most up to date data.

Below is a screenshot that shows the results of a search. In the example, they set a variety of filters and timeframes and are provided with this nice clean output of opportunities.

In the example, they set a variety of filters and timeframes and are provided with this nice clean output of opportunities.

Conclusion

Market Chameleon offers a wide variety of tools and products but caters to a more sophisticated investor.

It will be a bit difficult to get great value out of a subscription unless you’re an experienced trader.

To start with try out there free tools and if you like those, then think about upgrading.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.