Covered calls are a great place for beginners to start with options.

In this articles we’re going to take things to the next level with a strategy know as the Poor Mans Covered Call.

With this strategy traders can achieve similar returns with far less capital at risk.

In this article you will learn:

- Advantages and Disadvantages

- Best Underlying Instruments to Use

- How to Choose Strike Prices

- How to Deal With Earnings Reports

- Adjustments!

- See a Detailed Example of How I Managed a Trade in IYR

Introduction

Covered Call writing involves buying 100 shares of a stock or ETF and simultaneously selling a call on those shares.

It is a very popular strategy for income investors and has the ability to produce outsize returns in flat, down and slightly up markets.

The issue for some investors is that the costs can be prohibitive, this is especially so for those with smaller accounts.

Take AAPL for example. With the stock trading around $170, an investor would need to have around $17,000 in order to trade just 1 covered call.

There can also be issues with diversification. With so much capital needed it can be very difficult for smaller investor to create a diversified portfolio.

A Poor Mans Covered Call is a strategy designed to replicate a standard Covered Call trade, but with a much lower capital outlay.

This strategy is also used as a reduced risk method of generating a similar return.

With a Covered Call position, the trade would be required to purchase at least 100 shares of the stock which could potentially tie up thousands of dollars in capital.

With the Poor Mans Covered Call, a long-term, deep in-the-money call is used as a substitute for the 100 shares.

Sometimes, this call can be purchased for a fraction of the cost of 100 shares and have a similar payoff.

Traders should be aware that this is basically the same as leveraging your portfolio.

Gains and losses in dollar terms will be very similar between a standard covered call and a poor mans covered call, but the percentage returns will be more amplified using the poor mans approach.

Advantages and Disadvantages

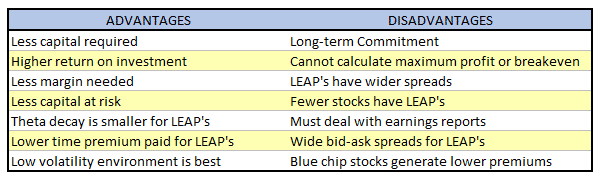

The below table shows some of the advantages and disadvantages of the poor mans covered call in comparison with a regular covered call.

Best Underlying’s For Poor Mans Covered Calls

Similar to regular covered calls, traders should focus on stocks they think will be neutral to slightly higher over the course of the trade.

Some traders (myself included) prefer trading stocks and ETF’s with lower volatility.

As such, the P&L fluctuations won’t be as high on a day to day basis and the trade can be easier to manage. Each to their own though.

My preference is focussing on blue chip stocks that I am happy to own for the long term.

Stocks in the Dow Jones Index for example area great place to start.

I also like using this strategy on ETF’s.

Poor mans covered calls are a great way to gain exposure to a particular region or sector.

In the past I’ve used this strategy extensively on IYR and EEM.

ETF’s have no stock specific risk and they aren’t subject to earnings announcements.

Therefore they are much less likely to suffer massive price moves based on a news event.

A simple portfolio could be created using ETF’s.

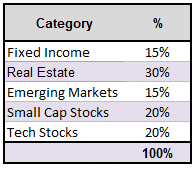

Let’s say an investor has the following target allocation:

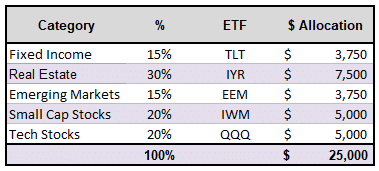

The investor could then use these ETF’s and trade poor mans covered calls. Let’s assume a portfolio size of $25,000:

Choosing Strike Prices

Alan Ellman, The Blue Collar Investor suggests the following formula when trading poor mans covered calls:

Difference between the 2 strikes + premium generated from the short call > cost of LEAPS

When choosing the long call there is a trade-off between how much capital you want to spend and how much time premium is embedded in the LEAP.

We want to pay the least amount of time premium possible because time decay will work against us on the LEAP.

I like to look around Delta 0.70 to 0.80 for the LEAP and I always check how much time premium is embedded in those strikes.

The deeper in-the-money the LEAP call is, the less time premium it is likely to have.

The less time premium it has, the more it will behave like the underlying stock.

For the short call, I like to be slightly out-of-the-money so that there is still some potential for capital appreciation in the trade.

But, it also depends on the underlying stock.

If I think the stock is going to be flat, I might consider an at-the-money call to increase the income portion of the position and forego any potential upside from the stock.

When selling the call, investors should aim to make sure the time premium in the short call is greater than the time premium in the LEAP. Usually this is not difficult.

The further in-the-money the investor goes with the LEAP call, the less time value, but the option will cost more.

How to Deal With Earnings Reports

Large drops (or gains) after earnings happen more frequently than is implied by statistical probability.

For example, earlier this year, I ignored my rules and held a position on NWL over earnings, only to see the stock drop 25%. Ouch.

As I’ve said numerous times in the past, when it comes to earnings, it’s best to avoid them.

For this reason I prefer sector and county ETF’s that are not subject to earnings announcements.

When trading poor mans covered calls on individual stocks, it’s best to try and avoid earnings.

Adjustments!

When it comes to adjustments, the process is very similar to that which you would employ for regular covered calls.

If the stock goes up, we will likely see some losses on the short call.

That’s generally ok, because the long call will have gone up by a proportionate amount.

In this case, there is probably no adjustment needed because we’ve made some good gains on the long call.

If the stock hasn’t blown too far through the short call, we can also think about rolling out in time and also rolling up, provided we can generate a decent credit.

If the stock has moved down, we can roll the call down to lower strikes.

By doing this we can collect more premium and lower the capital at risk / max loss.

We can also roll out further in time if we want to generate a higher credit and we don’t mind being in the trade a bit longer.

Time decay will pass more slowly on the longer-term short call however.

If the stock has gone down, we should also re-asses our assumption on the stock.

Do we still want the exposure?

Do we think it will rebound?

One benefit of the poor mans covered call when the stock declines, is that implied volatility will likely have risen.

This can mean the LEAP may not have declined as much because its value is being propped up by the higher implied volatility.

Rolling Down

Rolling down means we can collect more premium when rolling the sold call.

Or, we don’t have to move it as far to collect the same amount of premium.

If the stock moves to the sweet spot right around the short call at expiry, I generally keep the exposure and roll out to the next month.

If I’m still bullish I may also roll further out in price to give myself some more capital gain potential.

Doing this for a few months in a row, you can significantly reduce your cost basis.

Generally, I leave the LEAP option alone.

Spreads are wider with LEAPS so it can be hard to get filled at the mid-point which can get expensive if you are making multiple adjustments.

For this reason I tend to leave the LEAP alone through the course of the trade.

This video shows a typical set up that I will look for using VEEV stock as the example.

Now let’s walk through a longer-term trade that took a while to play out.

I’ll walk you through the decisions and thought process every step of the way.

Poor Mans Covered Call Example – IYR

I’ll now walk you through a trade example from 2017.

The trade worked really well, but there were a couple of mistakes I made, or things that I could have done better.

See if you can spot them.

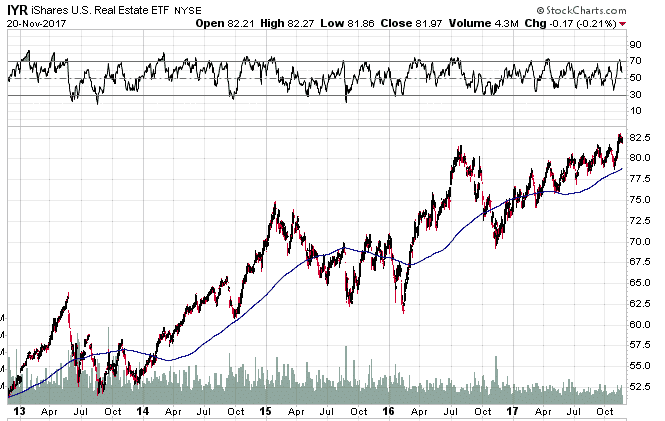

With this strategy, I like to avoid individual stocks and love the sector ETF’s. The example today is using IYR – the iShares US Real Estate ETF.

This is an instrument that I’m happy to hold for the long term.

I always want to have some exposure to real estate in my portfolio.

Other than the 2008-2009 period, this ETF tends to have a slow and steady rise higher as you can see below. Since 2013, dips have been excellent buying opportunities.

This type of setup is perfect for a poor mans covered call.

Here are the details of the trade:

Trade Date: January 18th 2017

IYR Price: $77.73

Trade Details:

Buy 5 18th Jan 2019 $68 Calls @ $11.89

Sell 5 17th March 2017 $80 Calls @ $0.94

Total Premium Paid: $5,475

If we check back to our formula, this fits our criteria:

Difference between the 2 strikes + premium generated from the short call > cost of LEAPS

The difference between the strikes is $12 + $0.94 premium received = $12.94 which is greater than the cost of the LEAP at $11.89, so we are good to go.

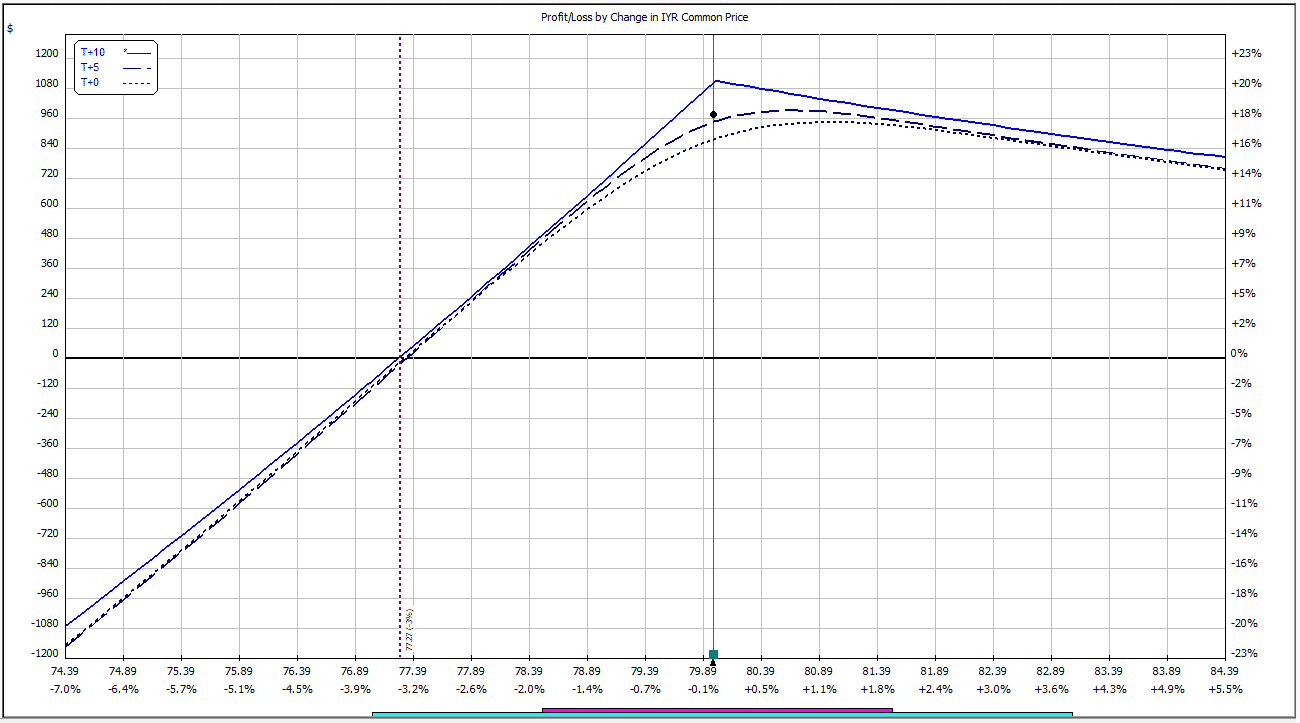

At this point IYR has risen slightly to $79.85, just below my sold call at $80.

The trade is +$780 as the LEAP has risen to $13.28 and the sold call is also showing a small profit thanks to time decay. The sold call is trading for $0.86.

At this point there isn’t a huge amount of profit potential left in the trade, but I still wanted exposure to IYR. As such, I close out the March $80 call and roll it out to April $80.

By doing this I was able to bring in an extra $230 in premium.

Date: March 2nd 2017

IYR Price: $79.85

Trade Details:

Buy 5 17th March 2017 $80 Calls @ $0.86

Sell 5 21st April 2017 $80 Calls @ $1.32

Premium Received: $230

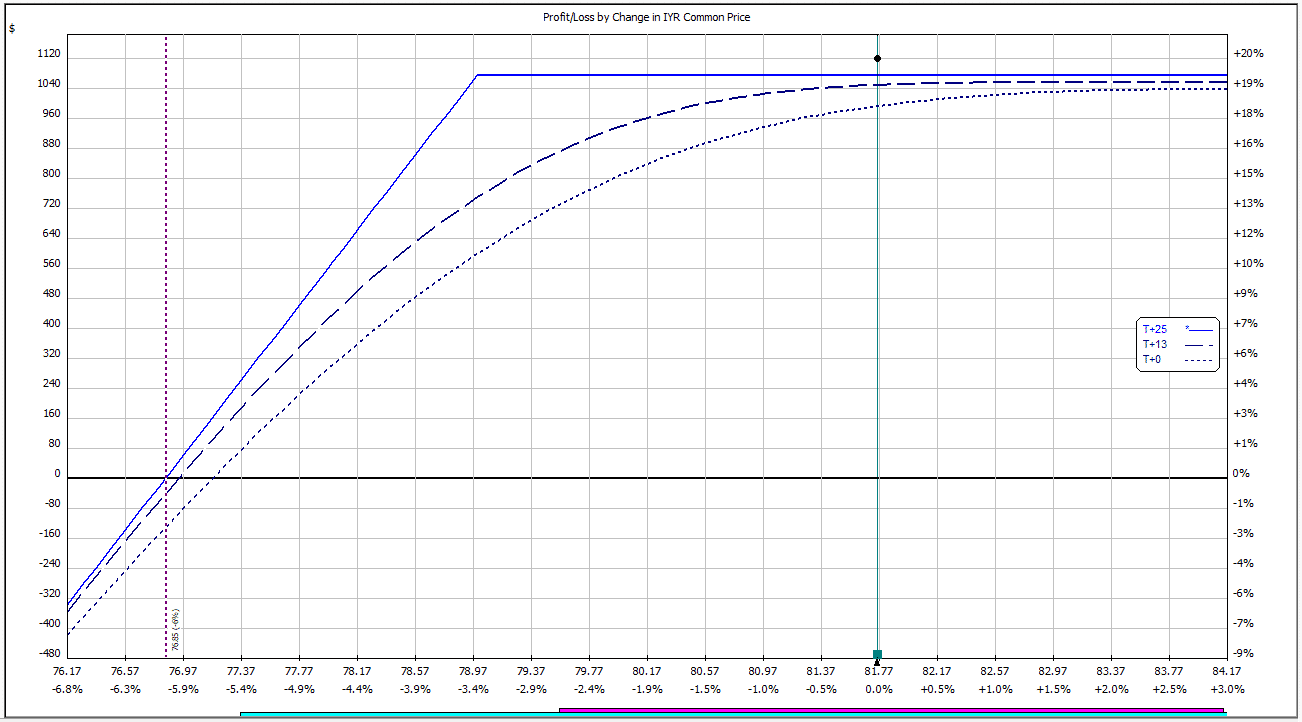

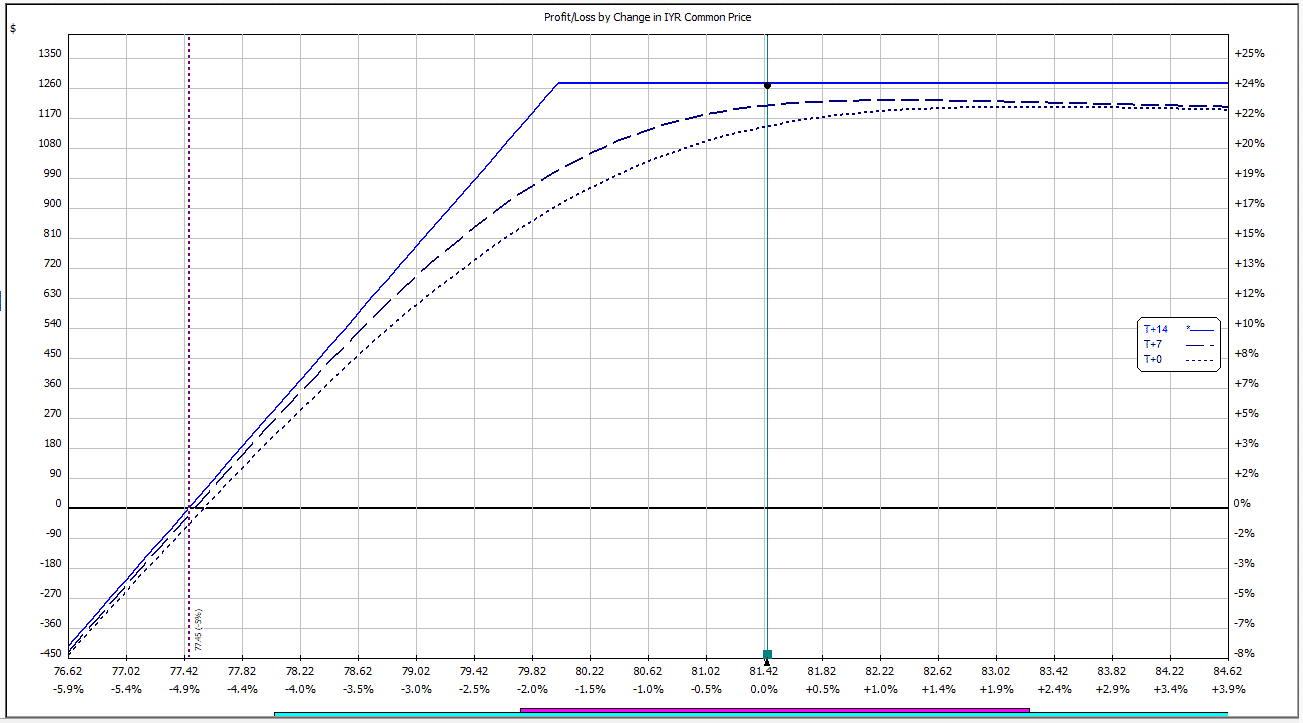

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

Once again, the trade is working out well. A couple of weeks out from expiry and IYR is trading right at the short call.

I take the opportunity to roll out again and bring in some more premium.

This time I also roll up by $1 to give myself some more capital gain potential.

Rolling out to June and up to $81 brings in another $390 in premium.

The position is +$975 at this point.

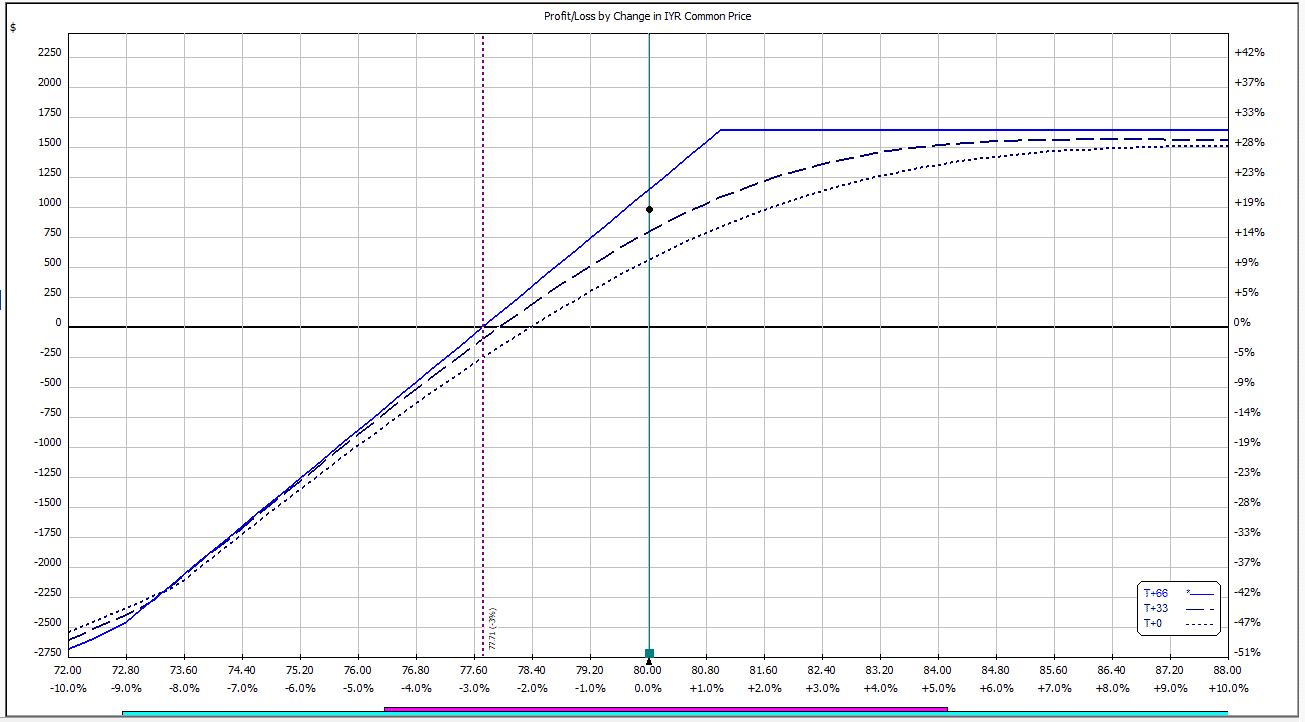

Date: April 11th 2017

IYR Price: $80.01

Trade Details:

Buy 5 21st April 2017 $80 Calls @ $0.40

Sell 5 16th June 2017 $81 Calls @ $1.18

Premium Received: $390

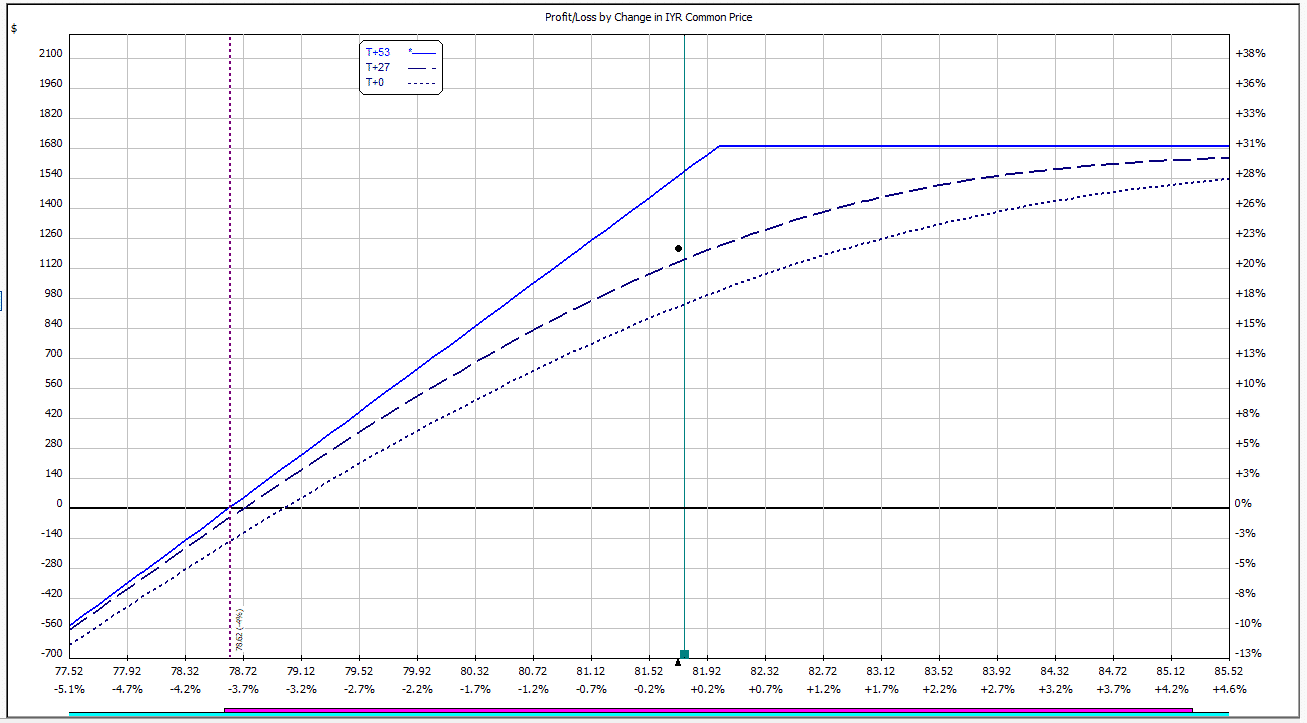

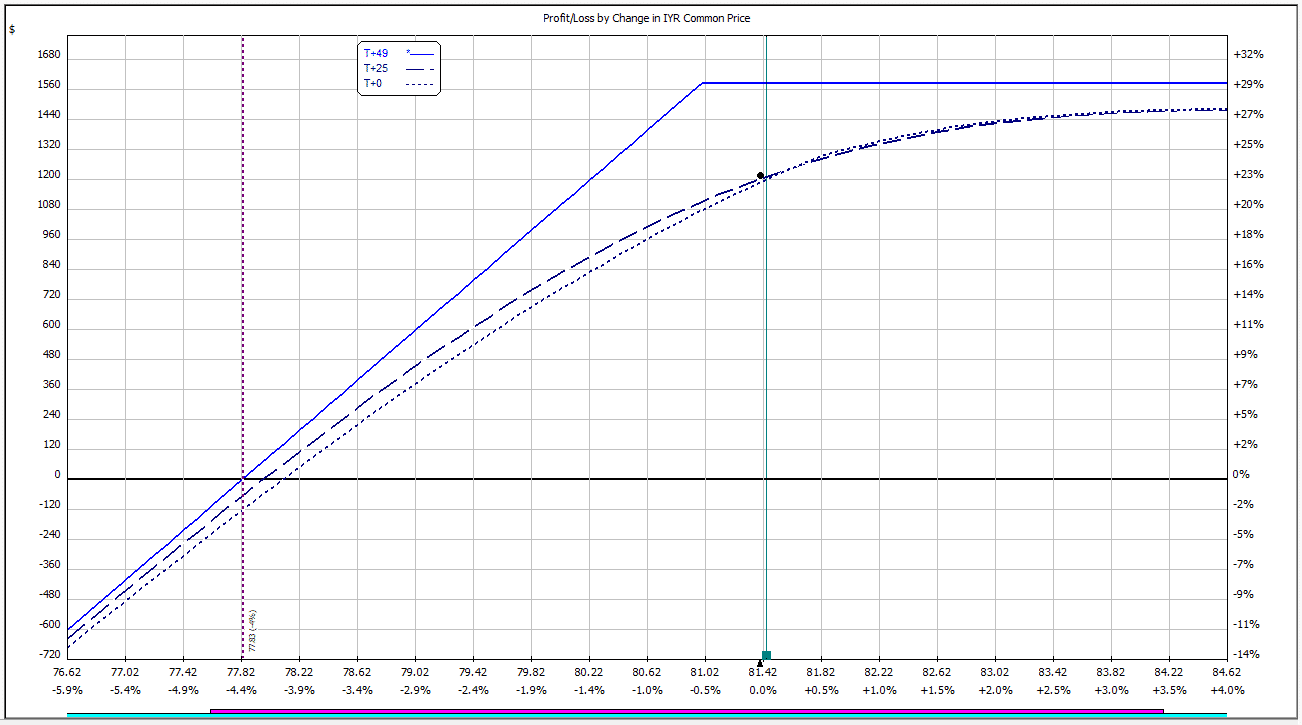

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

(note the graphs from here on are off slightly for some reason. On the upside it should slope slowly down to the right rather than being horizontal)

At the end of May, IYR had dropped back to $78.92 and my $81 June short calls were basically worthless.

At this point I rolled the calls down to $79 and out to July.

This roll brought in another $430 in premium.

I’ve also gone backwards a bit in the trade due to the drop in IYR.

Previously I was +$975, now the trade is back to +$720.

In hindsight, I was possibly a little aggressive rolling down the calls and didn’t give myself enough room for capital appreciation.

Within a few weeks IYR was back up near $82.

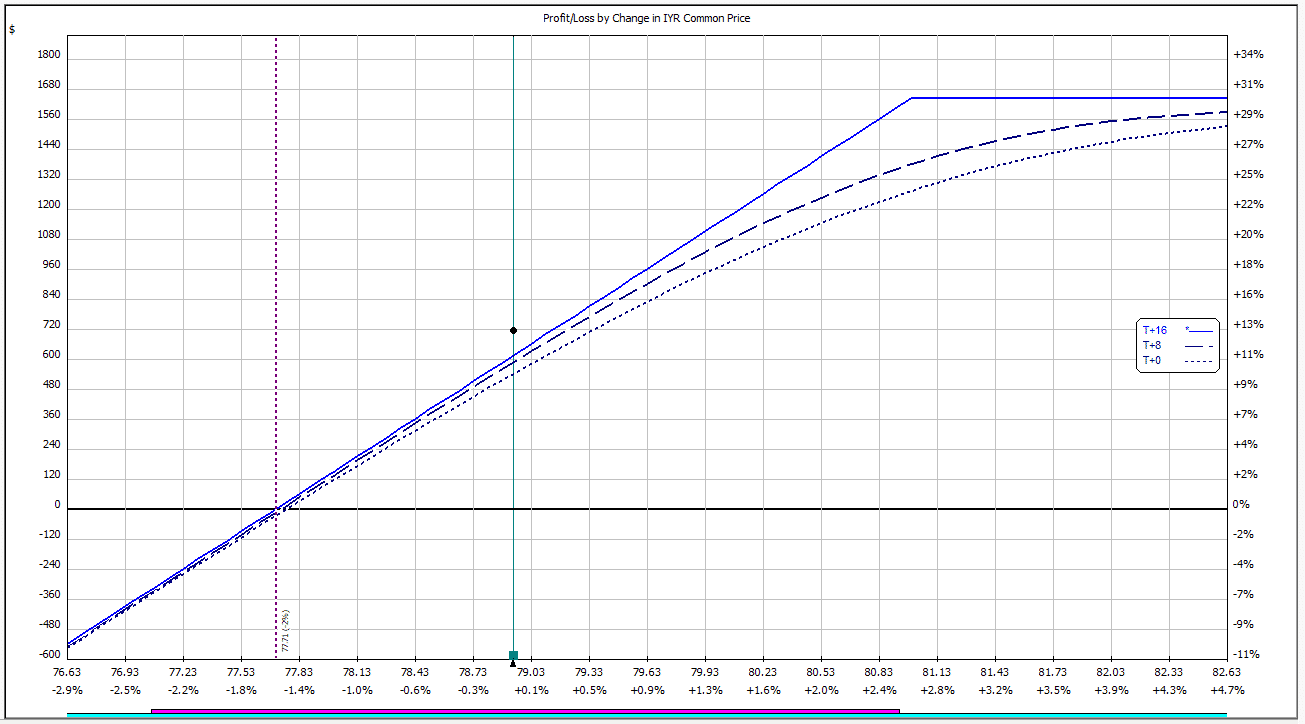

Date: May 31st 2017

IYR Price: $78.92

Trade Details:

Buy 5 16th June 2017 $81 Calls @ $0.06

Sell 5 21st July 2017 $79 Calls @ $0.92

Premium Received: $430

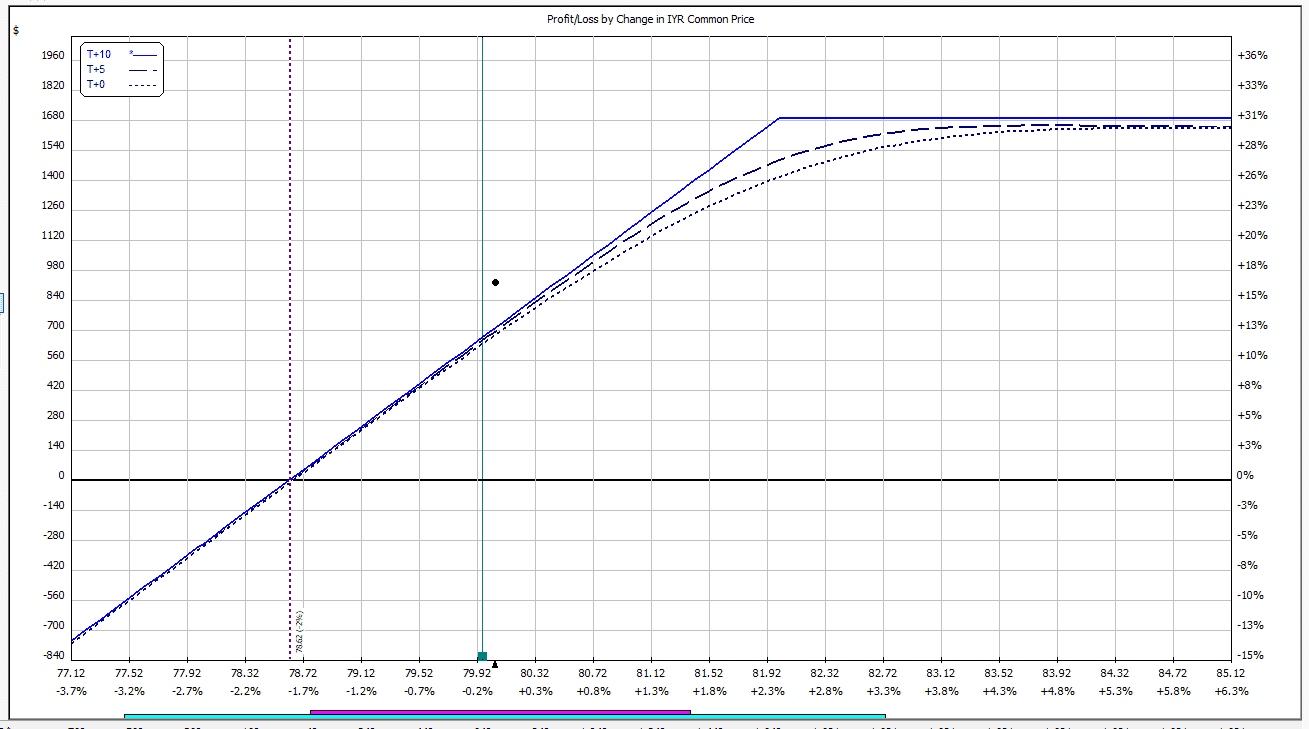

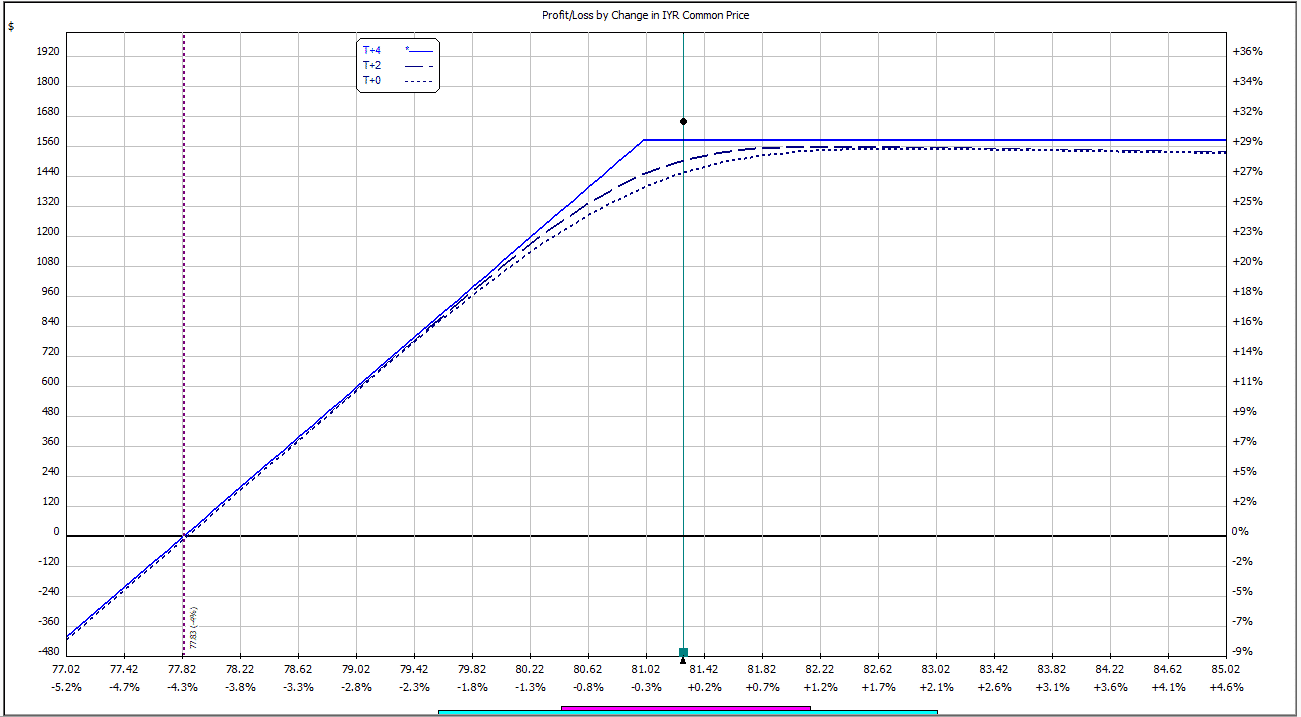

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

With IYR back up at $81.76 my short calls were well and truly in the money so I decided to roll up to $82 and out to August.

This adjustment actually cost me $885 which was a bit painful.

If I hadn’t rolled the calls down so low in the previous step, I could have avoided some of this pain.

The loss on the July calls has been offset by gains in the LEAPS however and the whole trade is back to +$1,120.

Date: June 26th 2017

IYR Price: $81.76

Trade Details:

Buy 5 21st July 2017 $79 Calls @ $2.69

Sell 5 18th August 2017 $82 Calls @ $0.92

Premium Paid: $885

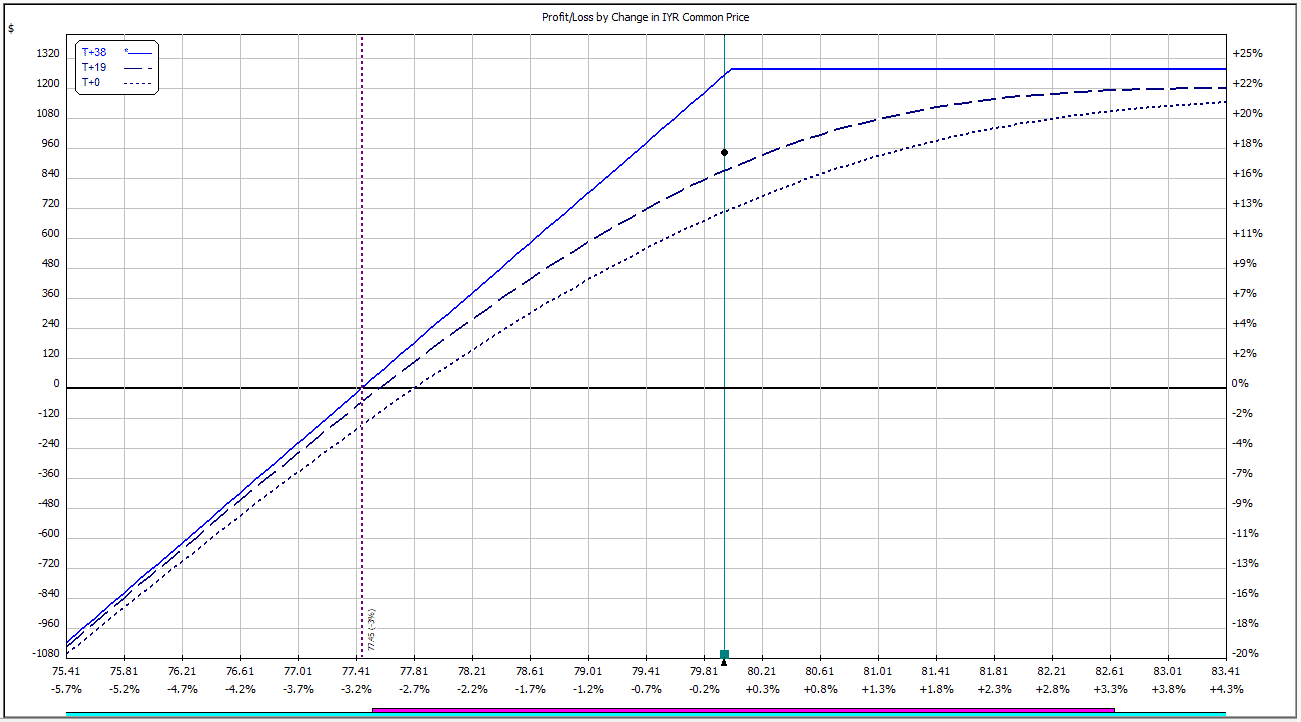

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

By August 8th, IYR has dropped again to $79.95.

The trade has gone backwards a little bit, but not too much thanks to the time decay on the August calls.

The trade has gone from +$1,120 to +$945.

Again, I decided to roll down to the at-the-money strike of $80 and out another month to September.

Given that the August calls were almost worthless and the September $80 calls were trading for $1.22, I was able to bring in $585 in premium.

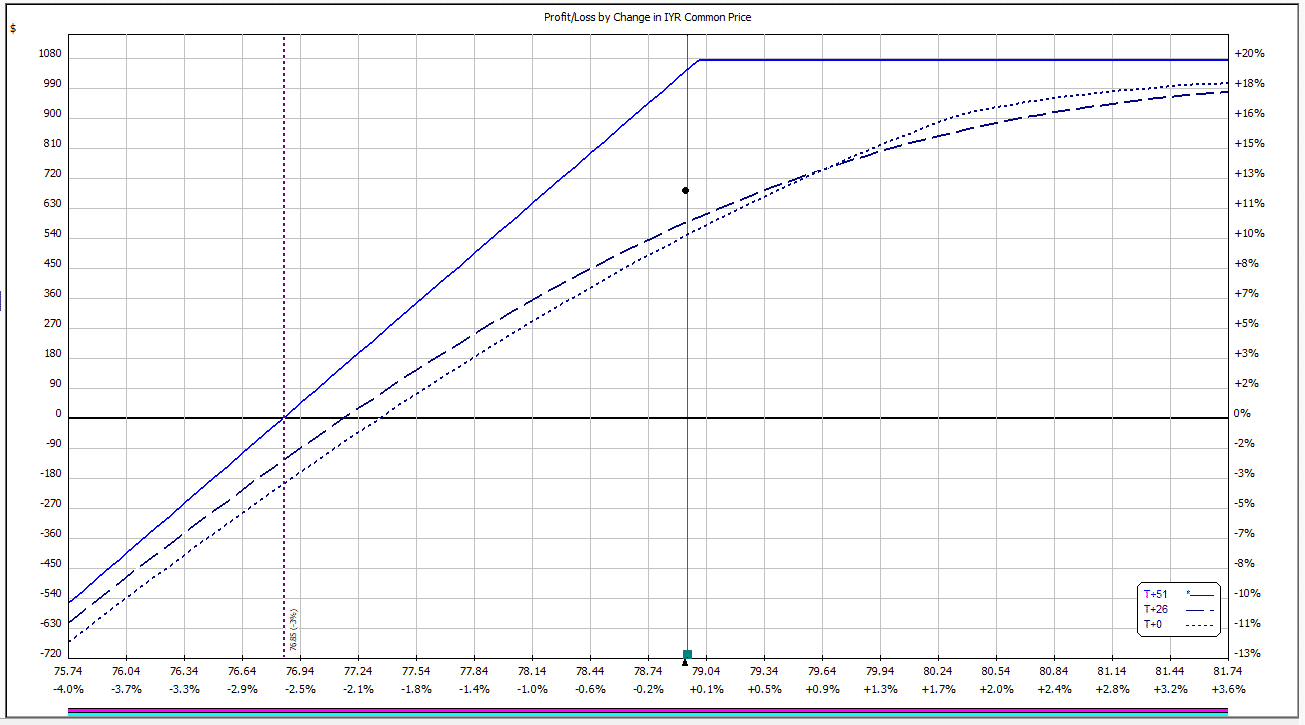

Date: August 8th 2017

IYR Price: $79.95

Trade Details:

Buy 5 18th August 2017 $82 Calls @ $0.05

Sell 5 15th September 2017 $80 Calls @ $1.22

Premium Received: $585

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

Moving forward to September 1st, IYR has risen from $79.95 to $81.44 which has seen the position go from +$945 to +$1,270.

At this point, my September $80 calls are in the money and have very little time value left, so I decided to roll out to October and up to $81.

This adjustment cost me $190 but gave me more time premium.

Date: September 1st 2017

IYR Price: $81.44

Trade Details:

Buy 5 15th September 2017 $80 Calls @ $1.62

Sell 5 20th October 2017 $81 Calls @ $1.24

Premium Paid: $190

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

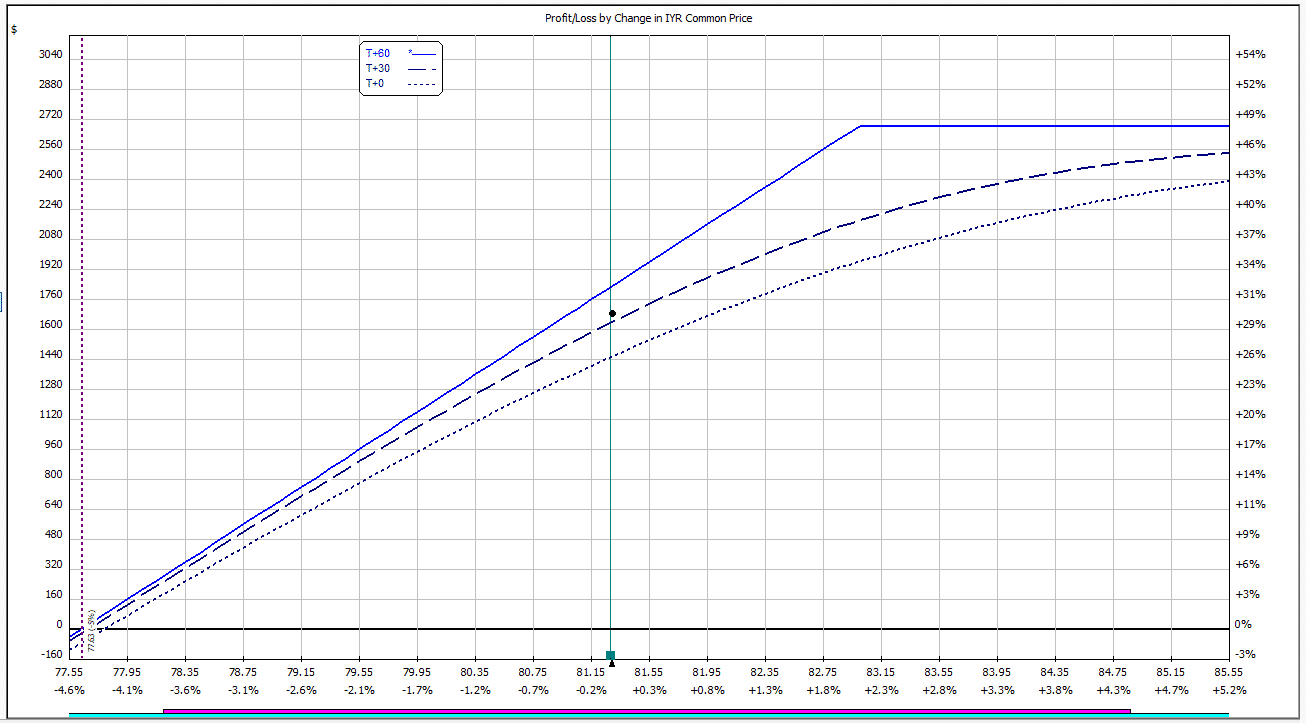

IYR stayed pretty steady over the next 5 weeks and by October 16th was trading at $81.29, basically the same spot it was on September 1st.

This was perfect for the trade and saw the position go from +$1,270 to +$1,685.

Over the 5 weeks, the short calls declined from $1.24 to $0.51 and the LEAP call held its value at $13.65.

This is because there was very little time premium in the LEAP and theta decay is very slow on the long term options.

For this adjustment I decided to roll out to December and up to $83. This adjustment brought in $100 in premium.

Date: October 16th 2017

IYR Price: $81.29

Trade Details:

Buy 5 20th October 2017 $81 Calls @ $0.51

Sell 5 15th December 2017 $83 Calls @ $0.71

Premium Received: $100

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

On December 16th I decided to close the position by letting the Dec $83 calls expire and closing the LEAP calls.

Total profit on the trade was +$2,055, not bad for a trade that only used $5,475 in capital!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Instead of rolling the out of the money calls which costs money why not let them expire and keep the entire premium originally received and then simply sell more covered calls?

Yep, sometimes I will do that but also if it’s OTM and doesn’t have much premium left, might as well roll it and bring in some more premium.

Gavin, what would happen if the stock price is above your short call at a given expiry, and you are caught unaware and it gets exercised? What happens to this trade? What happens in your account?

Hi Gary, if the short call gets assigned, the call would be removed from your account and you would have a position of -100 shares. You then have a couple of options, you could exercise your long call to offset the -100 shares or you could just buy 100 shares to close out the -100 share position. Let me know if that makes sense?

Here is some more info on option assignment.

https://optionstradingiq.com/option-assignment-and-exercise/

Generally with short calls, you will only get assigned if there is very little time value left and / or there is a ex dividend date coming up.

Very nice Gavin. Thank you so much for sharing actual trade to get much needed insight into thinking process. It is an invaluable learning and I can’t thank you enough.

Actually in reality, it should be called “smart man’s covered call”

Thanks Shripad. I like the sound of that. 🙂

It seemed IYR stayed in a range the whole duration of the trade. How would this trade compare to an iron condor trade that’s rolled out regularly?

Completely different strategies, so not sure how much value there would be in comparing them, but you could run a comparison using Option Net Explorer

https://optionstradingiq.com/optionnet-explorer-review/

Hi Gavin-Would it pay to ever roll up the Long call for a credit to finance a DITM short call roll. I currently have a position I’m bullish on and would like to roll my short call up and out and roll up my LEAP 1 strike to help pay for it

Really good article. I suppose the other disadvantage to add is that you won’t get any dividend (vs holding the stock).

Correct.

Gavin – is there a way to protect, say with a Long OTM Put?

Yes, you can buy cheap OTM puts or put spreads for protection.

Hi Gav

Before step 2 short 80.0 CALLs still had 0.86 of intrinsic value. What was the reason for rolling them ? Why did not you let them expire?

Thanks!

I could have let them expire, but I wanted to maintain the exposure, so rolling them out one month made sense in that scenario.

This blog was written over 6 years ago but I’ve only recently found Gavin’s site. So I don’t know if this will be seen by anyone, but … I’ve been doing “poor man’s covered calls” for over 3 years and have the following comments:

To JFR and MJ re: why roll the short call up rather than letting it expire … in addition to the scenario Gavin wrote about where the short’s premium is very small, here’s another reason I often roll up early. The issue is what do you think will result in the greatest credit, rolling into a new short call now or waiting and selling that short call later? If the stock is currently very near the short position’s strike, it probably won’t stay there and this might be the time to roll. Your current short time value will be high (because it’s nearly ATM), but the time value of the new position you are rolling into is also very high (assuming you are still staying ATM).

In response to G. Kane re: what to do if you get exercised, I would not cover my short position in the stock by exercising my long position. Presumably, it has a decent amount of time value even though it’s deeply ITM and you’d be throwing that time value away. What I’ve done in the past (yes, this has happened to me a few times) is to open a traditional covered call (buy the stock and sell a call). By purchasing the stock, I cover my short stock position which was created by being exercised. And the new short call position puts me back right where I was before being exercised … with a short call covered by a long call. Usually the new short call is at a different expiration and/or strike. Else I may get exercised again! But if the person who exercised me did so when my short position still had decent time value left (which makes that person a dufus), I may actually open a new short identical to the one that was exercised. Then I’d literally be right back where I was before except the guy who exercised me just gave me some free money.

In response to Tony re: rolling the long position up to bring in money to roll the deep ITM short position … I have done that several times. In fact, I’ve done it when my short position wasn’t deep ITM just because I wanted to cash in some of my profits (assuming the long position has gained a lot of intrinsic value). I didn’t see a response from Gavin on this issue so I’d really like some feedback as to whether that was a reasonable thing to do.

Hi CHUCK

I understand this component of buying the stock: “By purchasing the stock, I cover my short stock position, which was created by being exercised. And the new short call position puts me back right where I was before being exercised … with a short call covered by a long call” After doing the maths you would still come out the trade with a profit, just reduced by about 75% – Difference between the cost of buying the Shares and the Short Call selling price e.g. Buy shares @ $565, Exercised Short calls @ $535 = Loss of $30/100 shares.

I do not quite understand: “I may actually open a new short identical to the one that was exercised. Then I’d literally be right back where I was before, except the guy who exercised me just gave me some free money”. If you went and purchased a $535 further out to replace the exercised $535 you would still be short 100 shares and still $30 dollars ITM on the new short call. Am I misunderstanding this?? Thanks