Today, we are looking at the phenomena of IV crush after earnings.

The concept of IV crush is important for both option buyers and sellers.

Let’s take a look why that is.

Contents

- Introduction

- Why IV Drops After Earnings

- Selling Premium

- Selling A Straddle

- Selling A Strangle

- Iron Condor

- Double Calendar

- Double Diagonal

- Buying A Straddle

- The Double Fly

- Which Strategy Is The Best?

- FAQ

- Related Articles

Introduction

There is a lot of randomness in the market.

Only very few things occur with any kind of reliability.

One of those things is the drop in the implied volatility (IV) of the options of a stock who have just announced its earnings report.

Is there a way to capitalize on this phenomenon?

If everyone already knows of this effect, isn’t it already priced into the options?

We’ll look at some of the strategies that investors have come up with in an attempt to find an edge in the post-earnings “IV crush.”

Why IV Drops After Earnings

Prior to a stock’s earnings announcement, the IV of its options is high due to uncertainty.

Investors know that stocks have the potential to make a big move right after the earnings announcement.

What they don’t know is the direction of the move.

Many investors who own the stock will want to buy put options to protect that stock in the event that the price makes a big move down.

Speculators who are bearish on the stock will also want to buy puts.

Speculators who are bullish on the stock will want to buy calls to capitalize on its potential big move up.

This increases the demand for both put and call options, increasing the implied volatility value of the options.

After its earnings announcement, the pumped-up implied volatility comes back down because the demand for those options is no longer there.

Investors no longer need to buy puts. Speculators no longer need to buy calls.

This is what causes IV to drop after an event with uncertain outcomes.

In general, uncertainty causes the implied volatility of options to go up due to demand for the option and the potential for the underlying to make a large volatile move.

When the outcome becomes known, the uncertainty is no longer there.

If price were to make a big move due to the event, the move would have occurred. Hence IV drops.

Selling Premium

The premium of options is in direct relation to IV. When IV is high, the premiums are high.

When IV is low, the premiums are low.

The obvious strategy that comes to the mind of options sellers is to sell options before the earnings when premiums are high.

Then buy back the options after the earnings are announced when premiums are low.

Since the investors do not know the direction of the price movement, they typically will do it in a directional-neutral manner.

Selling A Straddle

One non-directional strategy is to sell an at-the-money call, and an at-the-money put.

This is known as selling a straddle.

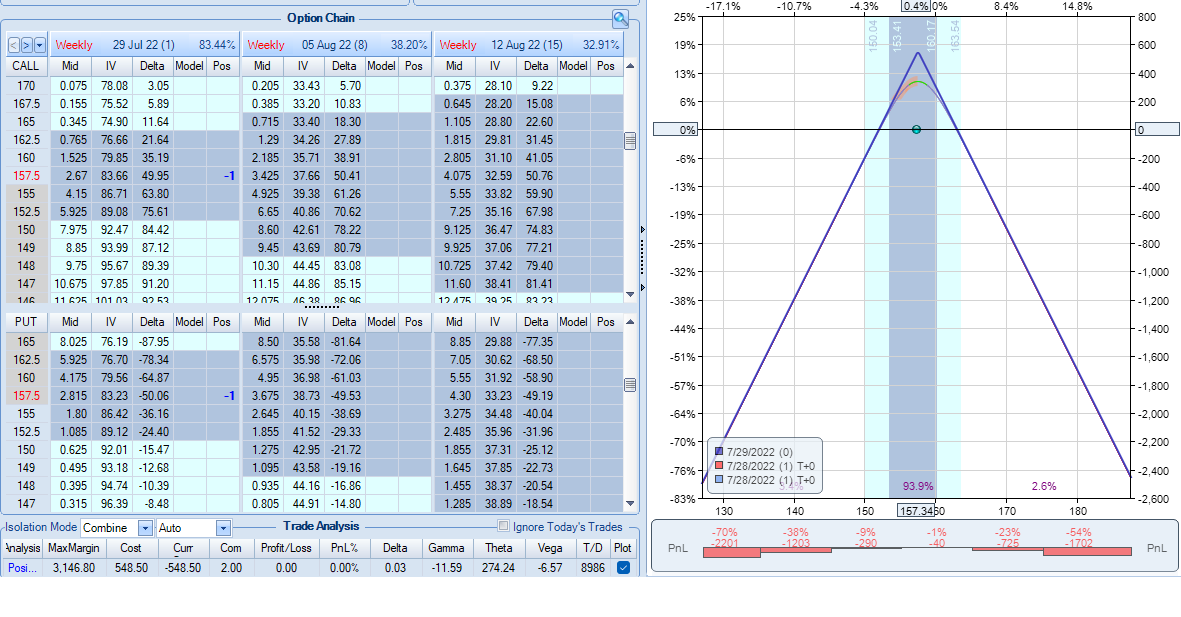

For example, Apple (AAPL) announces earnings after the market closes on Thursday, July 28, 2022.

Suppose we sell this straddle one hour before the market closes when AAPL is trading at $157.34

Date: July 28, 2022

Price: $157.34

Sell one July 29 APPL $157.5 call @ $2.67

Sell one July 29 AAPL $157.5 put @ $2.82

Total credit: $549

source: OptionNet Explorer

According to OptionNet Explorer, the IV of the call option and the put option are both around 50.

The options we are selling will expire the next day, on Friday, at the market close.

Let’s see where the trade is at post-earnings on Friday.

Five minutes after the market opens on Friday, Apple’s price is up 2.5%, and the straddle has a profit of $135.

The IV on both options has dropped to 36.

One hour after the open, the straddle is down –$15 because the price continued to go up to $163.

Two hours after the open, the straddle is up $208 because the price returned to $161.

And if you just let both short options expire, the profit on the straddle is $48.

Apple closed at $162.51 at expiration, and the short $157.5 call option would have been in the money and would have been assigned.

Buying 100 shares at $162.51 per share and selling them at $157.5 gives a loss of $501.

But since we collected $549, to begin with, we make a net amount of $48.

While some advanced traders like these, it can be quite risky in the event of a large price move because it is an unlimited risk strategy.

Selling a Strangle

Instead of selling options at the money, we move the short options further away.

Say that we want to sell a short call and a short put at the 20-delta.

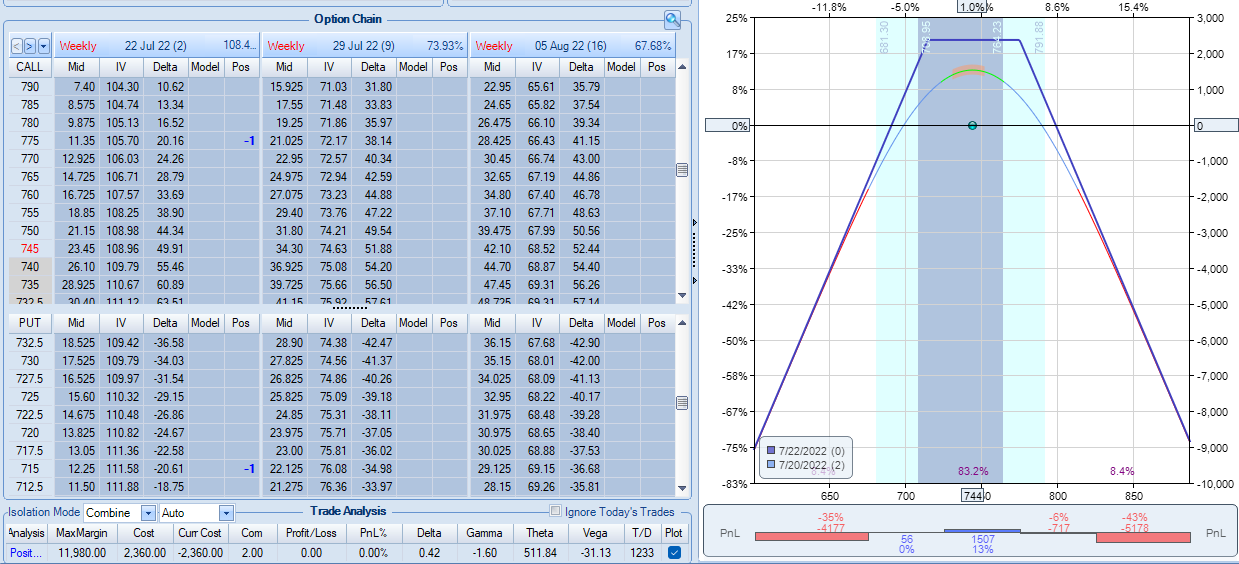

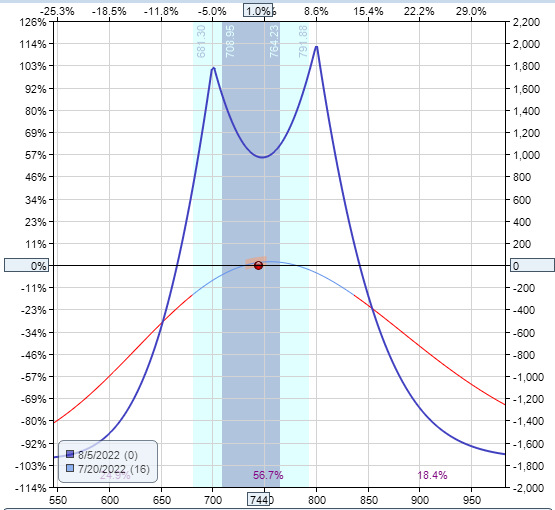

Tesla announces earnings after the market closes on July 20, 2022.

Let’s hypothetically sell a strangle one hour before the market close.

Date: July 20, 2022

Price: $744

Sell one July 22 TSLA $715 put @ $12.25 [IV=112]

Sell one July 22 TSLA $775 call @ $11.35 [IV=106]

Credit: $2360

The concept is the same: we sell high premiums and buy back after premiums have dropped.

One hour after the open the next day, P&L is at $890.

IV of the put and call options dropped to 100 and 75, respectively.

At the same day’s close, the strangle is at a loss of –$2011 because Telsa price is up 10% at $816.

There is still one more day till expiration. Should we dare see what happens next?

Okay, the next day, one hour after the market opened, the P&L is down by -$3929.

Quite a roller coaster ride.

This is what happens during a big move.

Just out of curiosity, what would the P&L of selling a straddle be for this trade?

In general, straddles are larger trades than strangles.

According to OptionNet Explorer, the margin requirement of this TSLA straddle is $14,880.

Whereas for the strangle, it is $12,000.

The straddle collects $4768 in credit at the start of the trade.

One hour after the open, on the next day, P&L is $900.

One hour after the open the following day, P&L is down by $4511.

Iron Condor

The iron condor is the defined-risk version of the strangle.

The amount of risk can be configured by adjusting the widths of the put spread and the widths of the call spread.

They can be of different widths to give the trade a directional bias, should they wish to do so.

Let’s run the TSLA earnings trade with an iron condor.

Date: July 20, 2022

Price: $744

Buy one July 22 TSLA $700 put @ $8.33 [IV=114]

Sell one July 22 TSLA $715 put @ $12.25 [IV=112]

Sell one July 22 TSLA $775 call @ $11.35 [IV=106]

Buy one July 22 TSLA $790 call @ $7.40 [IV=104]

Credit: $788

The amount of credit received is greatly reduced.

We have configured the condor to have about a one-to-one risk-to-reward ratio.

The max risk for this trade is $713.

One hour after the open the next day, P&L is at $52.

At the same day’s close, the P&L is at a loss of –$552.

The next day one hour after the market opened, the P&L is near a max loss of –$705.

As you can see, it is a much smaller trade, even though we are doing it on the same underlying.

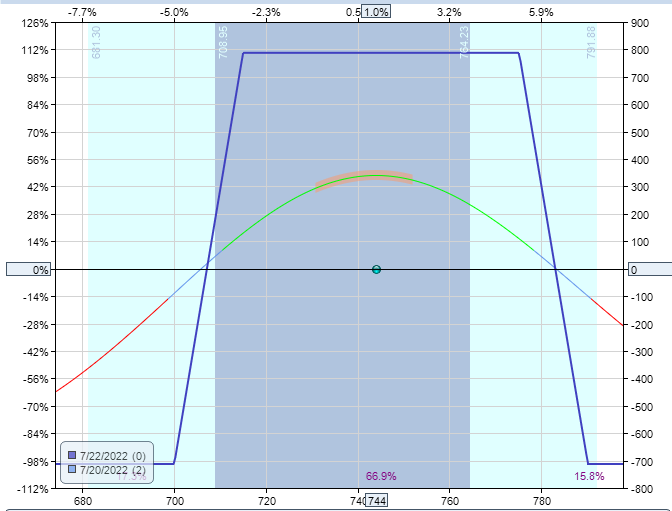

Double Calendar

Double calendars are also a direction-neutral strategy that some traders use across earnings.

Instead of having long options out of the money, the calendars use long options as protective legs further out in time but at the same strikes as the short options.

For example:

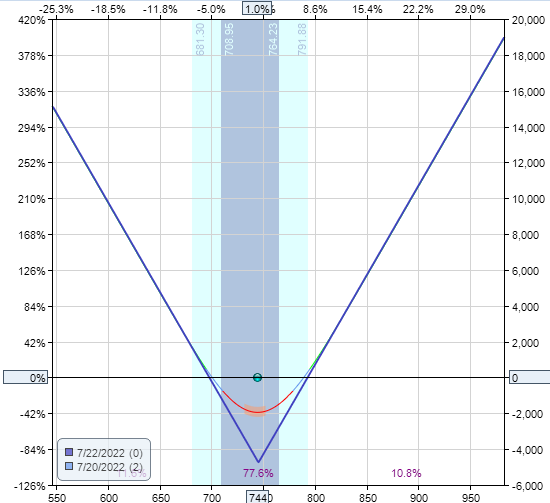

Date: July 20, 2022

Price: $744

Buy one Aug 12 TSLA $700 put @ $29.93 [IV=67]

Sell one Aug 5 TSLA $700 put @ $23.90 [IV=70]

Sell one Aug 5 TSLA $800 call @ $19.75 [IV=65]

Buy one Aug 12 TSLA $800 call @ $25.85 [IV=63]

Debit: –$1213

Note that the calendars are in slight backwardation.

The short options that we are selling have slightly higher IV than the long option that we are buying.

This is favorable to the trade because we are selling something with a high IV, hoping to buy it back when it drops.

We are buying protection on something with a lower IV, hoping its value does not drop too much.

This is what the graph looks like at the start of the trade.

source: OptionNet Explorer

One hour after the market opens the next day post-announcement, the P&L is $125, or 10% return on the capital at risk.

The double calendar is also a defined risk trade. Its max risk is the initial debit paid, which in this case, is $1213.

Option Values and IV Changes

Aug 12 TSLA $700 put @ $17.88 [IV=65 down by 2]

Aug 5 TSLA $700 put @ $12.20 [IV=66 down by 4]

Aug 5 TSLA $800 call @ $27.75 [IV=59 down by 6]

Aug 12 TSLA $800 call @ $35.45 [IV=59 down by 4]

The value (meaning the price of the option) of the short put had gone down to our benefit as expected. But the value of the short call had gone up.

This is because the underlying price had increased to threaten the short call.

This is expected as TSLA goes closer to the call options.

When options are closer to the current price, their value goes up.

In terms of IV, all four options dropped in IV as expected.

But the short options dropped more than the long options.

This is also favorable to the trade.

Let’s see how the P&L changes as time pass.

At the close of the day on July 21, the P&L had dropped to $77.50.

And one hour after the open the following day, the P&L is down $42.50.

Unlike the other examples, this trade still has 14 days to go till the expiration of the short strikes.

Double Diagonal

The double diagonal is similar to the double calendar except that the long options are placed further out of the money, which makes the double diagonal a larger capital at risk trade.

Date: July 20, 2022

Price: $744

Buy one Aug 12 TSLA $685 put @ $25.30 [IV=69]

Sell one Aug 5 TSLA $700 put @ $23.90 [IV=70]

Sell one Aug 5 TSLA $800 call @ $19.75 [IV=65]

Buy one Aug 12 TSLA $815 call @ $20.83 [IV=62]

Debit: –$248

Unlike the double calendar, the initial debit is NOT the max risk.

The max risk on this trade is $1748.

The value of the four options the next day post-announcement are:

Aug 12 TSLA $700 put @ $17.88 [IV=66 down by 3]

Aug 5 TSLA $700 put @ $12.20 [IV=66 down by 4]

Aug 5 TSLA $800 call @ $27.75 [IV=59 down by 6]

Aug 12 TSLA $800 call @ $29.65 [IV=59 down by 3]

The P&L one hour after the open post-announcement, its P&L is $175 and a 10% return on the capital at risk (just like the double calendar).

At the close of the day, the P&L dropped to breakeven of zero.

One hour after the open the next day, the P&L is at –$145.

Buying A Straddle

Buying a straddle is the opposite trade of selling a straddle.

Date: July 20, 2022

Price: $744

Buy one July 22 TSLA $745 put @ $24.23

Buy one July 22 TSLA $745 call @ $23.45

Debit: –$4768

One hour after the market opens the next day, P&L is down by $900.

At the close of the day, it is up $2316. The next day it is up $4511.

The P&L is the opposite of selling a straddle.

While the long straddle is profitable in this case, many feel that it will not be a profitable strategy over the long run.

This is because the market has priced in the expected move into the straddle cost.

In other words, for this straddle (for which I paid $4768) to be profitable, Telsa needs to move from $744 to $792.

This is exactly the amount Telsa needs to move to give me a profit on the long call at expiration.

Because ($792-$744) x 100 = $4800.

Similarly, on the downside, the expected move is for TSLA to be at $696.

Actually, the expected move is likely to be less than those numbers because the option price is slightly inflated (they do have to make some money from selling you the options).

But for the purpose of our discussion, this is good enough.

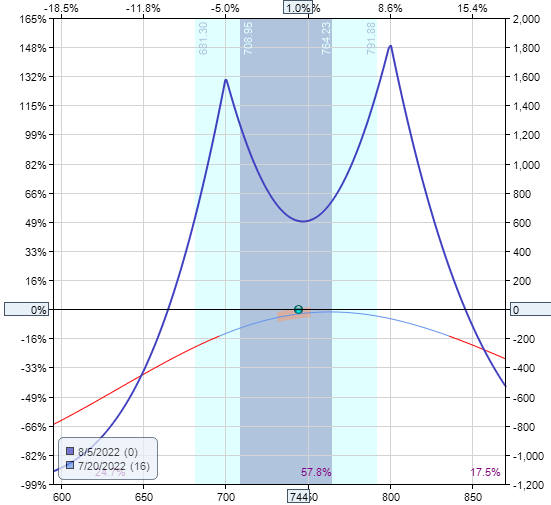

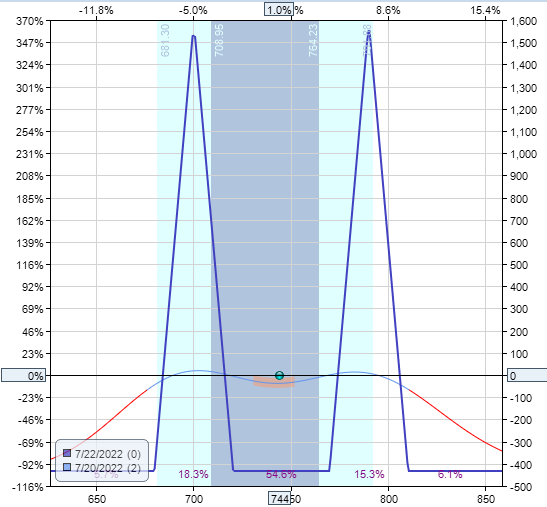

The Double Fly

Well, if the expected move is for TSLA to be at $696 and $792, why not put two small butterflies at those locations (or a little closer in)?

Date: July 20, 2022

Price: $744

Buy one July 22 TSLA $680 put @ $5.03

Sell two July 22 TSLA $700 put @ $8.33

Buy one July 22 TSLA $720 put @ $13.83

Buy one July 22 TSLA $770 call @ $12.93

Sell two July 22 TSLA $790 call @ $7.40

Buy one July 22 TSLA $810 call @ $4.00

Debit: –$433

The max risk on this dual-butterfly trade is only $433.

One hour after the open the next day, P&L is $115.50, up 26%.

At the end of the day, P&L is down –$87, down 20%

One hour after the market opened the next day, it is almost at a max loss of –$397.

Which Strategy Is The Best?

Many traders feel that, over the long run, buying a straddle for earnings will not be profitable.

This is because the expected volatility drop is working against us, and the options are priced high before earnings.

You are paying for a high-priced item you know will depreciate the next day.

The only way this trade will win is if the underlying makes a larger-than-expected move (as in the case of our example TSLA).

But most of the time, the underlying will make the expected move or less.

For this reason, some traders sell the straddle over earnings (rather than buy the straddle).

However, the short straddle has no protection in the event of a large move.

Therefore, some traders will only use a defined-risk strategy for earnings.

You don’t want to be caught with a big black swan move that can wipe out the profits of many trades.

So that leaves iron condors, double calendars, double diagonals, and double flies.

There doesn’t seem to be any point in trading double diagonals when they cost more and behave quite similarly to double calendars.

Iron condors are short vega. In contrast, double calendars are long vega.

When volatility is up as in pre-earnings, it makes sense to have a short vega trade that benefits from the volatility drop.

On the other hand, the calendar has the advantage that volatility drop affects short options more than long ones.

Double flies have a low cost and a good reward if the price moves into their profit zone.

I’ve seen traders use all three strategies in earnings play. Which is the best is difficult to say.

A few examples in this article will not be enough to draw any conclusions.

A more extensive study is needed.

It is also difficult to say whether there is any significant edge in trading earnings over the long run. It may very well come out to be close to breakeven.

Similar to what would happen if you flip a coin enough times, neither heads nor tails will win in the long run.

Nevertheless, trading earnings is like dessert.

It is fun and exciting, and you can certainly do it in small proportions, but it should not be your core bread-and-butter meal.

We hope you enjoyed this article on IV crush after earnings. If you have any questions, please send an email or leave a comment below.

FAQ

What is IV Crush?

IV Crush is a phenomenon in options trading where the implied volatility (IV) of an option decreases rapidly, resulting in a decrease in the option’s value, even if the underlying asset price remains the same.

What Causes IV Crush?

IV Crush is caused by a decrease in the expected volatility of the underlying asset. This can happen after an earnings announcement or other news event that was expected to cause a large move in the stock price but didn’t.

How Can I Protect Myself From IV Crush?

There are several ways to protect yourself from IV Crush, including avoiding trading options during high IV periods, using option spreads to limit your risk, and adjusting your trading strategy to take advantage of IV Crush when it occurs.

Is IV Crush Always A Bad Thing?

Not necessarily. If you are a seller of options, IV Crush can be beneficial as it can decrease the value of the options you have sold. However, if you are a buyer of options, IV Crush can result in significant losses.

How Can I Learn More About IV Crush?

You can learn more about IV Crush by reading articles and books on options trading, following experienced traders on social media, and practicing trading options on a demo account before risking real money.

Consider using a backtesting tool such as OptionNet Explorer to understand how IV Crush affects option prices.

Related Articles

IV Crush Example

How to Capitalize on IV Crush Over Earnings

IV Crush: What Is It And How To Take Advantage Of It

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi, Gavin

What do you think about neutral strategy. Sell put and call, and buy and short stocks?

Do you mean something like this – https://optionstradingiq.com/ewz-short-straddle-with-delta-hedging-pays-off-nicely/ ? If so, yes I like that strategy.