One of the most important concepts, when you are new to options, is understanding what Option Premium is.

This is because it is the fundamental part of the option itself.

This article will summarize what options premiums are and discuss the parts and value of this premium.

Let’s get started!

Contents

- What Are Option Premiums?

- What Are Option Premiums Made Up Of?

- Options As Insurance Products

- What Happens To The Option Premium Over Time?

- Is It Better To Buy Or Sell Option Premium?

- So, Which Should I Do?

- Concluding Remarks

What are Option Premiums?

An Options Premium is the price paid (buy the buyer) or the price received (buy the seller) to buy or sell an options contract.

It is seen as a dollar amount on the options chain, which gives the right to buy or sell 100 shares (of a stock or ETF) at a certain price.

What Are Option Premiums Made Up Of?

Options Premiums are made up of two components – intrinsic and extrinsic value. Intrinsic value is the value of the option if it is exercised today.

In contrast, the extrinsic value is the current price of the options contract minus its intrinsic value.

Let’s look at the example below.

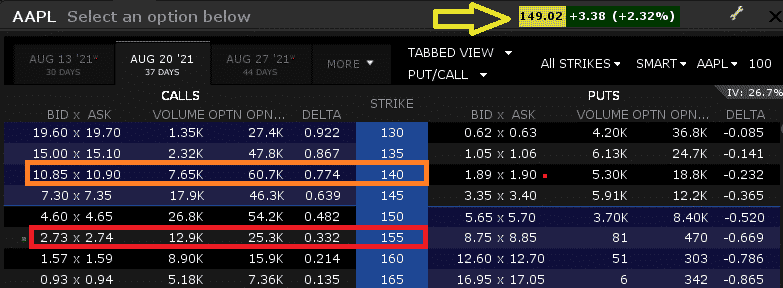

Here we have Apple stock trading at $149.02.

To calculate the intrinsic value of an option, we take the current price and subtract the strike (for calls).

In this example, the 140 call option has an intrinsic value of ($149.02 – $140) = $9.02.

That is the intrinsic value of an option if exercised today. In contrast the $155 call has an intrinsic value of $0 as ($149.02-$155) = <0

Yet we see that the 155 AAPL Call still has a value of $2.74.

This is all extrinsic value.

We can also see that the value of the 140 call is also higher than its $9.02 intrinsic value, indicating it also has extrinsic value (in this case, it has around $1.85 in extrinsic value).

The extrinsic value is made up of 3 major components.

Time till expiry: The longer the time till expiry, the larger the premium of the option.

Distance From Current Price: The Closer the strike is to the current price, the greater its value.

Volatility: The higher the volatility, the greater the premium of an option.

Take the Intrinsic and extrinsic value together, we have the value of the option and hence the options premium.

Options As Insurance Products

The best way to think about options is as insurance products.

Insurance products give holders the right but not an obligation for protection given a certain situation.

For example, homebuyers buy house insurance to protect their homes against unforeseeable circumstances such as natural disasters and fires.

To do this, they enter a contract with an insurance provider and pay a premium.

On the other side of the trade, the insurance provider receives the premium for the commitment to insure the home if a certain event occurs.

Source: Dreamstime

The example of home insurance is similar to an out-of-the-money option.

It has no intrinsic value. Unless, of course, you are insuring your home as it is burning to the ground!

That being said, it does have significant extrinsic value.

The amount of extrinsic value depends on the length of the contract, coverage provided, and the risk of natural disasters in the area.

For example, a house in a high fire risk area of California may require higher premiums than the same house in Washington.

This is the same as options premiums will be higher on Gamestop than Pepsi.

This does not mean that the insurance is overvalued or undervalued, simply one has greater risk and therefore requires greater premiums than the other.

What Happens To The Option Premium Over Time?

Over time an options contract loses its extrinsic value.

At expiration, the contract is simply a value of its intrinsic value at that point in time. If there is no intrinsic value, the contract expires worthless.

If the contract has intrinsic value upon expiration, the contract can be exercised.

The buyer will profit from the difference between the intrinsic value and the original premium paid.

Is It Better To Buy Or Sell Option Premium?

Naturally, the next question should be if you want to be an options premium seller or buyer.

The reality is that it truly depends.

Some people will simply sell options.

After all, it is the insurance company that usually makes money.

If not, why would they provide the insurance?

This is a fair point.

Despite this, selling options is less advantageous than selling private insurance.

While people looking for home insurance may have a few options to choose from, options buyers have thousands of sellers, all competing with each other.

This competition and lack of barrier to entry drives down this insurance to the lowest cost provider.

This, in the trading world, is the most competitive ask quote.

While it is true that options are systematically overvalued over long periods, a phenomenon known as variance risk premia, it may be less than many options sellers lead you to believe. Selling options also has additional tail risk.

Yes, you make money most of the time, but you are on the hook for large amounts when the contract moves against you.

Contrastingly, always buying options will often result in paying out money constantly with infrequent returns.

This can result in long sustained drawdowns while waiting for the next big move.

Compound this with a negative risk premia and it’s not pretty.

Options buyers who trade directionally can often be right on their view but not have time for it to play out, or the volatility they bought was too expensive.

This can lead to frustrating losses.

So, Which Should I Do?

Here is a simple rule.

Buy insurance (or options) on risks you cannot live with and sell insurance on risks you are able to pay for.

For example, it may make a lot of sense to buy insurance on your home, even if it is overvalued.

After all, the loss of your house could be catastrophic.

In contrast, buying microwave insurance makes little sense as it’s a risk we can live with.

Unless, of course, you frequently forget forks in the microwave, then perhaps the insurance is undervalued.

Taking it a step deeper, we can analyze different types of insurance, buy some and sell others.

For example, imagine that if the market crashes, we think Apple stock will not drop by very much.

We could sell a put on Apple, while buying a put on the S&P 500.

We receive options premium for the put we sold, while paying it out for the put we bought.

If the market crashes but Apple doesn’t fall much, we will make more money on the put we bought on the S&P 500 than we lose on the put we sold on Apple.

This is known as a relative value trade.

We could also look at it this way.

Imagine we currently hold Apple stock.

We think that it may move up slightly but are willing to provide someone insurance on a move above a certain price.

As we hold the stock itself, we are actually reducing our risk by selling this insurance. In return, we get a premium for giving up the right to profits past a certain level.

This is known as a covered call.

Concluding Remarks

Options premium is made up of two components, intrinsic and extrinsic value.

Intrinsic value is the option price if exercised today, while extrinsic value is the difference between the intrinsic value and the trading price of the contract.

Options sellers receive an upfront premium for selling options but are required to provide insurance on the intrinsic value of the contract upon expiration.

Overall neither selling or buying options premium is inherently better, and both should be considered as part of a diversified portfolio.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.