The Reverse Iron Butterfly is a rarely used but often effective options structure to take advantage of under-priced volatility.

This article will break down the Reverse Butterfly.

We will then discuss when we can use it effectively in our portfolio and provide some tips for its best implementation.

Let’s get started.

Contents

- What Is A Reverse Iron Butterfly?

- What View Does The Reverse Iron Butterfly Express?

- Why Don’t I Trade A Straddle Instead?

- Some Tips For Trading Reverse Iron Condors

- Concluding Remarks

What is a Reverse Iron Butterfly?

A Reverse Iron Butterfly consists of selling an out-of-the-money put, buying an at-the-money put, buying an at-the-money call, and selling an out-of-the-money call.

Alternatively said it is simply a long straddle and a short strangle.

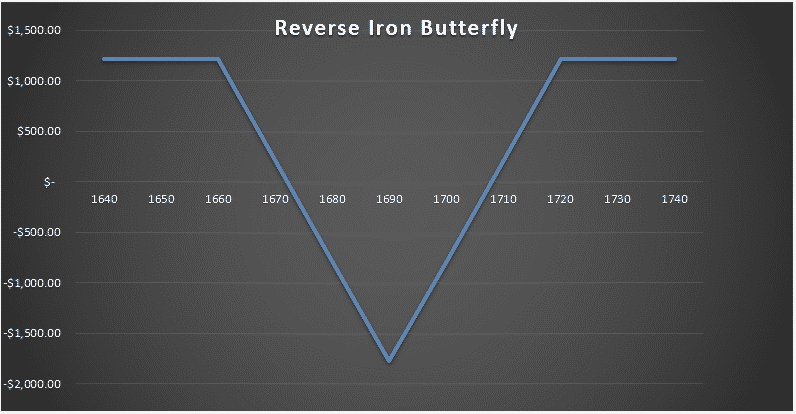

The structure is below.

To place this trade, we pay a debit.

The debit paid also coincides with our maximum loss on the trade.

Thankfully for us, it is rare to experience our maximum loss unless the stock pins to our long straddle’s strike on expiration.

What View Does The Reverse Iron Butterfly Express?

A Reverse Iron Butterfly expresses the view that we believe implied volatility is under-priced.

Alternatively, we think that the stock is expected to move significantly from our long straddle strikes either way.

Generally speaking, we are not expressing any directional view.

At inception, we are indifferent on whether the stock moves up or down, though we want it to move.

In terms of our greeks on inception, we are delta neutral, long gamma, short theta, and long vega.

As the position moves in either direction, we become long or short delta in the direction of the move unless we hedge.

Why Don’t I Trade A Straddle Instead?

If you ask why not trade a Straddle instead of a Reverse Iron Butterfly, it is a very valid question.

Remember, the principal reason we trade an Iron Condor or Butterfly against a short straddle is the protection it gives us in the event of a significant move in the underlying.

Without it, we are at risk for unlimited losses, not a very appealing situation.

In contrast, a long straddle is already risk-defined.

We can only lose a maximum of the debt paid.

There is no need for added hedging or protection with appropriate position sizing.

Despite this, there are some advantages of trading a Reverse Iron Butterfly over a straddle.

The first is that we reduce the amount of debit paid for the trade by selling the wings.

This both reduces our max loss and increases our probability of profit on the trade.

As long vol inherently has a low hit rate, this can help make it more appealing for those who want more frequent winners.

A second more important reason has to do with the wings themselves.

The reality is nobody wants to sell them. Market makers tend to want to be short the body and long the wings.

Retail traders love to punt on the wings due to their leveraged nature.

Furthermore, many options sellers want to avoid them due to the large margin requirements, for the small credit received, or even buy them as protection when trading a structure like an Iron Condor.

Due to these factors, overpricing tends to be evident in the wings.

Trading a Reverse Iron Butterfly gives up the unlimited profit potential of a straddle to compensate us with selling some small but expensive options.

Some Tips for Trading Reverse Iron Condors

Have the View that Volatility is Under-priced: A Reverse Iron Butterfly is long volatility. The most important thing is that you believe volatility is under-priced. If not, do not place the trade.

Use on Liquid Options: While it is true that wings are often expensive if spreads are wide, you can end up selling them at a bad price. Add on commissions for four legs instead of two, and a Reverse Iron Butterfly can be a worse trade than a regular straddle.

Trade the Wings Wide but not Too Wide: Having a narrow body results in a lower debit and a lower payoff if you are right. That being said, don’t go so wide where you are only getting a few pennies for your wings. I like somewhere between the 10-30 delta range.

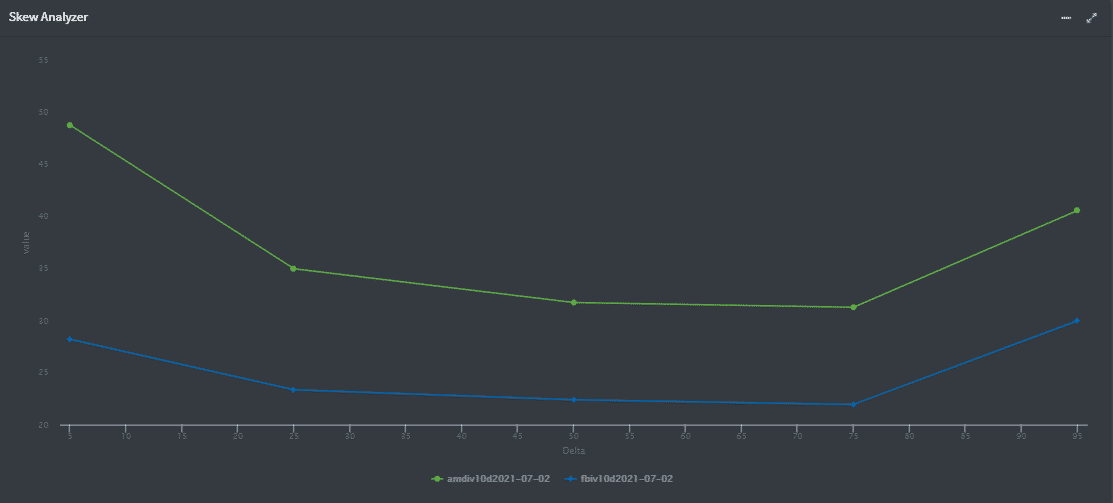

Focus on Options with High Curvature/Skew: Curvature explains how the implied volatility changes across different options strikes. Higher Curvature means we will be buying the Iron Butterflies Body at a much lower implied volatility than its wings. For example, in the graph below, we have AMD’s Skew in Green and Facebook’s in Blue. If all other things are equal, the skew makes it more tempting to trade a Reverse Iron Butterfly on AMD and not Facebook.

Source: Predicting Alpha

If you are sure, trade the Straddle: If you think there is severe mispricing of volatility, then capping your gains makes no sense. Trade a Straddle and allow long volatility to work in your favor.

Concluding Remarks

Reverse Iron Butterflies offer investors a structure to express the view that the underlying will move significantly from its current price and that volatility is under-priced.

They have a few advantages over straddles, including the lower debt paid and a higher probability of profit.

They also can benefit from selling often overpriced option wings.

Despite this, due to increased commissions and potential slippage, these benefits can be negated in some cases.

This may make long straddles more viable in certain situations.

What are your thoughts?

Do you prefer Straddles or Reverse Iron Butterflies in your portfolio?

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.