Option buying power is always reduced by the maximum loss amount but what about naked options where the loss potential is unlimited?

Contents

- What Is Stock Buying Power?

- Option Buying Power

- Option Buying Power For Single-Leg Bought Options

- Debit Spreads

- Credit Spreads

- Naked Options

- Conclusion

Options are a type of derivative, meaning that their value is tied to some other underlying asset.

As a derivative, it means there are many different ways a trader can profit from any movement (or lack thereof) in the underlying asset.

In the case of options, this can vary from indirect income such as collecting premiums, through to asset acquisition when exercising a right to buy stocks.

Coupled with most brokers offering margin loans (the ability to leverage your position), it can mean that a position’s costs relative to asset exposure can be highly geared.

As the price of an underlying option changes, it influences your overall portfolio capital and can help or hinder whether you are in a position to make future trades.

That’s why it’s important to understand what your buying power is so that you’re clear on your financial position and you can structure and manage your trades appropriately.

What Is Stock Buying Power?

Put simply, your buying power is the maximum amount of money (capital) you have available which you can use to make trades with.

It is for this reason that buying power is sometimes referred to as excess equity.

Buying power can be complicated by the fact that many traders use margin lending which impacts your buying power calculations.

As a result, simply looking at how much cash you’ve put into your brokerage account is often not sufficient – you need to be clear on what kind of account you’re using as well.

We’ll now explore some of the key brokerage accounts and their influence on buying power.

Note that not all brokerage firms are the same so use the following as a general guide and make sure you confirm the details with your chosen brokerage firm.

Non-Margin Account

These accounts use no margin or leverage so your buying power is simply equal to the value of cash in your account.

Since all your trades are for cash value, it means any gains and losses are 1:1.

As a result of this relationship, you can never lose more than the amount of cash you have in the account.

For example, say you wanted to buy 500 shares of a $20 stock.

If you were to execute this trade, your buying power will be reduced by $10,000 (500 x $20).

Traditional cash accounts are an example of a non-margin account.

Individual Retirement Account

An Individual Retirement Account (IRA) functions the same as a non-margin account, so no margin or leverage is used.

As a result, just like a non-margin account, your buying power is equal to your cash.

Margin Enabled Account

A margin enabled account means you can apply leverage to your positions.

In most standard margin enabled accounts, traders are given 2:1 leverage.

This means that for every $1 of cash in the account, you can buy $2 worth of shares, effectively doubling your profits but also risking the potential for double your losses.

Following on from the last example where we bought 500 shares of a $20 stock, this time our buying power would only be reduced by $5,000 instead of $10,000 because we would be using margin to buy 2 shares for every $20.

Put another way, if you deposited $3,000 into a margin enabled account at 2:1 leverage, you would have a buying power of $6,000.

Portfolio Margin Enabled Account

This account has two key differences compared to a standard margin enabled account.

The first difference is the amount of leverage, with this account typically having around a 6:1 leverage.

The second key difference is how your buying power is calculated.

In this account, your buying power is influenced by the largest projected loss for the day across all of your positions.

Volatility will also impact your buying power calculation.

Due to the leverage involved, the minimum amount of capital you need to have in order to obtain a portfolio margin is around $125,000 but for some brokers it can be higher.

In addition, net liquidity must be at least $100,000 at all times.

Day Trading Account

The final account we’ll explore is a day trading account.

These are assigned when a trader has been identified as a ‘pattern day trader’.

A ‘pattern day trader’ is someone who has executed four or more day trades during five business days while using a margin account.

These differ slightly to a regular margin account in that they are required to maintain a minimum $25,000 in cash in the account but other than that, they function in the same way as a regular margin account.

Option Buying Power

Depending on the type of options you are using to build a position, the way their buying power is calculated can change over time.

If you enter a position with limited risk, your buying power never changes.

This is because the level of risk is always known and is identified when the position is first created.

Examples of limited risk positions are buying a put or executing an option spread.

If you enter an uncovered position, your buying power can change as the price of supporting factors change (e.g. underlying stock price, premiums, etc.).

So if you’re ever entering into an uncovered position, it is always a good idea to never use up all of your account’s buying power.

Otherwise, if you trade turns against you for even an instant, your brokerage firm can force you out of the position when you may have wanted to hold on.

Option Buying Power For Single-Leg Bought Options

Unlike stocks, options cannot be purchased on margin. For single-leg, bought option the option buying power required is equal to the cost of the option plus any commissions and fees.

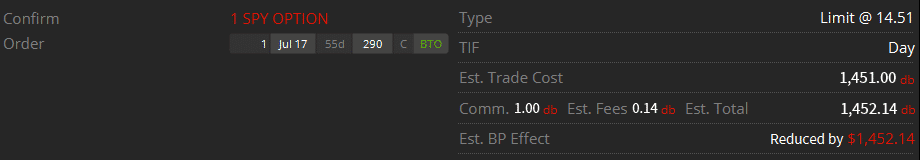

Let’s take a look at an example using a long SPY call option.

Using TastyWorks, the buying power is reduced by the expected amount.

Option Buying Power For Debit Spreads

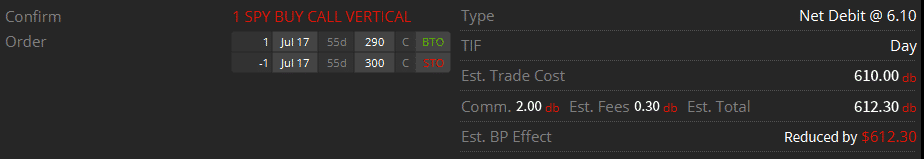

Let’s take a look at debit spreads now. Instead of just buying the 290 call, we’ll turn it into a bull call spread by selling the 300 call.

As expected, the buying power reduction at TastyWorks is the cost of the spread plus commissions and fees.

Option Buying Power For Credit Spreads

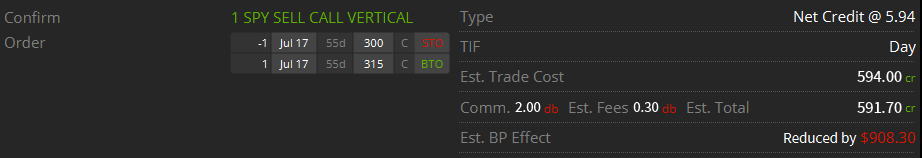

Let’s take a look at credit spreads and see if there is any different in the buying power impact.

Looking at a July 300-315 SPY bear call spread, we can see that the buying power reduction works on a similar logic and is reduced by the maximum possible loss plus commissions and fees.

The maximum los for this trade would be $1500 – $594 = $906, therefore the buying power is reduced by $906 plus the $2.30 in commissions and fees.

Option Buying Power For Naked Options

So far, we’ve seen that the buying power is always reduced by the maximum loss amount but what about naked options where the loss potential is unlimited?

First we need to understand the concept of gross maintenance margin and net margin.

Gross maintenance margin is the amount you have to keep in your brokerage account.

Net margin required is the gross maintenance margin less the premium received.

The standard calculation for gross margin when selling naked options is as follows:

Gross Maintenance Margin: (Stock price x 20% – Distance OTM ) x 100

Let’s work through another example together.

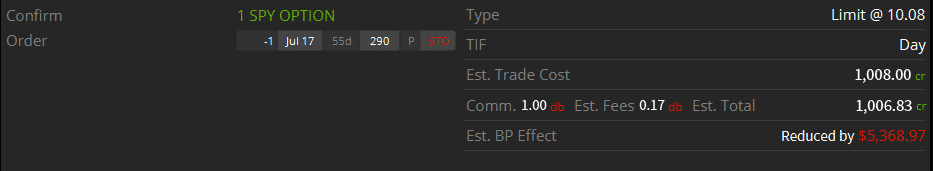

If we were to sell this naked SPY 290 put, the calculation would be as follows:

295.44 (stock price) x 20% – 5.44 (distance OTM) x 100

That results in $5,364.80 then we add $1.17 in fees to get to $5,365.97 which is within $3 of what TastyWorks is telling us:

This buying power will change over time as the trade progresses because of the key component in the calculation (stock price x 20%).

Using the example above, if the trade starts to go against us and SPY drop down to $292, here’s what the new margin requirement would look like:

292 x 20% – 2 = $5,640

That’s an increase of $271.03 so the margin requirement gets higher as the position moves against you and lower when it goes your way.

Something to keep in mind when trading naked options!

The calculation works exactly the same way when selling calls by the way.

Thankfully, we don’t ever really have to calculate this, we can just rely on our broker doing this calculation for us, but at least you now know how option buying power works!

Conclusion

Option buying power refers to the maximum amount of capital you have available in order to trade with.

With many accounts having some form of leverage available, your buying power can be increased over and above the actual amount of cash you deposited with your broker.

When trading options it’s important to consider whether you are entering into positions with limited risk or into uncovered positions, as the latter means that buying power can change over time.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Gavin, I think your screen shot under Gross Maintenance Margin is incorrect

tks R

Thanks! Fixed.