Today, we are going to focus on OTM options. OTM stand for Out-of-The-Money.

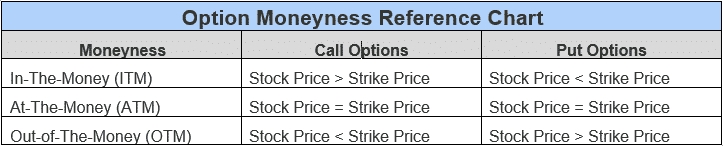

The degree to which an option does or doesn’t have intrinsic value is referred to as moneyness.

You have heard people use terms like At-The-Money or In-The-Money before, and option moneyness is what they’re talking about.

Contents

What is an Out-of-The-Money (OTM) Option?

Remember, moneyness only considers intrinsic value.

Notice the formulas below used to calculate option premium.

There is no mention of long or short option positions, which means that whether you are long or short the option, it has no effect on moneyness.

Let’s take a look at the call and put options to make certain we understand the option values.

- Call Option: Intrinsic Value (Stock Price – Strike Price) + Extrinsic Value = Option Premium

- Put Option: Intrinsic Value (Strike Price – Stock Price) + Extrinsic Value = Option Premium

In a nutshell, if intrinsic value is positive then those options are ITM. Conversely, options are out-of-the-money when their intrinsic values are negative.

Here is an easy reference chart to help you keep it straight in your head.

One more thing we need to discuss regarding option moneyness is the term deep applied to our ITM and OTM options.

There is no clear-cut definition of when an option transitions to the deep category.

Sometimes you will see an option referred to as deep ITM or deep OTM when referring to an option with strikes $5 or $10 away from the current market price.

I prefer a more logical approach that applies the term deep to options with a delta close to 1 for calls and -1 for puts.

Pros and Cons of OTM Options

So, ITM options have lots of intrinsic value and are sometimes used as a replacement for stocks, like in the poor man’s covered call strategy.

Since ITM options have lots of intrinsic value, that means OTM options must consist of very little intrinsic value.

If OTM options have so little intrinsic value, then they must have lots of extrinsic or time value.

Sounds a lot like a lottery ticket or gambling, huh?

OTM options are typically very cheap and if they pay off, they produce a very nice return on your investment.

The other side of the coin, since there is no free lunch, is that the probability of profit is rather low.

We said already that moneyness is unaffected by long or short positions, and this is true.

What is important to understand though is that OTM options are generally good for short positions while OTM options are typically not good for long positions.

This applies equally to calls and puts.

For example, if the market price of a stock is $50 and I hold an OTM $60 strike long call option then the stock price has to increase $10 for my option to be profitable.

If, however, I hold the short side of the same call option then unless the stock price rises $10 then my call option is profitable.

Looking at the put option version, if I hold an OTM $40 strike long put option then the stock price has to decline $10 for my option to be profitable.

If, however, I hold the short side of the same put option then unless the stock price declines $10 then my put option is profitable.

Another consideration is that since OTM options are, well OTM, your risk of assignment is minimal.

Using OTM Options

Let me begin this section with a cautionary warning.

I am relaying how one might use OTM options, but I’m not necessarily advocating your usage of them.

Utilizing naked (undefined risk) option positions can expose you and your account to significant risk.

OTM options could very well be used for speculating.

Suppose you’ve done your analysis and you feel the stock you analyzed is poised to make a major move or correction.

This is something that I‘ve done before myself.

In fact, just last week I bought 2 OTM $80 strike calls on MRK.

The market price closed on Friday around $75.

The stock is near 52-week lows, both CCI and RSI are near oversold levels, and IV percentage is 10%.

I think this stock is poised for a rebound and this position cost me $188 ($0.94 x 2).

I do not do a lot of this type of trade, but I like to have a few “for fun” trades every now and then.

OTM options can also be used for hedging a position or your portfolio.

I use OTM options for hedging my portfolio using VIX options.

The way it works is that I buy 10 delta VIX call options 120 DTE every 30 days. This creates an option ladder.

What happens is that I end up with VIX call options expiring every 30 days for the next 4 months out from today.

OTM Options Should Only Be A Small Part of Your Account

I limit my allocation to this strategy to 1% of my account.

So, every month I use 0.25% of my account to buy VIX call options.

How does this create a hedge for my portfolio? Let me ask you guys a question.

If the market tanks hard and the SPY declines several hundred points, what will most likely happen to volatility?

It will likely skyrocket, right?

Those VIX options will, hopefully, shoot up in price which will offset the losses in my other positions that followed the market into the pit.

Those two examples used long OTM options, but what about short OTM options?

They can be used as well, but they can open you up to significant price movement risk.

If you think a stock might move a bit and has a few binary events like earnings and dividends coming, but you still want to use it, then OTM short options could work for you, maybe.

In addition to the risk exposure, the premium you receive from them is usually very small.

This situation is not something that I would get into since there are far better trading tools out there.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I like the information above . Thanks so much.

Good Job Man