Covered call screeners are basically software that allows you to select your stock and options for the covered call based on criteria you specify using filters.

Let’s take a look at what they are and where to find the best ones.

Contents

- Example 1: What is a Covered Call Screener?

- Where do you Find a Covered Call Screener?

- Selecting a Covered Call

Adding an income strategy to your portfolio can be a good thing to help manage risk and grow your account.

The covered call strategy is a good way to do this, especially if you hold stock in your account.

We’ve established that adding covered calls to your arsenal can be a good idea, but how do you select the stocks and options to use?

Enter the covered call screener, which helps you put a covered call together.

Lots of websites out there offer these services to investors, some free, some pay-to-play.

What is a Covered Call Screener?

A Covered Call Screener is basically software that allows you to select your stock and options for the covered call based on criteria you specify using filters.

Sounds good so far.

What filters might be useful in setting up a covered call?

- Timeframe – how far out in the future do you want to look for selling your call?

- Stock – you can specify a list of tickers, P/E ratios, all sorts of Implied and historical volatility measures, dividend ratios, prices and the list goes on.

- Option – do you want to specify bid-ask spreads, open interest, a specific delta perhaps?

- Trade – you can set minimum targets for the trade like probability of profit, delta, or theta and even to avoid or look for earnings or dividend events.

- Return – setting minimum, maximum, and average profit return targets are a good way to evaluate covered call opportunities against each other. This choice requires a little more discussion because it involves calculations as opposed to just selecting a value. The calculation is based on a number of things including the underlying’s implied volatility and current price. It takes these pieces of information for all the tickers and calculates the expected returns over the timeframe of the trade. This gives us the ability to compare different covered call trades on equal footing.

When setting up a covered call, I like starting with a good solid stock I don’t mind holding.

If you want to create your own list of stocks, then you do so on the covered call screener or use the stock screener on your broker’s website to identify the stocks you want to use.

As a minimum I would suggest making sure liquidity in the underlying stock and the options are very good, the stock price is greater than $10 per share and that implied volatility is not going crazy (> 60%).

It’s up to you to figure out what additional criteria is important for your trades.

Additionally, I like to avoid earnings and dividends events, I also like trades with a timeframe of 30-60 days, and I shoot for an average expected return near the top of the list.

One additional note regarding max price of the stock.

You will need to buy 100 shares, so you need to make certain that your account can adequately support the purchase.

If you feel comfortable allocating $5,000 toward this strategy, then you should limit your stock price selection criteria to $50/share ($5,000 / 100).

As you may have surmised by now, there is nothing magical about a covered call screener.

It’s just applying filters and doing the math behind the scenes.

We can do it ourselves if we want to, but it’s nice to have someone else do the heavy lifting then we can just use the results to trade.

Trading is where we shine, right?

Where do you Find a Covered Call Screener?

Here is a short list of several covered call screeners.

I’m sure you can find many more if you go hunting.

BarChart – $29.95/month with discounts for 1-year or 2-year subscriptions.

OptionDash – $39/month with discounts for a 1-year subscription. They also have a free basic version to get started with.

Optionistics – $35/month with discounts for a 1-year subscription.

Quantcha – $89/month.

Born To Sell – $59.95/month with discounts for 3-month and 1-year subscriptions.

TD Ameritrade – Free if this is your broker.

Selecting a Covered Call

As an example, let’s use TD Ameritrade’s option screener to find a covered call trade.

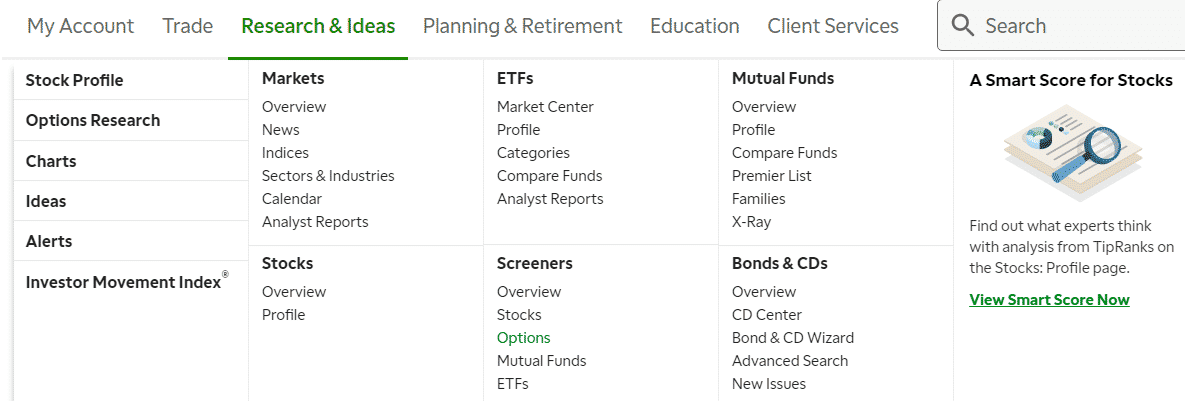

After logging in, go to “Research & Ideas” then click Options in the Screeners category as shown below.

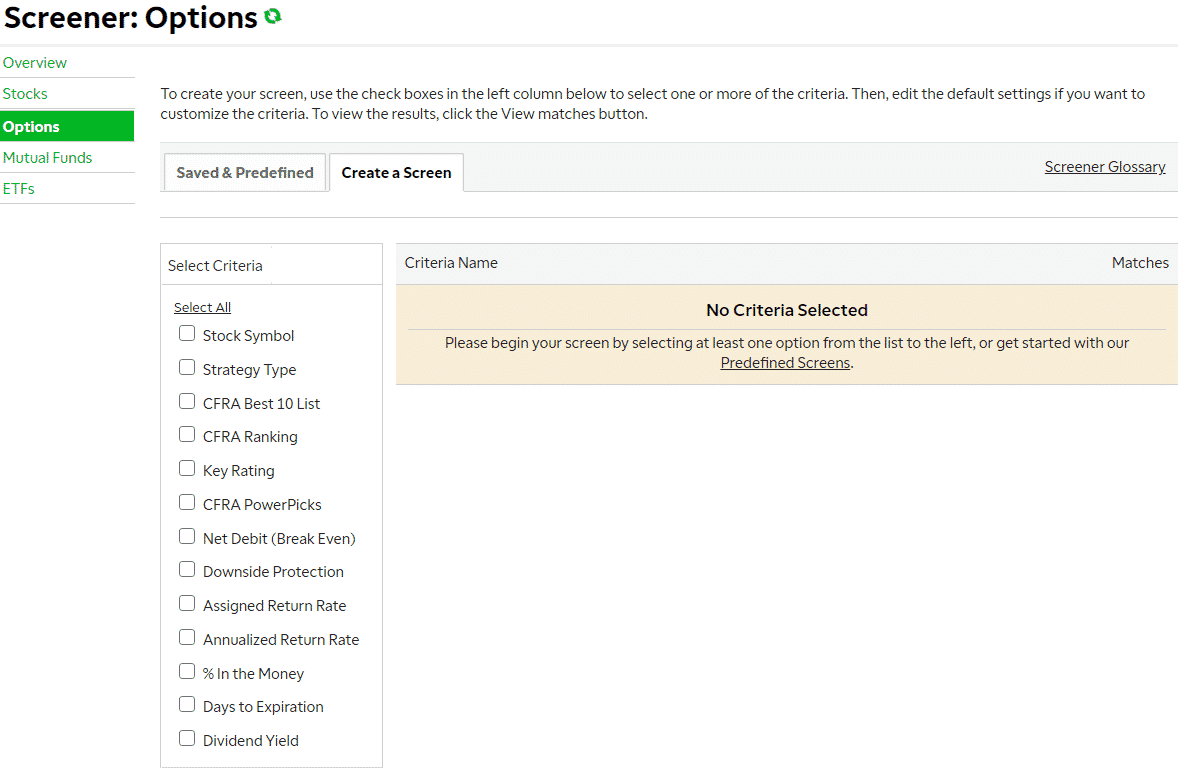

When the screener page opens, click on the “Create a Screen” tab.

On the left side of the screen, you see all of the criteria available to use for selecting your trade.

If you hover over the criteria items, then a pop-up will display the details of what the criteria is and how you might use it.

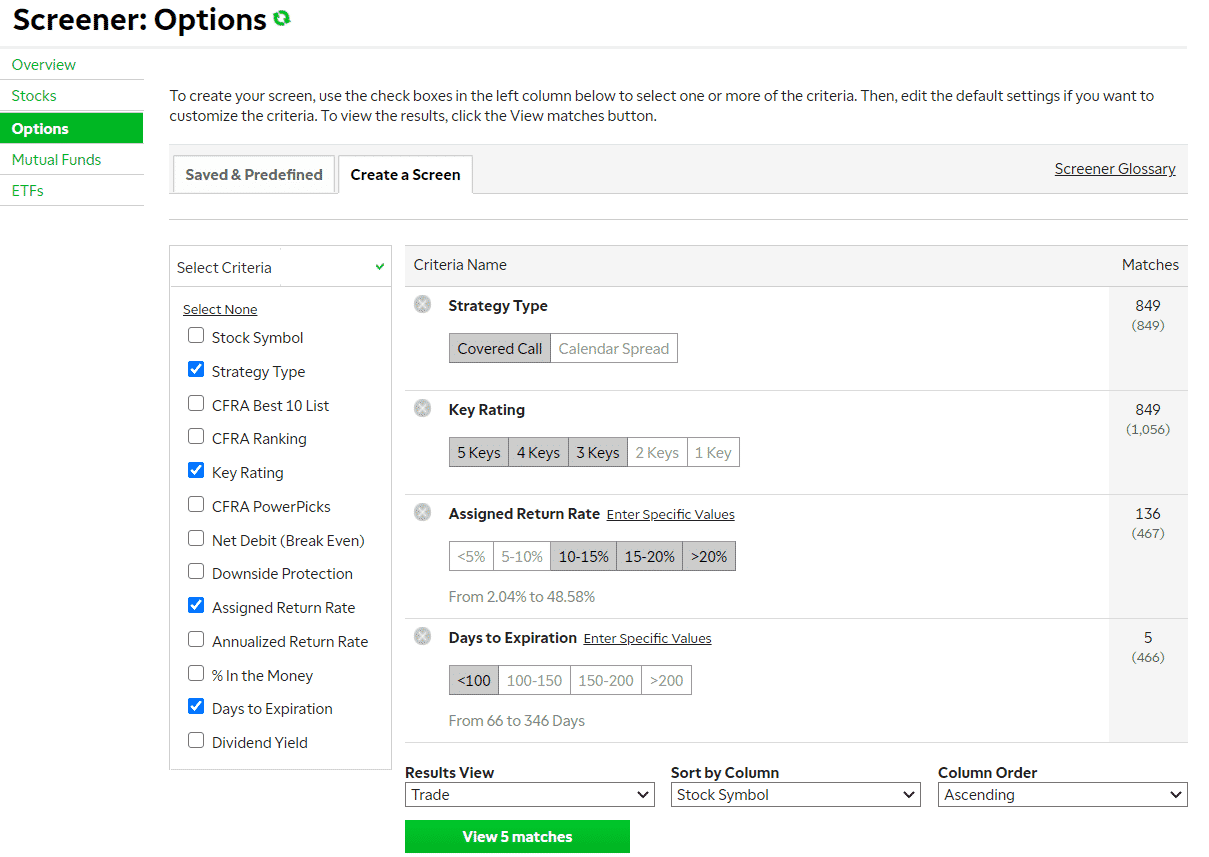

I am going to select “Strategy Type”, “Key Rating”, “Assigned Return Rate” and “Days to Expiration”. After I select my criteria, I set the values that I want for each one, see below.

I changed the “Results View” to Trade and clicked the “View Matches” button after entering my criteria settings.

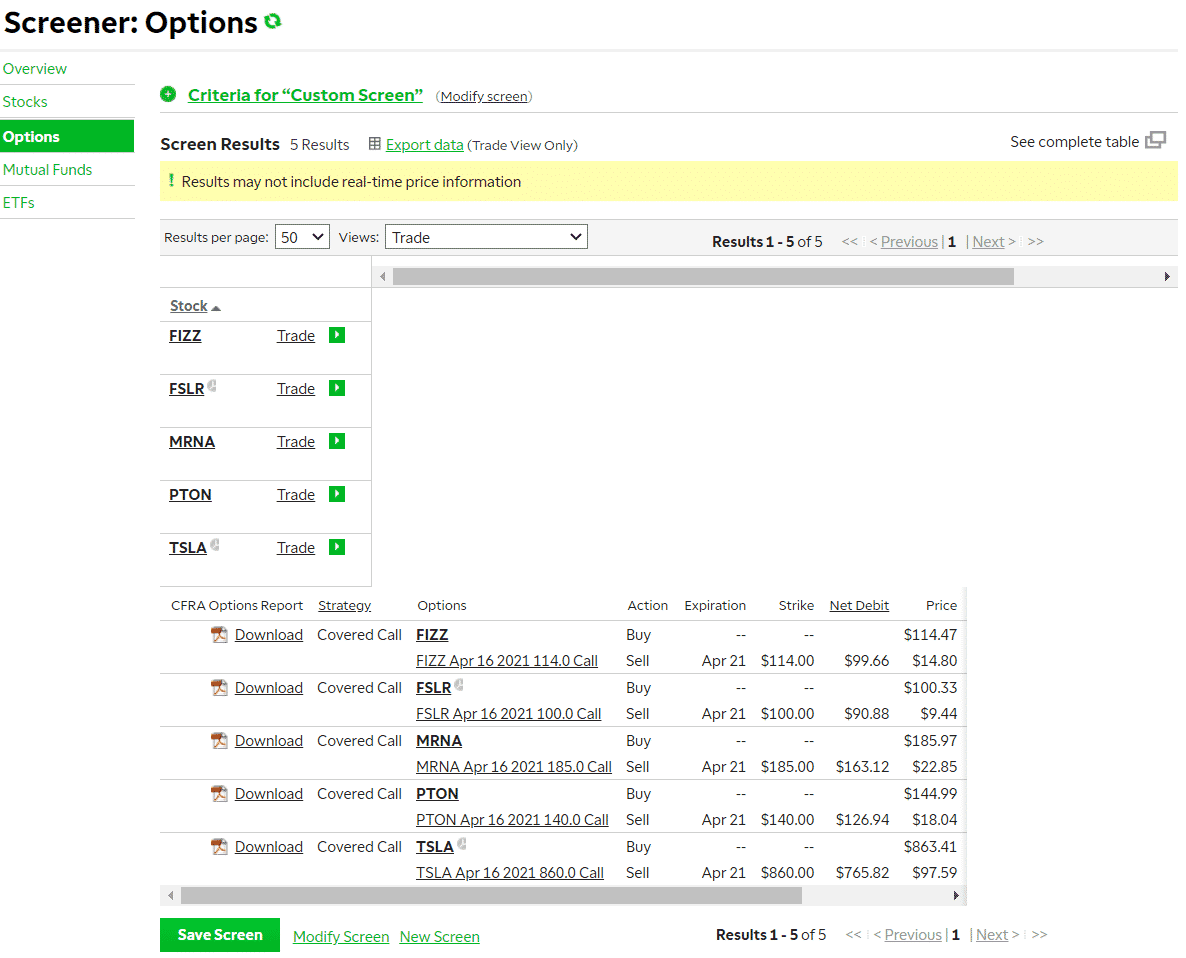

I now have a list of 5 possible covered call trades that satisfy my selection criteria.

I’ve had good success with FSLR in the past, so let’s take a look at that trade.

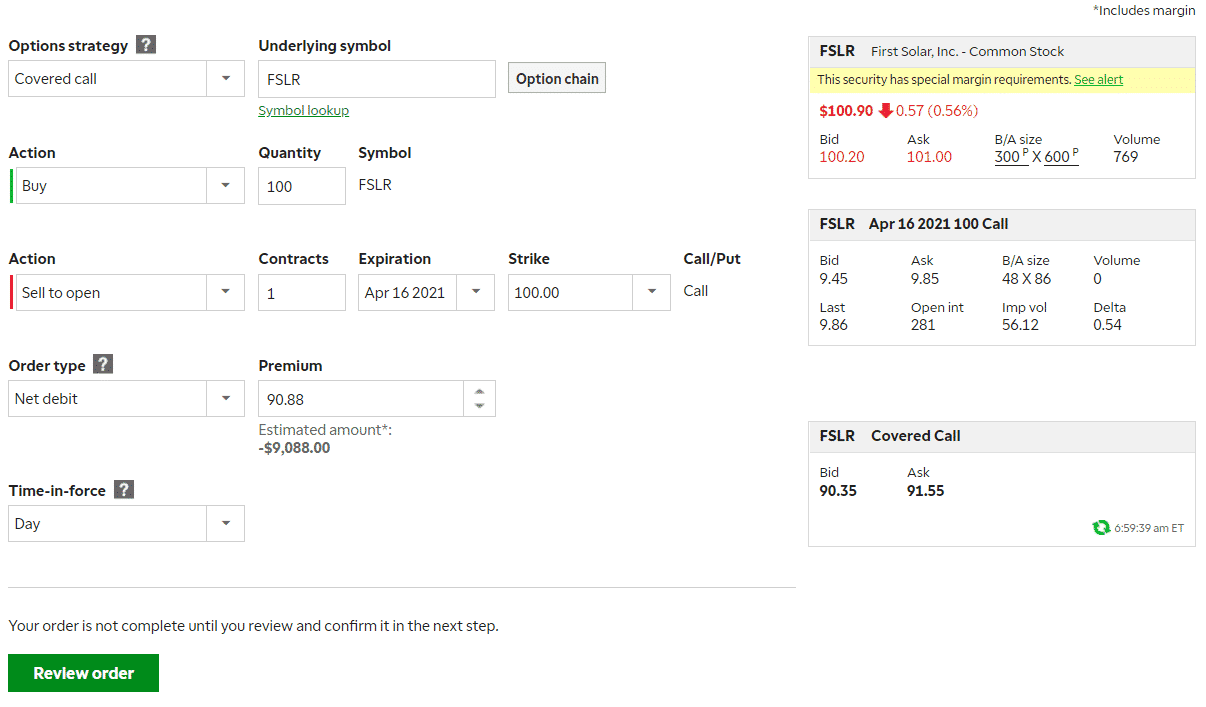

I clicked the Trade link next to FSLR and am taken to the Buy & Sell page.

Now, we are presented with the details of the trade.

How much stock to buy and specifically which call option to sell. I also know that I will have to lay out about $9,000 to enter this trade as is.

I am also free to modify the trade if I want.

Perhaps I don’t want to sell the call slightly ITM. I

can change that if I like and sell a $101 strike instead.

When I’m ready, I can click Review Order to start the execution of the trade.

Covered call screeners can be a great way to find trade ideas. If you’ve used any of the above platforms, leave a comment about your experience with them.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.