Today we’re going to look at covered calls for dummies including why we do them, how we do them and how to manage them.

Enjoy!

Contents

- What is a Covered Call?

- Why Sell a Covered Call?

- Covered Call Writing for Protection

- Profit & Loss

- Which Stock Should I Choose?

- Which Call Do I Choose?

- When do we Exit Covered Calls?

- How do we Exit Covered Calls?

- Risk of the Stock being “Called Away”

- Comparison Of The Premiums & Returns For Low Vol And High Vol Stocks

- Related Articles

What is a Covered Call?

A covered call is a strategy by which you sell (write) a call option while at the same time owning shares of the underlying stock.

Why Sell a Covered Call?

The goal of selling (writing) a covered call is to increase your income while owning the stock.

The income (premium) you receive from selling the call also covers a decline in the price of the stock.

Owning the stock and writing the call can outperform just owning the stock.

The stock price can fall, stay the same or rise slightly to be profitable.

This strategy; writing call options and owning stock will reduce volatility, (the higher the volatility the higher the risk).

Covered Call Writing for Protection

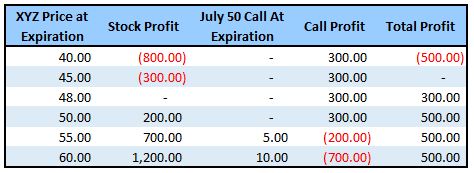

Example:

An investor buys 100 shares of XYZ common stock at $48.

The investor sells 1 XYZ July 50 call option.

This is called a covered call.

You will receive $300 from the sale of the July 50 call.

Profit & Loss

Max Profit: Distance between stock price & short call + premium received from selling the call.

Breakeven: Stock price – credit from short call

Loss: If the stock price falls significantly below the $300 premium you received.

Which Stock Should I Choose?

Choose low priced stocks with high implied volatility percentile. High IV means more premium is received for selling the call.

You can trade high beta stocks which will generate a lot of premium, but the stocks also move around a lot which can be stressful.

I prefer low beta stocks and ETF’s like KO, JNJ, PFE, IYR.

Which Call Do I Choose?

The short call is usually In-The-Money (ITM) or Out-Of-The-Money (OTM).

The OTM call offers a higher potential for reward, but is riskier than the ITM call.

When do we Exit Covered Calls?

Exit covered calls when the stock price has gone past your short call; that will give you close to maximum profit.

You should close a covered call if the stock price drops significantly.

How do we Exit Covered Calls?

We will roll our call down if the stock price drops.

If the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option and selling another call on the same strike in a further out expiration.

Risk of the Stock being “Called Away”

When you sell a call someone may exercise it, meaning you will be forced to sell your shares.

Let’s see what happens:

The stock was $48/share when you bought it.

The stock moves up to $50/share.

Someone “calls away” (buys) the stock at $50.

You will earn $200 on the stock. (100 shares X $2 = $200).

You still keep your $300 credit for the option.

Total Profit: $500 ($200+$300).

So being assigned is not necessarily a bad thing because it generally means you have made a profit on the trade. But, you no longer own the shares and will need to look for new opportunities.

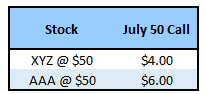

Comparison Of The Premiums & Returns For Low Vol And High Vol Stocks.

Let’s compare the returns for low volatility and high volatility stocks.

AAA stock is more volatile than XYZ and therefore has higher option premium.

Here are the prices:

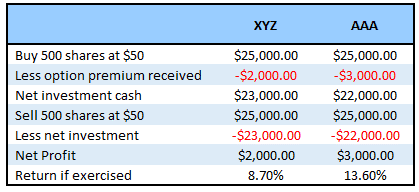

You can see from the above table that stock AAA will give you more premium ($6) than XYZ which gives $4.

You can see from the above table that the more volatile stock AAA has a potential return of 13.6%. XYZ having a smaller return of 8.7%

Note: Commissions and dividends are not included. Also, there are many different ways to set up this trade. This is a basic explanation for educational purposes.

Option Boxer has a great tracking spreadsheet for covered calls if you want to check it out.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Related Articles

Selling Covered Calls – A Detailed Guide

How To Write Covered Calls: 2024 Ultimate Guide

Weekly Versus Monthly Covered Calls

How To Make Money With Covered Calls

When to Roll Covered Calls

Selling Deep In The Money Covered Calls: Why Do It?

Covered Calls 101

Covered Calls With LEAPs Options Strategy

Supercharge Your Covered Calls Using LEAPS

Selling Weekly Covered Calls

Covered Calls: How to Adjust to Changing Market Conditions

neat … well done