Contents

- Theta

- Vega

- Option Sellers

- Theta Vega Ratio

- Implied Volatility (IV) Effects

- Where to Place Credit Spreads?

- Days to Expiration (DTE)

- The Numbers – Moneyness of Options

- The Numbers – Days to Expiration

- The Numbers – IV Environment

- The Numbers – Width of the Spread of the Wings

- The Numbers – Calls Side Versus put side

- Conclusion

You know about theta and about vega.

Next in your evolution as an option investor is to learn about the relationship between the two, known as the theta-vega ratio.

This ratio is useful for investors selling credit spreads and iron condors, since higher ratios will give provide an extra edge in these cases.

Where can these higher theta-vega ratios be found?

Short-dated options or longer dated options?

Further out-of-the money options or closer to the money options? Higher implied volatility options or lower implied volatility options?

We will start with basics and by the end you will understand why the theta-vega ratio explains the rationale for three of the iron condor rules:

- Sell in high IV

- Sell far out of the money at the 10-15 delta

- If not achieved 50% of max profit in half the time and if not stopped out, continue until seven days before expiration.

Theta

The value of an option decays as time passes.

Theta indicates the loss in value per unit of time.

An option owner has negative theta because the value of that option decreases with time.

The extrinsic value portion of an option must decrease to zero at expiration.

An option seller makes money by selling options at a certain price and buy it back at a lower price.

They have positive theta and passage of time works in their favor.

The more time till expiration the slower time decay (less theta).

As options get closer and closer to expiration, they decay faster and faster.

Vega

Vega is the measure of how much the option price will change if its implied volatility changes.

When implied volatility goes up, the price of the option generally goes up.

Option buyers will have positive vega.

Will be good for them if implied volatility increases.

Option sellers will have negative vega.

Will be good for them if implied volatility decreases.

When an option is at expiration, its price can no longer change.

Hence vega must go to zero at expiration.

Options with high vega means that these options prices are more sensitive to changes in implied volatility.

Vega is largest for at-the-money options.

And will be less the further out of money you go, or the further in the money you go.

The reason is due to higher extrinsic value embedded in the at-the-money options.

Vega for further dated options will be larger.

The reason is that further dated options have more extrinsic value.

Option Sellers

There are three main components that affect option pricing:

- Direction of the underlying

- Implied volatility of the option

- The passage of time

Option sellers exploit the passage of time, because this portion is a sure thing.

Option sellers can bet on the direction (using credit spreads) or not bet (using iron condors).

That leaves volatility as being the wild card.

Option sellers want implied volatility to decrease because that decreases the option prices.

However, volatility has a tendency to spike up unexpectedly (due to bad news or fear).

This is not good for option sellers.

Hence they see vega as volatility risk.

Theta Vega Ratio

Option sellers want large theta and want small vega — in absolute terms.

We disregard the positive/negative sign in the theta-vega calculations.

Option sellers look at the “theta-vega ratio”.

The larger this ratio, the better.

A general rule of thumb for selling out-of-the money options is a theta-vega ratio of greater than 0.2.

Implied Volatility (IV) Effects

As an option’s implied volatility increases, it’s extrinsic portion of the option increases.

Having more extrinsic value means that it will have larger theta because more extrinsic value needs to decay away in the same amount of time.

Having more extrinsic value also means a larger vega values (greater volatility risk).

So is it better to have higher implied volatility or not?

It turns out that in general, a higher IV Rank is associated with higher more favorable theta-vega ratios.

We will look at the numbers later.

This is why we want to sell credit spreads and iron condors in high IV environments.

Where To Place Credit Spreads?

So far, we have looked at selling a single option.

If we are doing a credit spread (selling one option and buying another option), the theta and vega effects get complicated.

We computed some sampling of the theta vega ratios using OptionNet Explorer historical data and found very consistently (with only a few exceptions) that selling further away from the money resulted in better theta-vega ratios.

This is why we want to sell credit spreads and iron condors further out of the money at the 10 to 15 delta.

For those who want to look at the numbers, we will provide below.

Days to Expiration (DTE)

What about days to expiration?

Which expiration cycles will give us better theta-vega ratios as option sellers?

Shorter dated options have faster theta decay and has smaller vega risk, hence shorter dated options have higher theta-vega ratio.

Is this true for spreads as well?

Yes, it is.

Shorter term iron condors do have better theta-vega ratios than longer term.

Numbers to follow.

However, shorter term iron condors have higher delta and gamma risk, which is a whole other discussion.

Shorter term iron condors require more active monitoring and adjustments.

So there is a happy in-between medium that is different for each investor.

Because iron condors have increasingly more favorable theta-vega ratios as they approach expiration, we allow for the iron condor to approach expiration as long as we have not hit our target and stop rules.

We close the iron condor 7 days before expiration to avoid assignment risk.

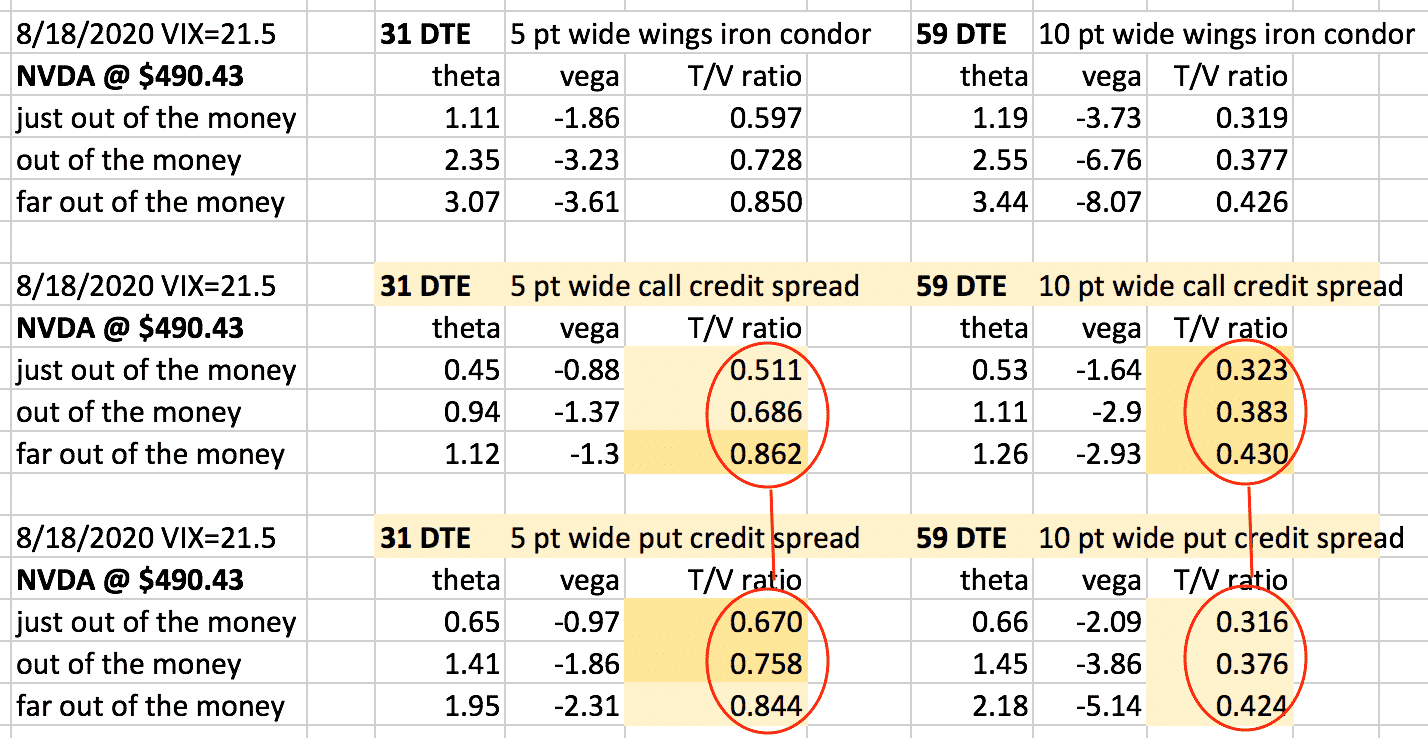

The Numbers – Moneyness Of Options

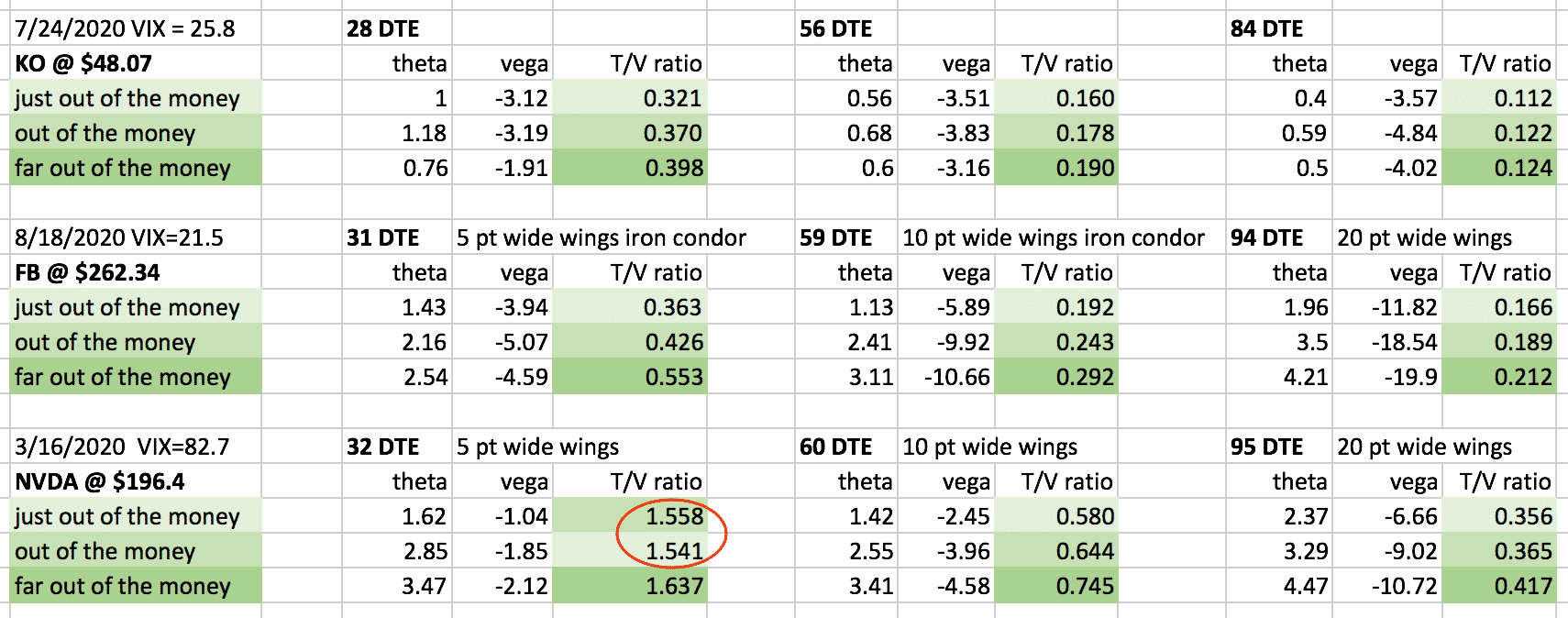

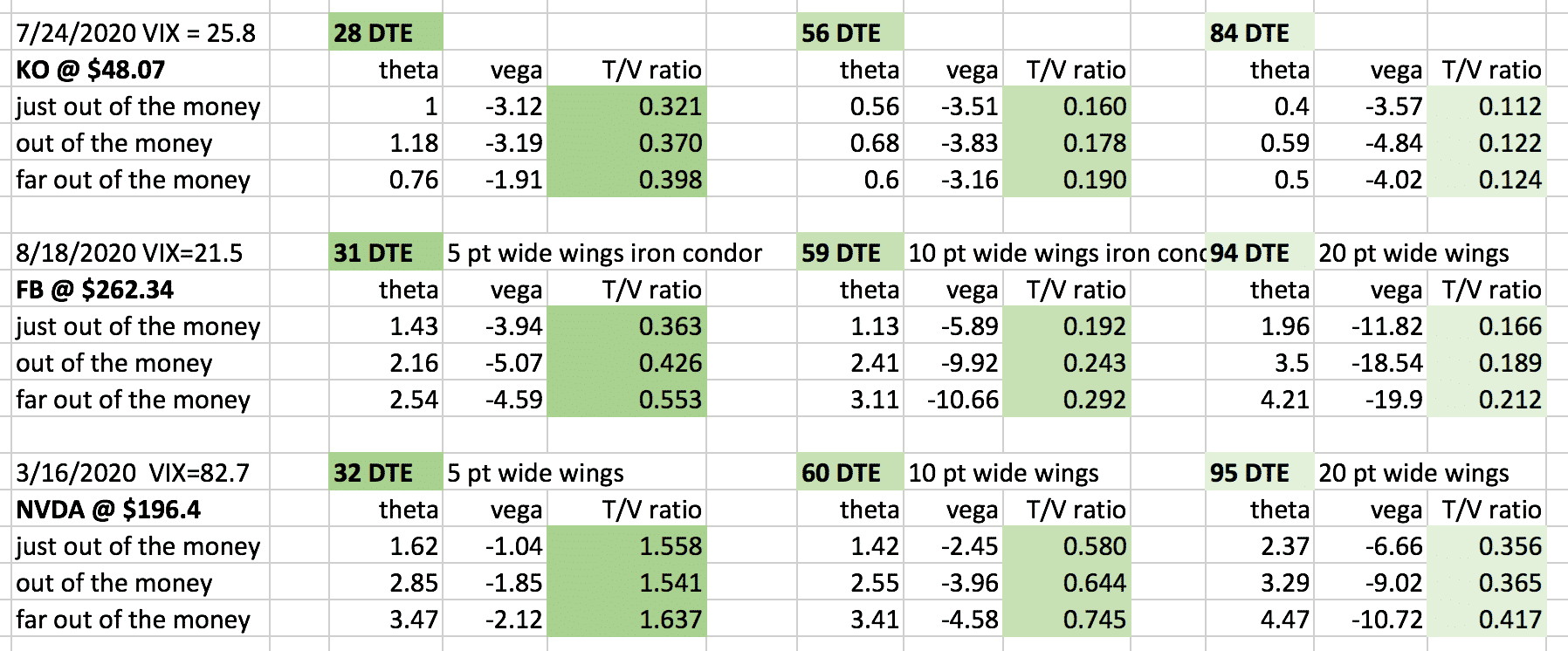

Except for the slight exception circled, we see that further out-of-the-money iron condors have higher theta-vega ratios.

This hold true in different IV environments and in different expiration cycles, and in different priced stocks.

The Numbers – Days To Expiration

Here we see that shorter dated iron condors have better theta-vega ratios

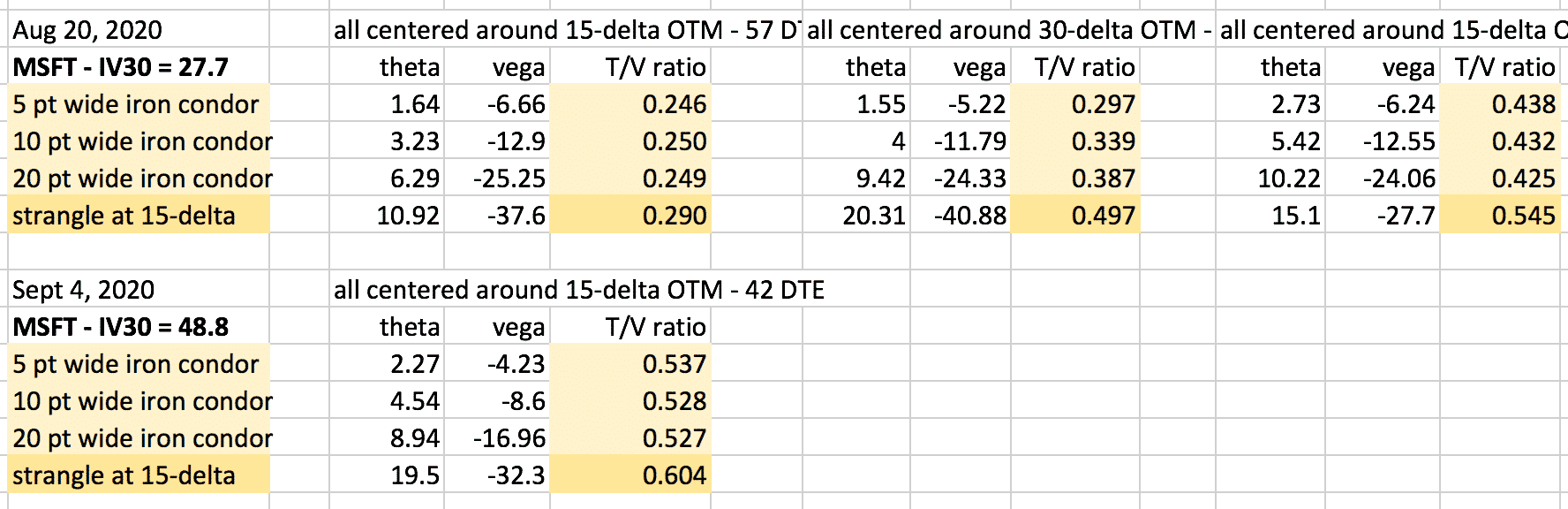

The Numbers – IV Environment

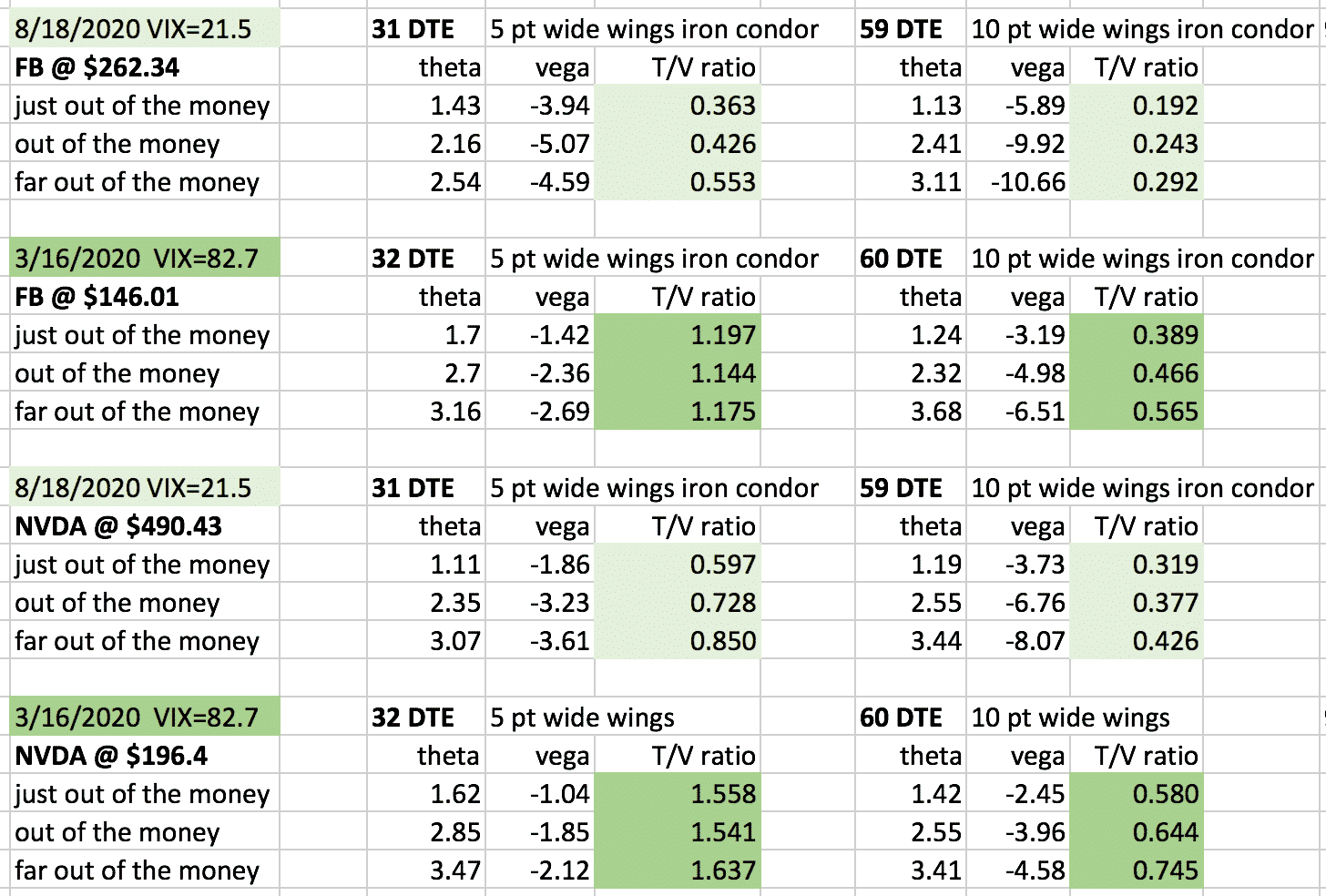

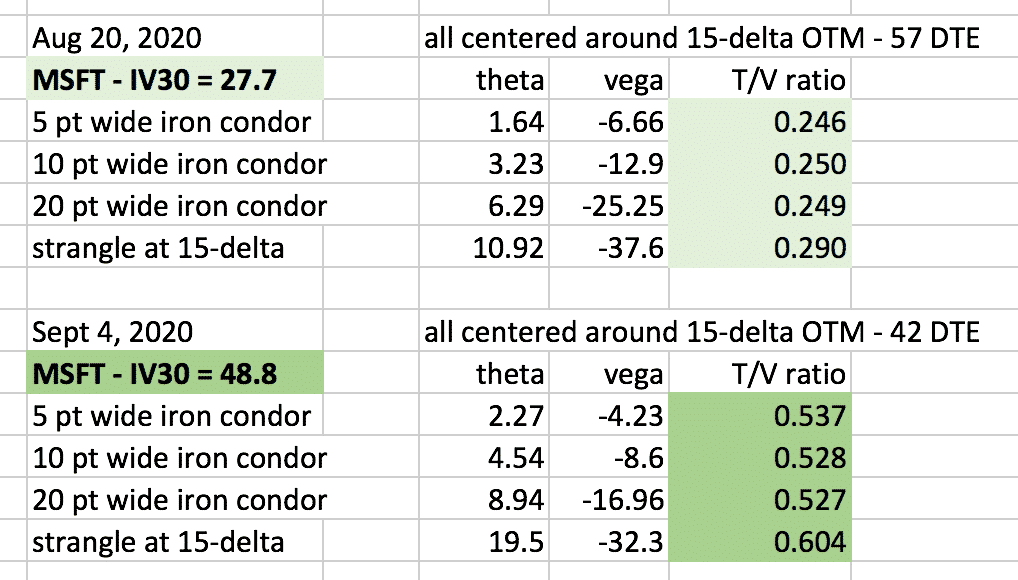

Taking a look at Facebook and Nvidia in both normal and high VIX environments, we see significantly higher more favorable theta-vega ratios when there is higher implied volatility.

This is true regardless of expiration length and regardless of how far out-of-the-money the wings are.

We see the same thing when we look at Microsoft when it had a high IV versus when it had a low IV.

It is true regardless of wing width.

Also true for strangles.

Because more favorable theta-vega ratio is associated with higher IV, some investors may choose to look at IV as a proxy for theta-vega ratio (since computing theta-vega can be time consuming).

The Numbers – Width Of The Spread Of The Wings

We don’t see much difference in theta-vega ratio when we vary the width of the spread in the wings.

In other words, a 20-point wide iron condor does not have a significantly better theta-vega ratio than a 5-point iron condor.

The theta-vega ratio is slightly better for the strangle than for the iron condor.

Since wide iron condors behave more like strangle, then in theory, wider wings should result in higher ratios.

However, the effect is negligible and mixed.

The Numbers – Calls Side Versus Put Side

When we calculated the theta-vega ratio separately between the puts and the calls of the iron condor, we do not see any pattern.

Any differences is probably due to random put/call skews.

Conclusion

Hopefully the numbers have convinced you that the theta-vega ratio is more favorable in high IV environments, in further out-of-the-money options, and in shorter dated options.

In theory, higher theta-vega ratio should provide an extra advantage for option sellers.

The reader is encouraged to track their theta-vega ratio to see if more of their winning trades are from higher theta-vega ratios or not.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi, how do we calculate the total vega and theta of a credit spread? I am quite confused with the plus and minus signs. Should we plus or minus the thetas and vegas? Would appreciate if you help me out

Yes, you add the two legs together.