I tend to generate a lot of controversy when I share this opinion, but I much prefer long term iron condors to short term condors.

Part of the reason for switching to longer terms condors was out of necessity. Moving back to Melbourne where the time difference is an issue, I needed a much lower maintenance method of trading.

Long term condors move very slowly in comparison to their short term counterparts so they have proven perfect for my timezone constraints.

SLOW MOVERS

I like to share an example from March 2018 to illustrate the point. RUT dropped 2.18% on March 20th with an associated spike in volatility. That’s just about the worst thing that can happen to an iron condor the day after you enter it.

Let’s look at 3 different condors to see how they performed:

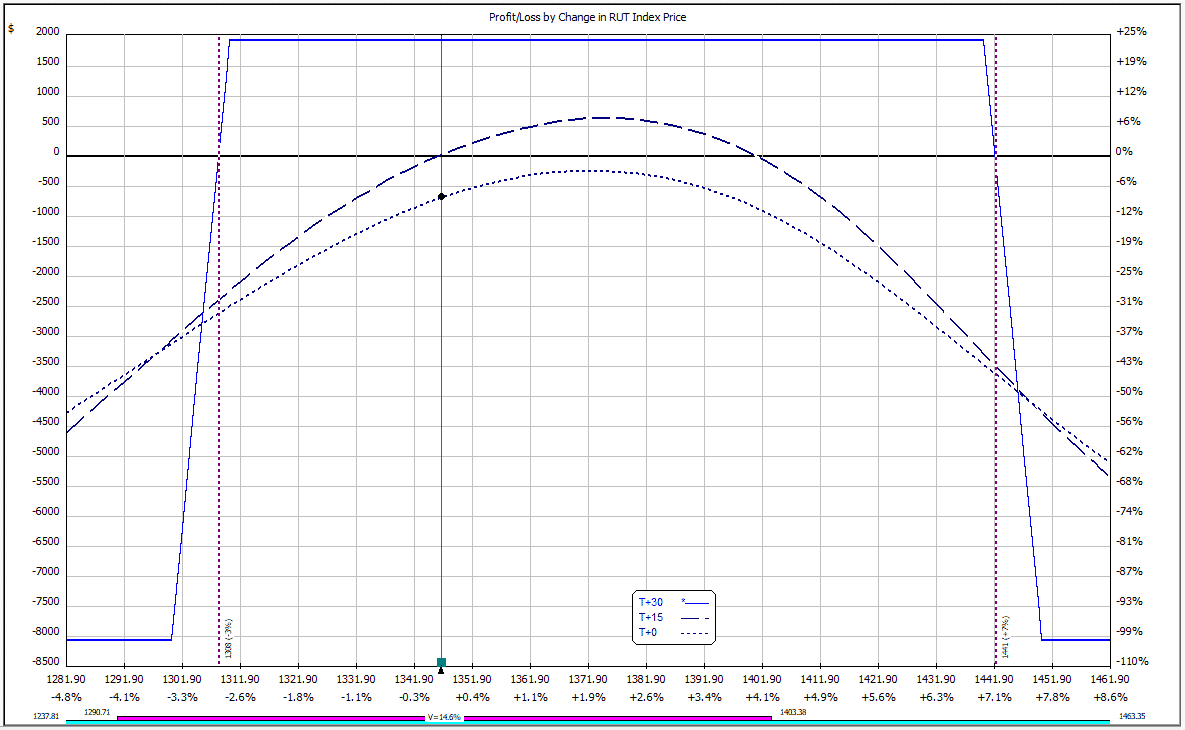

1. Monthly Condor with Delta of -16

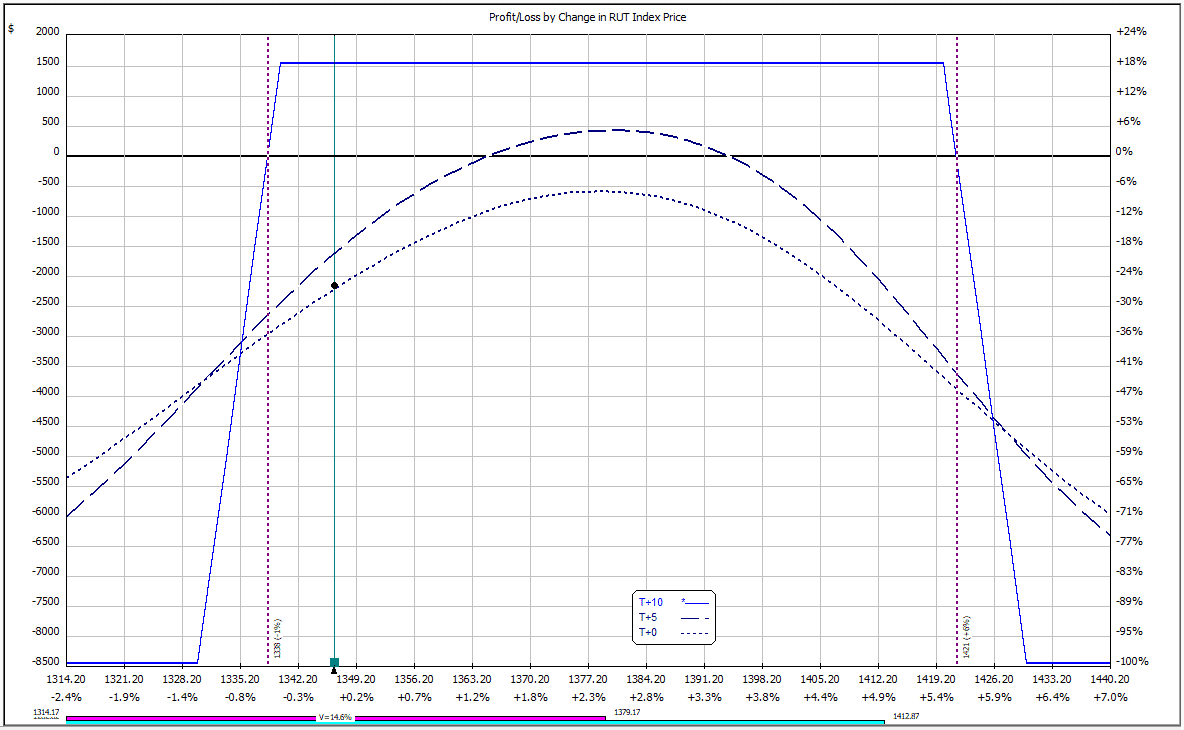

2. Weekly Condor with Delta of -12

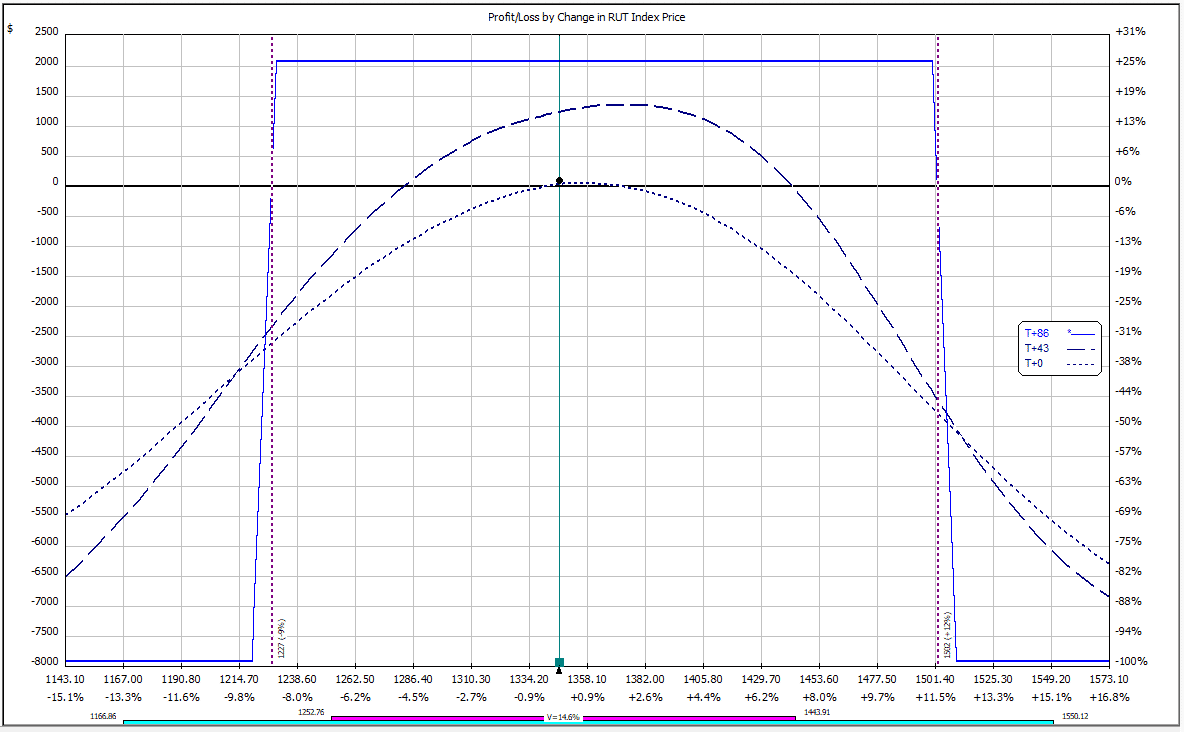

3. 90 Day Condor with Delta of -10

Give that the monthly condor had the highest negative delta, you might think that one would perform the best in a falling market, but the results might surprise you.

Here’s how the trades looked after the next day:

Monthly Condor down $550

Weekly Condor down $2,150

90 Day Condor up $100

You can see the 90 day condor performed by far the best out of the 3. Yes, the trade off is slower time decay and lower profits in quiet markets, but I’ll take that in return for reduced P&L volatility.

In situations like this, the weekly condor is in real trouble, the monthly condor might need to be adjusted but the 90 day condor can just be left alone to do its thing.

Everyone has their own preference and trading style, but for me, I find the long term condors suit my style much better than the shorter term condors.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.