Selling cash secured puts on stocks an investor is happy to take ownership of is a great way to generate some extra income.

A cash-secured put involves writing an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock.

The goal is to either have the put expire worthless and keep the premium, or to be assigned and acquire the stock below the current price.

It’s important that anyone selling puts understands that they may be assigned 100 shares at the strike price.

Contents

- Selling Cash Secured Puts

- Maximum Gain

- Maximum Loss

- Breakeven Price

- When Should You Sell Cash Secured Puts?

- What Is The Risk In Selling Cash Secured Puts?

- Why Sell Deep In-The-Money Puts?

- Selling Weekly Cash Secured Puts

- INTC Cash Secured Put Example

Selling Cash Secured Puts

Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership.

If the investor was strongly bullish, they would prefer to look at strategies like a long call, a bull call spread or a poor man’s covered call.

Investors would sell a put on a stock they think will stay flat, rise slightly or at worst not drop too much.

Cash secured put sellers set aside enough capital to purchase the shares and are happy to take ownership of the stock if called upon to do so by the put buyer.

Naked put sellers on the other hand have no intention of taking ownership of the stock and are purely looking to generate premium from option selling strategies.

The more bullish the cash secure put investor is, the closer they should sell the put to the current stock price.

This will generate the most amount of premium and also increase the chances of the put being assigned.

Selling deep-out-of-the-money puts generates the smallest amount of premium and is less likely to see the put assigned.

Maximum Gain

The maximum gain is equal to the premium received.

No matter how high the stock goes, this is all the investor can achieve.

Strongly bullish investors would be better suited with more bullish strategies.

Maximum Loss

The maximum loss will occur if the stock goes to zero and for that reason the risks of selling cash secured puts is very similar to outright stock ownership.

The total maximum loss is equal to the strike price x 100 less the premium received.

Assuming an investor sell a 50 strike put for $1.50 the maximum loss would be:

50 x 100 – 150 = $4,850

If the stock was trading at $53 at the time, then an investor purchasing 100 shares would have a maximum loss of $5,300.

For this reason, there is slightly less loss potential with cash secured puts, but the loss potential is still significant.

Breakeven Price

The breakeven price is calculated by taking the strike price, less the premium received.

Using our example of a 50 strike put sold for $1.50, the breakeven price would be:

50 – 1.50 – 48.50.

When Should You Sell Cash Secured Puts?

Obviously, we want to sell cash secured puts when we have a neutral to slightly bullish outlook on a stock, but there are a few other things to consider when determining the best time to sell cash secured puts.

Firstly, implied volatility is important because this determines how much premium is received for selling the put.

High implied volatility means high option premiums, so the best time to sell cash secured puts is when implied volatility is high.

Usually this occurs after a stock has seen a reasonably big drop which can also mean the investor is able to purchase the shares at a low price.

Personally, I like to look for high quality stocks (think Dow Jones Industrial stocks) and ETF’s that have experienced a big price decline and have reached oversold levels as measured by the Relative Strength Index.

In terms of time frames, some traders will look to sell weekly puts while others will look at 30-45 days to expiration as a sweet spot.

30-90 days is an acceptable range for the days to expiration and as you’ll see shortly, so is selling 12-month puts via a strategy known as a Dividend Strip.

What Is The Risk In Selling Cash Secured Puts?

The risks in selling cash secured puts is very similar, just slightly less, than outright stock ownership.

Any time you start thinking that there isn’t that much risk because Tesla can’t go bankrupt or Apple can’t go bankrupt, just remind yourself of people who sold cash secured puts on Lehman Brothers and Bear Stearns.

Companies can and do go bankrupt sometimes and selling cash secured puts is great when things are going well, but when things go bad, they can go really bad.

For that reason, investors should only sell puts on companies with a strong fundamental and technical outlook.

Look for companies with a competitive advantage and rising earnings per share.

One trap investors can fall into is thinking that a stock has dropped and “surely it can’t drop much further”.

That is false thinking and something you should try to avoid. Just because something is oversold, doesn’t mean it can’t get more oversold.

One very quick rule of thumb to avoid disaster is to stick to companies that are trading above their 200-day moving average.

Why Sell Deep In-The-Money Puts?

Why might an investor sell deep in-the-money puts?

Let’s take our earlier example of a stock trading at $53.

Instead of selling a put with a strike price of $50, a strongly bullish investor might consider selling an in-the-money put.

For example, if the investor has a strong opinion that the stock will rally, they might consider selling a put at $55 or even $60 if they are very bullish.

What happens when you sell a put in-the-money?

Firstly, more premium is generated which gives the investor a higher return potential (albeit with needing the stock to rise further).

While an investor selling an out-of-the-money put might have a more neutral outlook, an investor selling an in the-money put has a much more bullish outlook.

The other reason to sell in-the-money put would be to ensure (or at least increase the likelihood) that the put will be assigned and the put seller will take ownership of the stock.

Selling Weekly Cash Secured Puts

What about selling weekly cash secured puts? Typically, I prefer 30-90 day put sales, but let’s take a look at what it’s like to sell weekly puts.

We know that time decay is the most severe in the last week of an options life, so surely selling weekly cash secured puts provides the highest return?

Yes, in fact it does, but it also requires a lot of active management which may not suit some traders.

The other downside of selling weekly puts is that while the time decay is faster, the total amount of premium generated is less which provides less of a cushion in the event of a move lower in the stock.

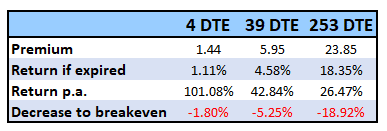

The table below compares weekly, 30 day and 9 month put sales using AAPL as our example stock:

As you can see, the shortest term puts provide the highest return on an annualized basis, but the lowest protection (only 1.80% decline to the breakeven point).

The 9-month put provides a much lower annualized return of 26.47% but also gives an -18.92% margin for error on the downside.

It’s up to each individual investor to find a style that suits their risk tolerance and requirements.

INTC Cash Secured Put Example

Let’s take a look at an example from January 7th using Intel (INTC).

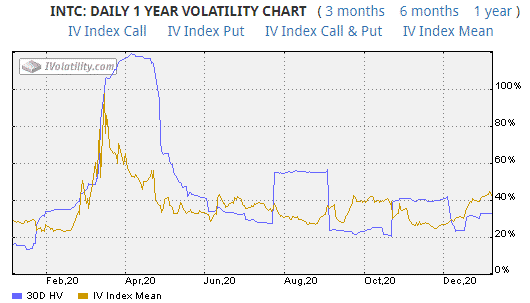

At the time, INTC had a very high IV Rank at 84% which means it is a good time to be selling option premium.

You can see below that the implied volatility (yellow line) was at the highest level we had seen since April.

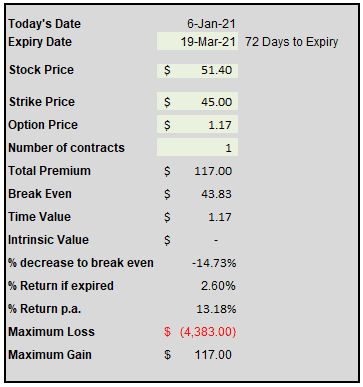

With the stock trading around 51.40, the put I was looking to sell was the March 19th 45 strike put which was trading at $1.17.

Here are the full details:

Trade Date: January 6th, 2021

Underlying Price: 51.40

Trade Details:

Sell 1 INTC March 19 45 put @1.17 (delta 20)

Net Credit: $117

Capital at Risk: $4,383

Plugging the details into my spreadsheet, I want to double check that the return potential is acceptable.

The annualized return comes in at 13.18% which is acceptable to me for that level of risk.

A trader selling this put would have an obligation to purchase 100 shares of INTC at a price of $45 if called up to do so.

t’s important to remember that even if the stock drops to $30 between now and March 19th, the trader still has to buy INTC at $45.

Let’s say INTC does fall below $30 and the trader is assigned 100 shares. The total cost would be:

100 x 45 – 117 = $4,383.

This gives an effective purchase price of $43.83 which was 14.73% below the stock price at the time.

Not only do you need to be okay with purchasing the stock at this price, you need to have the money reserved to make the purchase.

The main risk with the trade is similar to outright stock ownership. If the stock falls precipitously, the trade will suffer a loss, however the loss will be partially offset by the premium received for selling the put.

Cash secured puts are a fantastic way to generate a return on a stock the trader is happy to own.

Adding A Delta Hedge

If you recall, the main reason for selling cash secured puts on INTC was because of the high IV Rank.

Selling puts is a positive delta strategy, so the trader must have at least a neutral to bullish outlook on the stock.

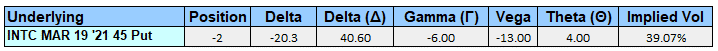

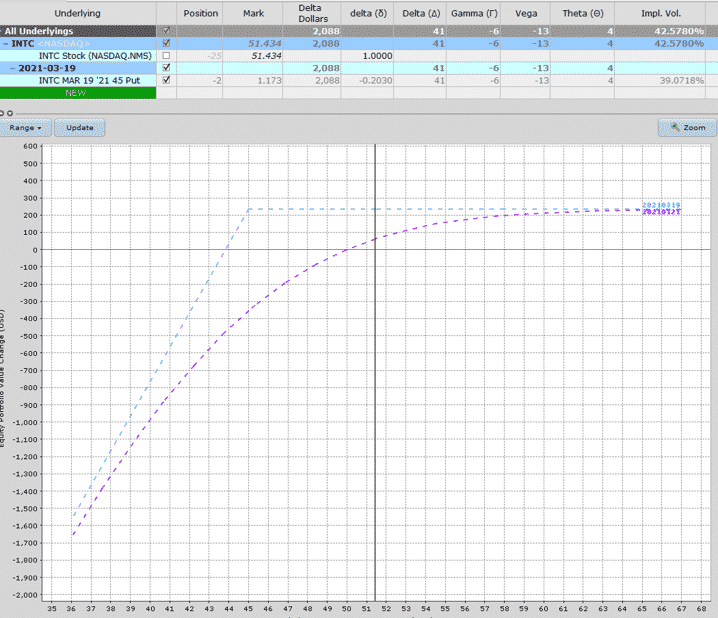

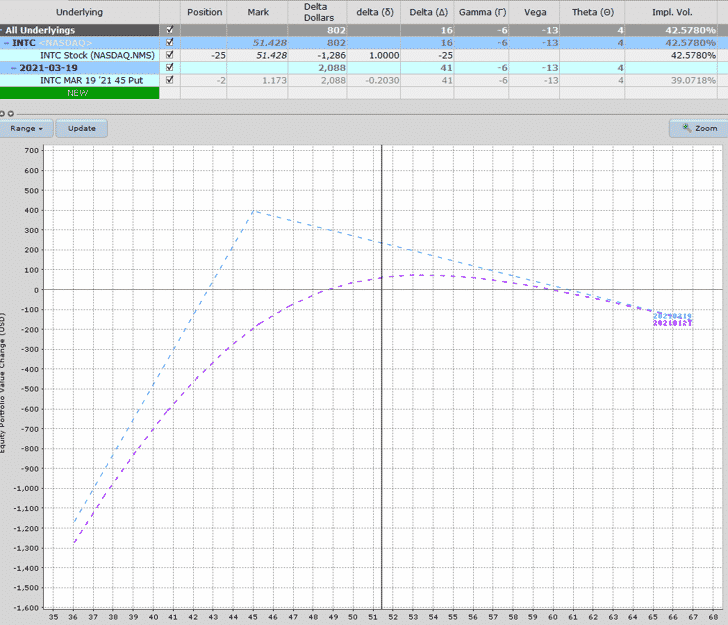

Here you can see the greeks for the cash secured put assuming we sold two puts:

The delta of the position is 41, so selling this put is equivalent to owning 41 shares of INTC.

What if the trader wants to sell the high implied volatility on INTC, but doesn’t want to take on too much delta?

Maybe the trade is not super bullish on INTC.

In this case, the trader can sell short some shares to hedge the delta exposure.

The trader could fully hedge the delta by selling 41 shares, or they could do a partial hedge.

In this case, I opted for a partial hedge of 25 shares.

Here you can see the cash secured put trade before an after the delta hedge.

BEFORE DELTA HEDGE

AFTER DELTA HEDGE

A few things to notice here:

1. Net delta has dropped from 41 to 16

2. Risk on the downside has been reduced. For example, looking at the interim line, if INTC dropped to 45, the loss would be around $350 – $360 without the delta hedge and only $200 with the delta hedge.

3. Profit will be lower in the event of a big rally.

Selling cash secured puts and adding a delta hedge is a favorite strategy of mine if I’m not super bullish on the stock, but want to take advantage of the higher than normal implied volatility.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

You put a figure of VXX put, not INTC put.

Thanks. Fixed.

What do you mean when you talk about a strategy known as a dividend strip? You mention it as part of selling a longer dated put.

Hi John, I’ll have an article on the Dividend Strip coming shortly.