Delta hedging is a crucial topic for option traders to understand, so today, we will take a deep dive into that topic.

Contents

- Introduction

- Hedging Options Using Delta

- How Often Should You Hedge?

- What Are The Benefits And Drawbacks Of Delta Hedging?

- Conclusion

Introduction

When trading options, there is always an element of risk that traders and investors need to deal with.

Being a successful trader means exposing yourself to as much upside as possible, while managing the risk of a position going against you.

There are many ways traders can protect themselves from price risks such as ensuring they have adequately analysed the profit potential of a position, maintaining appropriate position sizing, etc.

One of the most effective ways to manage price risk is by hedging your position.

Put simply, hedging your position is the process of eliminating, or at the very least minimizing, the price risk of a position and/or entire portfolio.

Typically, this involves eliminating the directional aspect of a position, sometimes referred to as price risk.

To eliminate price risk a hedge is taken whereby a trader will enter a position with the opposite direction of a very similar asset.

Hedging Options Using Delta

In options trading, delta refers to the relative price movement of an option, given a one point move in the underlying.

That is to say, delta refers to how much the option will change for every one point move in the price of the stock.

When going long calls, the delta value will fall between 0.0 and +1.0.

When going long puts, the delta value will fall between 0.0 and -1.0.

This information is used to dictate how much of the underlying you will need to buy/short in order to hedge your position effectively.

When you have a long position, you can reduce directional exposure by adding negative delta strategies to your position.

Likewise, for short positions, meaning negative delta, you reduce directional exposure by adding positive delta strategies to your position.

Say you had purchased a single call option with a delta of 0.55 and you wanted to hedge your position. To do so, you would need to short 55 shares.

The way this is determined is by multiplying the Delta value by 100, since each option’s contract will have 100 shares.

The opposite is also true. if you were to sell a call option with the same delta, you would instead buy 55 shares.

While calculating the number of shares to buy/sell for a hedge seems straight forward, it is actually a bit more complicated because the value of delta is always changing, so your position will need to change over time.

Say we use the previous example of buying a single call option with a delta of 0.55 and after you’ve hedged (by shorting 55 shares) the market moves and delta is now 0.65.

Due to the increase in delta, you would need to sell a further 10 shares.

Delta Hedging Examples

We’ll go through a detailed example of how to determine your hedging value as and when delta changes:

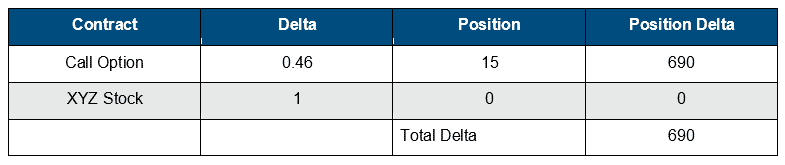

- A trader buys 15 call options on XYZ which has a delta of 0.46. This leaves them with a position delta of 690 (15 * 0.46 * 100).

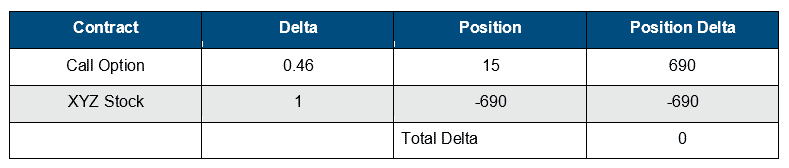

- To hedge the position, the trader sells 690 shares of XYZ, resulting in a position delta of zero.

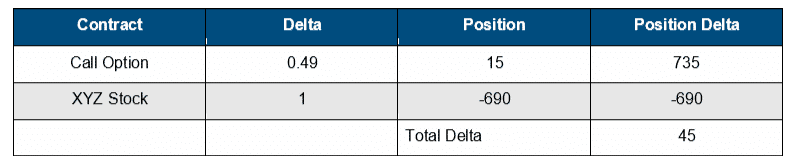

- After a positive day on the market, XYZ shares increase, resulting in the delta of the call option increasing to 0.49. This means the trader’s call options are now worth 735 deltas (0.49 * 15 * 100), while their short XYZ position is only -690, resulting in a net position delta of 45 (735 – 690).

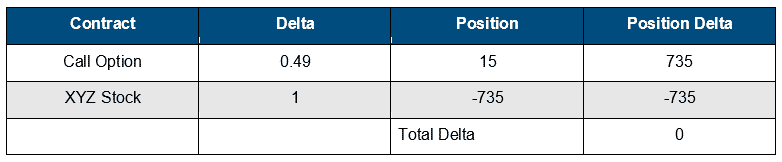

- To compensate, the trader sells an additional 45 shares of XYZ stock, returning position delta back to 0.

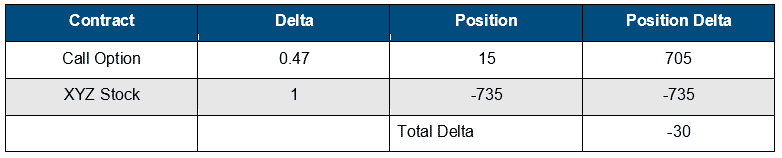

- The market moves again, however this time XYZ shares go down, resulting in an option delta of 0.47. This means the trader’s position of 15 calls is now 705, resulting in a position delta of -30.

- As the trader’s position is now showing a negative position delta (-30) the trader will need to buy back 30 shares of XYZ to return the delta to 0.

As you can see from the above example, all the trader needed to focus on to maintain the hedge was to observe changes in delta as a result of changes in the price of the underlying.

In practice however, there are several variables that can impact delta and therefore your hedge position.

The first as we’ve already seen, is underlying price. The next variables are interest rates, time and volatility.

However in all cases, despite whatever combination of variables affect delta, the process for hedging remains the same.

How Often Should You Hedge?

Given there are four variables affecting delta, it means there will be a high likelihood of delta changing often so the question of how often a hedge should be adjusted will come up.

In an ideal world, a trade would be hedged instantly whenever delta became non-zero.

In practice however, this isn’t feasible as the transaction costs required to constantly respond to changes in delta position would make this an incredibly costly exercise, eroding any potential benefit of hedging the position in the first place.

You should aim to devise your hedging strategy before you enter the trade, such that you have criteria for when to adjust the hedge, balancing out the need to protect you from price risk with the profit erosion that will come from each hedge adjustment.

There are a couple of good rules of thumb that I use:

- Hedge at a specific time each week, for example every Friday afternoon before the close.

- Hedge at a specific level of delta. For example, we could set a rule to only hedge if net position delta reaches plus or minus 30.

What Are The Benefits And Drawbacks Delta Hedging?

The main benefit of delta hedging is that it allows traders to hedge price risk in their portfolio and focus on the all important time decay.

Used effectively, traders can protect profits in the short term without having to unwind a long term position, allowing them to make bets where they anticipate strong, but risky moves.

The main drawback of delta hedging is that the position needs to be constantly monitored and adjusted to ensure the position is adequately hedged.

Due to this, there might be a high number of transactions required, resulting in profit erosion or overall portfolio losses from trading fees and trade execution slippage.

Here you can find an example of a trade where I used delta hedging. As it turned out, the trade would have been better without the delta hedge, but it’s an interesting case study in any case.

Finally, be mindful when hedging with options which can be particularly problematic due to time value.

As the expiration date of an option draws closer, there is less time for a trader to make a profit so the option loses time value.

When an option has high time value, it attracts higher premiums than options with a lower time value.

So as time goes by, premium will be affected which can result in the need for increased delta hedging in order to maintain a position delta of zero.

Examples

Let’s look at an example using an iron condor trade and look at a couple of ways we could delta hedge.

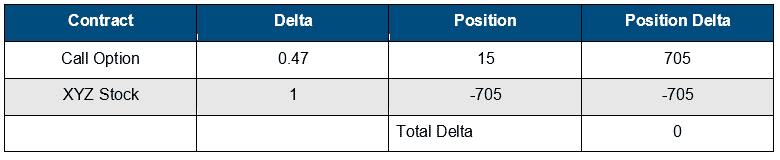

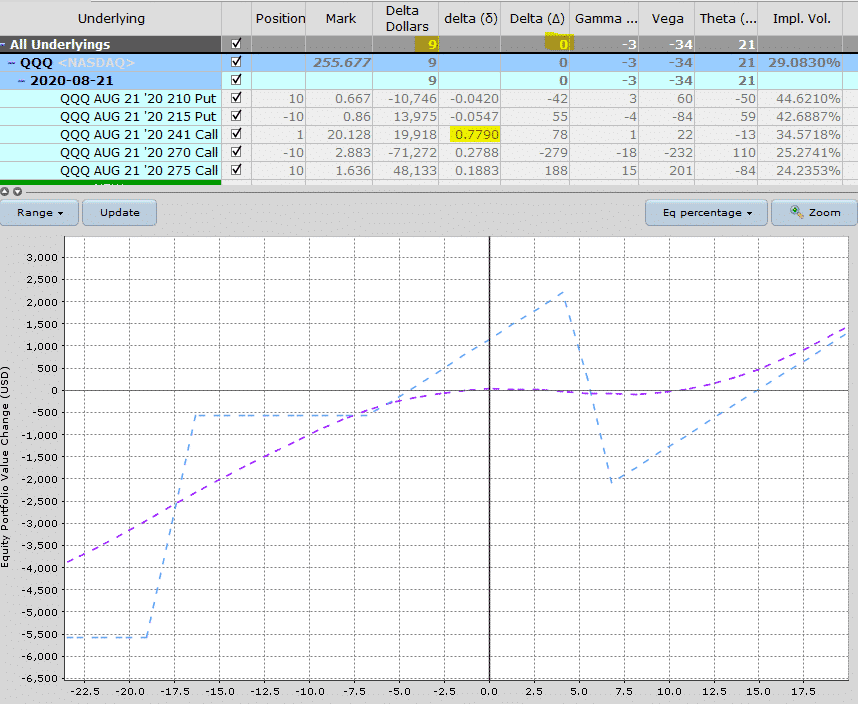

Here we have a QQQ iron condor. Let’s assume this was put on a few weeks ago and the index has rallied up and is putting the call side under pressure.

We can see in the payoff graph that the position is skewed and we can also see that net delta is -78 and delta dollars is -19,923.

Adjusting the trade might make sense here, but let’s assume the trader is very confident that QQQ won’t break above the short calls at 270.

Instead of adjusting the iron condor, they want to hedge some of the delta or price risk that would come from any further rally in the Nasdaq.

Let’s look at a couple of different ways they could do that.

BUYING SHARES TO HEDGE THE DELTA

With the net delta of the iron condor at -78, the trader could buy 78 shares of QQQ which would neutralize the delta and eliminate the price risk in the short-term.

Through buying 78 shares, the trader has created a position with 0 net delta and delta dollars of just 37.

Notice also that the T+0 line is much flatter at the current price.

Of course, the position won’t stay delta neutral for long and as the underlying stock starts to move again, the position will start to pick up either positive or negative delta.

The expiration graph also looks a little weird but don’t let that scare you off.

With a hedging strategy like this, if QQQ starts to drop again, the hedge is no longer needed and you can slowly sell the shares back at a small loss, returning the iron condor closer to it’s original form.

Where the trader decides to remove the delta hedge is personal preference, but on a trade like this if QQQ dropped 3-4% I would look at removing some or all of the hedge.

In this case we would lose some money on the hedge, but we don’t mind too much because we’ve been able to keep the iron condor open and hopefully still make a good profit, albeit slightly less than we might have originally hoped for.

There is also nothing stopping the trader from hedging only some of the delta. They don’t necessarily need to hedge all of it.

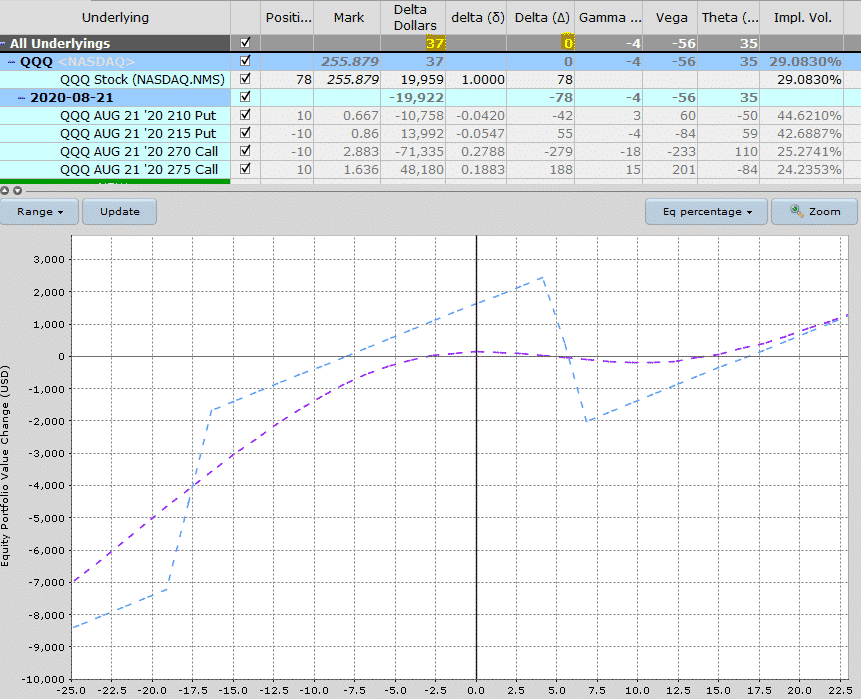

Here is the same trade with a 50% delta hedge rather than 100%.

Delta has dropped from -78 to -39

Through buying 39 shares, the trade has hedge half of his delta risk which is also a valid idea.

The trader could hedge 25% or 75%, any amount really and it’s up to the trader how much protection they want and how much they are willing to pay.

USING OPTIONS TO HEDGE THE DELTA

Hedging with shares is nice and easy because there are no other greeks to worry about.

39 shares = 39 delta and 78 shares = 78 delta that’s it, and those figures are constant. There’s no need to worry about vega, gamma or theta when hedging with shares.

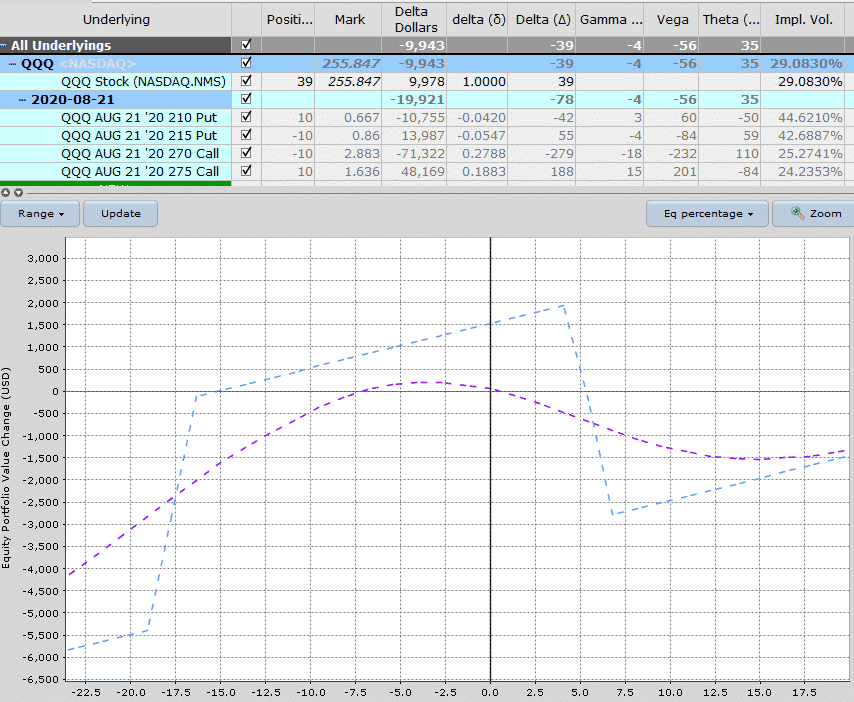

Still, the trade could also choose to delta hedge using call options in much the same manner.

Buying a 78 delta call also neutralized the delta and flattens out the T+0 line.

In this case however, there has also been an impact on the other option greeks.

Vega has been reduced from -56 to -34 and theta has also dropped from 35 to 21.

I’m not saying one version is better than the other, but wanted to highlight the differences.

Just like the previous example, the trader could decide hedge just half of the delta by purchasing a 39 delta call (there was no 39 delta available, only 38 or 40).

There you have an example of how to delta hedge on the call side.

The same thing can be done on the put side via selling shares or buying puts. Not your broker may have some restrictions around short selling shares.

Conclusion

Delta hedging allows traders to eliminate or at the very least, significantly mitigate price risk for a particular position or even an entire portfolio.

To execute a delta hedge, traders need to buy or sell an amount of underlying equal to the option position size x delta x amount of underlying per option contract.

As delta changes, traders will need to buy and sell underlying to bring their net position delta to zero.

Traders will need to devise an adequate hedging strategy before entering a position, as in practice it is ineffective to constantly adjust the underlying position with every move of the market.

Too many hedging adjustments will erode profits and mitigate any benefits the trader would have derived from hedging in the first place.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks Gavin, for the great articles. Another benefit to Delta hedging, using stock for example, could be to help us reduce the variance of our returns. For example, if we think that IV is greater than realized volatility, we can sell iron condors or strangles/straddles which initially have Delta=0, to take advantage of both vega and theta decay. Over a large number of trades we expect an average positive return but the variance of returns should be reduced if we systematically Delta hedge (and lower variance of log returns results in greater wealth creation). Obviously, systematically Delta hedging will introduce a steady stream of transaction costs, so perhaps there is an optimal amount of hedging based on the trade-off between returns and variance. Any thoughts would be appreciated!

Hi Nick, well said and yes you can get into a situation where you over-hedge. It might be worth setting a pre-defined delta level where you will adjust or a time based rule where you adjust delta once per week. Hope that helps.