Today’s trade review is a bull put spread example on PYPL that initially came under pressure but we were able to adjust our way out of trouble make it a winner.

Here are the details:

Trade Date: October 15th, 2020

Details:

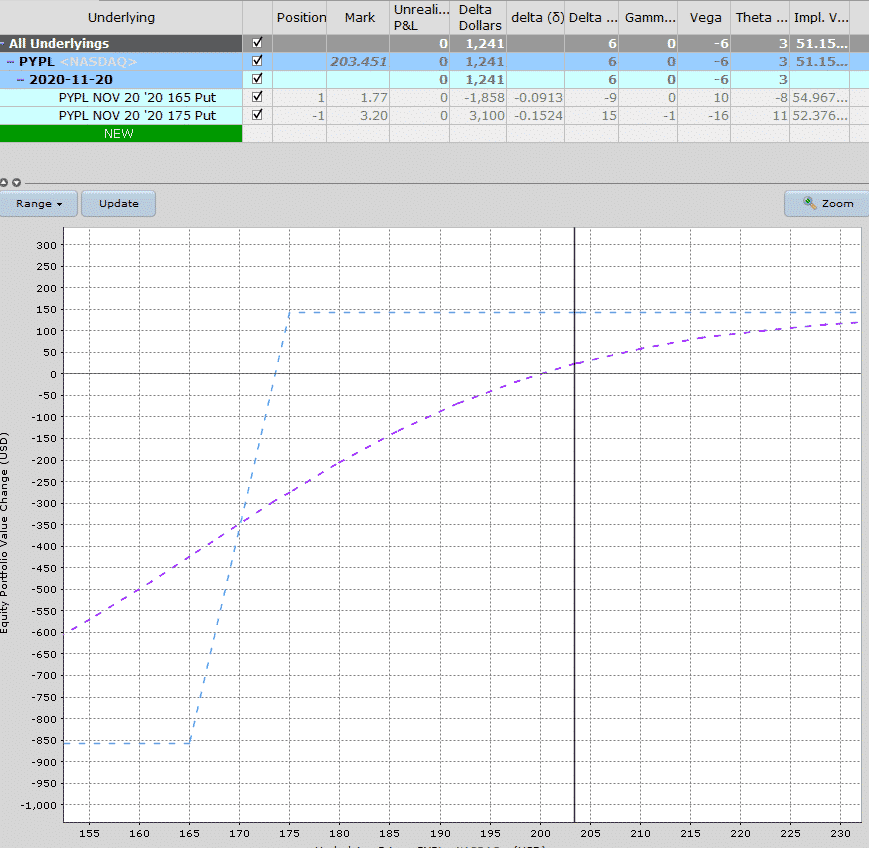

Sell 1 PYPL November 20th $175 put @ $3.20

Buy 1 PYPL November 20th $165 put @ $1.77

Premium: $143 Net credit

Max Loss: $867

Return Potential: 16.49%

Stop Loss: 1.5x premium received ($215)

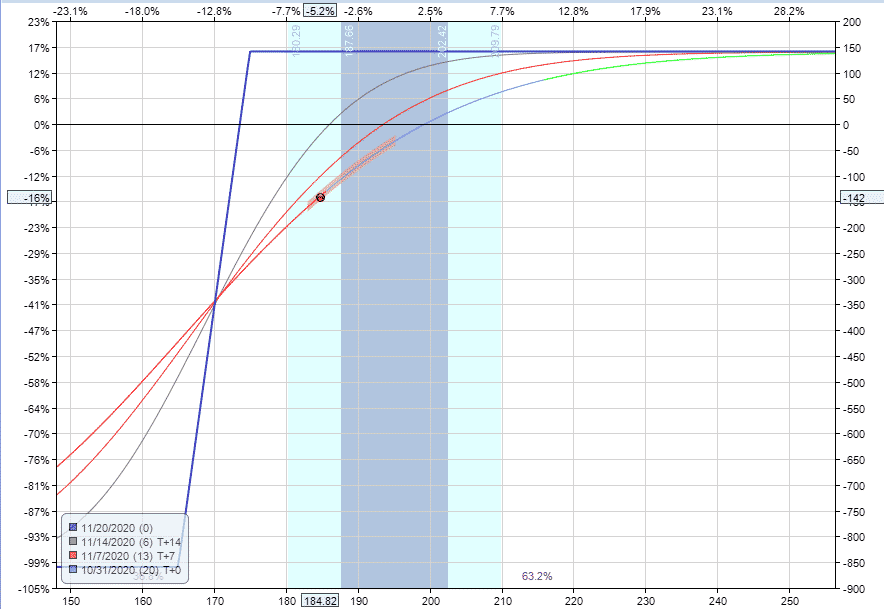

On October 30th, PYPL dropped to 184.82 and the delta of the short put had blown out to 33 (a definitely warning sign), but the stop loss had not been hit.

The trade was down $142 at this point, so we weren’t stopped out, but needed to make an adjustment.

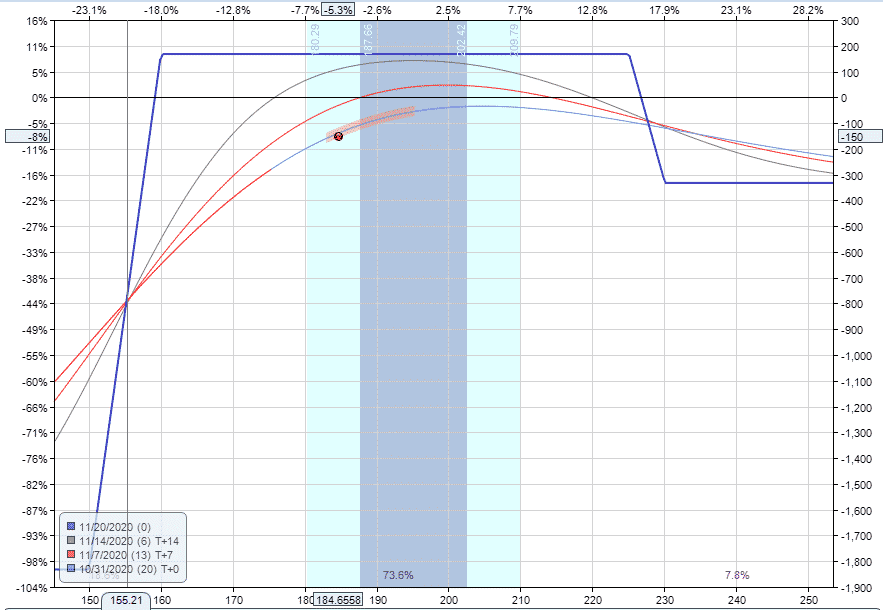

The adjustment was to roll the put spread down from 175-165 to 160-150 and increase the contract size to 2. At the same time, we sold a call spread at 225-230.

Before Adjustment

After Adjustment

Delta remained more or less the same at +11, but theta increased from 3.85 to 12.54.

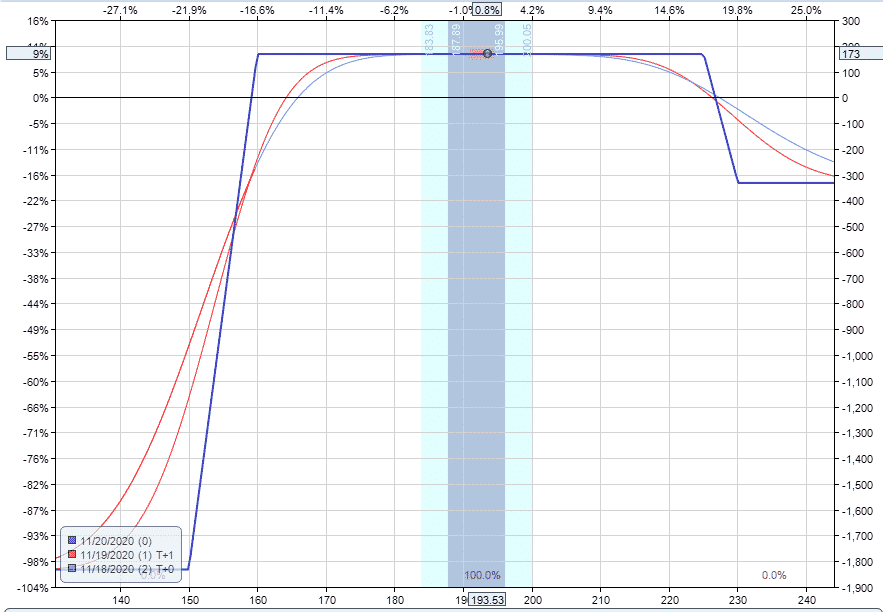

On November 20th, the spread expired worthless for a gain of $173 or 9.47%.

Full details in the video below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.