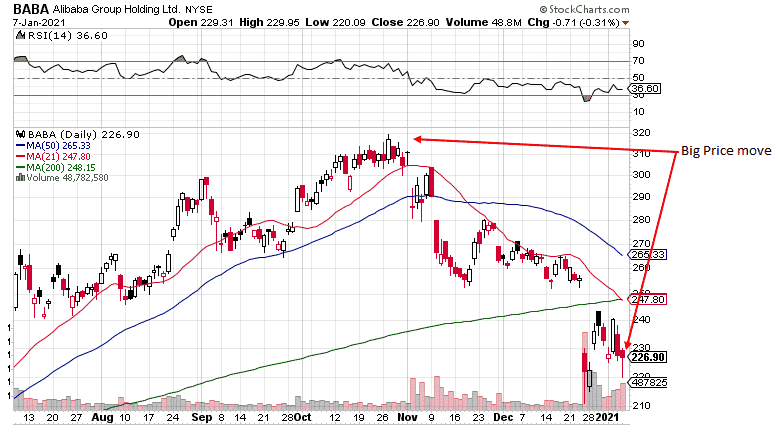

Today, I’ll walk you through a bear call spread example on BABA stock.

I’ll show you how I found the trade setup and why it is structure this way, as well as how to set a stop loss.

A bear call spread is a very common trade for options traders. It has a directional bias as hinted in the name and also benefits from time decay, so it is popular with income traders.

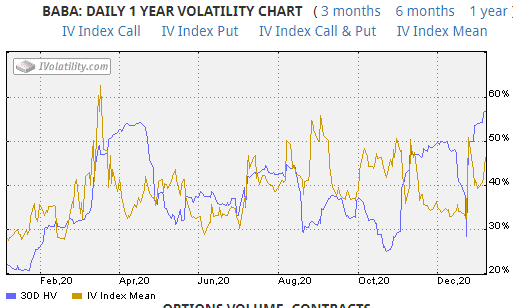

The fist thing I noticed was that BABA had a very high IV Rank due to some recent volatility in the stock price.

This makes it a good candidate for option selling strategies.

Per Interactive Brokers, the IV Rank was 89% which I then verified via ivolatility.com.

The setup for the bear call spread is pretty straight forward:

Date: January 7th, 2021

Underlying Price: 228.82

Trade Details:

Sell 1 BABA Feb 19 260 call @3.85 (delta 22)

Buy 1 BABA Feb 19 270 call @2.55 (delta 16)

Net Credit: $140

Capital at Risk: $860

Return Potential: 16.28%

Stop Loss: If BABA stock breaks 250

Full details and explanation in the video below:

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.