Contents

Overview

iVolatility.com provides information for equity options traders that help them analyze trades and manage risk.

They have a massive database that allows for backtesting and analysis.

They claim that it is the most complete and accurate source of data on the internet for analyzing correlations and implied volatility.

The interface is simple to use and the data can be accessed via direct feed or through an internet browser.

The services cater to active or professional traders who want access to more detailed information than what might be provided through their brokers.

They have over 70,000 worldwide who use their database to help make decisions when trading on every major exchange.

iVolatility has a very high-profile list of clients including the CBOE, the NYSE, as well as many major investment banks and hedge funds.

What’s Included?

Analytical Tools

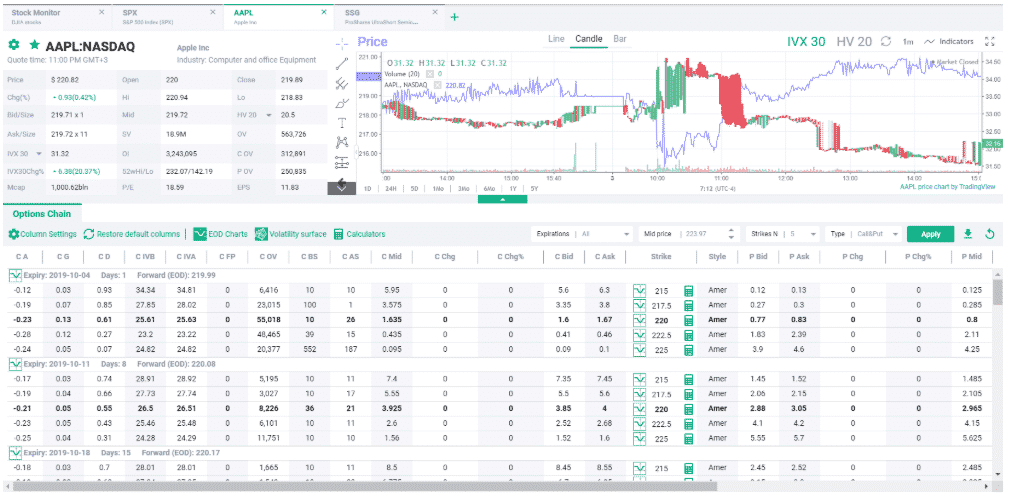

The analytical tools that are included with a subscription are an Interactive Options Chain, Stock Monitor, Underlying Sentiment Analyzer, Simple Strategy Analyzer, Historical Data Charts, Advanced Options, IV Graph, and INVX Volatility Monitor.

The Interactive Options Chain is fully customizable with a variety of metrics to choose from.

Once you have it configured the way that you want, you can download the chain to examine with other types of software, or keep it in iVolatility and navigate over to various types of calculators to look deeper into the chain.

The summary view displayed above the option chain is also fully customizable.

The Underlying Sentiment Analyzer is also a very interesting tool that iVolatility offers. It’s based on a variety of data and allows you to identify stocks that are particularly bullish/bearish or volatile/quiet.

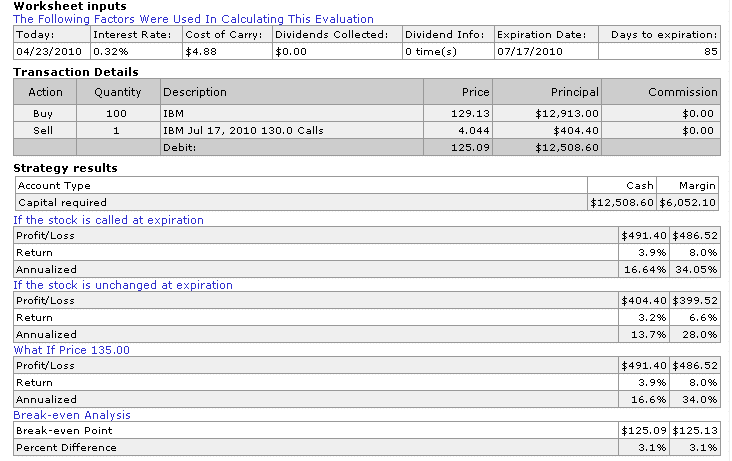

The most important tool for an individual trader though is the Simple Strategy Analyzer. There are three different strategies that it will analyze and based on the inputs, it will determine what your returns will be in several different scenarios.

The strategies that it analyzes are naked put writing, covered call writing, protective put purchases, and equity collars.

Below is an example of a covered call analysis.

This is a great view and really helps investors understand the trade that they’re about to enter.

In this example, we can see that they are buying 100 shares of IBM at $129.13 and use a covered call to lower their cost-basis to $125.09 per share.

This gives them some breathing room on the downside by lowering the break-even point but also limits the upside–the potential profit is capped at $491.40 on a cash trade.

While this is a good tool, I actually have an excel version that is much easier to use. You can download it below:

Scanning Tools

iVolatility offers a variety of scanning tools as well.

They include an Underlying Volatility Ranker, Simple Strategy Scanner, Spread Scanner, RT Spread Scanner, RT Options Scanner, and a Correlation Trading Scanner.

The Simple Strategy Scanner is a particularly useful tool and helps investors find that needle in the haystack.

The scanner will look for opportunities in naked puts and covered calls.

The Spread Scanner goes a bit deeper and will help investors and traders identify opportunities with two-leg strategies.

“You can scan for trading opportunities using criteria based on price and implied volatility of real market contracts and on specific indicators like Call/Put volume and Relative volatility.

One of the service’s features is an ability to automatically create delta-neutral strategies, or strategies with user defined delta.”

This is a really helpful tool and iVolatility supplies a 17-page pdf that explains in detail the features and how to use them.

The results of the scan can be viewed in tabs or graphically and of course, are available for download.

Calculators

iVolatility also has 3 calculators and all of them are crucial.

They have an Options Calculator, a Probability Calculator, and a PnL Calculator.

The Options Calculator provides a fair value and will display all the Greeks for any option.

You can also enter your bid price and the calculator will show you a theoretical Implied Volatility.

The Probability Calculator is incredibly detailed and has 14 different volatility metrics to choose from and will return 8 different probabilities such as the probability of the price finishing below a target, above a target, or between two target prices.

They summarize it best.

“Our probability calculator stands out from the rest in three aspects: flexibility of inputs and outputs, accuracy of calculations, and consideration of drift.

Our calculator allows for a wide range of forecasting volatility inputs, including ATM Volatility which is automatically populated for the contract expiring on your chosen future date…

Lastly, we have one of the few products which factors in drift.

Drift is a complex concept, but simply put: While volatility is nondirectional, interest rates and dividends effectively give underlying’s direction over time.

This “drift” may seem inconsequential on an ad hoc basis, but over time, factoring it in gives you an advantage over those who do not factor it in.”

Summary

iVolatility.com is an incredibly robust system and would be helpful to anyone who is serious about their option-trading strategies and gaining a deep understanding of the risk and probabilities of their trades.

They offer 4 subscription tiers.

The lowest level is only $29/month and gives you access to their Futures tools.

The most comprehensive subscription plan is $195/month which gives you full access to all of their tools including real-time monitors and data streams.

This is a reasonable price given the amount of information that they provide but at this stage I’m sticking with the free tools.

Because of the pandemic, they are also offering two free months to new subscribers.

If you sign up for quarterly payments they are also offering 50% off those payments.

Given the extreme levels of volatility that we’ve been seeing lately, it’s great to see they are trying to help traders navigate through this period by offering their tools and services at a discounted rate.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.