Contents

Each year, more and more people are drawn into the world of investing, excited to make their fortune, and live a life on their terms.

Unfortunately, most fail in this endeavor, not realizing that many forms of investing, such as options and futures trading, are zero-sum games.

A zero-sum game is one where somebody’s gain is another person’s loss.

For example, if I buy an options contract, I believe it will increase in value – likewise, the seller of the contract believes it will decrease in value.

Only one of us will be right and one of us will profit and the other will suffer losses.

Accordingly, since you will only profit if you are right and another person is wrong, it means you must have a contrarian view to theirs.

Unfortunately, it is not always enough to simply have a contrarian view to an individual investor, but often it is required on a more macro scale as well.

Take for example a market where most investors are bullish on equities and you share that view.

You would like to profit from rising equity prices using an options contract, so you decide to buy a long call.

For a long call to exist in the market place, it means that somebody out in the world would need to believe stocks will go down and are willing to sell you a long call.

Since most people are bullish and long equities, you may not be able to buy a long call at a reasonable price, let alone have enough volume to buy one in the first place!

Therefore to get the best prices, deals, and opportunities that deliver the best returns, you need to be willing to bet against the market consensus.

Contrarian Investing Is Harder Than It Sounds

Most people understand that to make good money in investing you need to be able to be contrarian and act with conviction.

In practice, however, most investors fail to do this as being a contrarian investor is a lot harder than it sounds.

This is due to psychological biases, such as the false consensus effect.

In the false consensus effect, investors tend to wrongly think that others believe what they believe and will do what they do.

If an investor believes equities will rise over time, due to the false consensus effect they will also believe that other investors believe this as well.

Accordingly, they may believe they are acting in a contrarian manner when in fact, they are actually following the herd.

Another factor in limiting contrarian behavior is ‘herd mentality.’

Human beings have evolved over millennia to work together in packs as it is safer to be in a crowd than on your own.

As a result, humans find it difficult to make decisions that make them stand out from the crowd as this risks social shaming, ridicule, and isolation.

This is compounded by the human tendency to avoid painful experiences, such as failure and public humiliation.

When a contrarian makes a call and gets it wrong, they suffer significantly more as they cannot blame the outcome on anybody but themselves.

There’s an old saying amongst corporates that “nobody ever got fired for hiring IBM” because since every other company did it, if something went wrong the individual procurement manager can’t be blamed.

In order to be a contrarian investor, investors must first be aware that these biases exist within them and to learn how to avoid and mitigate them.

Contrarian Investment for 2020 and Beyond

2020 has brought with it a fundamental paradigm shift in the investment landscape.

With widespread economic shutdowns, monetary printing, populism, and low-interest rates the world and therefore investment markets face a very different future compared to the last decade.

In order to invest as a contrarian in 2020 and beyond, an investor must start with understanding the current consensus view for the economic landscape:

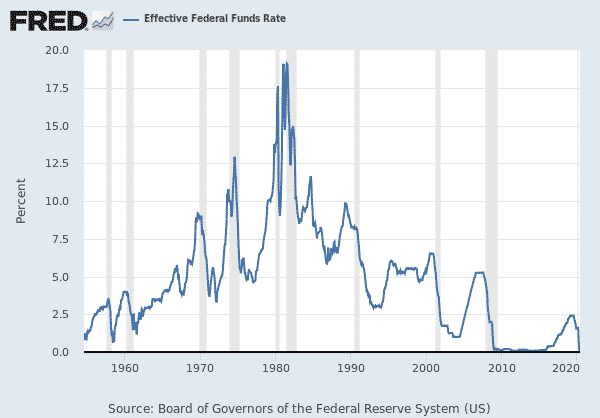

1. Zero-Bound Interest Rates For Longer

In June of 2020, US Federal Reserve chairman Jerome Powell made a media statement that “We’re not thinking about raising rates. We’re not even thinking about thinking about raising rates”.

The consensus view amongst the Federal Reserve, economists, governments, and investors is that interest rates will stay where they are for many, many years.

Low-interest rates drive up asset prices as it provides the country with low borrowing costs which allows individuals, corporations, and governments to take on more debt.

Interest rates are also used in the discounted cash flow calculations that are used to value financial assets, such that low-interest rates mean that investors are willing to pay more for financial assets.

Accordingly, an investor seeking to be contrarian might take the opposing view, reasoning that cheap debt might fuel a consumption spree that stokes inflation, forcing the Federal Reserve to raise interest rates.

To profit from this, some contrarian ideas investors could consider are:

• Shorting bonds as bond yields fall when interest rates go up

• Shorting equities as rising interest rates will worsen discounted cashflow and therefore valuations

• Going long gold as rising interest rates devalue the currency

2. Money Printing

In response to widespread economic shutdowns, many countries around the world have had to print currency to make up for lost incomes and to be able to meet liabilities and other obligations.

In addition, governments have also printed money in order to give it directly to its citizens, to support them during times of widespread unemployment as well as printing money to buy government debts and other financial assets.

Reserve Banks face the difficult challenge of maintaining a delicate balance between staving off economic collapse and avoiding hyperinflation.

Most investors believe that these money printing programs will end once countries exit government-mandated shutdowns.

A contrarian view might hold that the long-term economic damage brought about by even a few months of lockdown will require many years to be resolved.

Image credit marketplace.org

Image credit marketplace.org

This could be due to a chain reaction of company bankruptcies and defaults as businesses that were already on the brink of collapse before the shutdowns are unable to stay afloat.

To prevent systemic collapse governments may be forced to continue printing money, bailing out both individuals and corporations.

To profit from this, some contrarian ideas investors could consider are:

• Buying financial assets that governments are directly buying, such as corporate bond ETFs

• Go long equities and long gold, both of which benefit from additional liquidity

• Short the currency as it becomes devalued relative to other countries that are not printing money

3. Sector Specific investing

The events of 2020 have led to a fundamental shift in consumer and business spending habits.

In response to widespread unemployment and reduced wages, people have cut down on discretionary spending.

In addition, travel restrictions mean that people are staying at home, foregoing spending on activities normally involved in travel.

As a result, stocks in sectors such as hospitality, travel and tourism have been hardest hit, in many cases falling to levels that imply near-bankruptcy or a lack of return to profitable growth for almost a decade or more.

A contrarian investor has to be willing to stare into the face of a rapidly falling stock price in a universally despised sector and overcome the fear affecting the minds of other investors.

For example, many investors fear it will take years for airlines and cruise lines to recover due to international travel restrictions.

However, should a vaccine be made widely available, a strong surge in demand for international travel may occur due to pent up demand from people who previously canceled holidays, overseas celebrations, and business trips.

Likewise, hospitality and tourism stocks could experience a similarly sharp rebound, presenting opportunities for investors with a long-term view and a willingness to bet against the herd.

4. Changing supply chains

In response to increasingly threatening rhetoric against China by the US, coupled with the risks that were laid bare as shutdowns impacted tight, concentrated supply chains, companies are reconsidering their entire end-to-end supply chains.

In particular, they are reviewing their heavy reliance on China as the primary manufacturer of supplies as well as reviewing opportunities to revive onshore manufacturing capabilities in response to government incentives.

The consensus believes that a decoupling from China will take place and countries will increasingly rely on other manufacturing centers as well as local, onshore manufacturing.

A contrarian may take a different view, in that the nature of world economies is that some countries will always be better at producing certain goods compared to others.

This may be due to one or more favorable conditions, such as corporate-friendly laws, good economic environments, an educated workforce, efficient supply chains and logistics, geography, political stability, etc.

Ultimately, regardless of where production is held, the consumer decides if a product will be successful or not, and there is no getting around the fact that price is a major consideration in any purchase.

While individual countries may have the noble intention of securing on-shore manufacturing jobs, these companies may struggle to retain these capabilities once government incentives and subsidies cease and consumers vote with their wallets.

This could mean that within a few short years, particularly as the threat from the Coronavirus disappears, manufacturing could shift back to specialized locations as it did in the decades from 1990 to 2020.

A contrarian might have observed that as a result of the China decoupling narrative, the China market indexes have not experienced the tremendous rebounds that other major economies such as the US stock market has experienced.

Going long Chinese equities could provide lucrative opportunities for those going willing to go against the herd.

Conclusion

Contrarian investing is something many investors agree with but find difficult to put into practice.

This is due to the fact that humans have a number of psychological biases and belief systems which mean that it is difficult to go against the consensus, particularly after failing once or twice.

Investors who are aware of these biases and find ways to mitigate and control them will find themselves with a number of lucrative opportunities.

When considering contrarian investing for 2020 and beyond, investors will need to consider what the prevailing consensus is and then to spot opportunities that go against the crowd.

Some major themes for the years following 2020 are:

1. Interest rates that will remain zero-bound for many years

2. The continued printing of currency by central banks across many economies

3. Understanding sectors that have been hardest hit as a result of restrictions and/or changing consumer spending habits

4. Changing supply chains across the globe and the shift to on-shore manufacturing

In all cases, there are a number of options available to investors willing to be contrarian, all of which might sound uncomfortable at first glance.

This includes shorting equities in response to interest rates rising, going long gold with the believe money printing will not be ending soon, going long airline stocks with a view that a vaccine will be delivered soon, and finally, betting on the world being unable to permanently shift manufacturing away from China.

While it is impossible to know which, if any, contrarian bets might pay off, the one thing that is certain is that in the zero-sum game of investing, the best returns are reserved for those willing to stand apart from the crowd, take the blame when they’re wrong and ultimately, be contrarian.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.