When it comes to trading options for income you can’t go past selling weekly options as they give you the most bang for your buck, but it does involve some risk!

Most people are going to choose to sell weekly put options for income, while other might look at covered calls. They are effectively the exact same trade.

Today, I’m going to cover everything you need to know about selling weekly options.

We’ll look at bullish strategies, bearish strategies and neutral strategies.

Let’s get started.

Contents

Strategy Selection

Strategy selection is vitally important when selling weekly options.

Certain strategies such as short straddles and short strangles involved naked options and can expose your account to unlimited risk.

Not that those strategies don’t have a place in a weekly option strategy, but it’s important to understand the risks of selling naked options.

Let’s dive into some of the main strategies to consider for selling weekly options:

Bullish Strategies

Most traders will start out by selling puts.

These can either be cash secured or naked. Let’s look at the cash secured variety first then move on to naked puts, then covered calls and bull put spreads.

Cash Secured Puts

A cash secured put is a conservative options strategy that can be used to purchase a stock for lower than the current price.

The thing that makes it cash secured is that the trader must have enough available cash in the account to cover assignment if that occurs.

I love using this strategy on high quality, blue chip stocks and preferably ones that pay a nice dividend.

That way, if I do get assigned I can collect some dividends and turn it into a wheel trade by selling covered calls.

I particularly like looking for beating down stocks in the Dow Jones Industrial Index. These are quality companies that generally don’t stay oversold for too long.

Let’s look at an example:

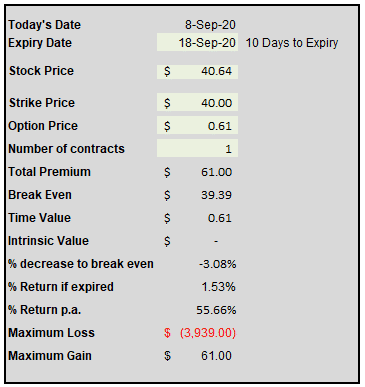

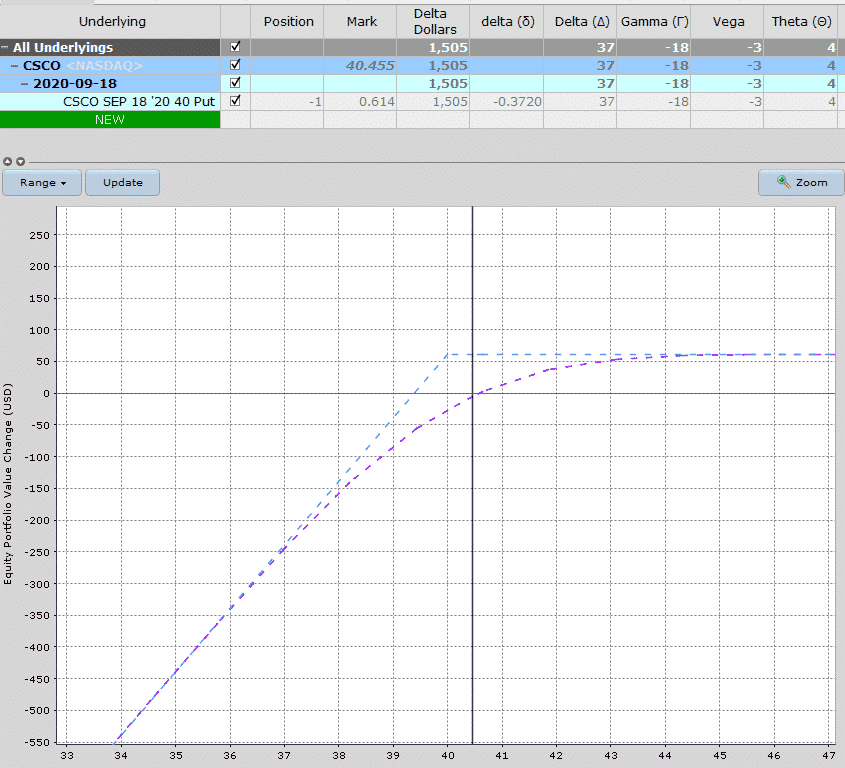

CSCO CASH SECURED PUT

Date: September 8, 2019

Current Price: $40.45

Trade Set Up:

Sell 1 CSCO Sept 18th, 40 put @ $0.61

Premium: $61 Net credit

Capital Requirement: $3,939

Return Potential: 1.53%

Annualized Return Potential: 55.66%

With this trade, there is 10 days to expiration and the potential to earn a 1.53% return in that time which words out to 55.66% per annum.

Remember that if a trader gets assigned on this weekly put, they can take ownership, collect the dividends and sell covered calls against the stock.

You can download this handy excel calculator if you want to analyze weekly cash secured puts.

Naked Puts

Selling naked puts is basically the same as selling a cash secured put with the difference being the trader never has any intention of owning the shares.

If the trader doesn’t have enough capital in their account to cover assignment, they’re basically taking a leveraged exposure.

Let’s look at the same CSCO example but use the margin as the capital requirement rather than the capital required to take ownership.

CSCO NAKED PUT

Date: September 8, 2019

Current Price: $40.45

Trade Set Up:

Sell 1 CSCO Sept 18th, 40 put @ $0.61

Premium: $61 Net credit

Capital (Margin) Requirement: $752

Return Potential: 8.11%

Annualized Return Potential: 296.08%

Those return numbers all look very impressive, but it’s important to remember that the trader’s risk is effectively the same as a cash secured put and percentage losses will also be magnified.

Traders also need to be very careful of early assignment if they do not have enough capital to cover that assignment.

It is very risky to trade naked puts without enough capital to cover assignment.

Covered Calls

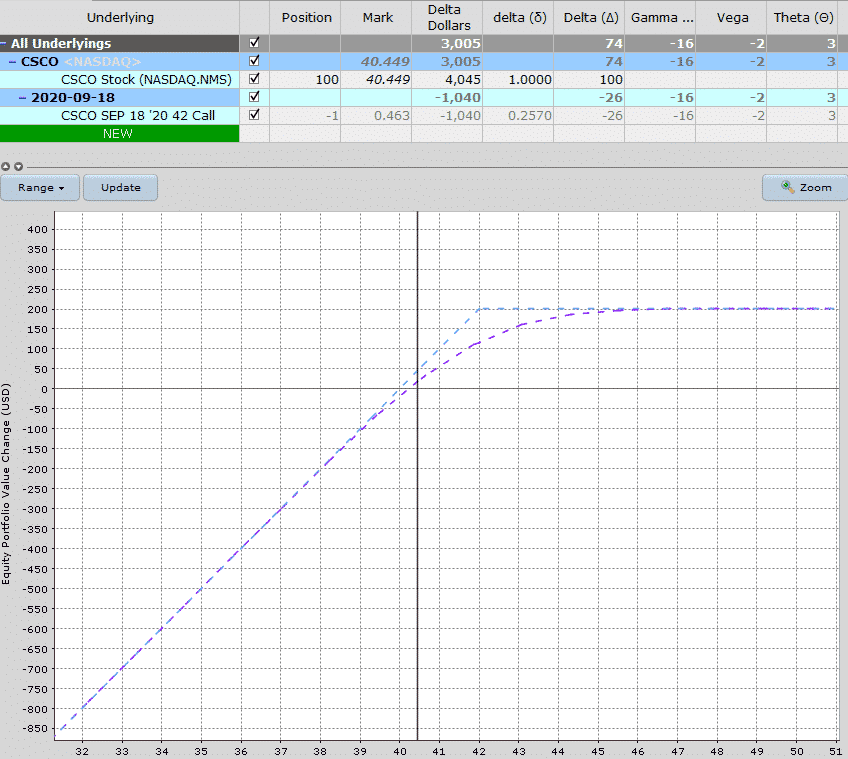

A covered call is very similar to a cash secured put. The strategy involves purchasing 100 shares of a stock and then selling a call against that stock position.

Let’s look at an example using CSCO stock so that we can compare it with the cash secured put:

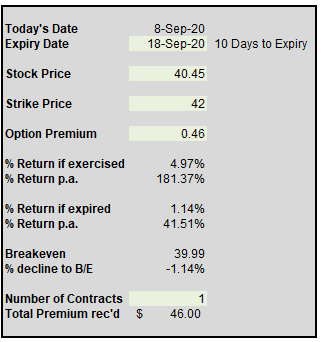

CSCO COVERED CALL

Date: September 8, 2019

Current Price: $40.45

Trade Set Up:

Buy 100 CSCO Shares @ $40.45

Sell 1 CSCO Sept 18th, 42 call @ $0.46

Premium: $46

Capital Requirement: $3,999

Return If Expired: 1.14%

Annualized Return If Expired: 41.51%

Return If Exercised: 4.97%

Annualized Return If Exercised: 181.37%

Notice the similarity in the risk graph. The return potential is higher in this case because the sold call is out-of-the-money meaning there is some capital gain potential in the trade.

To create the exact same risk graph as the cash secured put example, we would sell an in-the-money call with a strike of 40.

We also have a similar return if the call expires worthless (assuming no change in stock price), but the return if the call is assigned is much higher.

This is because of the additional capital gain potential of $1.55 (difference between the stock price and the sold call strike).

Bull Put Spreads

Bull put spreads are one of the best weekly income strategies because they are a risk defined strategy.

To execute a bull put spread a trader would sell an out-of-the-money put and then buy a further out-of-the-money put.

You can read all about them here, but let’s also look at an example.

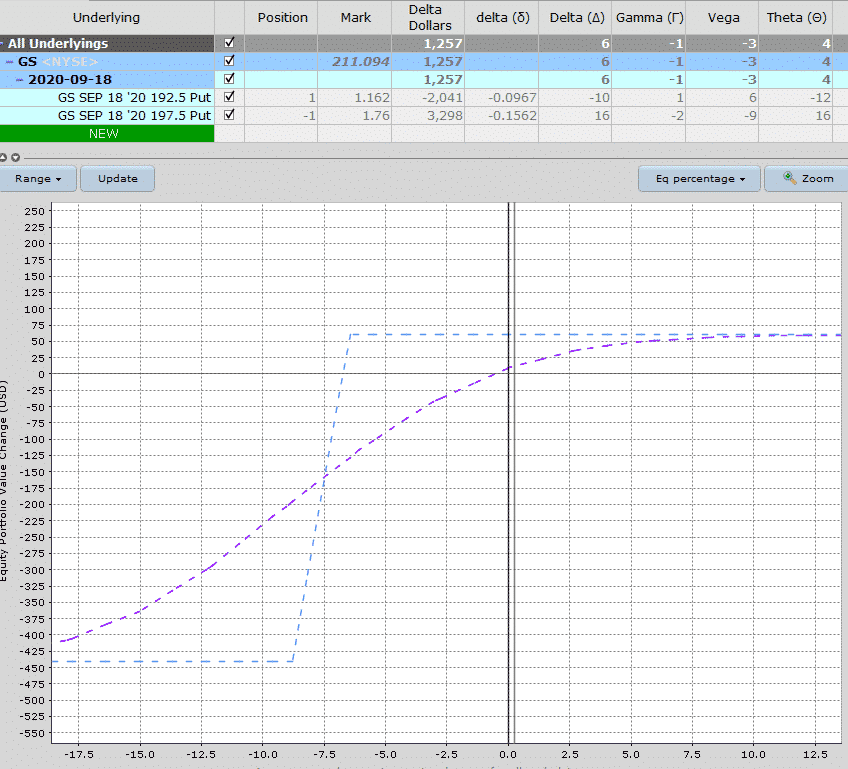

GS BULL PUT SPREAD

Date: September 8, 2019

Current Price: $211.09

Trade Set Up:

Sell 1 GS Sept 18th, 197.50 (15 delta) put @ $1.76

Buy 1 GS Sept 18th, 192.50 (10 delta) put @ $1.16

Premium: $60 Net credit

Capital Requirement: $440

Return Potential: 13.64%

Annualized Return Potential: 134.52%

Breakeven Price: 196.90

This bull put spread example has the potential to return nearly 14% in just 10 days which equates to a 134.52% return per annum.

Bearish Strategies

Bear Call Spreads

Bear call spreads are the opposite of bull put spreads and involve selling an out-of-the-money call and buying a further out-of-the-money call.

You can read the full 4,500 word guide here, but let’s look at an example:

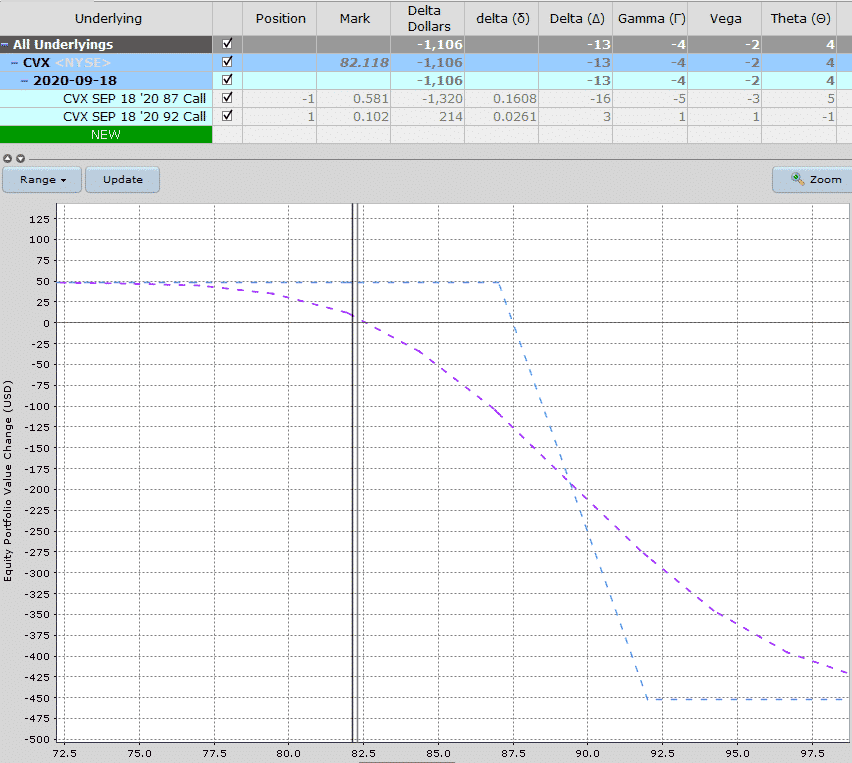

CVX BEAR CALL SPREAD

Date: September 8, 2019

Current Price: $82.11

Trade Set Up:

Sell 1 CVX Sept 18th, 87 (16 delta) call @ $0.58

Buy 1 CVX Sept 18th, 92 (3 delta) call @ $0.10

Premium: $48 Net credit

Capital Requirement: $452

Return Potential: 10.62%

Annualized Return Potential: 104.76%

Breakeven Price: 87.48

Naked Calls

Selling naked call options is not a great idea because they come with unlimited risk.

Technically, it can be done, but it’s not recommended at all for beginners.

If you do get assigned on a naked call, you would then have a -100 share position in your account.

You could then turn it into a reverse wheel trade, but that’s pretty advanced and beyond the scope of this article.

Neutral Strategies

Iron Condors

Iron condors are simply a combination of a bull put spread and a bear call spread.

If you’re new to iron condors, you’ll want to check this post out first, but the great thing about condors is you don’t have to have a directional opinion on a stock.

Just place the trade and then manage it according to the rules and guidelines.

The other advantage of condors is that you’re generating two lots of premium without having to use up any extra margin.

Some guidelines to consider for iron condors:

- Don’t enter if VIX futures are in backwardation (just remember the saying “bad things happen in backwardation”)

- Short strikes around delta 10-15

- Stop loss 2x premium received

- Adjust if either short strike hits delta 25

- Profit target 50% of premium received in less than 50% of the duration, otherwise hold until 7 days to expiry.

Let’s look at an example:

< FREE 10 Lesson Iron Condor Course >

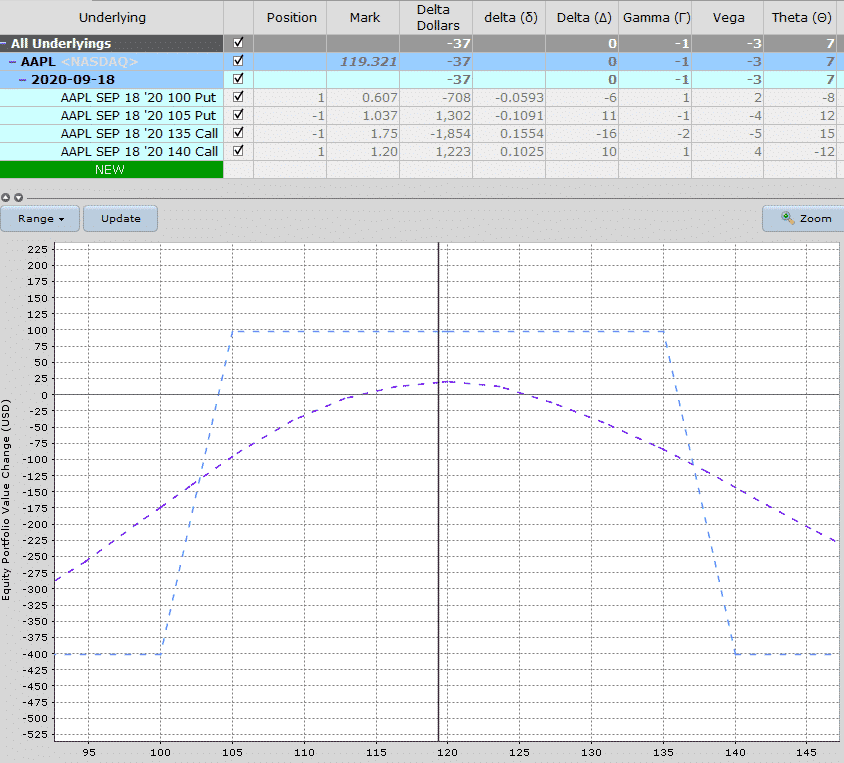

AAPL IRON CONDOR

Date: September 8, 2019

Current Price: $119.32

Trade Set Up:

Sell 1 AAPL Sept 18th, 105 (11 delta) put @ $1.04

Buy 1 AAPL Sept 18th, 87 (16 delta) put @ $0.61

Sell 1 AAPL Sept 18th, 135 (15 delta) call @ $1.75

Buy 1 AAPL Sept 18th, 140 (10 delta) call @ $1.20

Premium: $98 Net credit

Capital Requirement: $402

Return Potential: 24.38%

Annualized Return Potential: 240.49%

Breakeven Prices: 104.02 and 135.98

Trading an iron condor results in two lots of premium being received so the income potential is higher than a single vertical spread.

The capital requirement is also reduced because of the second premium received which results in a very high return potential of 24.38% or 240.49% annualized.

Short Straddle

A short straddle is an advanced options strategy used when a trader is seeking to profit from an underlying stock trading in a narrow range.

Since it involves selling both a call and a put, the trader gets to collect two premiums up-front, which also happens to be the maximum gain possible.

Due to the two premiums collected upfront, beginners are often attracted to this strategy without realizing the risks they face.

The trade has unlimited risks in both directions so for this reason it is not recommended for traders with less than 12 months experience.

Let’s look at an example:

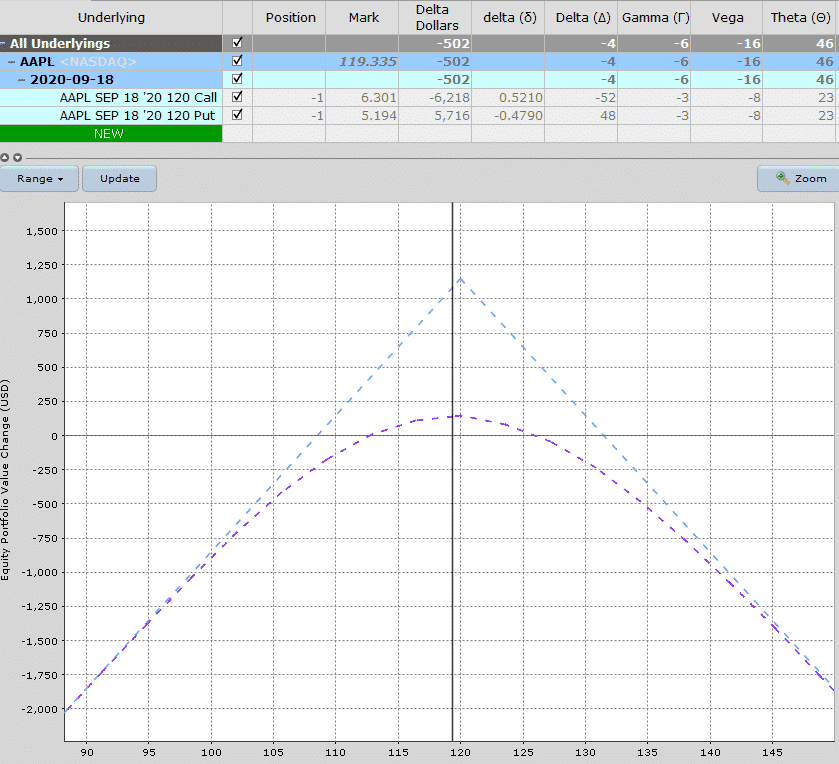

AAPL SHORT STRADDLE

Date: September 8, 2019

Current Price: $119.32

Trade Set Up:

Sell 1 AAPL Sept 18th, 120 put @ $5.19

Sell 1 AAPL Sept 18th, 120 call @ $6.30

Premium: $1,149 Net credit

Capital (Margin) Requirement: $1,827

Return Potential: 62.89%

Annualized Return Potential: 620.40%

Breakeven Prices: 108.51 and 131.49

While the return potential looks incredibly impressive, it’s important to remember that this strategy involves unlimited risk.

Even though the capital requirement is only $1,827 the potential losses are much, much higher.

Short Strangle

A short strangle is very similar to a short straddle in that they both involves selling a naked call and a naked put.

The difference here is that the strikes are placed out-of-the-money rather than at-the-money.

The trade still has unlimited risk in both directions.

Let’s look at an example:

AAPL SHORT STRANGLE

Date: September 8, 2019

Current Price: $119.47

Trade Set Up:

Sell 1 AAPL Sept 18th, 110 put @ $1.83

Sell 1 AAPL Sept 18th, 130 call @ $2.64

Premium: $447 Net credit

Capital (Margin) Requirement: $1,488

Return Potential: 30.04%

Annualized Return Potential: 296.34%

Breakeven Prices: 105.53 and 134.47

This weekly short strangle example also has a high return but not as high as the short straddle. The breakeven points are also slightly wider.

Stock Selection

Stock selection and strategy selection go hand in hand for selling weekly options.

Traders should only sell weekly put options on stocks with a bullish outlook.

Here are some criteria to consider following for bullish weekly trades:

- Only trade stocks above the 50-day and 200-day moving average

- 50-day and 20-day moving averages are sloping upwards

- RSI is not above 80

- Strong stocks experiencing minor pullbacks to relieve overbought conditions

- VIX term structure is not in backwardation

Here are some criteria to consider following for bearish weekly trades:

- Only trade stocks below the 50-day and 200-day moving average

- 50-day and 20-day moving averages are sloping downwards

- RSI is not below 20

- Weak stocks experiencing minor rallies to relieve oversold conditions

Risks

Many traders are attracted to the idea of selling weekly options because of the high return potential, but it’s also important to understand the risks.

Weekly options will move very quickly, which can be a good thing (if the trade moves your way) or a bad thing (if the trade moves against you).

One losing trade can potentially wipe out weeks’ worth of winning trades.

Weekly options are hard to adjust because of the limited time left in the trade.

If a trader isn’t able to watch the trade closely and close it out quickly if it moves against them, losses can accrue very quickly with little chance of recovering the trade via an adjustment.

While percentage gains for selling weekly options look extremely attractive, it is also important to consider the percentage returns for losing trades.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Your GS bull credit spread example is wrong. Says to sell on both legs.

Thanks fixed.