The “Dogs of the Dow” is an investment strategy that gained popularity during the 1990s after a top money manager from that decade named Michael B. O’Higgins mentioned this approach in his book “Beating the Dow”.

Ever since then, investors have followed the “Dogs of the Dow” strategy due to its simplicity and low risk.

If you are looking for investment ideas for 2020 you may want to keep reading to learn more about this strategy and the companies that are currently classified as “Dogs of the Dow” for this year.

How Does the “Dogs of the Dow” Strategy Work?

The Dow Jones Industrial Average (DJIA) is one of the most popular stock indexes in the world and also one of the oldest. Ever since this index was introduced, investors track its performance as an indicator of the performance of the market as a whole.

As of now, the DJIA is composed of 30 large corporations, also known as blue chips.

The Dogs of the Dow strategy basically consists of identifying the 10 stocks with the highest dividend yield within the DJIA to invest the same amount of money on each of them at the beginning of each year.

After the year ends, the portfolio must be rebalanced and “the Dogs” are substituted by the highest dividend-yielding stocks at that moment.

Some of the assumptions that support the Dogs of the Dow as a sound investment strategy are the following:

- Blue chip stocks with a high dividend yield are usually at a low point on their business cycle and their value should pick up throughout the year.

- The dividend policy of these companies is not adjusted based on the performance of its shares and, therefore, the market will eventually recognize that they “underpriced”.

- These companies are financially sound as they are some of the largest and most widely recognized corporations in the world.

These Are the 2020 Dogs of the Dow

Dow (DOW)

Dividend Yield: 5.12%

ExxonMobil (XOM)

Dividend Yield: 4.99%

IBM (IBM)

Dividend Yield: 4.83%

Verizon (VZ)

Dividend Yield: 4.01%

Chevron (CVX)

Dividend Yield: 3.95%

Pfizer (PFE)

Dividend Yield: 3.88%

3M (MMM)

Dividend Yield: 3.26%

Walgreens (WBA)

Dividend Yield: 3.10%

Cisco (CSCO)

Dividend Yield: 2.94%

Coca-Cola (KO)

Dividend Yield: 2.89%

Does This Strategy Work?

The underlying assumption of this strategy is that the return earned on the Dogs of the Dow should beat the performance of the Dow Jones Industrial Average (DJIA) as a whole.

I like to use the Dogs of the Dow strategy with options as part of my long-term portfolio.

The question would be: has this been the case in previous years?

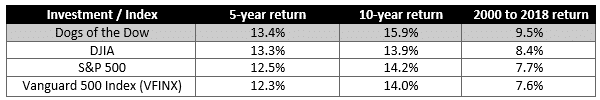

The answer is YES. The Dogs of the Dow strategy has beaten the performance of the S&P 500, the DJIA and the Vanguard 500 consistently over the long term.

Here is a comparison between the 5-year, 10-year, and the entire millennia’s performance of this strategy vs. each of these indexes:

Source: dogsofthedow.com

Trade safe!

P.S. I’ll be running another free webinar on Tuesday 8pm New York time – Market Analysis Plus 4 Trade Ideas You Can Implement Right Now. Click Here To Register.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.