“The Dogs of the Dow is an investing strategy that consists of buying the 10 DJIA stocks with the highest dividend yield at the beginning of the year. The portfolio should be adjusted at the beginning of each year to include the 10 highest yielding stocks.” – Investopedia

The Dogs of the Dow theory was created in 1972 and has proven to be successful more often than not over the years. Sometimes the simple things work the best and this strategy is simplicity to the core. Purely stated, the Dogs of the Dow theory involves buying the 10 highest yielding stocks of the 30 companies in the Dow Jones Industrial Average at the start of each year. The portfolio is then rebalanced at the start of the following year.

The thesis of the trade is that these 10 stocks are quality companies with stable business and healthy, consistent dividend payment. They are temporarily unloved or have experience short-term declines due to various market factors but are likely to bounce back at some point soon.

Companies in the Dow have historically been very stable companies that have been able to weather economic storms. It is unlikely they are going to go out of business any time soon.

Does It Work?

As with any investment strategy, you cannot say in advance that this will work 100% of the time. However, over the long run, the strategy has proven to be a good one. According to Investopedia, between 1957 and 2003, the Dogs outperformed the Dow Industrials by about 3% returning 14.3% annually versus the Dow’s 11%. From 1973 to 1996, the outperformance was even more impressive returning 20.3% annually versus 15.8%.

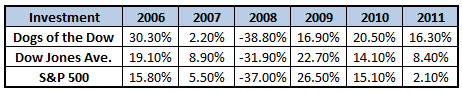

The following returns were reported by www.dogsofthedow.com

The 2015 Dogs

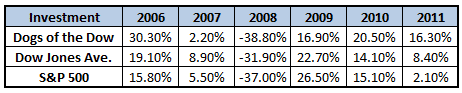

Below is the list of stocks that will make up the Dogs of the Dow theory for 2015.

Using Options To Trade The Dogs Of The Dow

A different method of trading the Dogs of the Dow would be using options. The typical strategy would be to buy all 10 stocks using 10% of your portfolio for each. Rather than do that, you could start selling some cash secured puts on some of the stocks. If you end up being assigned your purchase price will be even lower than the current stock price which make the effective dividend yield even higher.

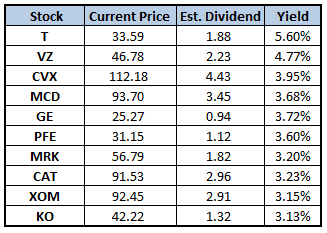

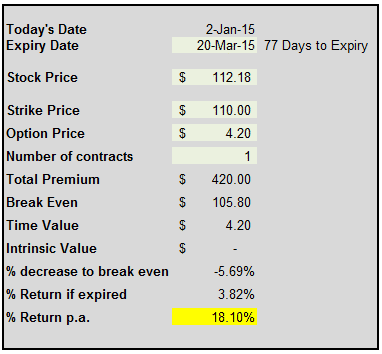

CVX is a stock that has taken a bit of a beating recently due to falling oil prices. With the stock at $112.18 it is around 17% below its 52 week high and is currently yielding 3.95%.

Instead of purchasing the stock outright, you could sell a March 20th $100 put for $4.20.

If CVX remains above $110 on March 20th, your put expires worthless and you have made $420 for a return of 3.82% in 77 days or 18.10% annualized. If CVX falls below $110 at expiry, you will be assigned on 100 shares. You net purchase price will be $105.80 and your effective dividend yield will be 4.19% which is slightly better than the 3.95% available if you bought the shares today.

Remember that once you are assigned, you can also start selling covered calls. If your net purchase price is $105.80, you could potentially sell a 3 month $110 call for around $3-4. This increases your yield even further and gives you a little bit of upside potential as well.

Selling covered calls over the Dogs of the Dow stocks is a great strategy for building a long term exposure to high quality, high yielding stocks.

Will you try this strategy in 2015?

1 Comment