With 2014 now done and dusted, investors invariably start looking to the year ahead.

Some investors may look to rebalance their Dogs of the Diw portfolios, while others may look back over the past few years to try and find the next big trend.

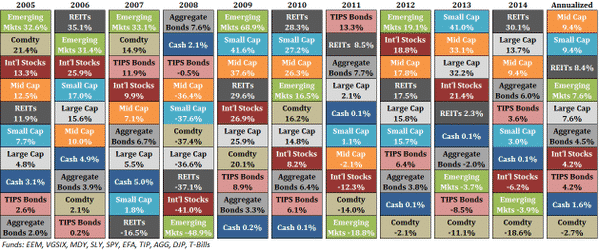

This week Ben Carlson of A Wealth of Common Sense posted this excellent graphic showing the performance of various asset classes over the last few years. Will REITS continue to perform well in 2015 or will Emerging Markets make a comeback after two years in the doldrums?

In addition to this, Robert C. Doll of Nuveen Asset Management came out with his 10 predictions for 2015. These are shown below:

- “U.S. GDP grows 3 percent for the first time since 2005.”

- “Core inflation remains contained, but wage growth begins to increase.”

- “The Federal Reserve raises interest rates, as short-term rates rise more than long-term rates.”

- “The European Central Bank institutes a large-scale quantitative easing program.”

- “The U.S. contributes more to global GDP growth than China for the first time since 2006.”

- “U.S. equities enjoy another good yet volatile year, as corporate earnings and the U.S. dollar rise.”

- “The technology, health care and telecom sectors outperform utilities, energy and materials.”

- “Oil prices fall further before ending the year higher than where they began.”

- “U.S. equity mutual funds show their first significant inflows since 2004.”

- “The Republican and Democratic presidential nominations remain wide open.”

I agree with most of these, particularly the first four. I definitely think we will see more volatility in US equity markets.

The other big impact is going to come from falling commodity prices.

What do you think are the big trends for 2015? Let me know in the comment section below.